Why This Week’s Quant Catastrophe Did Not Lead To A Market Crash

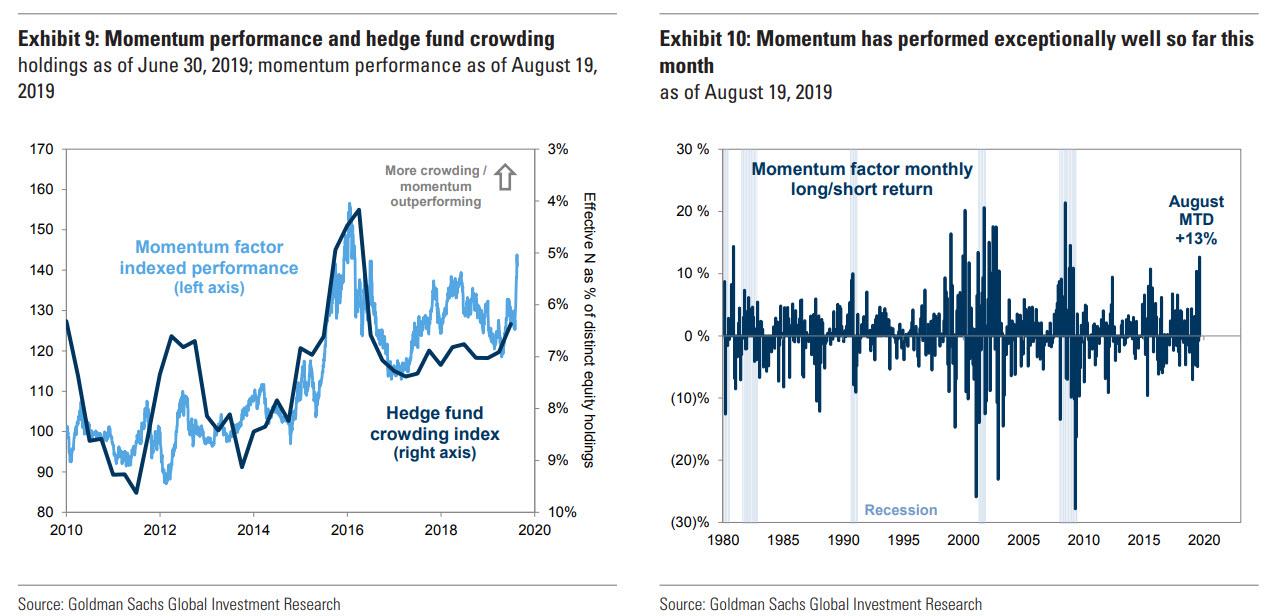

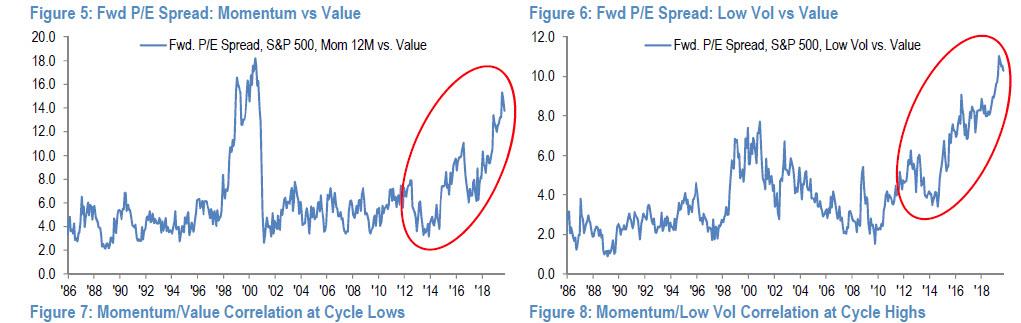

While the broader market barely noticed, and in fact the S&P was up 1% on the week, quant funds and style-trading hedge funds suffered one of their worst weeks in history as every single popular trade suddenly collapsed, while all the unpopular, formerly money-losing trades ripped in traders’ faces as a 6-sigma rotation into Value from Momentum/Low Vol that began at the end of August accelerated this week. For those who missed it, since Monday, “Momentum” sold off more than 10% while much-maligned “Value” trades ripped 7% higher, as the most crowded trades imploded, precisely the event we warned about just a few weeks ago in “Crowding Is Now One Of The Biggest Market Risks“.

And so, when the inevitable unwind came, it was fast and it was furious: in fact, according to JPMorgan, this was one of the largest 3-day Momentum-Value rotations in over 30 years (99.8%-ile), triggered by a combination of i) better than expected economic data (something we also warned about last weekend), ii) monetary and fiscal stimulus, iii) easing trade tensions, iv) stabilization in yields, all at a time when factor positioning (long Momentum and Short Value) was extreme as the following charts show.

