Analyst With $0 Price Target On Tesla Says Growth Story “Clearly Over” After August Delivery Estimates

While Elon Musk has been busy nervously trying to write off Porsche’s Taycan and apparently falsely claiming that he has time booked for the Model S at the Nurburgring next week, newly released estimated delivery numbers for August have the company’s skeptics smelling blood.

For instance, Ed McCabe of TLF Capital, who has a $0 price target on Tesla, according to Business Insider.

For him, the newly release estimates of Tesla’s August delivery numbers, published by InsideEVs last week, show that “organic demand is extremely weak”.

The blog posted estimates of 1,050 for the Model S and 1,825 for the Model X – both meaningfully lower than August 2018. For the Model 3, the automaker is estimated to have delivered 13,150 vehicles, down from the 13,450 in August 2018.

McCabe wrote in a report Thursday: “While there is no reasonable justification for a structurally unprofitable and horribly managed company to enjoy a $40 billion market cap, proponents of the stock tout its growth. That story is clearly over.”

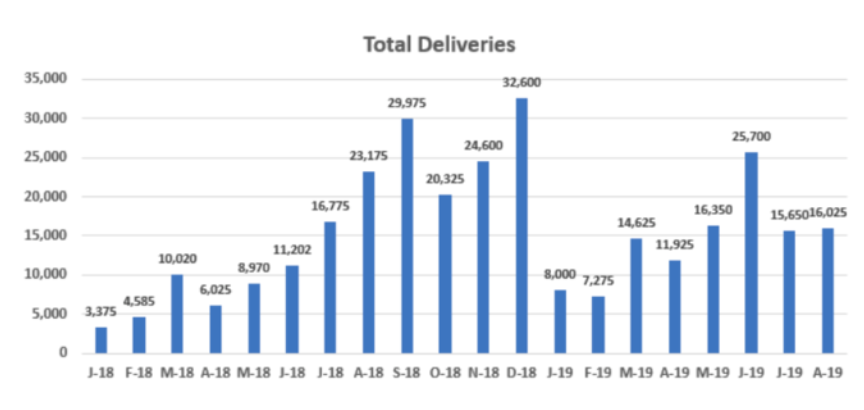

But these weak numbers have done little to have Tesla update its guidance. In its most recent quarterly update, the company reaffirmed guidance of 360,000 to 400,000 deliveries worldwide for the year. These numbers haven’t been updated since.

Total sales stood at about 158,000 halfway through the year, which is less than half of the low end of the company’s guidance, meaning the company would need to see robust production in the second half of the year.

That doesn’t look to be the case, given the August estimates.

McCabe said:

“To reach the low-end of guidance Tesla needs to average 103K deliveries in the remaining two quarters of the year. To reach the high-end it needs to average 123K. Both would exceed Tesla’s second quarter record. Neither will happen. It’s also irrelevant. The company is structurally unprofitable. The more cars Tesla sells the more money it loses.”

He concluded his note last week by stating: “Remember that the staggering losses and cash burn have occurred while Tesla has had the electric vehicle market essentially to itself and Musk has promised imminent and sustainable profits and cash flow generation multiple times. Back-to-back quarters of negative revenue growth, increasing losses, and cash burn will make plain to even the most ardent believers that Tesla is not a viable business.”

Tyler Durden

Mon, 09/09/2019 – 15:14

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com