How 5G Will Change Your Life

As Saxo Bank’s Peter Garnry recaps yesterday’s Apple event, the company introduced its iPhone 11 which now comes in three different versions with cheapest version selling for $699 which a price cut aimed to lure smartphone buyers back into Apple’s realm (at the expense of a drop in Apple’s ASP). The stock market reacted positively to the news, but criticism has surfaced that Apple is falling behind as the new iPhone 11 is not coming with a 5G integration which makes almost impossible for Apple to have growth in China where local smartphone makers such as Huawei is introducing smartphone with 5G integration. Beginning in the second half of 2020 this will be a constraint for Apple.

Why does 5G matter?

To answer that question, we have excerpted from a recent Deutsche Bank report explaining “how 5G will change your life.”

Amidst hype and high expectation, the 5G roll-out has begun. It recently launched in Korea, while the US, UK and others have commenced trial versions and China has said it will soon grant commercial licenses for its network. To take advantage, companies such as Samsung and LG have launched 5G smartphones. In total, $160bn is being invested annually in the construction of 5G networks according to GSMA, the mobile network operators’ association. It expects 5G to contribute $2.2tn to the global economy in the coming 15 years, just a little less than the size of the UK economy.

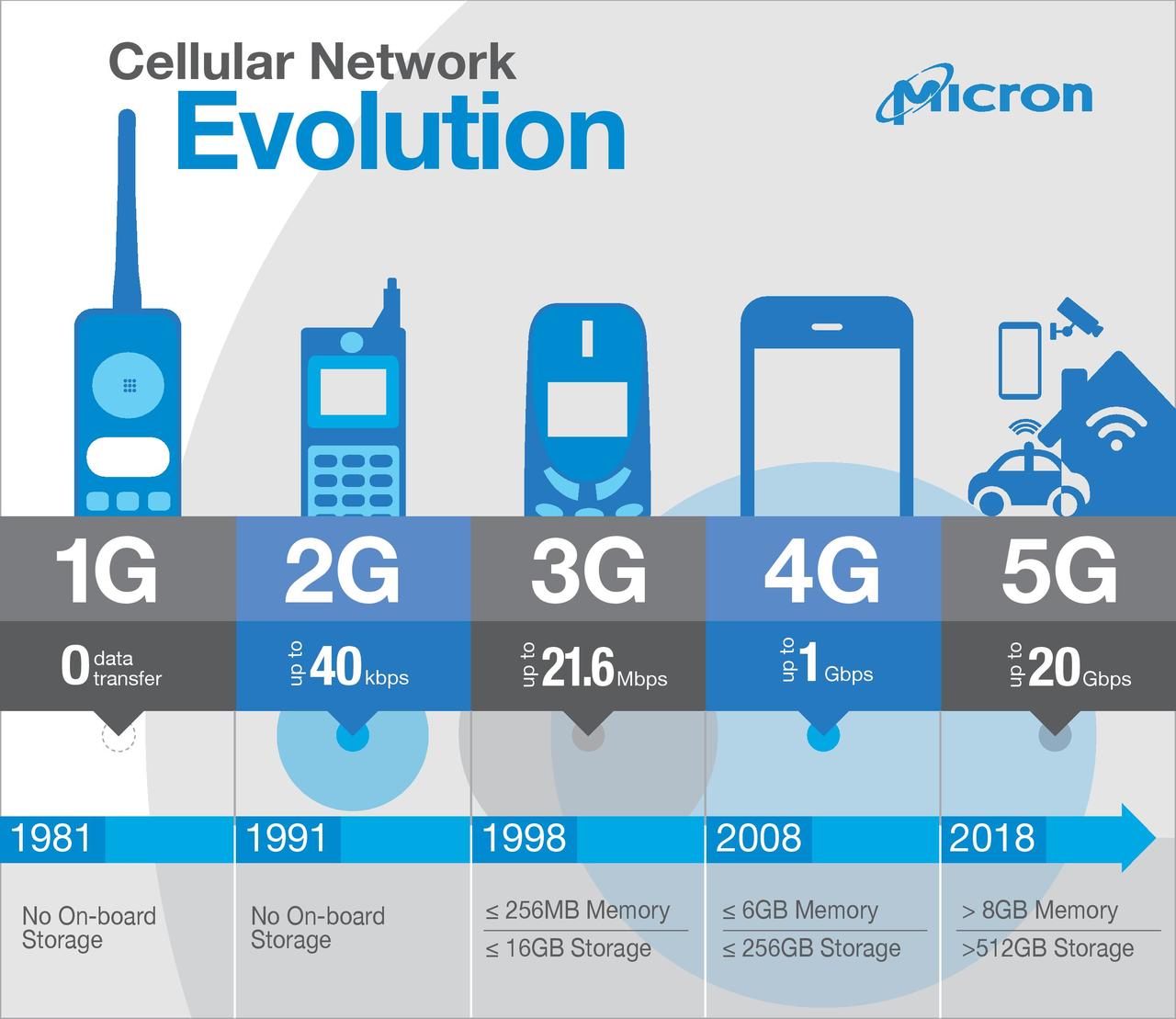

Yet, for all the fanfare, many in the industry are quietly nervous. Among other things, one of the biggest concerns is that there is no ‘killer application’ ready and waiting to be unleashed that requires the 5G network. That trepidation stands in direct contrast to the 4G and 3G roll-outs. The former allowed good-quality streaming video and the latter photo sharing and other types of multimedia. Both were a boon for hardware, software, and network providers.

