Very Divided FOMC Cuts Rates As Expected, Fails To Address Liquidity Crisis, Sees No More 2019 Cuts

Summary: Tw critical things stand out:

-

The Fed is very divided: 7-3 vote to cut. 7 predict another cut this year. 10 say hold or raise

-

No mention of POMO or permanent repo ops: watch G/C explode overnight

* * *

As we detailed earlier, things have not gone exactly according to plan since The Fed cut rates for the first time in a decade:

But today is a big day for Jay Powell as he has to somehow explain why he is cutting rates in the face of:

Surging inflation

Source: Bloomberg

Dramatically positive macro surprises

Source: Bloomberg

Unemployment near record lows

Source: Bloomberg

Stocks near record highs

Source: Bloomberg

Bond yields near record lows

Source: Bloomberg

Dollar near record highs

Source: Bloomberg

Of course, there is the fact that policy uncertainty has never been higher…

Source: Bloomberg

And The Fed just suffered the biggest short-term liquidity crisis since 2007!

Source: Bloomberg

The market is completely priced for at least a 25bps cut today…

Source: Bloomberg

But, we note that markets have become more hawkish in recent weeks – shifting from expecting 2.7 rate-cuts to just 2 rate-cuts in 2019 (including today)…

Source: Bloomberg

Perhaps, Powell has seen this chart?

FedEx down 12% from open…

If the FedEx signal is anything to go by, then we are headed for rather bad times ahead..

I have my chips on this as well.. pic.twitter.com/SRisUCSoLc

— AndreasStenoLarsen (@AndreasSteno) September 18, 2019

https://platform.twitter.com/widgets.js

Data-Dependent, my arse.

How many dissents this time? (anticipated dissents – Esther George, Eric Rosengren and, possibly, Jim Bullard)

Source: Bloomberg

* * *

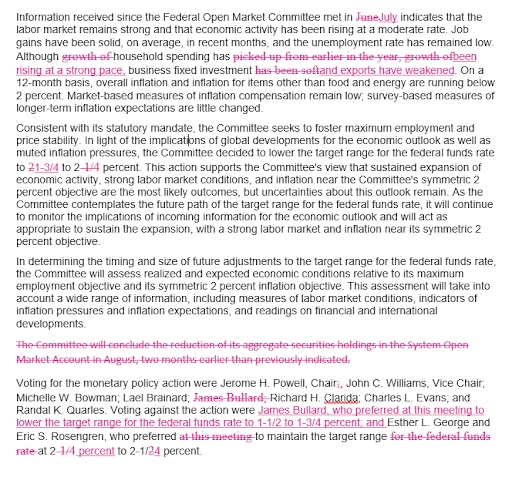

To check all the dovish boxes, Powell would need to: cut 25bps, suggest more to come (dovish tweaks to language), median dots adjusted lower, fewer dissents, restart QE. As BMO noted:

In terms of assumptions for the FOMC, a 25 bp cut is essentially a done deal. The statement should maintain language that the Committee “will act as appropriate to sustain the expansion” to keep the door open to future rate cuts. The dot plot will shift lower, though we’d caution against over-interpreting this forward guidance due to the divergence between modal member forecasts and monetary policy implemented with a risk-management focus. We’re skeptical that the longer-run dot will decline further from 2.5%, which should continue to provide support for long rates (5y5y is around 2% while 10y10y is closer to 2.5%).

Anyway, here’s what he did…

-

*FED CUTS MAIN TARGET RATE 25 BPS TO 1.75%-2%

-

*FED LOWERS RATE ON OVERNIGHT REVERSE REPOS BY 30 BPS TO 1.7%

7-3 vote to cut. 7 predict another cut this year. 10 say hold or raise

3 Dissents

-

GEORGE, ROSENGREN DISSENT FOR NO CUT

-

BULLARD SEEKS 50 BPS

Bloomberg’s Key Takeaways from the Fed decision:

-

No surprise on main action, as FOMC cuts benchmark rate 25 basis points for a second straight meeting — to 1.75%-2% target range

-

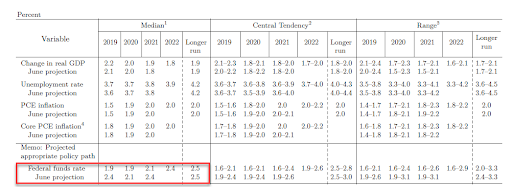

The dot plot of rate forecasts is somewhat hawkish, showing a split over the need for more easing, not just in 2019 but in coming years: Seven officials see an end-2019 funds rate of 1.625%, with five at 1.875% and five at 2.125%; none see the rate going below 1.625% through 2022

-

Esther George and Eric Rosengren again dissent in favor of no cut, while James Bullard seeks a half-point cut; it’s the first decision with three dissents since 2016, under Janet Yellen

-

The Fed also lowered the interest on excess reserves rate and the overnight repurchase rate by 30 basis points, with the central bank seeking to regain control of the benchmark as money-market strains persist

-

The FOMC reiterates that it will “act as appropriate to sustain the expansion”; the statement contains minimal changes, mainly to note household spending gains have been “strong” while business fixed investment and exports have “weakened”; the mention of exports is new and there’s a more explicit nod to trade tensions weighing on growth

-

Fed officials’ economic forecasts were largely unchanged from the prior round in June; there’s a slight upgrade in GDP growth expectations, but policy makers still see the expansion slowing and nowhere near Trump’s 3% goal

And the DOT-plot adjusted…

Fed projections show no further cuts in 2019, but seven of 17 policymakers saw one more cut as appropriate

Source: Bloomberg

Looking at the dot plot, it’s clear there are three camps within the Fed:

-

Pre-emptive accommodation is not needed; we’ve already done too much

-

We’ve delivered the necessary amount of pre-emptive accommodation for now

-

More pre-emptive accommodation is needed

The Fed is now expecting 2019 fed funds rate at 1.9 where we are now…

* * *

Full Statement below:

* * *

Good luck in the press conference.

Tyler Durden

Wed, 09/18/2019 – 14:07

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com