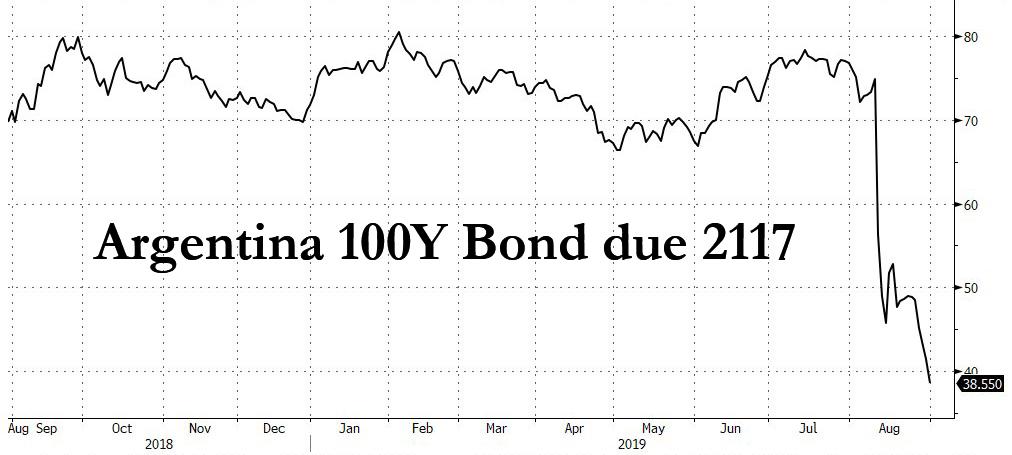

Almost exactly two years ago, the 20-some year old millennials that make up the majority of the fixed income investment universe couldn’t get enough of a brand new, and quite ridiculous, security that was being offered by Argentina: 100 year bonds. Demand was so high, in fact, that the bond sale was 3.5x oversubscribed as we wrote at the time , when we also warned that this particular offering will soon end in tears.

The tears came earlier this month, when in a “shocking” outcome – because apparently it hadn’t dawned on anyone that a political regime that is forced to push for austerity as its IMF masters demand will be kicked out overnight – the “market-friendly” Macri regime was tossed out in a primary for the upcoming presidential election, sending the country’s currency and risk assets crashing. Oh, and those 100 year bonds which could be bought for 75 cents on the dollar just 3 weeks ago can now be purchased at half that price.

Unfortunately, all those 20-year-olds who couldn’t get enough Argentina bonds in the summer of 2017, are strangely missing to buy today’s dip, and not just because S&P downgraded the country to “selective default” late on Thursday – for the simple reason that the government decided to effectively default on some $101BN in bonds, its 9th default since Argentina’s independence from Spain in 1816, but also because of what Argentina’s presidential front-runner told the WSJ in an interview today, namely that the government’s new plan to restructure its short-term debt shows the country is virtually insolvent, hardly the stuff bondholders who have been burned – over and over – on Argentina bonds wanted to hear.

“Now, there is no one taking Argentine debt, or anyone who can pay it,” said Alberto Fernández, who as candidate of the Peronist coalition is now expected to win October’s presidential election. “Argentina is in a virtual, hidden default.”

Actually, the default is neither virtual, nor hidden. Don’t believes us? Just look at the above chart. But in any case, if Argentina is already virtually in default, then “what are the incentives for Fernandez to continue making payments rather than seek a negotiated restructuring?” asked Whitney Baker, founder of Totem Macro in New York, who noted that his comments to the Wall Street Journal “seem to validate that argument, rather than being the cause of incremental uncertainty.” He also noted that given the opposition candidate’s biases, it’s “a great opportunity to blame the default on Macri” and, of course, the IMF “and then seek to negotiate broader debt relief later,” she said.

The default – however one wants to define it – took place earlier this week, when outgoing president Mauricio Macri ’s government unilaterally extended the maturity of all short-term paper and said it wants to restructure its debt with the IMF, after the country’s treasury was unable to roll over obligations with the private sector.

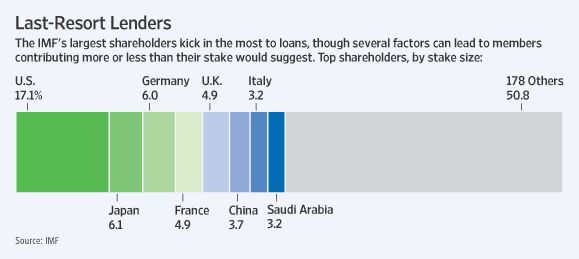

This means that not only will international creditors be shafted, but so will the IMF, whose loan, the largest ever in IMF history, will be impaired. Just don’t tell US taxpayers – after all the US is the single biggest source of IMF funding…

… that their money was used to fund “humankind’s most expensive re-election campaign”, which is what Fernandez called the 2018 IMF’s $57 billion bailout of Argentina:

“What I want them to understand in the IMF is that they are guilty of this situation,” Mr. Fernández said. “It was an act of complicity with the Macri administration. It was humankind’s most expensive reelection campaign, and they gave money to a compulsive spender.”

