The Moment You Know You Know, You Know!

Authored by Lance Roberts via RealInvestmentAdvice.com,

Last week, we started our discussion by itemizing the list of all the things going “right” for the bullish narrative.

-

Trump easing up on tariffs and trade negotiations

-

The ECB (European Central Bank) went “all-in” on cutting rates and launching more Q.E.

-

The economy is showing some signs of life as data is “less bad” than it was previously, and as we concluded:

“All the bulls need now is the Fed to ‘cut’ rates at the meeting next week.”

On Wednesday, the Fed did just that by cutting rates the expected 0.25% which aligned with our previous analysis:

“With markets hovering at all-time highs, the unemployment rate near record lows, and inflationary pressures near their target levels, there is little reason to be cutting rates now.

For the bulls, the good news is, they will cut rates anyway.”

What the markets focused on, however, was The Fed suggesting they are open to “allowing the balance sheet to grow.” While this isn’t anything more than just stopping Q.T. entirely, the markets took this as a sign that Q.E. is just around the corner.

This is probably a mistaken conclusion.

Reminder: it is normal for the Fed’s balance sheet to grow gradually. This is what he means. Not resumption of QE, as some have assumed. https://t.co/vUC3peXwrz

— (((Frances Coppola))) (@Frances_Coppola) September 18, 2019

https://platform.twitter.com/widgets.js

To illustrate this point, the chart below shows excess reserves, required deposits, and currency in circulation. As you can see, everything went “pear-shaped” in 2008.

However, let’s zoom in a bit and add the Federal Reserves balance sheet. Prior to 2008, notice the Fed’s balance sheet was growing directly proportionate to the growth rate of the currency in circulation (which follows the growth rate of the economy.)

Therefore, what the Fed is suggesting is NOT more Q.E. but rather, just the normal “organic” expansion of the balance sheet in relation to the growth of the economy and the currency in circulation.

It was this realization that ultimately disappointed the bulls late last week.

Bulls Remain In Charge

However, despite the short-term disappointment, the bulls remain in charge for the time being as markets cling near all-time highs. The question we posed last week was:

“Is it all priced in?”

The risk/reward does not favor the bulls short term. The market is back to very overbought conditions, the upside to the top of the bullish trend channel is about 1.9%. The downside risk is about 5.5%.

(Chart updated through Friday. Shows the overbought condition as been slightly reduced.)

However, on an intermediate-term basis, all of our primary indicators are beginning to reach levels which have typically denoted short-term market peaks.

This analysis keeps our portfolios weightings on the long-side, but we remain hedged currently which we slightly increased last week, along with additions to our intermediate-term bond holdings and gold. Cash also remains a slight overweight in model allocations and equities slightly underweight..

We discussed the reasoning for an additional hedge with our RIAPRO subscribers this week:

- We added a starter position of VXX to portfolios yesterday to hedge against a pickup in volatility. We are likely a bit early, and volatility will likely drift lower in the days ahead, but as noted by the red box, volatility is extremely suppressed.

While our portfolios remain bullishly biased for the time being, that will NOT always be the case.

As discussed many times in the past, the point of risk management is NOT trying to win “short-term battles” by chasing asset prices, but the winning of the “war” by not losing a large chunk of investment capital during a market decline.

The Moment You Know

David Bowie once said:

“The moment you know you know, you know.”

Unfortunately, for the vast majority of investors, they often come to this realization far too late to do anything about it.

Of course, it is these drawdowns which destroy the time value of money. Such was the message in the “Stability/Instability Paradox:”

