“This Move Is Incredibly Painful”: What’s Next For The Historic Quant Carnage?

As noted overnight, when it comes to the ongoing “quant carnage” which has manifested itself in a historic rotation out of the momentum factor and into value/low vol stocks, JPMorgan’s head quant Marko Kolanovic predicted that “the value rotation can continue and the broad market could move higher going into October negotiations, and if real progress is made, continue into a more sustained rally.”

So, setting the stage for another quant clash today is Morgan Stanley’s own, and highly respected, Quantitative and Derivative Strategies team, which disagrees with Kolanovic’s forecast for a lengthy factor mean-reversion, instead arguing that the bulk of the momentum selloff (and value short squeeze) is almost, or 75% over, even as QDS thinks that there will likely be additional (but slower) unwinds over the next few weeks.

Pointing out what most traders already know, MS notes that “this move is incredibly painful” because both the longs and the shorts are moving counter to positioning, as the long leg of Momentum (reflective of consensus longs – Tech, Defensives) is selling off and the long leg (reflective of consensus shorts – Cyclicals, Value) is rallying. As already discussed overnight, this is an incredibly rare occurrence: over the last week, the long leg selloff has been a 1 standard deviation event, while the short leg has rallied 4 standard deviations. According to Morgan Stanley, “there have only been 7 other weeks since 1999 where both the long and the short leg converged by more than 1 standard deviations each.”

Which leads us to the next obvious question: echoing what Marko Kolanovic said was the number one question from clients in light of such a historic move, namely “when will this end” in the aftermath of another nearly exactly flat day for the S&P 500, and another bloodbath for momentum, Morgan Stanley’s QDS head Chris Metli writes that history suggests the momentum selloff is 75% done, with some residual, if shallower, unwinds over the next few weeks. Specifically, the four factors governing the unwind according to the MS strategist remain: i) volatility (VaRs), ii) P/L, iii) the calendar, and iv) fundamentals.

- Higher portfolio volatility (VaR) means less ability to take risk, and all else equal this should mean lower leverage and a continued de-grossing. Whether a quant fund explicitly managing to volatility or a discretionary manager watching VaR risk limits, all investors are sensitive to higher volatility in their portfolio (and yes, portfolio volatilities are higher despite VIX not moving here).

- Most investors are still comfortably up on the year, which should slow a de-grossing. But given the size of this P/L shock and a rising focus on year-end, investor sentiment is poor and ability to buy dips is deteriorating.

- In Morgan Stanley’s client conversations over the last two days, most investors are looking at this largely as a positioning-driven move, and not seeking to structurally change their portfolios. “This means that without a fundamental catalyst, this unwind is likely on the order of weeks instead of a multi-month regime shift”, according to Metli.

- That said, portfolios are fragile – should there be a fundamental shock, this could continue to be very ugly and last much longer.

As a result, Morgan Stanley believes traders should be sensitive to other potential accelerants of an unwind:

- The unwind could put more pressure on quant P/Ls, lessening their ability to provide liquidity and market making services to the larger market. The underperformance of sector-neutral momentum versus momentum that has sector tilts (sector-neutral more quant vs sector-tilt more discretionary) is worrisome here, according to MS.

- CTAs and Risk Parity funds that are long bonds could need to sell if bond yields continue to rise, pushing bond yields higher still which could exacerbate the short squeezes in Value and the laggard leg of Momentum.

- Derisking leading to more aggressive selling of longs, which can put pressure on broader markets and impact a broader set of investors (i.e. a replay of 4Q18).

