Bankers Make Billions From Fed Money Printing As Double-Dip Recession Fears Surge

Tyler Durden

Thu, 07/16/2020 – 10:04

The Federal Reserve’s stunning effort to keep credit flowing in the system during the virus pandemic and resulting lockdowns have been like striking gold for the biggest US banks, reported Bloomberg.

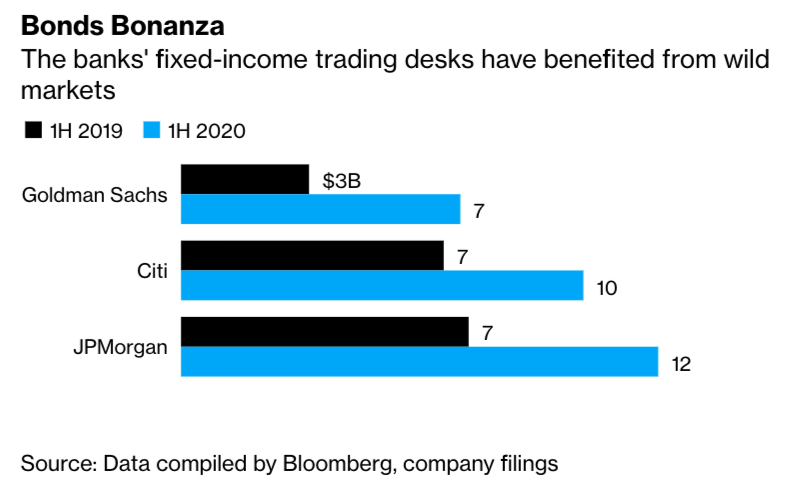

Capital markets were frozen at the start of the pandemic, but as soon as the Fed set up an unprecedented series of programs to support corporate debt markets and cut interest rates, bankers were able to handsomely profit from trading and arranging debt deals for companies seeking cash. This powered JPMorgan Chase & Co. and Citigroup Inc.’s profitability despite rising loan-loss provisions and even resulted in Goldman Sachs Group Inc. smashing earnings expectations.

“Goldman’s earnings this quarter were too good — almost indecent, in fact,” said Octavio Marenzi, CEO of capital markets consultancy Opimas. “The Fed has been able to engineer a huge bounce-back in the markets by injecting trillions of dollars, benefiting investment banks primarily. This will lead to calls for the government to do more to help Main Street rather than Wall Street.”

A Fed-induced capital markets boon fueled with newly printed money and bailouts has raised concerns whether the central banks disproportionately helped Wall Street at the expense of small businesses going bust.

While the average blue-collar American was forced into food bank lines and given lousy Trump stimulus checks, the fatest cats at Wall Street banks celebrated the Fed’s saving grace, as they collectively reported a $10 billion windfall, thanks to bond trading and debt deals.

“The $10 billion figure is the gap between the $20.5 billion that the three banks generated from their fixed-income trading and debt underwriting units, and the $10.4 billion average quarter for those businesses over the last four years,” said Bloomberg.

Citigroup’s investment bankers reported their best quarter in a decade, supported by debt underwriting. JPM traders locked in a massive $7.3 billion gain in fixed-income trading during the second quarter.

Goldman said fixed-income trading saw “significantly higher revenues” over the quarter. Goldman CEO David Solomon told analysts Wednesday, “the activity levels that we saw at the end of March and April were really extraordinary.”

Solomon added, “in a period where there’s an enormous change and enormous volatility in markets, we became super busy because our clients are super busy.”

The Fed’s unprecedented money printing to support big banks during the virus pandemic was to make sure credit kept flowing and volatility was suppressed.

Much of the credit Fed injected into the banks appears to be a onetime surge, considering the central bank’s balance sheet more than doubled in the last several months, but now contracting. This all means top banks who saw huge volumes in debt deals and large trading gains might see a slump in activity in the back half of the year – unless the Fed prints a couple more trillion dollars due to a double-dip recession.