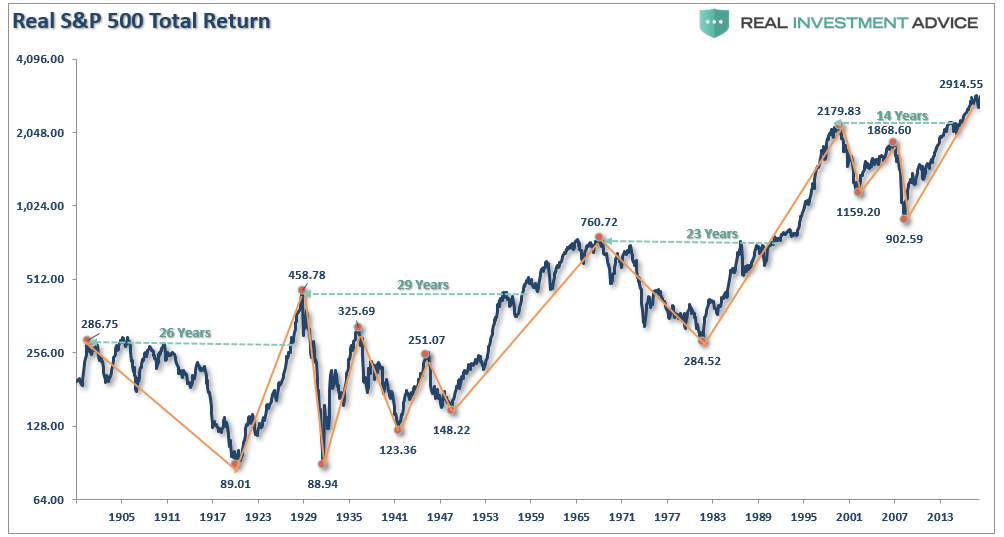

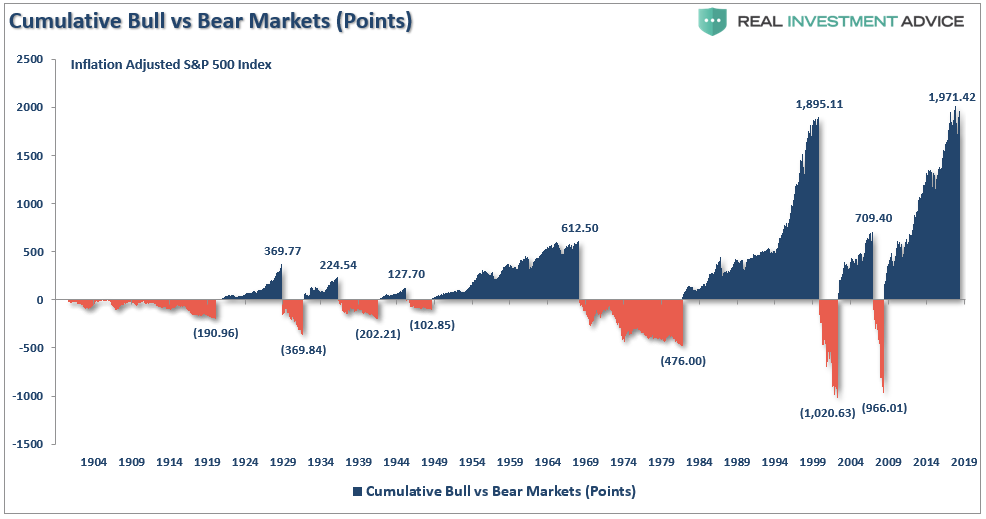

“The point here is that ‘all things do come to an end.’ The further from the ‘mean’ something has gotten, the greater the reversion is going to be. The two charts below illustrate this point clearly.”

Bull markets, with regularity, are almost entirely wiped out by the subsequent bear market.

Despite the best of intentions, market participants never act rationally.

There is an important distinction between investing success and failure as it relates to the destruction of capital during drawdowns. Last week, Ben Carlson had an important tweet:

Crazy but true:

$10k invested in the S&P 500 in Jan 2000 would be worth $29,181 by the end of Aug 2019

$10k invested in the S&P 500 in Jan 2010 would be worth $32,100 by the end of Aug 2019

— Ben Carlson (@awealthofcs) September 18, 2019

https://platform.twitter.com/widgets.js

The point he was making is by investing money in markets, and not worrying about drawdowns, it will grow over time. The math certainly supports his argument.

Why hire a “financial adviser?” Just buy a cheap index fund, sit on it, and you will be fine. It is a great concept for the purveyors of ETF and index-based products, just not necessarily good for you.

Let me explain.

Ben, who graduated from college in 2005, didn’t have money invested, or manage assets for others, during the 2008 financial crisis. (That’s not a criticism, I wish I were that young.)

The reality is that experience is a hard teacher.

