Goldman’s Clients Are Getting Angry That Teenage Daytraders Are Crushing Them

Tyler Durden

Sat, 06/13/2020 – 16:25

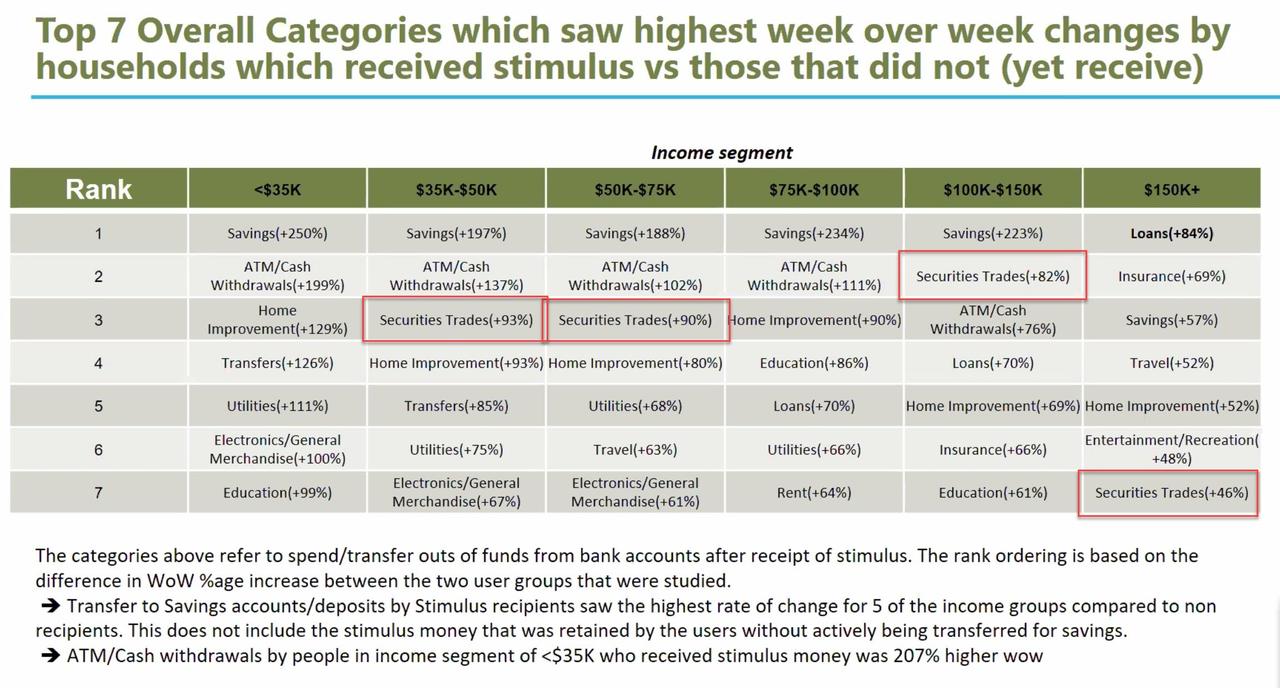

Two weeks ago, shortly after we first observed that the primary source of capital used by the Robinhood army of daytrading retail investors has been government stimulus, unemployment and benefit checks…