As we noted in prior reports, when factor positioning becomes extreme rotations can be very violent and managers can give back prolonged periods of gains in a matter of days and weeks. In the current rotation ~5 months of Momentum outperformance was given back in only 3 days. Similar price action was observed during the Low Vol bubble unwind in 2016.

At the same time CTAs and other trend-following strategies suffered big losses this week drawing comparisons to the Quant Quake of February 2018. And yet, while the past few days saw quant funds suffer greater losses than 2016 and even the infamous August 2007 quant crash, despite repeated comparisons to the broader market shock observed during the Feb 2018 Volmageddon, the broader market barely blipped in response the shocking moves below the market’s surface.

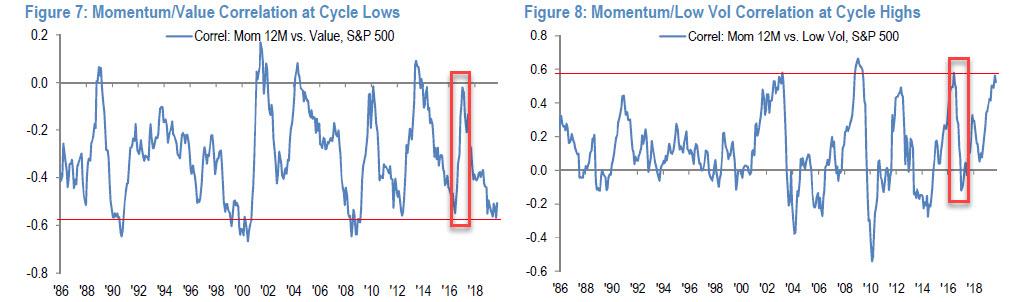

This in turn prompted JPM’s Nikolas Panagirtzoglou to ask why, given these sectoral and style shifts, the sharp losses suffered by CTAs and the chatter about a Quant Quake, are equity markets so benign and calm… Especially compared to the last time we had a Quant Quake in February 2018. As a reminder, back then not only did global equities briefly enter a correction, slumping by 9% in a week but the resulted rise in equity volatility – the VIX had spiked to close to 40% – had induced capitulation on short volatility positions causing a Quake in Volatility funds also. Furthermore, similar to now…

… in January 2018 there was a large short base in VIX futures which was abruptly covered by volatility hedge funds during the first week of February 2018 amplifying the rise in VIX. Why did a similar covering of short VIX futures positions not happen this week?

Put otherwise, why did the quant crash of September 2019 not lead to a broader market crash like February 2018 (yet, similar to the isolated nature of the August 2007 quant crash)?

According to Panigirtzoglou, the answer is that the nature of the CTA correction is very different to that seen in February 2018. As the JPM quant explains, CTAs had entered February 2018 with very elevated long positions across most equity futures, very elevated short positions across most bond futures, very elevated long positions in the euro and very elevated long positions in oil. In other words they held very extreme positions across a wide range of futures contracts.

Then, in one giant, self-reinforcing wave of exponentially rising volatility, as some of these quant funds, i.e. those employing mean reversion along with momentum signals, started getting out of extreme positions, equity indices started going down triggering position unwinding by other more pure trend following funds. As a result, equity indices suffered sharp declines during the first week of February 2018 triggering an increase in volatility not only in equities but in other asset classes also. In turn the rise in volatility forced volatility funds, especially those that were systematically short volatility, to exit their short volatility positions, amplifying the move.

The current backdrop is very different, for the simple reason that CTA positioning is currently extreme mostly in the bond space rather than in equities or other asset classes, and as a result the violent reversal is taking place in the 10Y Treasury, not the S&P500.

We can see this in the following momentum signal tables which show the z-score as a proxy for the strength of the momentum signal for each asset class. With the exception of some niche commodities such as Nickel, extreme z scores of 1.5 stdevs or above were only found in the bond space up until the end of August.

Yet while equities were insulated from a violent move, bonds were not. In fact, the rise in bond yields since the start of the month, when the 10Y dropped to a near record low 1.43%, induced CTAs to start cutting previously extreme long bond futures positions, amplifying the move in yields. At the same time, and unlike Feb 2018, there was no extremity in equity futures positioning to be unwound by CTAs as they were only modestly long equities. As a result, the CTA losses this month did not spill over to the equity market or equity volatility. As a result, by being confined to the bond space, the CTA losses so far this month are close to a third of what we had seen previously during February 2018.

A similar analogy can be observed for risk parity funds, an important component of the Quant fund universe, which like CTAs are little changed MTD again contrasting with the heavy losses they had suffered during February 2018.

