After a turbulent August, when market volatility meant bond deals were few and far between while traders were soaking up the sun on various Caribbean islands, the bond market came back with a bang on the first trading day of September when a record 20 companies sold $26 billion of bonds on Tuesday alone, taking advantage of the plunge in borrowing costs over the past month to load up on cheap debt.

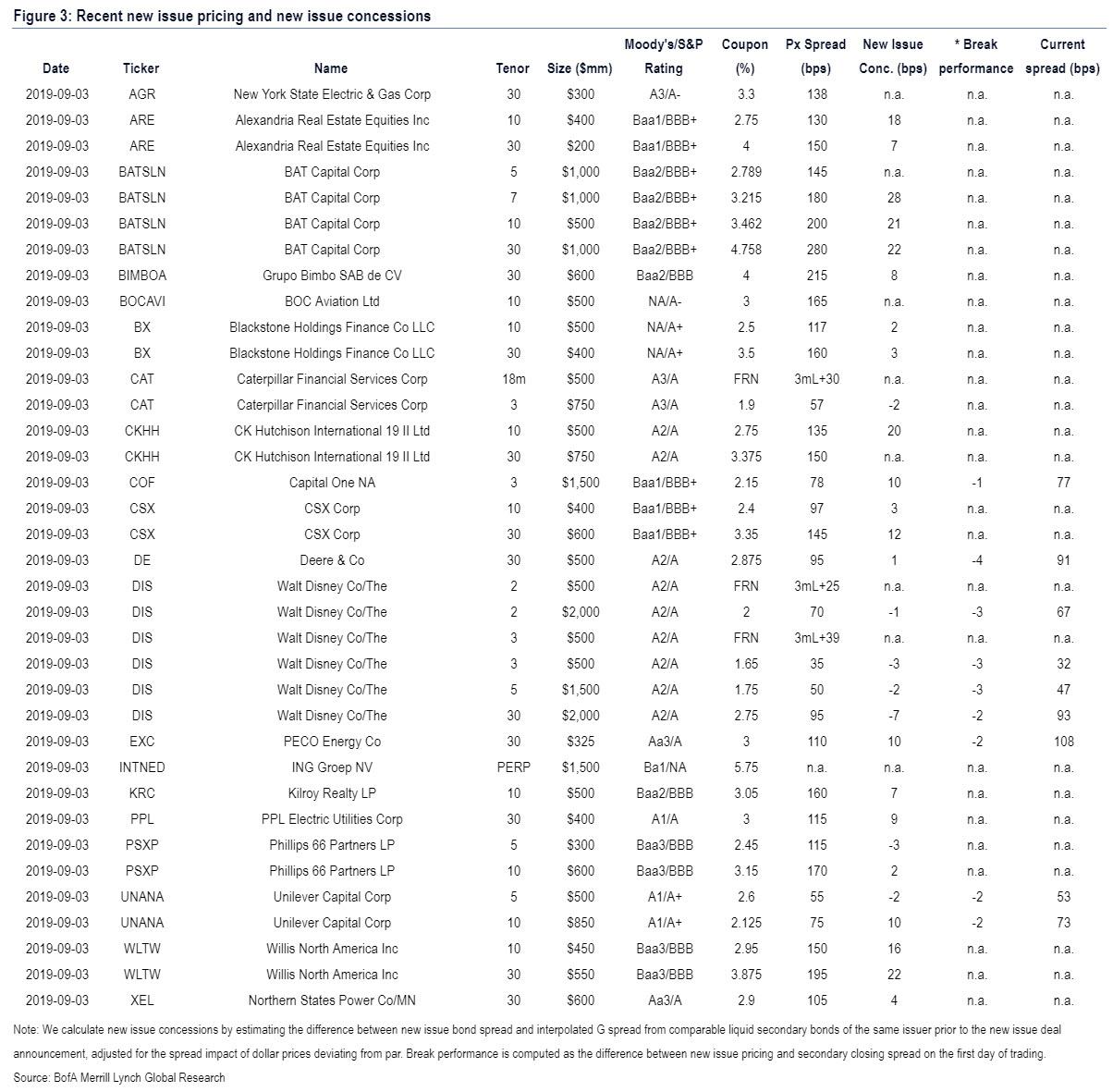

Investment grade companies such as media giant Disney, consumer giant Unilever, E&P icon Phillips 66, tractor maker Deere and industrial bellwether Caterpillar were among the 20 issuers tapping the market, according to Bank of America. Disney alone issued $7 billion of bonds across six maturities; its 30-year bond, the largest tranche at $2bn, sold for just 95 basis points above Treasury yields (a 7 basis point new issue concession) compared with an average of 124bp for an index of 30-year corporate debt. Other companies also took the opportunity to push out the average maturity of their debt by issuing longer-dated bonds: 12 of the bond issues had a maturity of 30 years, while ING went so far as to issue a “perpetual” bond.

