BP Crushed By COVID, Set To Take $17.5 Billion Asset Hit After Slashing Oil Price Outlook

Tyler Durden

Tue, 06/16/2020 – 04:15

BP p.l.c. (BP) will write off up to $17.5 billion from the value of its assets after it slashed its long-term energy price forecasts, a direct result of the COVID-19 pandemic that has crashed the global economy and significantly reduced oil demand.

BP said in a press release on Monday that the virus-induced economic downturn has led to the review of its portfolio and its capital development plans as it must adapt to a post-corona world. It now expects “the pandemic having an enduring impact on the global economy, with the potential for weaker demand for energy for a sustained period.”

Management expects the pandemic will “accelerate the pace of transition to a lower-carbon economy and energy system,” which means the company must reinvent itself, including a reduced focus on oil and gas and a more significant push towards renewables.

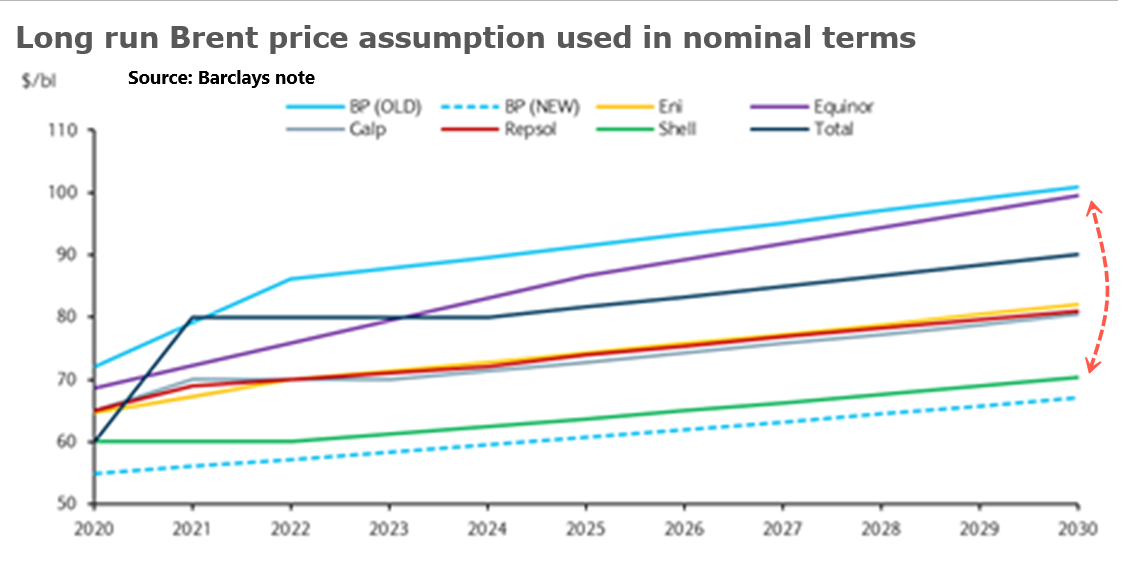

BP lowered its long-term price assumptions for Brent crude prices to an average of $55 a barrel until 2050, down nearly 30% from previous estimates of $70. The reduction in long term price assumptions led to expectations of non-cash impairment charges and write-offs in second-quarter earnings, expected in August, of $13 billion to $17.5 billion. There was also mention that some oil and gas projects in the early exploration stages could be sidelined.

“These difficult decisions — rooted in our net-zero ambition and reaffirmed by the pandemic — will better enable us to compete through the energy transition,’ BP’s Chief Executive Bernard Looney said.

Looney told the Financial Times that COVID-19 might have ushered in “peak oil” demand.

“It’s not going to make oil more in demand. It’s gotten more likely [oil will] be less in demand,” he said.

BP’s Brent crude price outlook is the lowest among Europe’s top oil majors (h/t Reuters):

The substantial impairment is mainly on BP’s oil and gas exploration assets and will lower the company’s asset value by around 10%, pushing the equity to debt ratio to about 48%, RBC Capital Markets said in a note. This suggests the company could lower its dividend in the coming quarters.

Charlie Kronick, a senior climate adviser for Greenpeace UK, said BP’s revision of crude prices was “long overdue.”

“Accelerating the switch to renewable energy will be vital not only to the climate but to any oil company hoping to survive in a zero-carbon future,” Kronick added.

As of Monday morning, BP shares trading on the London Stock Exchange were down a little more than 4% on the news.

When it comes to short to intermediate-term energy forecasts, Goldman Sachs’s analyst Damien Courvalin, who on May 1 turned bullish on oil, wrote a bearish note last week indicating Brent price could reach as low as $35 near term.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com