Finally, what about equity hedge funds? As Panigirtzoglou explains, the equity hedge fund universe is dominated by the $900bn universe of Equity Long/Short hedge funds which are more susceptible to equity sector shifts than other hedge funds. These Equity Long/Short hedge funds are largely directional exhibiting a beta of close to 0.5 on average relative to the global equity market. Around 15% are Quantitative, including the Equity Market Neutral category which typically exhibits a very low equity beta.

So what did we learn from the performance of Equity Long/Short hedge funds this week? On Monday HFR released the performance of monthly reporting funds for August, when Equity Long/Short hedge funds lost 1.63% (or 1.8% asset weighted) which implies a beta higher than 0.5 relative to the MSCI AC World index which lost 2.6% of August. This suggest that, contrary to what that “other” JPM quant claimed last week, Equity Long/Short hedge funds were caught up with above rather than below average equity exposures in August.

Curiously, this contrasts with the performance of daily reporting Equity Long/Short hedge funds, which lost only 0.2% in August, thus exhibiting a much lower beta, a discrepancy that persisted for most of this year. Furthermore, in addition to losing little in August, these funds are up 0.7% MTD practically unaffected by this week’s big sectoral and style rotations. This is also true with daily reporting Equity Market Neutral funds which are also up MTD and little changed on the week.

In other words, as Panigirtzoglou notes, the daily reporting Equity Long/Short hedge funds appear to have been practically unaffected by this month’s rotation, “casting doubt on the idea that they were at the heart of this month’s rotation, thus shifting the blame to other equity investors outside Equity Long/Short funds.” It is of course possible that monthly reporting Equity Long/Short hedge funds suffered by more than their daily reporting counterparts over the past week, and anecdotally there is some evidence of this, but this won’t be known concretely until September performance is released at the beginning of next month.

So where does the above discussion leave JPMorgan’s “bad cop” quant (not to be confused with the “good cop”) in terms of equity market positioning? Here, Panigirtzoglou makes five observations:

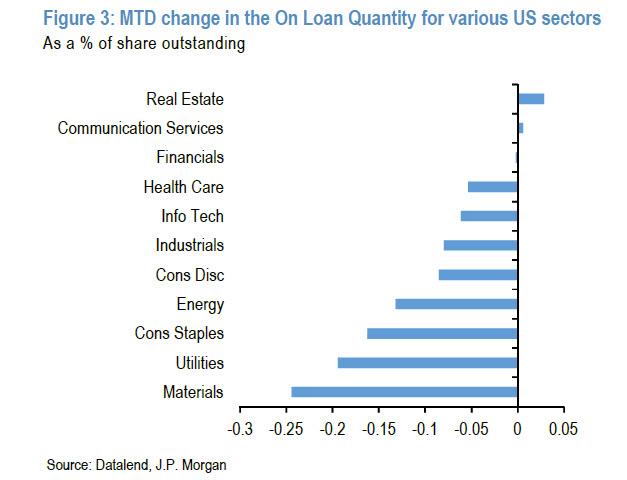

1) Not all of the sectors that outperformed MTD, i.e. Financials, Energy, Industrials and Materials, were driven by short covering. For example by looking at “On Loan Quantity” from Datalend (which collects data from all major prime brokerage firms in the street) as a proxy for the short interest across US equity sectors, Materials saw the biggest short covering. Energy and Industrials saw some short covering also. But Financials saw little change in its short interest, suggesting that the latter might have been boosted by new buying rather than covering of shorts (Figure 3).

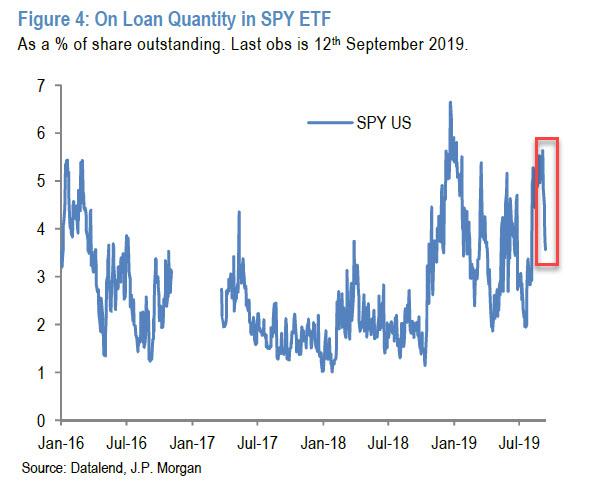

2) Figure 3 shows that most sectors saw short covering MTD suggesting that overall equity positioning shifted to significantly less bearish or more bullish stance relative to last August. This is consistent with JPMorgan position metrics related to the overall US equity market. In fact, the bank’s short interest proxy on SPY ETF (Figure 4) declined sharply this month from the high levels of last August and stood at a fairly neutral “middle of the past year” range.

