Softbank Planning To Quadruple-Down On WeWork, FT

With billions already ploughed into the money-losing real estate company, and a combination of massive cash-burn and a $6bn loan contingent on its IPO, Softbank’s Masa-san appears cornered into quadrupling down on the giant tech company’s investment in Adam Neumann’s ‘creation’.

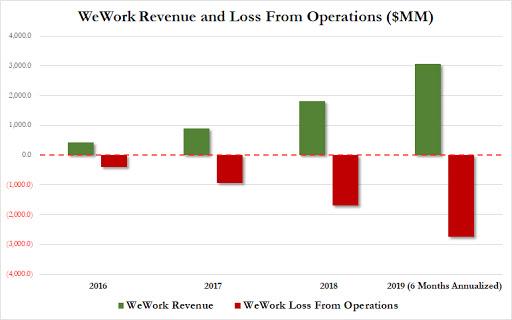

As a reminder, for every dollar WeWork earned in revenue last year, it lost roughly two.

And as its IPO-contingent funding evaporates, bond market investors are getting anxious…

Source: Bloomberg

To the point where WeWork is riskier than Tesla, Ukraine, and South Africa…

Source: Bloomberg

However, there is hope. As The FT reports, SoftBank is in talks with WeWork to increase a $1.5bn investment the Japanese telecoms-to-technology group has agreed to put into the office leasing company next year, according to people briefed on the matter.

A recut deal would see SoftBank invest at least $2.5bn, but would reduce the price per share at which it acquires WeWork stock, giving it a larger stake in the lossmaking property group, the people said.

Critically, the equity investment from SoftBank could unlock additional financing options for WeWork, without which it could quite clearly be a zero (the group burnt through more than $2.5bn of cash in the first half of 2019).

It appears this future investment would be the fourth 10-figure money drop:

-

Aug 2017 – $1.3bn

-

Jan 2019 – $1bn

-

Jan 2019 – $5bn

-

Apr 2020 – $2.5bn

But who’s counting?

Tyler Durden

Wed, 09/25/2019 – 20:30

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com