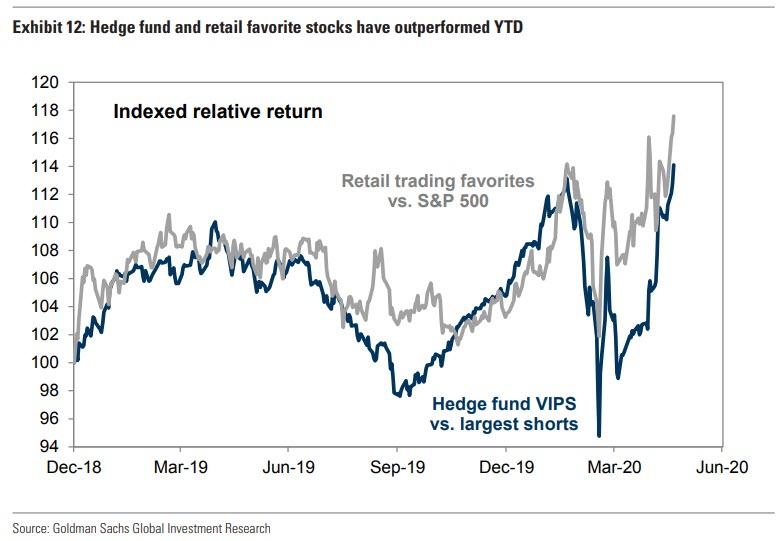

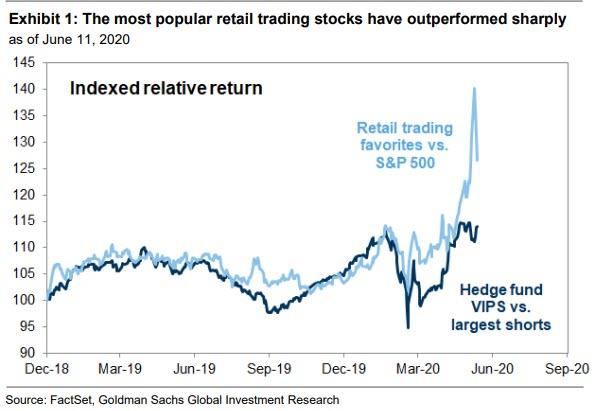

… we reported that something unprecedented has happened: a basket of Goldman “retail favorite” stocks had outperformed not only the broader S&P500, but also Goldman’s basket of most popular hedge fund stocks.

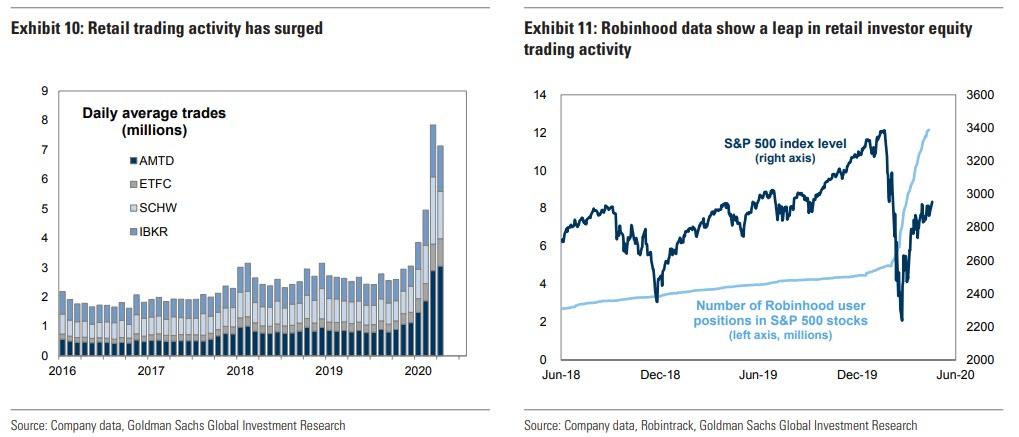

Indeed, as Goldman highlighted at the end of May, as a result of free government money, zero cost online trades and millions of bored “unemployed from home” Gen-Zers, there has been nearly a tripling in retail user activity this year, with the number of distinct user-positions in S&P 500 stocks rising from 4 million at the start of 2020 to 5 million at the market peak in February, 7 million at the S&P 500 trough in March, and 12 million as of the end of May (since then this number has exploded even higher). This sharp increase in retail trading amid still muted hedge fund bullishness in a very illiquid market, helped a basket of popular retail stocks (which for those who have access can track it using Goldman’s Marquee platform under the GSXURFAV ticker) outperform the S&P 500 by 13 percentage points YTD.

Or maybe unprecedented is too strong a word: after the last time retail outperformed hedge funds was in late February – just two days after the S&P hit an all time high – when we posted the exact same observation, and concluded by saying that “while it is certainly a novelty to see retail investors outperform hedge funds, we doubt this divergence will last long.”

It did not, and the market crashed just days later.