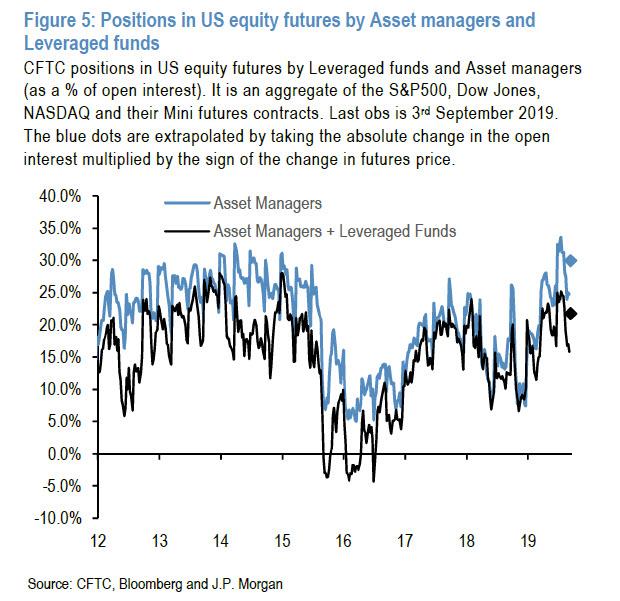

The US equity futures positions by Leveraged Funds and Asset Managers (Figure 5) have also reversed last month’s decline and stand at the upper end of the past year’s range.

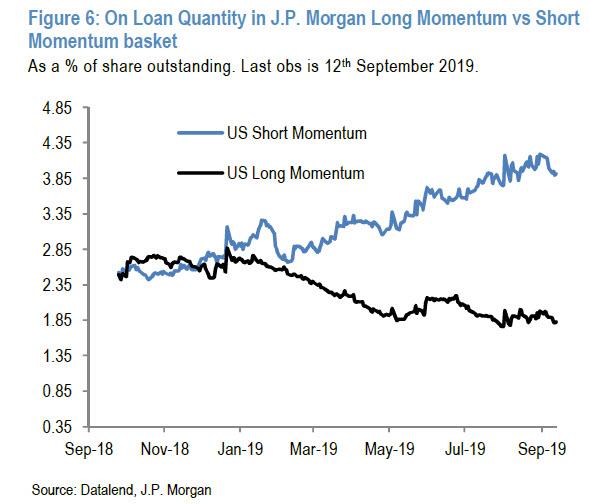

3) Across Long/Short equity style baskets, the biggest gap was between the short interest of Short Momentum and Long Momentum equity baskets. This gap remains wide even after this week’s covering (Figure 6).

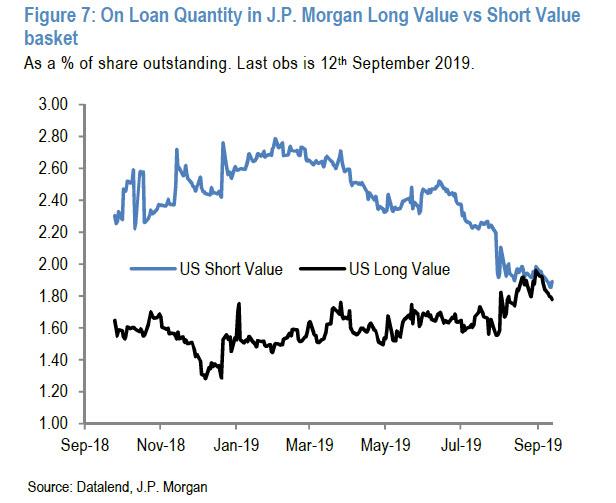

4) There was little gap in JPM’s short interest proxy between Long Value and Short Value equity baskets before this week’s rotation as this gap had closed from last August already (Figure 7).

5) The gap between the bank’s short interest proxies for Short Momentum vs. Long Value equity baskets remains large (3.9% vs. 1.8%)

So with all that in mind, and with the lack of a broader market shock (and reset) as compared to Feb 2018, Panigirtzoglou notes that – similar to Kolanovic – he sees more room from a technical point of view for the gap between Short Momentum and Long Value equity baskets to close assuming the fundamental triggers of this rotation continue to be in place.

Said otherwise, despite this month’s shocking sector and style rotations, JPMorgan is not seeing evidence of a Quant Quake, with CTA losses so far close to just a third of what we saw in the Quant Quake of February 2018; meanwhile, daily reporting Equity Long/Short hedge funds including Quants appear to have been practically unaffected by this month’s rotation, casting doubt on the idea that Equity Long/Short hedge funds were at the heart of this rotation…

Tyler Durden

Sat, 09/14/2019 – 17:10

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com