Futures Tumble, Stocks Slide As China Wants More Talks Before Signing “Phase One” Trade Deal

Who would have possibly thought that Friday’s “Phase One” trade deal with China wasn’t worth the paper it was signed on?

If trade ties between China and the U.S. get back normal, it is “totally possible” for China to import $40b-$50b of agricultural products from the U.S., says China’s Taoran Notes

So even the agri deal is contingent/ not finalized

— zerohedge (@zerohedge) October 14, 2019

Oh wait, it wasn’t even signed, despite Trump’s tweeted assurance that the consequences of the deal with happen “immediately.”

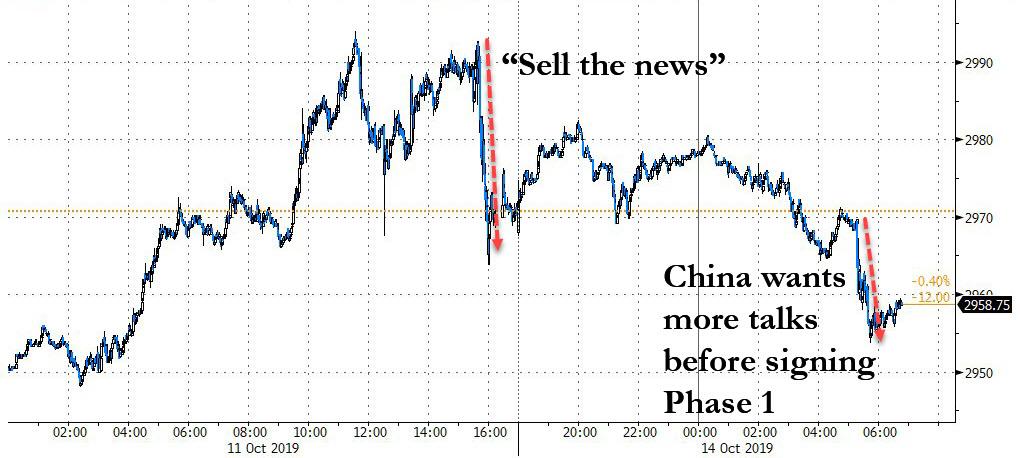

Well, with futures initially rallying today in continuation of Friday’s sharp move higher, the rally first fizzled then futures tumbled just after 5am ET when Bloomberg reported that China wanted “further talks” as soon as the end of October to hammer out the details of the “phase one” trade deal touted by Trump before Xi Jinping agrees to sign it.

In other words, Friday wasn’t even Phase 1 – it was more like Phase 0.

As Bloomberg adds, Beijing may send a delegation led by China’s top negotiator, Liu He, to finalize a written deal that could be signed by the presidents at the Asia-Pacific Economic Cooperation summit next month in Chile. Why the delay? Because as we wrote over the weekend in “It’s All About The December Tariffs Now: “These Negotiations Look Much More Difficult Than Phase 1“, China now wants Trump to also scrap a planned tariff hike in December in addition to the hike scheduled for this week, something the administration hasn’t yet endorsed.

Meanwhile, as we also detailed over the weekend, the details of the “verbal agreement” reached in Washington last week between the two nations remain unclear, with many pointing out that nothing of matter was actually achieved and that China was desperate for the US agri imports anyway to avoid starving its population and prevent a social uprising. While Trump hailed an increase in agricultural purchases as “the greatest and biggest deal ever made for our Great Patriot Farmers in the history of our Country,” China’s state-run media only said the two sides “agreed to make joint efforts toward eventually reaching an agreement.”

In any case, after initially trading higher following Friday’s late “sell the news” dump, futures reversed after rising to within 1.8% of a record close Friday and slumped to session lows as much as 0.4% after the report…

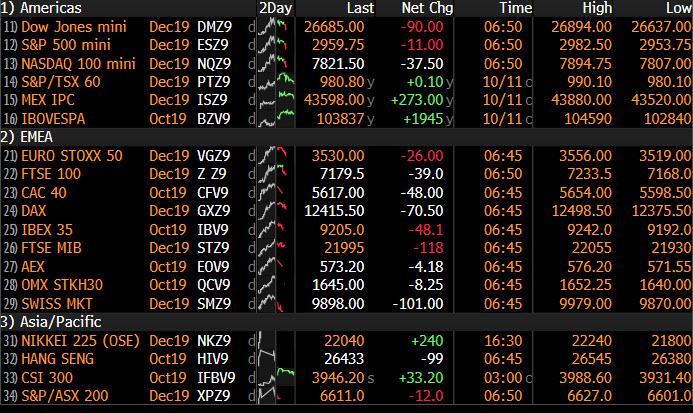

… while Europe’s Stoxx Europe 600 Index falls to session low, down as much as 1%, with rasic resources shares extending declines to as much as -2.8%, while banks remain as second-worst industry group, down 1.7%.

Stocks had climbed earlier from Sydney to Hong Kong, helping sustain a rally in emerging-market assets after after the positive conclusion of the latest round of trade talk. However, the latest negative trade deal news came after most of Asia had closed so expect all of this euphoria to be promptly unwound.

Add to this the unwind of the Brexit “hope” trade on Friday which saw cable explode higher amid optimism of a Brexit deal, as a result of murmurs of dissatisfaction from the EU and fears that Johnson’s ‘Queen’s Speech’ agenda might be voted down, becoming the first such loss for a government in 95 years, which rattled British markets, driving both the pound and British stocks lower, with the sterling down nearly 1% against the dollar at one point from a three month high, erasing a large swath of its gains from Thursday and Friday, its largest two-day rally in ten years.