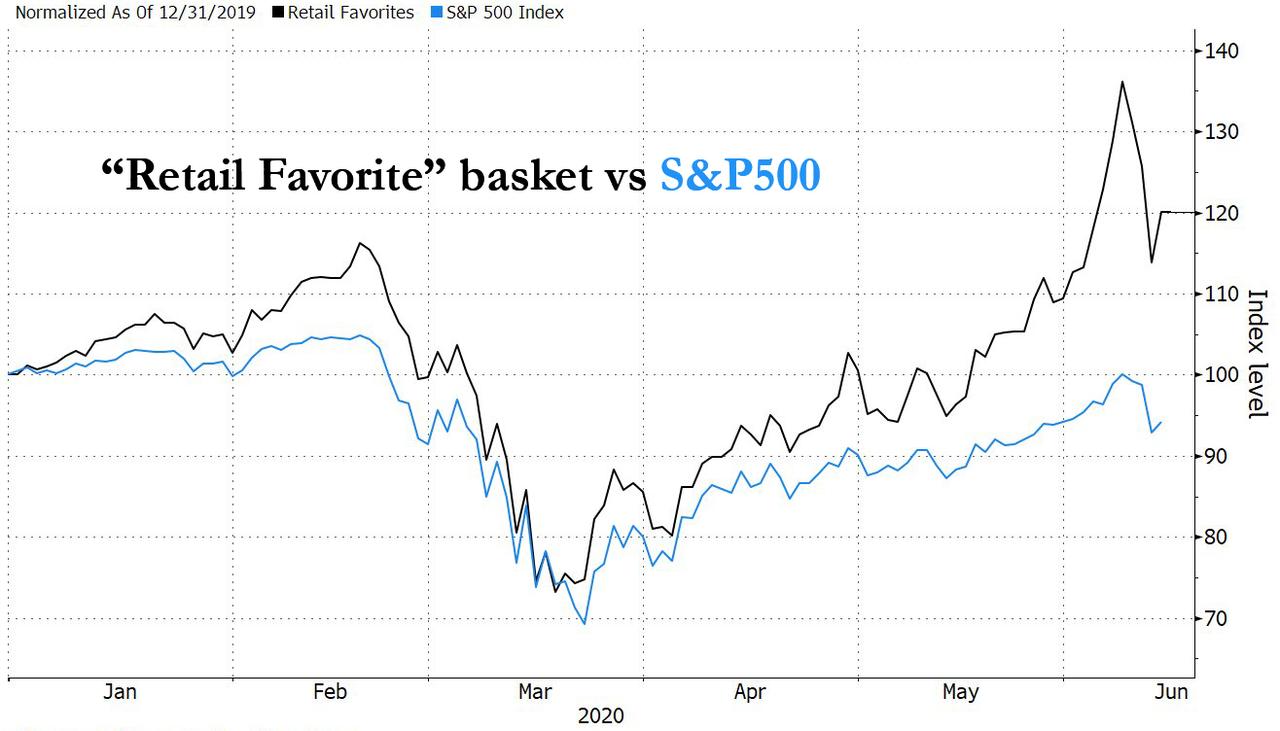

However, what has happened since is truly unprecedented because if retail had merely smacked “smart money” returns at the end of February, it has positively crucified both the smart money – and all the money in the face of the S&P500 as of right now, when the basket of most popular retail stocks is up 20% YTD compared to the S&P which after Thursday’s rout ended down 5% for the year…

… and the Hedge Fund VIP basket which is roughly unchanged YTD. Even on a hedged basis (retail favorites/S&P500 vs hedge fund VIPs/largest short pair trades), the retail army is up almost 30% despite last week’s rout, massively outperforming virtually everyone else, and as the Goldman chart below shows, since the start of 2019, retail is outperforming hedge funds roughly 3 to 1.

To be sure, retail outperformance was somewhat hobbled after last Thursday’s rout but not nearly enough to catch down to the broad market, which experienced its sharpest decline since bottoming on March 23, which shockingly took place one day after arguably the most dovish Fed statement ever, one in which the central bank announced its intention to keep the funds rate at 0-25 bp through 2022, while formalizing open-ended QE. (that said, the S&P is still 36% above its March low largely thanks to the trillions in Fed stimulus).

This disconnect between retail and hedge fund performance has not gone unnoticed by Goldman’s clients – who pay Goldman handsomely to outperform – or be told how to outperform – the market.

As David Kostin writes in his latest Weekly Kickstart, unlike the past three months, when many of the bank’s client discussions centered on the disconnect between financial assets and the economy, as “most institutional investors have been stunned by the juxtaposition of the sharpest GDP contraction on record with a 36% market rally”, in recent weeks, (increasingly angry) investors have focused on a different type of disconnect between Wall Street and Main Street: The relative performance of institutional and retail investors.