The pain was compounded on Thursday when S&P downgrading Argentina’s debt to selective default on Thursday. “This has immensely stressed debt dynamics amid a depreciating exchange rate, a likely acceleration in inflation, and a deepening economic recession,” S&P said in a release.

Which then brought up the question: will Argentina’s next regime cooperate with creditors and the IMF to boost creditor recoveries, or will it be a freefall bankruptcy? The answer, it appears, is the latter.

In his first interview with a foreign-media outlet ahead of the election, Fernández told the WSJ that he was unwilling to support the government’s emergency measures aimed at containing rising volatility. “The market now knows where they’re headed,” he said at his campaign headquarters, referring to the government’s efforts to restructure short-term debt.

The 60-year-old future president said that when elected, his administration would aim for a balanced budget eventually. But he first plans an ambitious program to restore purchasing power by increasing wages and government pensions, while containing inflationary pressures with a broad-ranging pact with employers.

“To reverse this cycle you must launch a plan to boost consumption, and I will not ask permission from the IMF for it,” said Fernández, prompting the worst possible case of PRSD flashback over at the IMF headquarters.

In the same interview, Fernandez dismissed market concerns about a potential Peronist victory, and said that the $57 billion bailout from the IMF, its largest on record, is partly to blame for Argentina’s financial-market slide.

Instead of being used to replace more expensive debt, Mr. Fernández said, the dollars from the IMF have evaporated in capital outflows as the government burned foreign-currency reserves to contain the steady depreciation of the Argentine peso. Which, incidentally, is precisely what we said would happen last year.

IMF Approves Upsized $56.3BN Bailout Loan For Argentina: Here Are The Implications https://t.co/HILnhejJMP

— zerohedge (@zerohedge) October 27, 2018

https://platform.twitter.com/widgets.js

And indeed, the central bank has spent close to $1.5 billion to meet rising demand for dollars since mid-August, or about 10% of its net foreign-currency reserves. Worse, according to calculations by First Geneva Capital Partners, Argentina will drain its net foreign currency reserves within the month if it continues spending dollars at the current rate. So Buenos Aires has a choice: watch as its currency becomes the next Bolivar, or run out of dollars in days.

All of this, incidentally, was obvious to anyone who wasn’t an idiot, i.e. an IMF employee.

“The current crisis is a case of déjà vu,” he said in recalling the country’s financial collapse in 2001 that led to its default on $100 billion in government debt, a record at the time. His disagreements with the IMF’s conditions are also similar, he added.

Fernández piled on the criticism, and said he made it clear he doesn’t support Macri’s austerity measures to balance the government’s budget, which were among conditions agreed with the IMF: “Mr. Macri’s government caused damage similar to what Argentina suffered in 2001: a debt default, no foreign-currency reserves, a steep devaluation and increased poverty.”

One need look no further than Greece to see just how effective recent IMF interventions have been.

But the irony is that the fate of the IMF is now likely tied to how the monetary fund resolves the crisis situation involving its biggest ever client: Argentina has defaulted eight times on its foreign debt through its 200-year history (make that 9 times now). It has also received close to 30 support packages from the IMF, which has had a rocky relationship with previous Peronist leaders.

Meanwhile, without the IMF, the Argentina economy will quickly collapse, as economists say Argentina lacks the financial firepower to stimulate the economy, which contracted by 5.8% in the first quarter from a year earlier. And not everyone blames Mr. Macri for the country’s latest financial debacle.

What happens next? Nobody knows: as the WSJ notes, Fernández is a veteran politician who likes to play guitar and listen to Argentine rock music, and has extensive links across a Peronist movement that includes organized labor, far-left groups and conservative provincial governors. While seen as more pragmatic than his predecessor Christina Kirchner, who nationalized foreign companies and imposed capital controls when economic conditions deteriorated toward the end of her term, he may have no other choice.

For now, Fernández said he is against capital controls and expropriations. He said that if he wins, he will seek to attract foreign investment, focusing on efforts to continue developing the vast Vaca Muerta formation, home to one of the world’s largest deposits of shale oil and gas. “For us, it’s startling that the world believes that Macri is the solution.”

It wasn’t clear jsut how he hopes to attract foreign investment: if Argentina’s 100Y bonds which now yield over 18% aren’t enough, one wonders just what will Argentina have to offer to make itself attractive.

The IMF, which gave Argentina a $57 billion bailout in 2018, said Wednesday that it was assessing the measures.

One can’t blame outgoing IMF head Lagarde for trying to keep a low profile: after all her next job is to head the ECB, and after her absolutely disastrous tenure at the IMF, one can’t wait to see just how she destroys the Eurozone as her final parting gift.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com