Turkish Lira Surges After Central Bank Cuts Rates More Than Expected

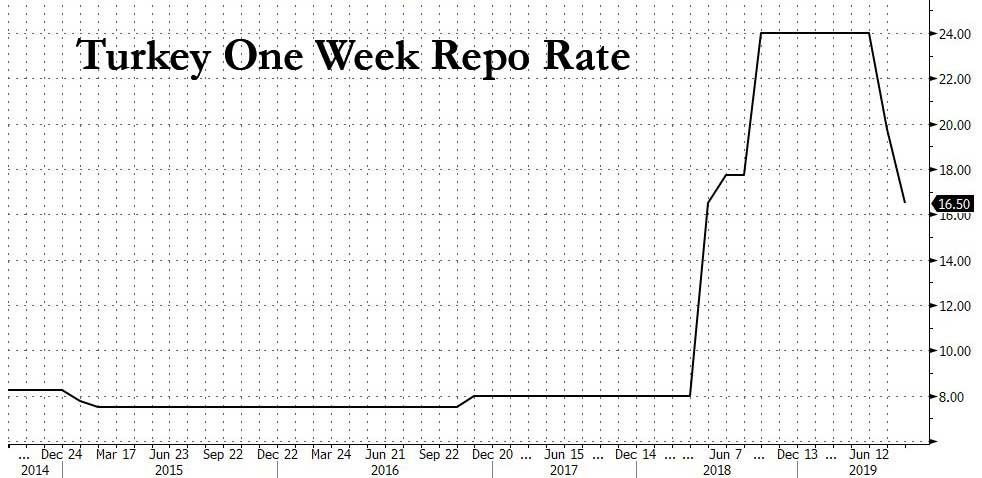

While the Turkish lira’s status as the world’s favorite carry currency is disappearing with every central bank rate cut, today’s news that the CBRT cut rates by a more than expected 325bps from 19.75% to 16.5% (consensus expected a 17.25%), although less than the whispered 500bps (following Erdogan’s warning that a major rate cut was coming), and down from a recent high of 24%…

… was enough to send the USDTRY tumbling – at least in initial kneejerk reaction – from 5.75 to 5.6830, after the central bank forecast inflation dropping beneath its July forecasts therefore expecting it to get back to target quicker than previously and signalling a normalizing economy following last years lira crisis.

While the rate cut was greater than expected, with Turkey’s inflation now surprisingly running far slower than most had expected in recent months, at just 15%, the real rate is still a solid 1.5%, even if it moves Turkey toward the end of the pack of major EMs in terms of real rates. Of course, how much the inflationary print is accurate, and whether any of the underlying economic assumptions reflect reality in Turkey rather than just what Erdogan wants – and just like Trump, Erdogan wants much lower rates reality be damned – is a different matter entirely.

The CBRT also saw inflation beneath July forecasts and said that keeping the disinflation process on track with the target path requires the continuation of a cautious monetary policy stance.

The central bank also said that the extent of monetary tightness will be dependent on underlying inflation – which just like in the US it is no longer seeing – and noted that the improvement in inflation expectations and mild domestic conditions support disinflation in core indicators.

Some more details from the full press release:

“In addition to the stable course of the Turkish lira, improvement in inflation expectations and mild domestic demand conditions supported the disinflation in core indicators. In August, consumer inflation displayed a significant fall with the contribution of core goods, energy and food groups. Domestic demand conditions and the level of monetary tightness continue to support disinflation. Underlying trend indicators, supply side factors, and import prices lead to an improvement in the inflation outlook. In light of these developments, recent forecast revisions suggest that inflation is likely to materialize slightly below the projections of the July Inflation Report by the end of the year. Accordingly, considering all the factors affecting inflation outlook, the Committee decided to reduce the policy rate by 325 basis points. At this point, the current monetary policy stance, to a large part, is considered to be consistent with the projected disinflation path.”

In kneejerk response, the Turkish Lira, now yielding over 3% less against its FX pair surged, although these initial reactions tends to be unwound once the investing public, or in this case Mrs Watanabe, reads between the CBRT’s lines.

Tyler Durden

Thu, 09/12/2019 – 07:19

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com