Since the March 23 low, our Hedge Fund VIP (GSTHHVIP) and Mutual Fund Overweight (GSTHMFOW) baskets have each returned 45%, outpacing the 36% S&P 500 rally by 900 bp. However, a basket of the most popular retail trading stocks (GSXURFAV) has returned an incredible 61%. As we highlighted in May, broker data reveal a tripling of retail trading activity as the market declined.

Why are Goldman’s clients angry?

Because instead of listening to Dave “Stool President” Portnoy, the self-proclaimed king of the Robinhood daytrading army, something they can do for free by just following his twitter account, they are instead paying Goldman a 2-3% commission for what? To underperform by as much as 1600 bps. And those that are not getting angry, they should be, because the conditions that have allowed Portnoy to take the other side of Warren Buffett’s airline trade but to also outperform all of the “smartest guys in the room”, are the same that are allowing bankrupt Hertz to issue up to $1 billion in worthless stock to Robinhooders: it’s the Fed’s green light to go crazy and just buy everything, which is the only obvious trade in a market in which the Fed has made failure impossible – something we have been pounding the table on ever since 2013 when we said that the best performing strategy is to go long the most shorted names, a trade that has generated tens of thousands of bps in alpha as BofA “discovered” last year (but sure, call us bears).

So in an attempt to win back some goodwill from its clients, Goldman’s Kostin lays out several observations on whether it no longer makes sense to pay for a professional financial advisor (such as Goldman), when the Fed has assured that this is a market where 10-year-olds (i.e., the e-trade baby all grown up) can make money hand over fist:

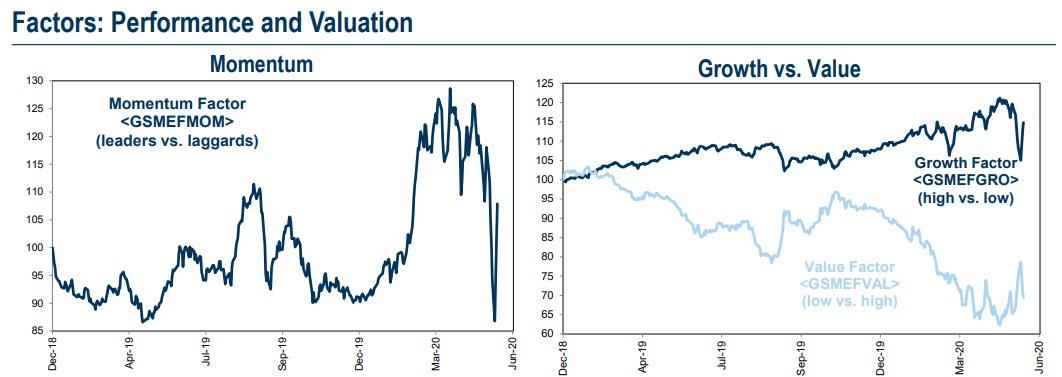

The surge in retail trading activity has amplified the market rotation toward cyclicals and value stocks. High quality growth stocks outperformed during the market drawdown and continued to lead in the first weeks of the rebound, narrowing market breadth and contrasting with past bear market recoveries. Between March 23 and the middle of May, our long/short Growth factor returned 9% and our Momentum factor rose by 2%. This dynamic benefited institutional investors, who had shifted toward growth stocks as the market declined. Since mid-May, however, our Momentum factor has declined by 19% as improving virus and activity data pushed investors toward cyclicals, small-caps, and other economically-sensitive, low- multiple stocks. Stocks with these qualities which were quickly embraced by value-seeking retail investors, and now make up a large portion of our retail basket.