The concepts of “buy and hold” investing, “dollar-cost averaging,” etc. become mainstream commentary at the end of bull market cycles. It was the same in 1999, and in 2007, when I was managing money for clients.

I can tell you this with absolute certainty.

“When the bear market sets in, all the investing complacency goes flying out the window. Clients no longer care about low cost, indexing, or ‘time in’ the market, as their losses mount. Conversations are no longer about buying dips, but rather ‘get me the f*** out.’”

Everyone sells.

It is just a function of where your pain point is as losses mount. While investors may stay the course during a 10-20% decline, it is an entirely different matter when personal wealth is dropping 30, 40, or 50%.

If you were invested in 2008, you know what I mean.

It is just human nature.

However, what Ben’s analysis misses is the “time value” of money during those periods. Yes, a “buy and hold” portfolio will grow in the financial markets over time, but it DOES NOT compound.

Read this carefully: “Compound returns assume no principal loss, ever.”

To visualize the importance of this statement, look at the chart below of $100,000, adjusted for inflation, invested in 1990 versus a 6% annual compound rate of return. The shaded areas show whether the portfolio value exceeds the required rate of return to reach retirement goals.

If your financial plan required 6% “compounded” annually to meet your retirement goals; you didn’t make it.

This is the single most important thing to understand about investing.

“Investing is not about just growing capital. The actual GOAL is growing SAVINGS to a future target which will provide a required livable income in retirement adjusted for inflation.”

If you f*** that up by not saving enough, taking on too much risk, and losing a chunk of your capital by speculating in the financial markets, you are going to have a tough time when you retire.

Two bear markets should have taught “financial advisers” this by now.

It is why 80% of Americans are almost entirely dependent on social security for retirement needs despite the longest bull market run in history. ($100,000 in savings, or less, isn’t going to cut it)

Time is the most valuable commodity there is. It is also the one commodity you can not get more of.

You Don’t Want To Hear That

I know, I know. That’s being “bearish,” and that is “no fun.”

As Bob Farrell once quipped: “Bull markets are more fun than bear markets.”

Here is what you really want to me to write:

“If you just put all your money into this ETF portfolio, it will compound at 8-10% a year, and you can spend all your time at the beach.”

Or,

“Here are the six stocks you can buy today, and retire on tomorrow.”

Or, just in case you haven’t started investing yet:

“If you can just save $100 a month, buy an S&P index fund, and dollar cost average into it every month in a Roth, it will grow at 12% a year and you will have $1 million in 30-years.”

These types of articles sell products, get advisers clients who lure them in with promises of above-average returns for a small annual fee, and attract advertisers. This is why the media is full of “optimistic” articles touting exactly those issues.

The problem is they are all mathematically wrong.

The truth is…you don’t want to hear to truth.

Like the fact, that $1 million today is NOT $1 million in 30-years.

Or that you don’t actually get “average” returns from portfolios.

(We wrote a complete series on the many investing myths of the market and how to do better.)

Think about it this way.

“IF investing actually worked as advertised, wouldn’t “everyone” be rich?”

But they aren’t, because two major bear markets either wiped them out financially, or destroyed their confidence in investing in the markets.

Most of the people in the mainstream media, and most people writing articles on investing, like Ben, have never actually been through a “bear market.” They may have witnessed it, but watching the “war” from the safety of your living room is very different than dodging bullets on the front line.

Of course, after a decade long bull market, it is certainly understandable that many investors, advisers, and planners have been lured into the belief that a “financial crisis” can never happen again.

Another crisis will happen. They have happened all throughout financial history going back to the 1600s, and Central Banks won’t be able to bail the markets out next time.

There is simply TOO. MUCH. DEBT.

However, it is these “beliefs,” “investment strategies,” and “complacency” which tend to mark the peaks of market cycles.

“The golden rule of investing is to buy low, and sell high.” – said every great investor in history

Here is what you DON’T SEE at market bottoms. (The point when you should be mortgaging the house to buy stocks.)

-

Companies like $TSLA and #WeWork which are cash burning machines, and potentially fraudulent companies, going public.

-

Investors chasing the highest risk assets like junk bonds, levered loans, and structured products.

-

People buying into silly and potentially extremely dangerous programs like the “F.I.R.E.” movement.

