While Bill Dudley may blame Trump for exposing the Fed’s political nature, the market has already figured out what an escalating trade war with China means in practical terms: much lower rates – in fact as shown below consensus is for 120bps of rate cuts by the end of 2020 – which results in much easier liquidity conditions and higher asset prices (as BofA’s Michael Hartnett puts it “trade war thus far bullish via lower rates rather than recession“).

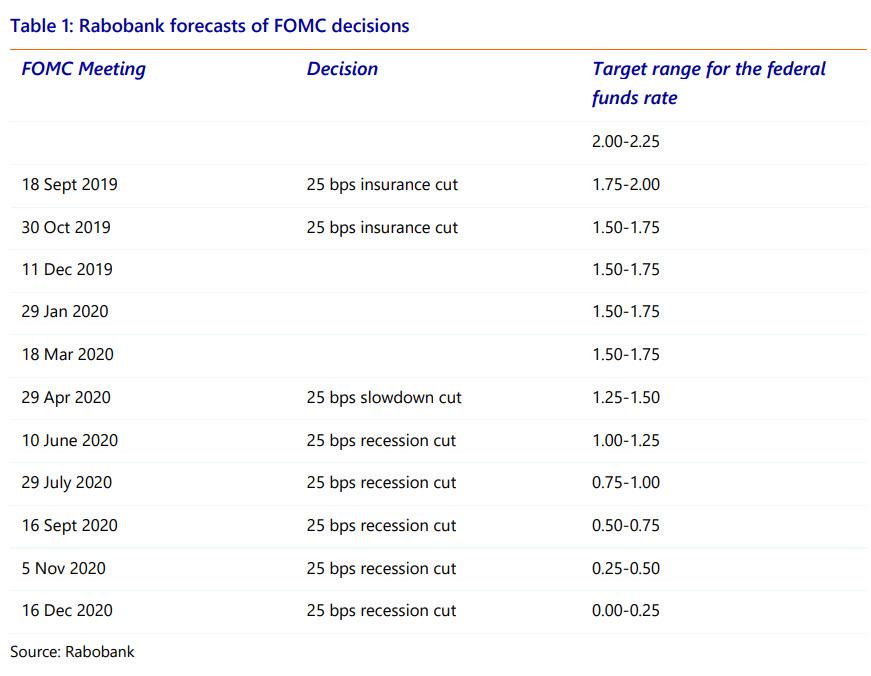

In fact, one may argue that the market is too sanguine, and that as Rabobank recently predicted, the Fed will cut back to ZIRP by December 2020, when after 8 rate cuts, the fed funds rate is back to 0.00-0.25%.

Obviously, the biggest question is whether the Fed will stop there, or – like the SNB, ECB, BOJ, and so on – will continue into negative territory.

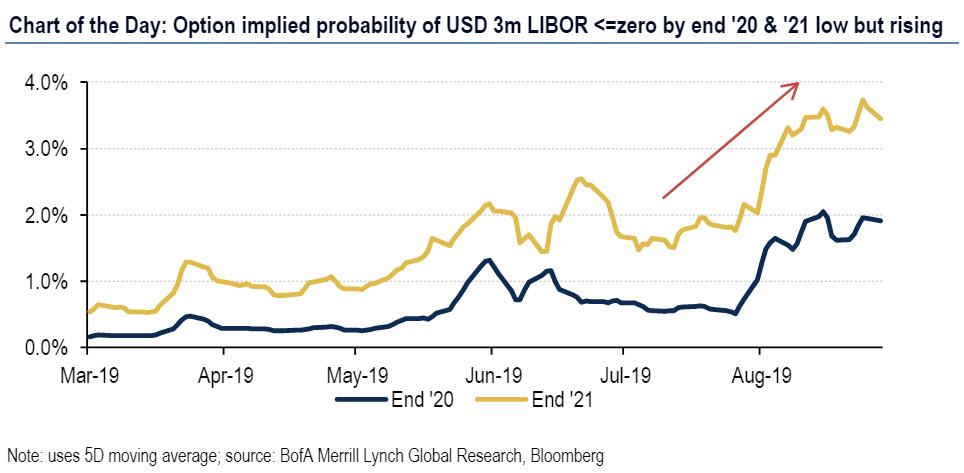

And while negative rates generally remain a taboo topic in the US, it may come as a surprise to some that in addition to aggressively pricing in the return of ZIRP, the rates market now assigns low but increasing odds the Fed will need to take rates negative in the next few years. As the following chart from Bank of America makes clear, the option implied odds of subzero USD 3M Libor has risen to a non-trivial 2% by the end of 2020 and just shy of 4% by 2021.

What’s going on here?