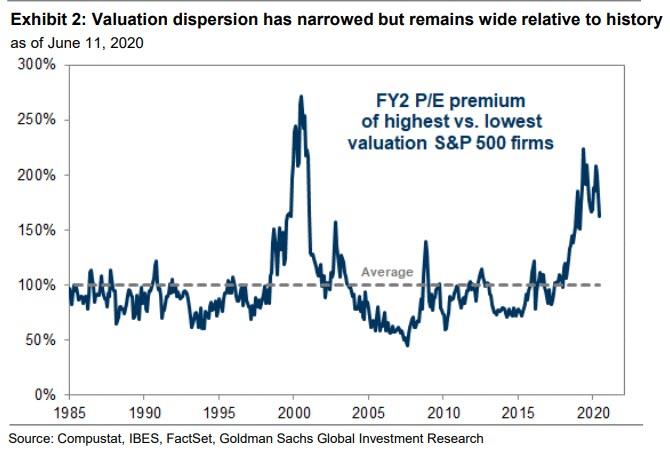

Despite the recent Value rally, the dispersion of stock multiples is still extremely wide relative to history. Last month, the gap in valuations between the highest and lowest valuation stocks registered the widest on record outside of the Tech Bubble peak. During the last few weeks that spread has narrowed, but it still ranks in the 93rd percentile since 1980. Wide valuation dispersion signals long-term opportunity for value investors. However, the volatile rotations in recent weeks underscore just how difficult timing that opportunity can be. We believe most investors should include some value exposure in their portfolios, although the degree will depend on time horizon and risk tolerance, among other factors. In the medium-term, the challenge is determining which laggards are value opportunities and which leaders will experience fundamental growth that justifies current elevated valuations.

Yes David, we know the challenge, the problem for you – as you try to earn your pay and provide the solution – is that as the market continues to trade increasingly insane based on the whims of 10-year-olds, not even the most spot on accurate analysis based on fundamentals will matter one bit when the marginal price setters are traders who are still not legal to drink and maybe drive.

Which is why the Goldman strategist cops out and takes the easy way out: just keep buying what has worked for the past decade, namely tech, resulting in even narrower market breadth even though it was Kostin himself two months ago warning that “narrow market breadth is always resolved the same way: narrow rallies lead to large drawdowns as the handful of market leaders ultimately fail to generate enough fundamental earnings strength to justify elevated valuations and investor crowding. In these cases, the market leaders “catch down” to weaker peers.” Maybe amid the shock of his clients, Kostin is hoping they don’t recall what he said less than two months ago:

The unrivaled market leader this year has been Tech, and we expect it will continue to outperform [ZH: really? that;s not what you said on April 27]. The Information Technology sector has returned +7% YTD, and even following this week’s decline the NASDAQ 100 trades within 1% of its pre-crisis peak. As the market was falling, the sector was supported by its quality attributes, including strong balance sheets and high profit margins, as well as the resilience of its earnings. This year analysts have revised down Tech 2021 EPS by just 5%, compared with a 20% cut for the remainder of the S&P 500. In addition, low interest rates increase the value of the sector’s long-term growth prospects that, in cases like ecommerce and cloud usage, have been accelerated by the impact of the pandemic on consumer and business activity. Major risks to the sector include its popularity, which could cause underperformance in the event of a sharp investor derisking, as well as the possibilities of government regulation and tax reform. While Health Care EPS estimates have been similarly resilient, political risk has suppressed the sector’s multiples, as is often the case prior to presidential elections.

And so on. Meanwhile as Kostin, and his very generous clients contemplate the tea leaves and analyze such meaningless “data” as cash flows, growth projections, technical reversal patterns and what not, the rabid army of millennial daytraders rushes from one stock to the next, sending it soaring then plunging with no regard for underlying data, in one truly unprecedented pump and dump scheme, where all those who jump in first make a killing, while the laggards are crushed.

As we noted recently, until Powell does something to stop this catastrophic mockery of efficient markets, which are now juiced to the gills with the Fed’s trillions in newly printed money, nothing will change. And judging by what Powell just said last week, nothing will change for a long, long time:

“The Fed doesn’t believe, and shouldn’t believe, that it can forecast the stock market, and therefore recognize a bubble in real time,” said Princeton University economist Alan Blinder, a former Fed vice chairman, in a Bloomberg Television interview. “They’re pretty easy to recognize after the fact, after they burst. But, in real time, in a predictive way, pretty much impossible.”