Underwriting volumes “will definitely come down,” JPMorgan CEO Jamie Dimon told analyst Tuesday.

“All this capital is not being raised to go spend. It’s being raised to sit on the balance sheet so that you’re prepared for whatever comes next,” said Dimon.

And what comes next you may ask?

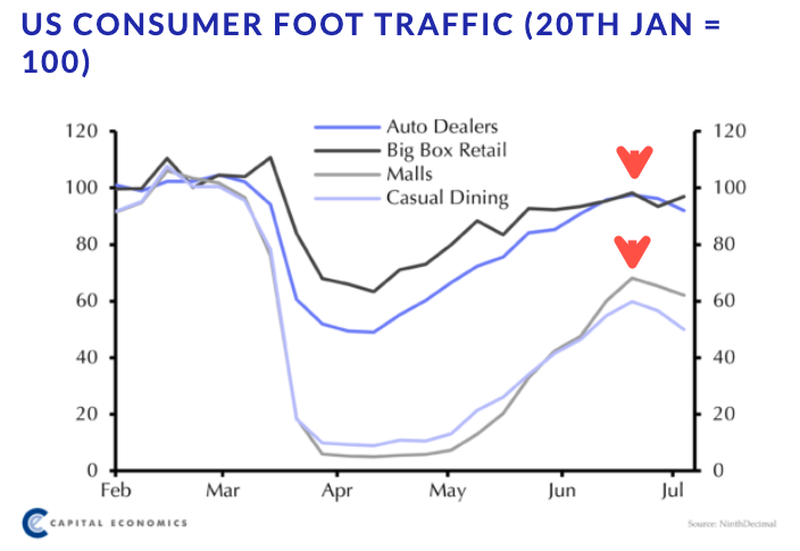

Well, a double-dip recession could be in the cards as the economy stalled in late June.

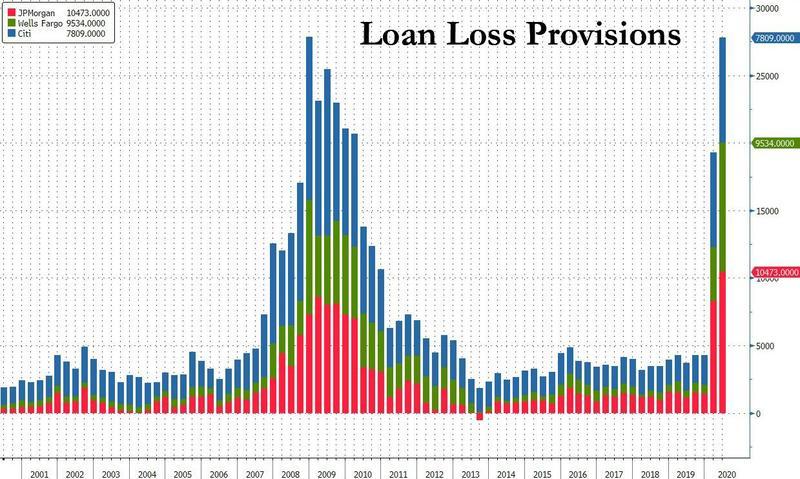

With trouble ahead, the banks are preparing with second-quarter loan loss provisions for JPMorgan, Citi, and Wells Fargo now total $47 billion as a pandemic-led spike in missed loan payments could soon unleash a broader consumer bust cycle.

The problem is the Trump administration has the consumer on life support with stimulus checks. When that goes away, along with deferment of auto loans, credit cards, and mortgages – it will be crunch time for the working poor. A fiscal cliff is coming July 31, unless another round of checks is given to consumers, even then, the overall economy has stalled, jobs aren’t coming back as quick as expected as the shape of the recovery has morphed from a “V” to a “U” or “L.”

The Fed has prepared the banks and the largest companies for the worst-case scenario, that is, well, Gary Shilling can explain what comes next…

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com