As BofA’s rates strategist Mark Cabana writes today, “the Fed has only eight remaining 25bp cuts before reaching zero and the market baseline is that the Fed will expend roughly five of these by early 2021, leaving it with only three remaining.” This prompts BofA to suggest that “the Fed not only faces challenges from its limited conventional easing arsenal, but also from an increasingly limited unconventional easing arsenal.”

One major hurdle the Fed is facing is the “persistently flat”, as one may call the inverted yield curve, which is a new limitation on the Fed’s unconventional easing arsenal, one which “limits the impact of UST QE or UST twist. Each of these tools was originally conceived to compress longer-dated UST “term premium” to stimulate the economy via lower borrowing costs. However, a persistently flat yield curve may make such objectives moot. Persistent macro uncertainties that keep the UST curve flat could increase the odds the Fed finds itself more rapidly at the “outer rim” of its unconventional easing arsenal.”

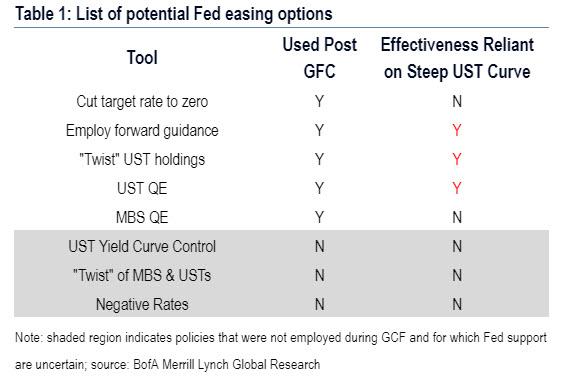

This, according to Cabana, raises risks the Fed may need to use other unconventional tools to combat a more severe downturn including yield curve control, “MBS vs UST twist”, and – as the market increasingly is pricing in – negative rates.

* * *

Taking a step back, if all goes according to plan, the Fed will cut rates – 5 or 6 times over the next 15 months – and the economy will reboot itself, with GDP rising above 2%, perhaps as high as 3%. Alas, the odds of such as “priced to perfection” world are virtually nil, which then leads to a far more unpleasant discussion: what are the Fed’s options in case “Plan B” is needed.

According to BofA, assuming the Fed faces a sufficiently severe macro shock to cut rates all the way to zero, the Fed will be expected to once again employ unconventional monetary policy easing tools. And, as Cabana posits, the market likely believes the sequencing of these tools will be built on the post-global financial crisis playbook, though additional options may be considered. Such additional “outer rim” easing options may include yield curve control, twist of MBS vs UST holdings, and ultimately negative rates.

One “outer outer rim” alternative would be for Congress to amend the Federal Reserve Act to allow for the purchase of non-government guaranteed assets such as stocks (something both the BOJ and SNB have been doing for years); however it is worth noting that this action is beyond the scope of the Fed to solely decide, and will likely be codified around the time the socialist president of the US – whoever she may be – aggresively pursues the Green New Something and launches MMT/helicopter money.

One look at the table above would suggest that the Fed still has many options for unconventional easing, especially when considering that the Fed will likely employ enhanced forms of forward guidance (such as average inflation or price level targeting). However, as BofA explicitly cautions, “the Fed’s easing playbook is somewhat curtailed if the yield curve remains flat.“

Why? Stated simply, a flat yield curve near zero is “problematic” for some Fed unconventional balance sheet policies (eg, twist, QE) since they are designed to lower longer-dated interest rates and could push the yield curve into inverted territory, per BofA. Here, Cabana cites one recent Fed study which suggests the Fed’s post-crisis balance sheet policies lowered the US 10Y yield by 100bp; So if the fed funds reaches zero in coming years a similar-sized unconventional easing would risk inverting the UST curve. This is even more problematic since the yield curve is already inverted. Needless to say, the Fed has no interest in pushing the yield curve (even more) into inverted territory since it (1) signals concerns over the longer-run growth outlook and (2) creates financial intermediation and profitability concerns for banks and pensions.

It is worth noting that just last week the San Fran Fed published a study warning against negative rates by bringing up the feedback loop observed in Japan, where negative rates only pushed inflation expectations to record-er lows. Here, BofA picks up and notes that the Bank of Japan’s experience with very low interest rates and a flat curve, which have complicated its ability to continue implementing unconventional monetary policies. BoJ Governor Kuroda sated in 2016 that an “excessively lowered and flattened yield curve could weaken the transmission … of monetary easing by squeezing banks’ profit.” In addition, a decline in expected rates of returns of insurance and pension products may have an adverse impact on consumers’ confidence.”