Really? Impossible? How about one look at the chart of bankrupt Hertz…

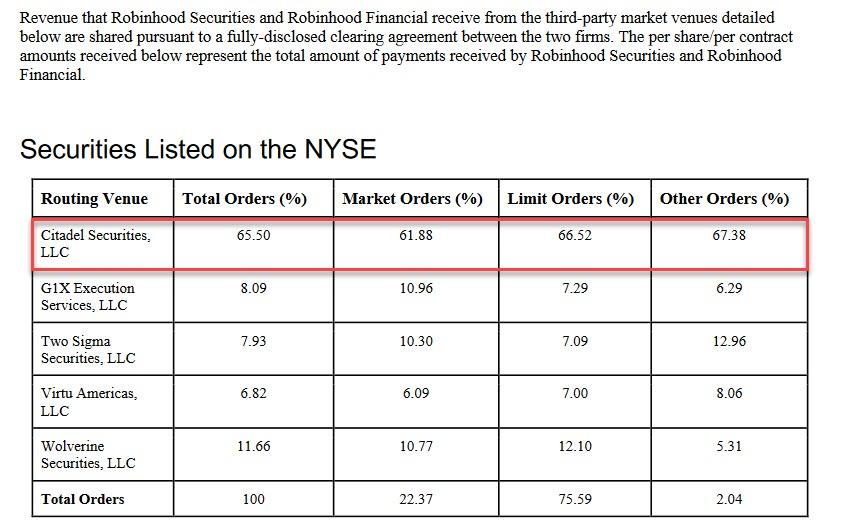

… whose market cap almost hit $1 billion last week and prompted the company to do the unthinkable: try to sell stock to the hordes of Robinhood daytraders, whose tiny trades are being frontrun all day long by HFT algos which are accentuating the momentum and allowing a handful of small investors to have an outsized impact on the market (below is Robinhood’s latest 606 Report: 65.5% of all orders are sold to Citadel).

Or how about Chesapeake? Or maybe Fangdd, you worthless career economist.

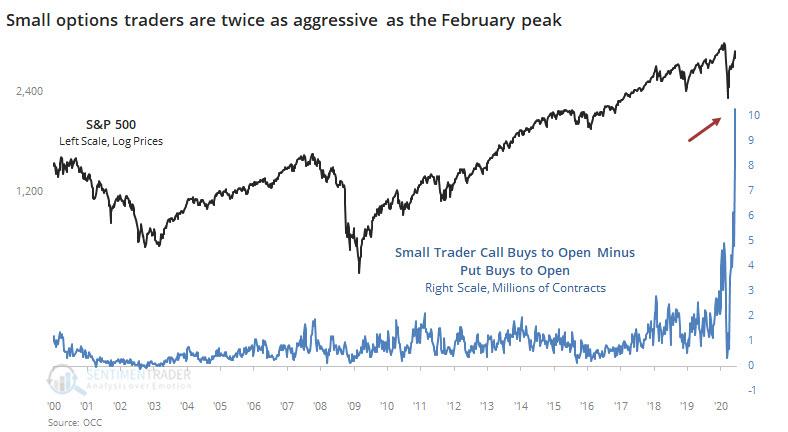

Meanwhile, retail investors – confident they can never lose – and certainly their returns to date justify it, are betting more and more aggressively on the market, in the form of the ever more levered upside bets such as tiny, short duration calls. According to SentimentTrader, one-contract transactions have surged to 13% from roughly 9%. The smallest of traders bought more than 14 million speculative call options in the week ended June 5, an all time high.

“We have Instagram influencers and now we have Reddit influencers,” QVR’s Benn Eifert told Bloomberg. “They post a trade idea in an option, in a single name, and within an hour you see hundreds of thousands of call options placed, which is totally insane.”

Insane? Yes, but it’s working, and who can blame them: the Fed chairman himself said he will do nothing to pop the bubble (which he can’t see) with tens of millions of Americans out of work. That means that, all else equal, when it comes to market insanity you ain’t seen nothing yet. Jim Bianco, president and founder of Bianco Research LLC, agrees, and says that it all comes down to the Fed’s only mandate: never again allow a drop in stocks.

“That’s why we’re seeing a giant rush of small retail investors and everybody else into the market,” Bianco told Bloomberg Television Wednesday. “When you go into the market, you go to the riskiest end of the market, so you buy bankrupt companies, you buy beaten down airlines, you buy cruise ships, you buy retailers because they will benefit the most from a support system where everything is targeted, and the markets will always go up.”

And as they do, and as “retail investors” retire at the old age of 11, Goldman’s clients will get angrier by the day until one day, who knows, we may just see riots in the streets with chants of “millionaires’ lives matter.“

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com