Some more details via the FT: CSX, the railway operator, raised $1bn in 10-year and 30-year bonds, in part to redeem debt due in October 2020. Deere & Co will use its $500m 30-year bond sale to help repay debt maturing next month. The bond sold at 95bp above Treasury yields.

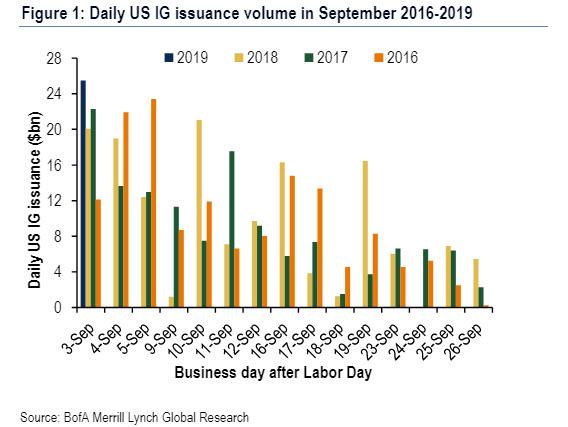

Yet while Tuesday marked a new high for daily issuer count (20 vs. the previous record of 17), it represented only half the $51.5bn record volume priced on Sep 11, 2013, according to Bank of America. Moreover Tuesday’s dollar-volume is very much in the ballpark of what markets typically see after Labor Day. As a reminder, September is typically a busy month for bond issuance as bankers, investors and corporate treasurers return to their desks after a summer lull. This year it follows a particularly quiet period: only $84 billion of new investment-grade bonds were sold in August.

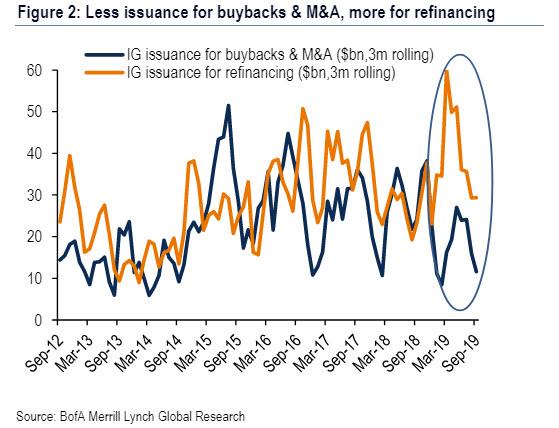

What is also notable is that the new issuance “use of proceeds” appears to be shifting from supporting re-leveraging activities to refinancing in the currently low interest rate environment holds true as $18.7bn of today’s issuance included commercial paper, term loan, short and long-term debt refinancing in the use of proceeds language.

Yet even in this barrage of new issuance, there were some less fortunate names: Hyundai Capital announced a deal during Asian hours but decided to postpone it given crowded market conditions today as well as presumably a country and sector combination particularly sensitive to the US-China trade war.

To be sure, demand was brisk, with the average new issue concession improving to 7.7bps today from 8.5bps two weeks ago, even as the average break performance remains solid at 2.3bps tighter today versus 2.9bps tighter two weeks ago.

In addition, Carlyle Group, Evergy, Pinnacle Financial, Highwoods Realty, Healthcare Trust of America, and Severstal have announced fixed income investor calls this week with possible USD issuance to follow. On the other hand, Danaher priced €6.25bn of Reverse Yankee bonds to fund the acquisition of GE’s biopharma business at an average concession of 35bps versus USD secondary comps.

Curiously, clients had no problem finding space on their balance sheets for the new issue avalanche, and dealer inventories rose by a modest $500mn despite the high new issuance volume.

As the FT notes, with investors piping into corporate debt in August amid a global bond rally, the average yield in a broad index of investment-grade bonds calculated by ICE Data Services dropped from 3.21% at the start of the month to 2.87% at the end. “This is a natural reaction to the bond market rallying so hard,” said Kevin Muir, who also blogs as the Macro Tourist. “We are seeing companies taking advantage of that and borrowing.”

According to Bank of America analysts, the 2019 year-to-date period is the lowest for issuance since 2014. Last week, they predicted that the next month would bring up to $130bn of new bond sales, with around $40bn this week alone, boosting issuance back in line with the average for the past five years.

The potential for new corporate fundraising has been helped by money flowing into investment-grade bond funds in recent weeks. Investors are trying to balance a desire for higher-yielding assets, following a dramatic fall in global sovereign bond yields, while remaining in relative safe areas of the market due to uncertainty over the trade war between the US and China and its potential impact on the US economy.

“There is definitely a huge amount of demand,” said BofA’s Hans Mikkelsen, a strategist at Bank of America. “Foreign yields have collapsed. So foreign investors have no choice but to buy US bonds.

Meanwhile, as noted above, this year investment-grade bond issuance has tilted towards refinancing outstanding debt and away from funding acquisitions or stock buybacks, said Mr Mikkelsen. “The dominant use of proceeds is refinancing now,” the BofA strateigst said. “It’s what I would expect. Companies are not trying to add leverage. Now is the time to refinance into lower yields and extend the maturity of your debt.”

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com