This is backed up by our dbDig primary research1 which shows that in the US, only ten per cent of customers are prepared to pay $6 or more for 5G services and one-quarter of customers say they are not prepared to pay any extra at all. Yet when we look at China a different picture emerges. Indeed, two-thirds of Chinese customers are willing to pay for 5G if it means quicker uploads to social media or the ability to play mobile games with very low load time. That is double the proportion of US customers who are willing to pay for the same services. It seems part of the reason is that the Chinese are far more likely to report issues with signal strength when they are in rural areas. Given smart phones have become a crucial engagement tool in rural Asian areas (see our piece titled, ‘The emerging market technology skip’) the willingness of the Chinese to upgrade is not surprising. However, the future for 5G smartphone service in developed markets seems more uncertain.

On top of the concerns about user uptake are the voices of health professionals, environmentalists, and politicians who worry about radiation emissions. Take Brussels, for example, a city with very strict radiation regulations. There, a pilot 5G project was halted on health grounds with the environment minister proclaiming, “The people of Brussels are not guinea pigs.” In Switzerland, authorities have commenced a 5G radiation monitoring programme. And all this comes before considering the stern political rhetoric that has accompanied the choice of Chinese suppliers for 5G infrastructure (see our piece titled, ‘The politics of 5G’).

So given that many smartphone users are wondering whether they should bother upgrading to 5G, the network providers cannot be blamed for wondering just how aggressively they should spend the money to roll out 5G networks. Consider that 5G works on a much shorter wavelength than 4G. Because of that, it cannot travel as far as the longer wavelengths of earlier networks. It also has more trouble penetrating the thick walls of buildings. To deal with this, network providers will need to install perhaps five times more base stations than they have with 4G, and some of those stations may be more costly to build. The extra cost, then, is significant and the initial roll-outs will almost certainly be confined to densely-populated urban areas.

So, is it a situation of “build it and they will come”? Will the roll out of 5G spur a frenzied development of 5G-specific applications in a similar way to how 4G catalysed a plethora of video-related products? Or will network providers need to see evidence of a demand for 5G and a willingness to pay before they can justify the expense of rolling out 5G beyond city centres? While we wait for the ‘killer app’ to be developed, the answer is it will probably be a bit of both until a virtuous cycle is established.

The thing is that unlike the move to 3G and 4G, some of the most important uses of the 5G network are unlikely to take place on a smartphone, at least for now. Instead, the initial uptake in 5G will likely be driven by the manufacturing industry and public utilities, not individual consumers. Some countries have made significant plans for this. Germany, for example, has reserved a 100 megahertz band between 3.7 and 3.8 gigahertz to be used exclusively by industrial companies for their local networks. German company Siemens is one of the companies at the forefront of 5G industrial applications (see our piece titled, ‘Siemens case study’).

Some call it the Industrial Internet of Things, others Industry 4.0. Either way, the story is the same. The IIoT is a network of intelligent industrial devices, that is, machines that have in-built sensors that collect data and communicate with each other. This allows them to adjust how they perform a task to what is happening elsewhere in the factory, or inform a human of a certain need to make the process more efficient. The idea is not new, but so far, ‘smart factories’ have been extremely limited. One key problem is the latency of existing 4G networks. Although it may be small, just a second’s delay for a precision manufacturing job can result in serious damage to the product. The 5G network with latency at the lower end of the millisecond range will go a long way to fixing that. For example, a robot arm will be able to stop itself immediately if a camera identifies a foreign object on the conveyor belt.

The very-low latency of 5G opens up the possibilities for using machines in remote locations or where it is difficult to lay cables. For example, industrial companies use IWLAN networks for the monitoring of power networks on islands or the identification of leaks in oil and gas pipelines.

Reliable wireless connectivity will also enable autonomous robots on the factory floor. These will be able to move themselves to where they are needed, particularly in cases where a breakdown or bottleneck occurs at one point on the production line. It is true that factories are currently configured for cable-connected robots and reorganising the factory to allow for autonomous robots will be expensive. But in time this will change as the design of many factories is currently very inefficient as they are frequently back-solved to account for the requirements of cable-connected robots. Not only that, but it will also allow for more mobile human staff in factories. Currently, most control panels are wired as they are generally deemed too critical to be left to a wireless connection. Reliable 5G connections will change that. Furthermore, ultra-low latency augmented reality applications will also be enabled for technicians.

