Big-Tech Bid, Small-Caps Skid As Gold Hits 9 Year Highs

Tyler Durden

Fri, 07/10/2020 – 16:01

On the week, Nasdaq has soared higher once again, notably divergent from the rest of the markets with Small Caps actually down on the week…

Which has sent the ratio of Megacap-Tech to Small Caps back near a record high…

Source: Bloomberg

Nasdaq is up 8 of the last 9 days and 17 of the last 20 days – this is easy!!!

[youtube https://www.youtube.com/watch?v=J2Ln2X-Jrb4]

Interestingly, today saw the week’s performances flip with Small Caps surging as Nasdaq slipped. Markets were sold at the cash open then immediately ramped higher…

Spot the odd market out (Chinese stock speculation re-erupted this week)…

Source: Bloomberg

Notably Defensives and Cyclicals have rallied tick for tick higher since the European close yesterday – very unusual moving together…

Source: Bloomberg

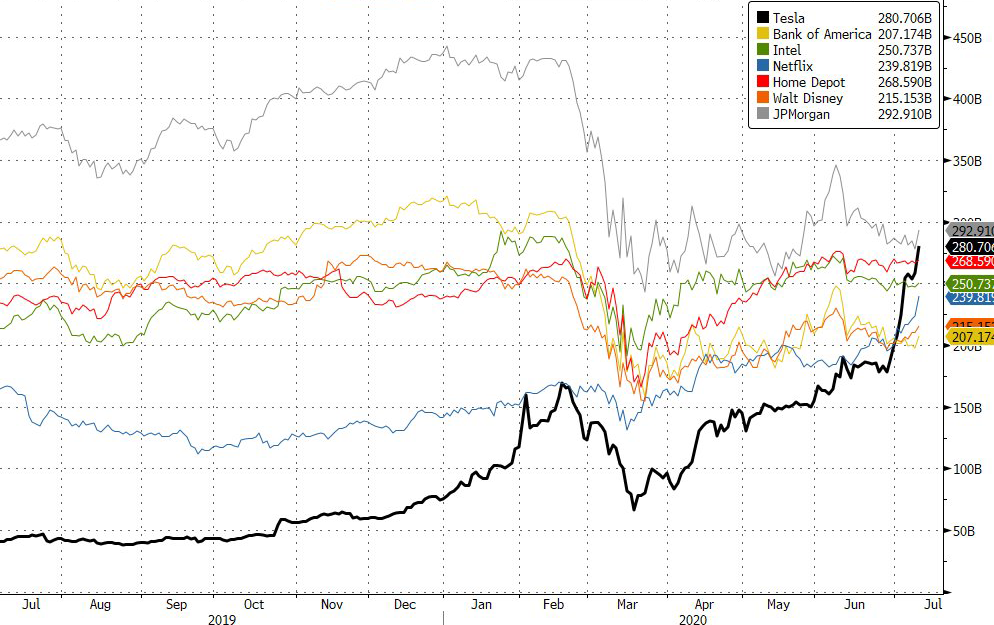

And then there’s TSLA – up from $1000 to $1500 in 7 days…

And who’s buying?

TSLA’s now as big as JPMorgan… and TSLA is now bigger than Ford + GM + BMW + Daimler + Volkswagen combined

Source: Bloomberg

Treasury yields touched a two month lows today…

Source: Bloomberg

Then ripped back higher with 5Y and 2Y unch on the week, the long-end still notably lower (and the curve flatter)…

Source: Bloomberg

The Dollar ended lower on the week, chopping around in a tight range…

Source: Bloomberg

Cryptos were all higher on the week, led by Ripple…

Source: Bloomberg

Copper was the week’s high-flier as China erupted in speculative excess. Oil was down…

Source: Bloomberg

Big intraweek drop in WTI was bid back above $40…

Silver held above $19…

And gold clung to $1800…

Spot Gold reached back to its highest since 2011…

Finally, you have to laugh right…

Bonds ain’t buying it…

Source: Bloomberg

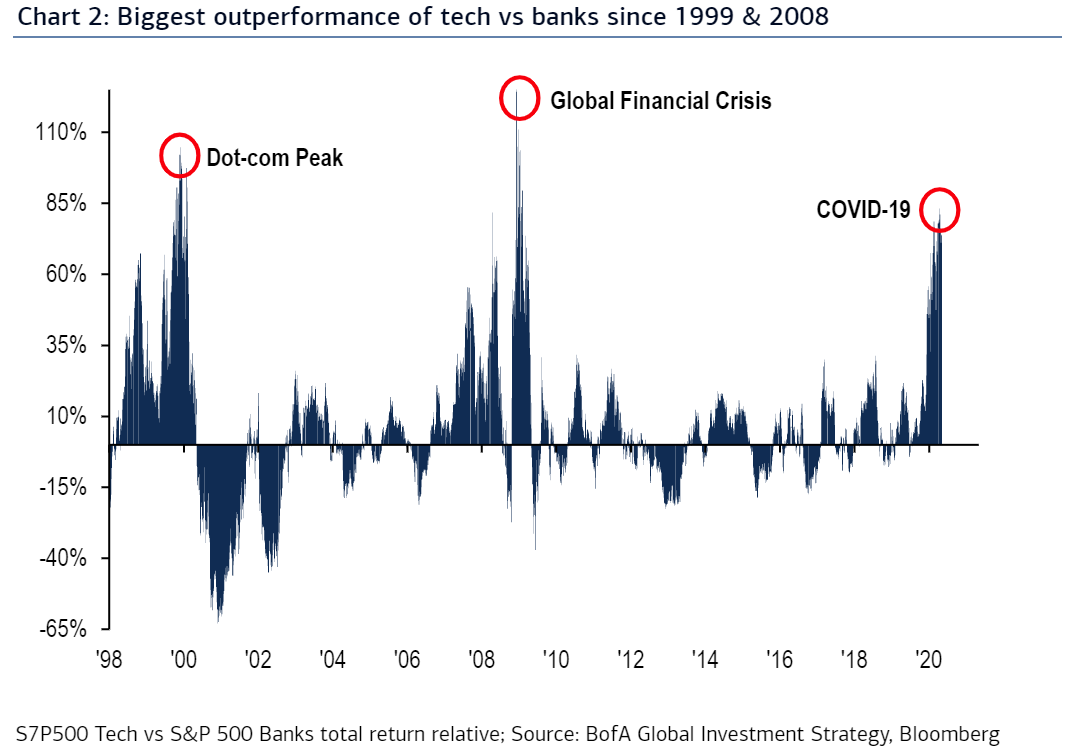

Because fun-durr-mentals…

Source: Bloomberg

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com