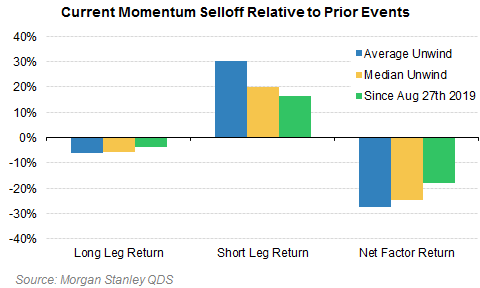

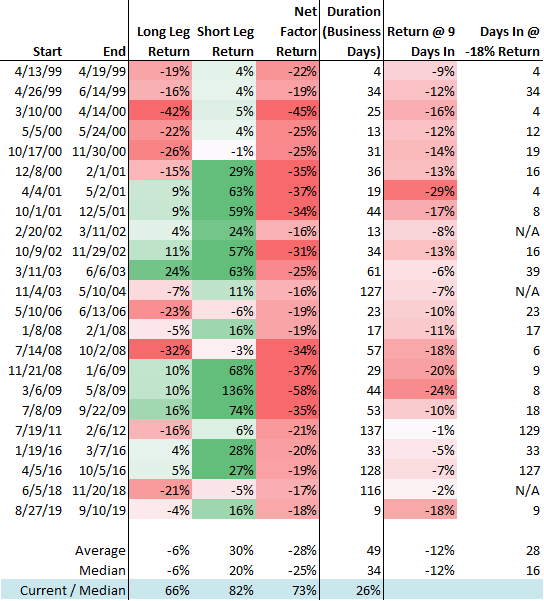

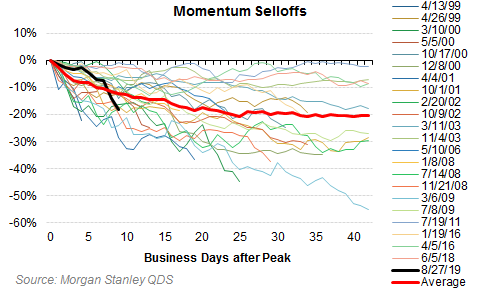

With that in mind, here is how the unwind looks so far compared to prior moves:

The median momentum move from peak to trough typically lasts 34 trading days and sees a -25% return (of which -20% comes from a rally in the short leg). This selloff has lasted only 26% of the typical duration of a selloff, but has already moved 75% of the way to the median in terms of price.

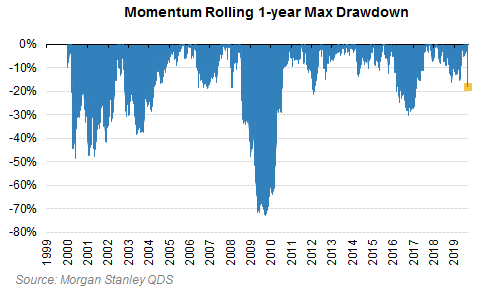

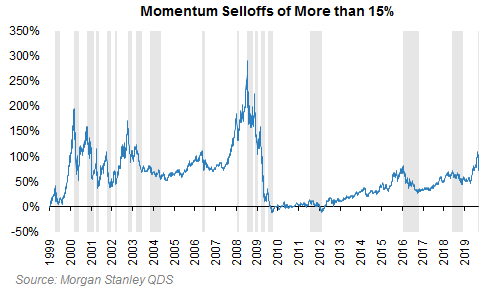

The above periods are selected by taking selloffs of 15% or more, separated if there was a 10-15% rally in between. But some of these declines can cluster, and cumulative momentum declines can get much worse with historical max drawdowns from peak of -30% or more.

This selloff has been very violent – tracking worse than average and worse than all but 3 prior declines at 9 trading days off the peak.

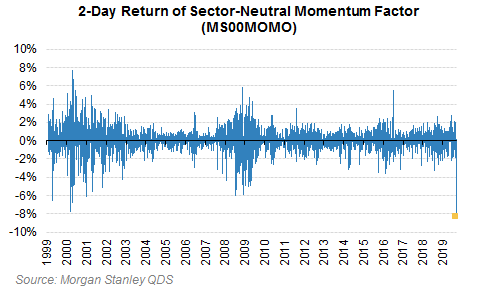

The two day move in sector-neutral momentum (MS00MOMO) is now the worst on Morgan Stanley’s records (back to 1999).

Other measures of momentum (non-sector neutral, MSZZMOMO or the Dow Jones index) aren’t quite as bad but still rank in the worst handful of observations on record.