Of course, industrial markets are just at the beginning of their digitisation journey. As factories begin to implement 5G, the network will grow. That will allow control to be increasingly decentralised. It will also allow for a link to be made with suppliers. This is great news for those that engage in just-in-time inventory processes, or wish they could. For example, if a supplier can be notified of a factory delay the moment a machine detects it, shipments from that supplier can be delayed to accommodate. This also trims energy costs and reduces throughput times.

Another application factory owners have long desired is predictive maintenance. Apart from the speed and latency benefits of 5G, the network is much better than 4G at handling multiple devices at once. In fact, 5G makes it possible to transmit the data generated by one million IoT devices per square kilometre in a factory complex. That should cover the complete production line of most factories and their associated temperature measurement and flow sensors. Indeed, by some estimates there will be 80 billion connected devices generating 180 zettabytes of data in 2025, 45 times the amount of data generated in 2013.

All that data allows for the strain on components to be better analysed and the cost savings can be significant. This is best illustrated with an example. Take a brewery which has thousands of valves that secure the smooth transfer of liquid through the machines. From time to time, one will break causing downtime or, even worse, a contamination of the product. To avoid this, the norm is to exchange all valves at specific intervals based on historic projections of breakage rates. In a 5G smart factory, sensors can measure the actual strain on the valves and alert the human controllers when a specific one needs to be replaced before it breaks and without throwing away otherwise perfectly good valves.

Further down the road, 5G technology should accelerate the adoption of industrial and enterprise mobile internet use case beyond factories. One example is the opening up of new technology acceptance models for mainstream consumer internet companies to expand into enterprise solutions. In fact, given the potential applications, this will likely become a mega-trend. The US will likely lead the way. To put the figures in context, the technology software and services industry represents one-third of all US listed technology companies’ market value. In North Asia by contrast, the figure is under ten per cent and it is difficult to identify many strong enterprise software companies in the region. That said, it will not be all one-way traffic from North America. China has strong ambitions to build stronger digitally-connected infrastructure and aims to become less reliant on foreign and overseas technology for enterprise software.

While the first applications of 5G may be in the industrial space, one of the most anticipated consumer-facing applications is the autonomous car. The necessity is the close-to-zero latency of 5G – critical if autonomous cars are to be linked together and make split-second decisions. Although the world is some way from widespread adoption of autonomous cars, they have the potential to offer safety and environmental benefits with 5G as the backbone. They will also likely be the most visible part of a smart city (see our piece titled, ‘Who wants to live in a Smart City’).

Other consumer-facing applications currently under development include remote surgery which requires very-low latency services. On the entertainment front, virtual reality films will require the high speed of 5G networks. Consider that a standard two-hour film streamed in high-definition on Netflix will consume four gigabytes of data. The same film in virtual reality will use ten times the amount.

To examine just the consumer and industrial benefits of 5G is to merely see one side of the coin. The other is which companies and industries will benefit and, crucially, when.

In the first instance, it is the hardware equipment makers that should benefit as they are the ones to construct the infrastructure to lay out the 5G network. Then it will be the turn of the software makers. History shows that the providers of content, such as video and games, have benefitted at this point as digital content tends to be more intuitive from a business model standpoint and thus has faster adoption. Following this are businesses that require more infrastructure support. With 3G and 4G, this included the e-commerce and food delivery industries.

The consumer internet industry is likely to be a ‘late cycle’ beneficiary of 5G technology. Internet companies tend to identify and release new innovative services and content once there is sufficient reach and penetration. Thus, a sufficiently installed 5G base is a likely pre-requisite for the consumer internet industry.

Yet, the industry will also note how market valuations reacted to the 3G and 4G upgrades in the past. At first, investors were pessimistic, fearing the unknown costs and worried about the extent of adoption of the applications enabled by the technology as well as cannibalisation. These fears weighed on market valuations early in the cycle before becoming a tailwind later. This was particularly noticeable in Asia. During 2011 and 2012, major Asian internet stocks reached then-historic valuation lows in China, Japan, and Korea. In China, the market valuation of these large listed stocks remained flat in 2011 despite the jump of one-third in the underlying earnings outlook. In the more mature Japanese market, the aggregate sector’s market value fell eight per cent despite a six per cent increase in earnings.

As the industry decides the extent of its initial roll-out, it will be cognisant of the lessons learnt from the transition from 3G to 4G. Then, streaming video was the ‘killer application’ that was ready to go as soon as the 4G network was installed, and customers were enthusiastic in their take-up. The net consequence was lower earnings for consumer internet companies as the increase in bandwidth and content procurement costs skyrocketed, relative to the periods where text and static image-based content consumption were mainstream. In other words, the early phase of improving network quality was a cost that wracked on the nerves of investors. It would be safe to assume telecommunication executives will use this experience and temper their enthusiasm for an immediate wide-spread 5G roll out.

But despite the nerves of suppliers, the concerns of health professionals, and the political complications, the tangible benefits of 5G networks, will likely become commonplace far sooner than many expect.

Tyler Durden

Wed, 09/11/2019 – 22:25

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com