Oil and gas companies are facing an onslaught of bankruptcies as the “shale revolution” appears to be coming to an unceremonious end, at least on Wall Street, according to the Wall Street Journal.

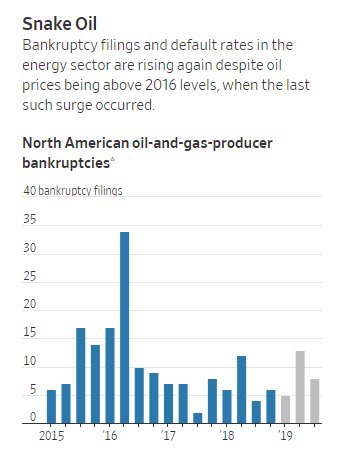

Companies like Sanchez Energy Corp., Halcon Resources Corp. and 26 other oil and gas producers have all filed for bankruptcy this year, already matching the 28 industry bankruptcies from all of 2018. The number is expected to rise as debt maturities for those looking to cash in on the shale revolution and make bets on higher oil prices years ago are now looming.

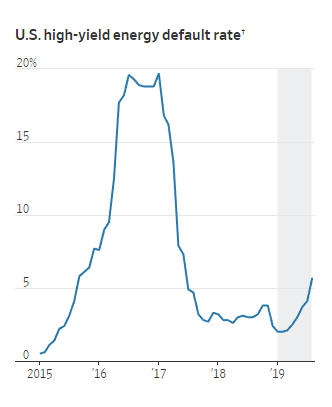

5.7% of all energy companies with junk rated bonds are defaulting as of August, the highest level since 2017. The metric is “considered a key indicator of the industry’s financial stress.”

The defaults are on the rise as companies struggle to service debt, bring in new money and refinance existing debt. The once-darling shale business model has been under significant scrutiny from Wall Street over the last 18 months, adding to the headwinds for many companies.

Investor interest has faded after years of meager returns while, at the same time, companies struggle to meet their cost of capital with oil prices below $60/barrel.

Private companies and smaller drillers have felt the most pain thus far. These companies “collectively generate a large portion of U.S. oil,” and their distress is indicative of wider distress throughout U.S. shale.

Patrick Hughes, a partner at Haynes & Boone said: “They were able to hang in there for a while, but now their debt levels are just too high and they’re going to have to take their medicine.”

Halcon filed for bankruptcy in August, just three years after it last filed for bankruptcy, due to a production slowdown in West Texas and higher than expected processing costs. The company’s chief restructuring officer (which we guess is probably becoming somewhat of a permanent position after filing bankruptcy twice in 3 years) said the bankruptcy was partly a result of lenders cutting the company’s credit line by $50 million earlier this year after it violated its debt covenants due to too much leverage.

Sanchez Energy also filed for bankruptcy in August, citing falling energy prices and a dispute with Blackstone over assets that were jointly acquired from Anadarko Petroleum in 2017. Blackstone said Sanchez defaulted on a joint deal to develop the assets and, as a result, Blackstone was entitled to take them over.

Other shale drillers, like EP Energy Corp., have also missed debt payments. EP missed a $40 million interest payment due August 15 as it continued to struggle from the debt piled atop of it as a result of an Apollo-led buyout in 2012.

As of Q2 2019, the company had debt to the tune of 6x its EBITDA. The company has said it has to mid-September to make the payment and is considering a “range of options”, including bankruptcy, to deal with the issue.

Lately, the slew of bankruptcies isn’t so much a result of low crude prices, either. In 2016, when crude prices were below $30/barrel, 70 U.S. and Canadian oil and gas companies filed for bankruptcy. Crude prices have nearly doubled since then. Instead, it’s more a result of debt – and the many companies who took on debt after the 2016 slump all face upcoming maturities over the next four years. While just $9 billion is set to mature throughout the remainder of 2019, about $137 billion will be due between 2020 and 2022, according to S&P.

And debt of companies like Alta Mesa Resources remains as risky as it gets. After being handed a $1 billion “blank check” to invest in shale, the tide has turned on the company in a big way.

Paul Harvey, credit analyst at S&P, said: “A lot of companies are highly levered and facing maturities on their debt that I like to call a murderer’s row, maturities are coming year after year.”

According to S&P, the lowest possible yield an investor can earn on a bond without the issuer defaulting stands at 7%, as of July, in oil and gas. That metric is about 4% for the overall market. For junk bonds, such yields are almost 13%. Energy companies have predictably backed away from the high yield market as the cost of capital has increased, with high yield issuances falling 40% from the same period a year earlier. Overall high yield issuances were up 32%.

Tim Polvado, the head of U.S. energy for the Paris-based bank Natixis SA concluded: “Any available capital structure is going to be more expensive than it was a year ago.”

As is the case in many bankruptcies, equity holders could be “all but wiped” in many of these shale companies, while bondholders jockey for seniority and priority as the likely new owners.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com