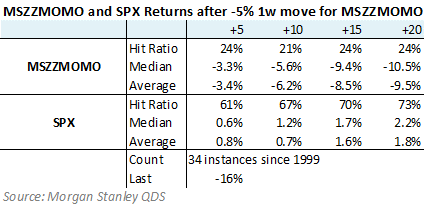

What typically happens to Momentum following a selloff of similar sharpness? It depends on how you look at it. When MSZZMOMO has sold off more than 5% in any given week the factor typically continued to sell off over the following few weeks.

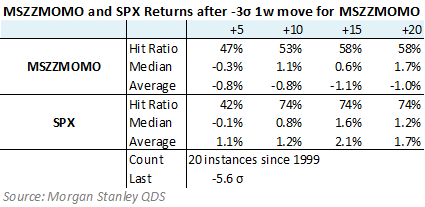

But normalized for the vol environment, following 3-standard deviation Momentum selloffs subsequent returns were positive more often than not (although with a big left tail from a few very negative observations).

Notably SPX returns were typically positive after large Momentum declines, either way you measure it.

Yet while JPMorgan and Morgan Stanley disagree on the duration of the current move, they both agree on one key feature of the recent violent whiplash: namely, that this move is incredibly painful because both the longs and the shorts are moving counter to positioning – the long leg of Momentum (reflective of consensus longs – Tech, Defensives) is selling off and the long leg (reflective of consensus shorts – Cyclicals, Value) is rallying. In fact, according to Morgan Stanley, over the last week the long leg selloff has been a 1 standard deviation event, and the short leg has rallied 4 standard deviations. And the punchline: “there have only been 7 other weeks since 1999 where both the long and the short leg converged by more than 1 standard deviations each.”

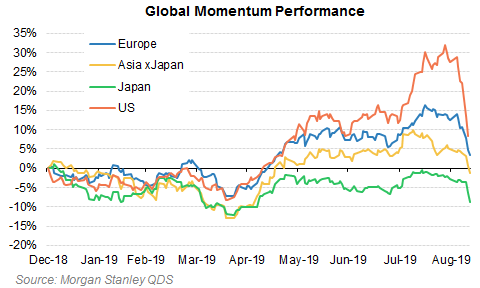

Yet the disagreement between the two quants prompts reasserts itself as Metli issues a warning to Kolanovic, who sees a continuation of the current move as a bullish outcome, one which will ultimately lift most of the neglected risk assets: to the Morgan Stanley strategist, that could not be further from the truth, because “what started with simple short covering has spread into long selling, and the momentum unwind is now global. This means it is impacting a broader array of investors and could drive spillover into overall market if it persists.”

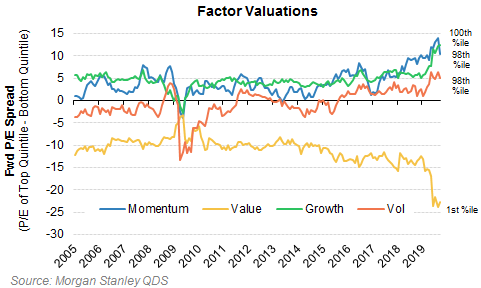

In parting, Morgan Stanley notes that while the price action has been violent, and the likelihood of a protracted move is small, the bank’s quants warn that only a small part of the excesses it flagged as risks in “What if Everyone is Wrong?” have been worked off. As such, factor valuations still remain painfully stretched…

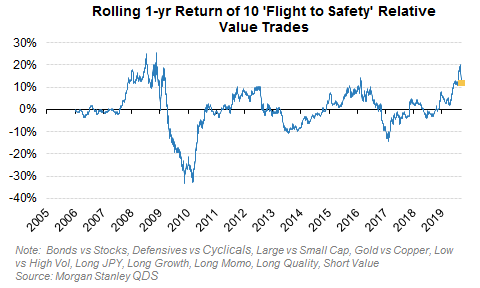

… and the flight to safety trade has hardly been fully unwound.

At the end of the day, it all goes back to central banks, and how much longer they will be able to delay the moment of historic mean reversion, i.e. to before the moment where central banks became equity market activists, and which – if Albert Edwards is right – will send the S&P back to the “generational low” of 666, if not lower.

Tyler Durden

Wed, 09/11/2019 – 18:05

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com