The Surge In “Surprise” Medical Bills Bankrupting Americans Can Be Blamed On Private Equity

Surging “surprise” medical bills in the U.S. are private equity’s fault, a new FT opinion piece claims.

These “surprise” medical bills continue to be a major talking point in the U.S. and are likely to be a key issue during the upcoming 2020 Presidential race. The term refers to invoices that are generated after a patient is admitted to the hospital and treated, without their knowledge, by someone not in their insurance plan.

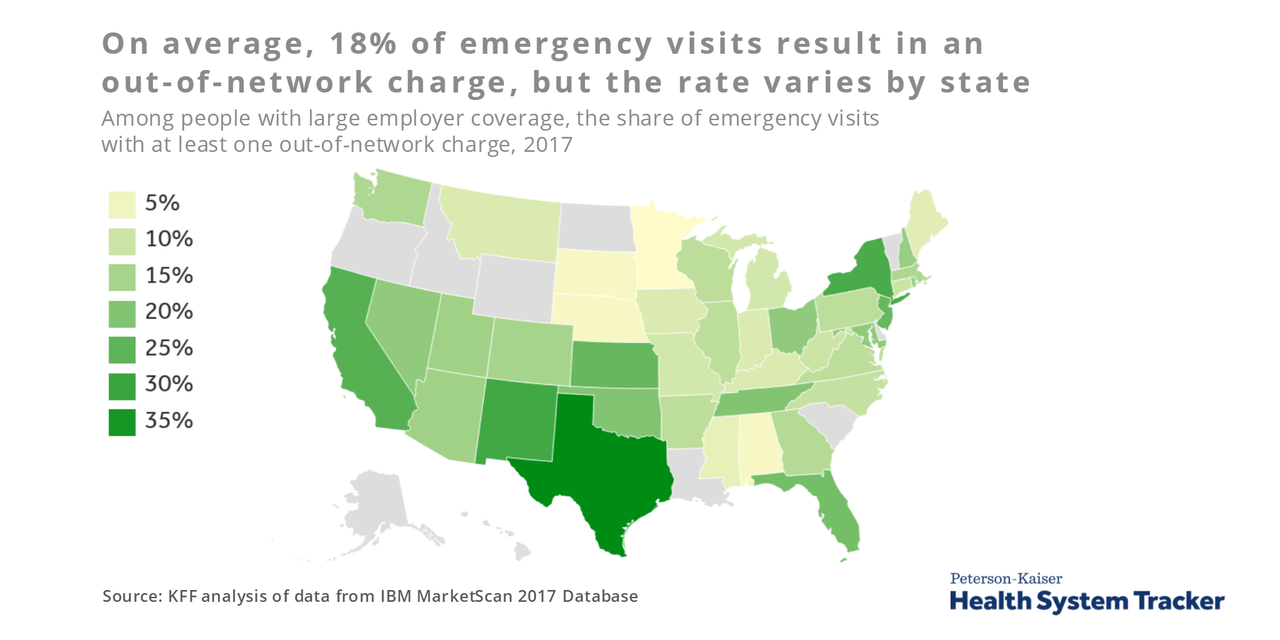

And a recent Stanford study shows that these “surprise” bills continue to become more ubiquitous. They are up from about 33% of visits in 2010 to almost 43% in 2016. For inpatient stays, the number is even more alarming: the jump goes from 26% to 42%, with the average cost per patient rising from $804 to $2,040. It’s an issue that only adds to the overwhelming debt bubble we have again created in the U.S.

The opinion piece notes that these rising costs come not from hospitals, but rather from the “backwaters of the financial markets”:

The prices of junk bonds issued by “physician services companies” have been sliding in the past month as their owners weigh the possibility and costs of political intervention. These point to the real source of the problem: private equity’s silent colonisation of parts of the healthcare profession.

A recent paper by two US academics highlights how private equity activity has driven up the price of healthcare for American consumers. The problem is a result of “the interplay of buyout strategies (which pile leverage on to companies and emphasise financial returns) and the business of treating people, where sick patients have no power to shop around and outcomes come first,” the piece notes.

Private equity has acted as a consolidator in healthcare services, building giant physician services groups like Envision, HealthTeam and AirMedical Group.

Envision was a company that was flipped between public and private ownership since 2005. It employs 70,000 staff and spans services like emergency rooms, radiology and anaesthesiology. The businesses are perfect for what private equity is looking for. The academic paper states:

“Emergency medical services are a perfect buyout target because demand is inelastic, that is it does not decline when prices go up.”

And in addition to being inelastic, demand is robust: about 50% of medical care comes from emergency room visits.

The deals that physician service groups work out with hospitals are rarely transparent to the public. And this is probably for good reason:

But a study by Yale University of the billing practices of EmCare, Envision’s physician staffing arm, showed that when it took over the management of emergency rooms, it nearly doubled patient charges compared with those levied by previous physician organisations.

Which raises the question why hospitals go along with these arrangements. Well, some have struck joint-venture deals with physician companies, splitting the extra revenues these entities stick on patients. But for many, they don’t have the resources or the industry clout to combat surprise billing on their own.

As a result, congress is now considering legislation to curb “surprise” billing in healthcare. The larger debate, as the U.S. will certainly be subjected to leading up to 2020, is whether or not private equity companies belong in the healthcare sector to begin with. Their tactics have done nothing but “give more credence to the arguments of Elizabeth Warren and others,” the piece concludes.

Tyler Durden

Tue, 10/08/2019 – 23:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com