Corporate Buybacks Accelerate To Strongest Weekly Level In History

When it comes to politics, one thing is certain: it is all about fake news, and how it is spun. Which is why some people prefer finance: after all, when it comes to math-based financial data, reality is either a 1 or a 0.

Unfortunately, it now turns out that even financial “data” can mean whatever one wishes to read from it. Case in point: today’s CNBC appearance by Goldman’s chief equity strategist David Kostin, who when commenting on the fate of the market in the context of trade war, warned that stock buybacks – the primary driver of stock upside together with the Fed in the past decade – “are getting muted” (1’40” in the clip below) and thus clients are turning cautious.

There is just one problem with Kostin’s statement: it is dead wrong, at least according to the latest buyback data from Bank of America’s trading desk.

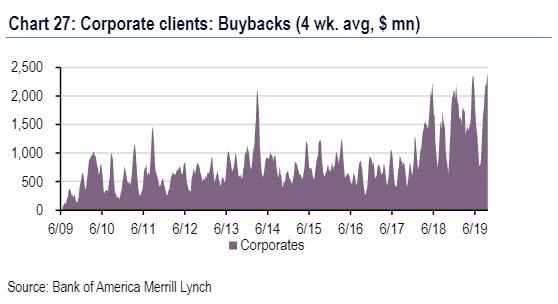

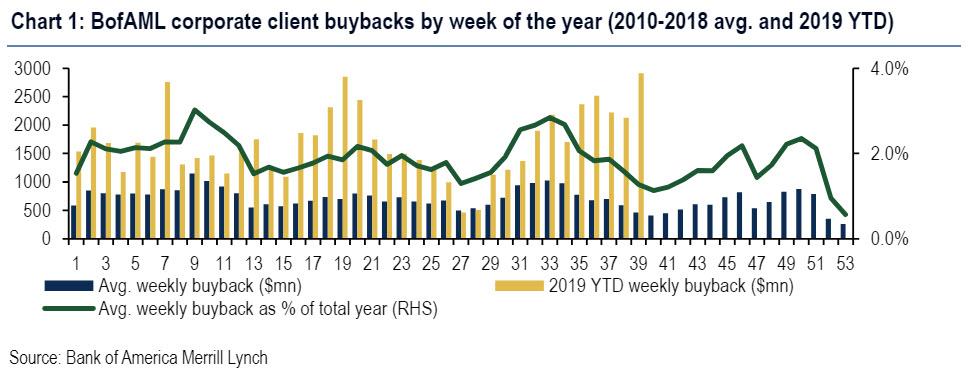

As BofA’s Jill Carey Hall writes in her latest client flow trends, “corporate buybacks accelerated to their strongest weekly level in our data history since 2009″, led by Tech buybacks for the fifth week. This is in line with BofA’s expectations, which had predicted that tech would benefit from a ramp up in buybacks YTD given the high announced/completed buyback ratio for the sector heading into the year.

As a result of this burst in stock repurchases, cumulative YTD buybacks are now +25% YoY, with 3Q to date buybacks +39% YoY and stronger than normal seasonal trends (which typically slow through late Sept, and pick up over the next ~6 weeks amid earnings season).

In other words, far from “muted” – as Goldman claims- stock buybacks heading into the Q3 blackout period have been bigger.

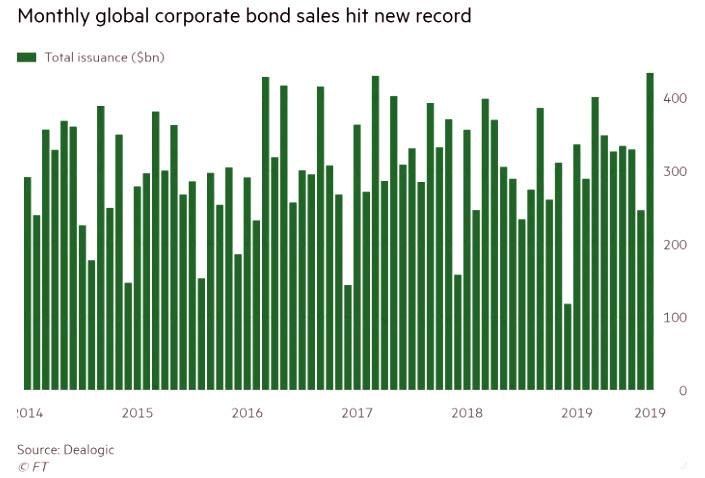

But why did buybacks just soar to an all time high? After all, isn’t it naive and foollish to launch a record stock repurchase program with the S&P at all time highs? Well, no, when the one paying for it is the greatest fool of all – the yield-starved corporate bond investor. Recall that September saw a record monthly corporate bond issuance, with some $434 billion in bonds sold globally, $5 billion more than the previous all time high of March 2017.

And since a substantial portion of the proceeds is used for stock buybacks, it should not come as a surprise that we just saw a record week for stock buybacks… and why stocks are surging today even as both PMIs now suggest the US is headed for a recession.

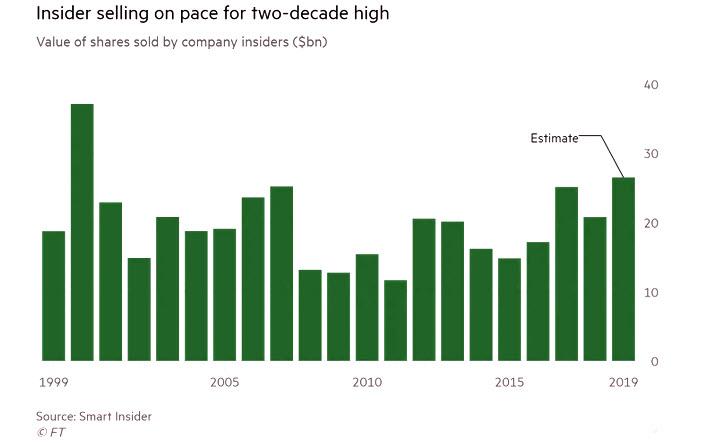

But if companies are buying every share of their stock they can find – with no price discrimination – who are the sellers? We know that answer too: as we reported a week ago, corporate insiders – typically CEOs, CFOs, and board members, but also venture capital and other early state investors – sold a combined $19BN of stock in their companies through to mid-September. Annualized, on track to hit $26BN for the year, which would mark the most active year for insider sales since 2000, when executives sold $37bn of stock amid the idiotic frenzy of the first tech bubble. That 2019 total would also set a post-crisis high, eclipsing the $25bn of stock sold in 2017.

Finally, as for Goldman once again completely misrepresenting reality and peddling “fake news”, we hope that by now that comes as no surprise to any of our regular readers.

Tyler Durden

Thu, 10/03/2019 – 14:40

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com