These considerations led the BoJ to adopt a policy of yield curve control (YCC) whereby it targets a specific yield level as opposed to a quantity of bonds to purchase. It is also why the BoJ has worked to steepen the back of its yield curve to generate more favorable conditions for banks and pensions. Even with these modifications to BoJ policy implementation, there are still risks it will need to abandon its goal of monetary base expansion to prevent a problematic flattening of the JGB curve.

In the US, the very flat and low level of UST rates has already been met with the US Treasury proposing the issuance of ultra-long bonds in an attempt to help steepen the curve (whether this happens is a different matter).

So with the US Treasury curve flat (and inverting), Bank of America believes that could “accelerate Fed move to the “outer rim” of easing options” to wit:

If the Fed cuts rates to zero and faces a flat curve, we see risk it rapidly exhausts its other unconventional monetary policy tools to more seriously consider “outer rim” easing options. These would likely include having the Fed concentrate balance-sheet expansion on agency MBS and more seriously consider new easing options such as yield curve control, “MBS vs UST twist”, and potentially negative rates.

We present some of Cabana’s thoughts on each of these “outer rim” easing options below:

- Yield curve control (YCC): the Fed would likely model any YCC strategy after the BoJ and focus on maintaining rate levels below a certain threshold. Such an approach would focus on the price of USTs as opposed to the quantity of UST purchases. Governor Brainard discussed this possibility in a May 2019 speech, but suggested focusing purchases at the UST front end. Pros: Fed purchases can be limited as long as rates are below threshold, the Fed can manipulate yield curve to mitigate financial intermediation issues. Cons: Fed loses control of its balance sheet during YCC.

- MBS vs UST twist: the Fed could theoretically buy agency MBS while selling USTs. The Fed might consider such an approach to stimulate the housing market and tighten mortgage spreads while limiting the risk of deliberately inverting the yield curve (recall, agency MBS purchases would remove duration and convexity risk from the market which could place downward pressure on USTs; to limit the downward pressure on US rates the Fed could sell USTs). Note this option is more theoretical and has not been discussed by Fed officials. Pros: stimulates the mortgage market, does not increase Fed balance sheet size. Cons: increases credit and convexity risk, further exposes Fed to criticism of credit allocation.

- Negative rates: prior Fed comments on negative rates have been lukewarm at best. Fed officials are well aware of the mixed results from negative rates abroad and the financial intermediation issues of negative rates for money market functioning (eg, money market mutual funds, fed funds trading implications, etc), pension solvency, and bank profitability. The Fed would also need to clarify its legal authority to charge banks for its reserve holdings. We believe negative rates in the US are a possibility and in May 2016 then-Fed Chair Yellen did not rule the Fed potentially utilizing negative interest rates. Pros: allows the Fed to ease policy when facing the zero bound and a flat yield curve. Cons: financial intermediation issues, market functioning concerns, potential political backlash.

Ultimately, none of these will likely be powerful enough to prevent the market from crashing once speculation swirls that the Fed has reached the policy impotence level of its lifecycle. At that point the Fed may have to borrow a page out of the SNB and BOJ playbook and purchase stocks (and perhaps other assets) directly in the open market.

For this to happen, Congress would need to amend the Federal Reserve Act to allow for the purchase of non-government guaranteed assets; as such an action is clearly beyond the scope of only the Fed. As BoFa explains, “the Federal Reserve Act’s discussion of open market operations states that eligible collateral must be a “direct obligation of, or fully guaranteed as to principal and interest by, any agency of the United States.” As such, BofA believes that “Congress would need to amend the Federal Reserve Act to allow for the Fed to purchase a broader range of collateral as a part of its standard open market operations to include credit or potentially equities.”

Will Congress go so far as to amend the charter of the Fed? With the S&P above 2,000 not a chance; but wait for the S&P to tumble to 1,000 or below and you will be amazed how quickly Congress can reach a bipartisan decision to keep equities propped up, especially since as the ancient Alan Greenspan correctly noted on CNBC, it is the market that now determines the state of the economy, not the other way round. Of course, once the Fed starts officially and openly buying stocks, it’s game over for efficient capital markets and Soviet style central planning will be name of the game until the system finally collapses under its own weight.

Until then, we highlight BofA’s conclusion that “market participants should be aware of the potentially limited easing arsenal of the Fed if it has to take rates to zero and face a flat UST yield curve.” In such an environment, the Fed would find its policy space is limited given relatively ineffective forward guidance and a reluctance to invert the curve via UST QE or twist. The flat – or rather inverted – curve would propel the Fed toward the “outer rim” of its unconventional easing policies and shorten the distance between when it might employ yield curve control, a “MBS vs UST twist”, or negative interest rates.

Which is why keep an eye on those “low” odds of a subzero 3M Libor in 2021: this time next year, we expect that probability to be at or above 50%, which would make a Eurodollar bet on negative rates in 18-24 months one of the most lucrative trades ever.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com