-

Advisors who promote “Buy and Hold” and “Dollar Cost Averaging” investment programs. (More than likely they have never seen a bear market.)

-

Wall Street hitting the markets with investment products which carry increasingly higher levels of risk to meet investor appetites. (Wall Street is a sales organization that creates products for consumers)

-

Untried and unproven products and investment programs like “Robo-Advisors”

And….Bowie Bonds, are back!

A good example by my colleague Michael Lebowitz:

“In 1997 musician David Bowie, and in particular his revenues, supported an asset-backed security. In a first of its kind, Ziggy Stardust, Starman, and many other popular songs were securitized, raising $55 million for the artist. Investors received a stream of cash flows based on the sales of his 25 albums. In return for the lump sum of cash, Bowie forfeited any revenue from those albums until the bonds matured.

Bowie bonds attracted investors for several reasons. Some investors found value in the bonds, thinking music sales would skyrocket. Clearly these investors did not see the coming digitization of music and the revenue implications. Other investors were simply fans and wanted to own a piece of the rock legend. The bonds also attracted speculators. Risk-taking was in vogue in the later ’90s. It seemed like the object of many investors was to find the latest and greatest investment with the possibility to make them rich. Unlike Pets.com and e Toys, Bowie bonds did not default and in 2007 paid off its investors.”

Note: note the year the bonds were issued – 1997. So, here we are nearly two decades after the dot com crash and a decade after the financial crisis, and risk-taking and speculation are back in style. Mike continues:

“From negative interest rates to excessive valuations along with a rash of non-profitable IPOS, signs of risk fever surround us. Like Bowie bonds signaled in the late ‘90s, another omen is warning that a top is near.

Spencer Dinwiddie, a guard for the NBA’s Brooklyn Nets, recently announced that he would follow in Bowie’s shoes and issue a security backed by his basketball contract. Like Bowie, Dinwiddie will receive a lump sum cash payment today instead of income spread out over the life of his contract. Dinwiddie’s wants the cash today so he can invest and assumingly earn more than investors in his bonds. His basketball bonds will be issued in digital tokens.

It seems like Dinwiddie is not only trying to take advantage of liquidity chasing digital assets as well as the demands of investors seeking investments with extra yield but he, in turn, wants to speculate with the money as well. Said differently, speculators are feeding the behavior of speculators.

In the late 1990s, investors chased any company that was thought to have been in involved in the World Wide Web. Bowie bonds made more sense than many dot com companies but nonetheless revealed the rampant speculation of the day. In the mid-2000s, investors were enamored with mortgage debt backed by subprime debt that could “never default.” Today speculators are chasing traditional and digital assets in what may be the broadest instance of overvaluations in at least 75 years.”

It is from this point, given valuations are once again pushing 30x earnings, that we review the expectations that individuals facing retirement should consider.

-

Expectations for future returns and withdrawal rates should be downwardly adjusted due to current valuation levels.

-

The potential for front-loaded returns going forward is unlikely.

-

Your personal life expectancy plays a huge role in future outcomes.

-

The impact of taxation must be considered.

-

Future inflation expectations must be carefully considered.

-

Drawdowns from portfolios during declining market environments accelerates the principal bleed. Plans should be made during up years to harbor capital for reduced portfolio withdrawals during adverse market conditions.

-

The yield chase over the last 10-years, and low interest rate environment, has created an extremely risky environment for investors. Caution is advised.

-

Expectations for compounded annual rates of returns should be dismissed in lieu of variable rates of return based on current valuation levels.

Importantly, chasing an arbitrary index that is 100% invested in the equity market requires you to take on far more risk that you most likely realize.

For the majority of individuals today facing, or in, retirement the two previous bear markets have left many further away from retirement than they ever imagined.

The next one will destroy those goals entirely.

Investing for retirement, should be done conservatively, and cautiously, with the goal of outpacing inflation, not the market, over time. Trying to beat some random, arbitrary index that has nothing in common with your financial goals, objectives, and most importantly, your life span, has tended to end badly for individuals.

As Michael concludes:

“We do not know, but we do know what we know, and we know that current investor behavior is unsustainable.”

You can do better.

Tyler Durden

Sun, 09/22/2019 – 12:30

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com