UK PM Boris Johnson told his Cabinet on Sunday that a Brexit deal is achievable but added that that while a pathway to an agreement could be seen, there is still a significant amount of work required and the UK must be prepared to leave on Oct. 31st. Furthermore, it was also noted that EU negotiators warned his plans are not yet good enough to be the basis for an agreement, while it was also reported that Brussels is demanding further Brexit concessions from UK which has prompted warnings that a deal based on additional compromise would be rejected by Parliament. The main issues, following a briefing by EU Brexit Negotiator Barnier to the EU27 are: rebate system is complex, plans will not be ready for the end of the transition and it’s unclear how we can ensure goods for Northern Ireland remain in Northern Ireland. EU Source notes that a deal at the summit is very difficult, but not impossible.

With the US bond market closed for Columbus Day – it remains a mystery why equities trade today when the Treasury market is on vacation – traders bought what safe assets they could, and the dollar strengthened against all other G10 currencies except the Swiss franc and the yen as Brexit euphoria waned and investors waited for further progress on the trade front.

The Bloomberg Dollar Spot Index gained for the first time in four days as risk-on trades are unwound, mostly to take profit, according to two traders in Europe. Haven-currency short positions were also trimmed by leveraged names during London hours; the yen hit a day high after a report that China wants further talks as soon as the end of October to hammer out the details of the “phase one” trade deal touted by Donald Trump before Xi Jinping agrees to sign it.

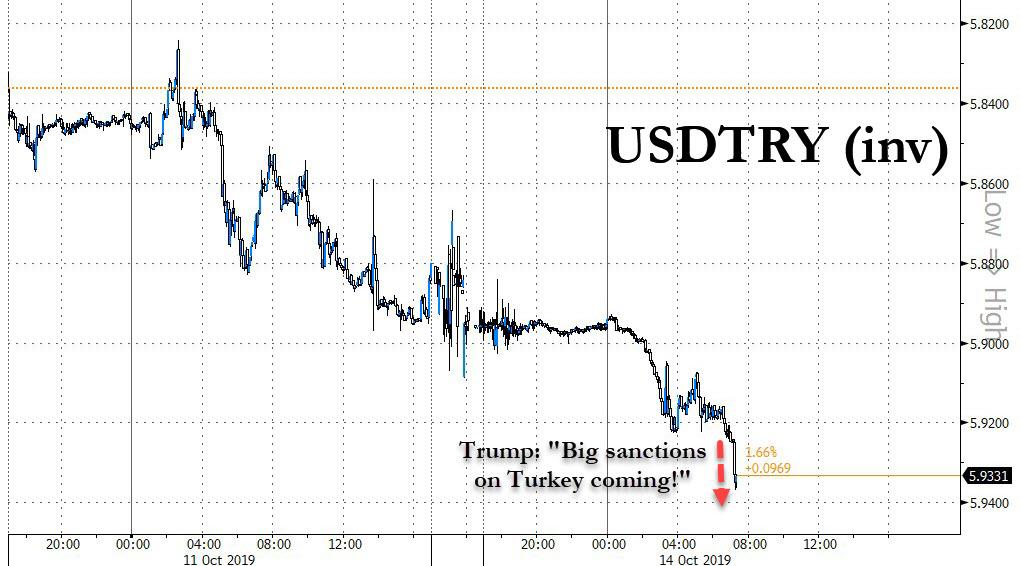

The Turkish lira tumbled as suddenly Erdogan finds himself in the middle of a diplomatic scandal where virtually every western power is bashing his invasion of northern Syria and Trump moments ago warned on Twitter that “big sanctions are coming!” sending the lira plunging to session lows.

Turkey’s stock market also tumbled as the U.S. and Europe increased threats to impose sanctions over the incursion into Syria.

Elsewhere, the yuan erased most of its earlier gains offshore.

The bottom line: investor skepticism to the “Phase 1” trade deal proved well-founded after Bloomberg reported that Beijing still wants to hammer out the fine print, with some sticking points remaining. Worse-than-expected September trade figures in China underscored the growing pressure on both Trump and President Xi Jinping to reach a deal to avert a wider slowdown in the global economy.

For those who missed it, overnight China reported that exports were down 3.2% yoy in September (USD terms), from a decline of 1.0% yoy in August, roughly in line with consensus expectations. Imports continued to soften, declining 8.5% yoy in September (v.s. -5.6% yoy in August), also below consensus expectations. In sequential terms, exports declined 0.3% mom sa non-annualized in September, down further from a contraction of 2.2% in August. Imports also extended the weakness by declining 2.3% mom sa non-annualized in September (vs. -0.9% mom sa in August). China’s trade surplus increased modestly to US$39.7bn in September from US$34.8bn in August.

Exports to the US posted a significantly larger year-on-year decline in September (-21.9% yoy in September v.s. -16.0% yoy in August) after the 15% US tariffs on around USD 125bn of goods went in place on September 1. Exports to Japan also contracted 5.0% yoy in September after a rebound in August. Exports to the EU and ASEAN both slowed as well to +0.1% yoy and +9.7% yoy in September (from +3.2% yoy and +11.2% yoy in August), respectively. Weakness in imports were widespread across major trade partners, particularly weak from the US (-15.7% yoy in September).

“Let’s not get carried away,” said Raoul Leering, head of international trade research at ING Bank NV. “There is a very tough journey ahead for the U.S. and Chinese negotiators to cut a deal that really has substance.”

And so with it becoming clear that nothing was resolved on the trade front, traders will be busy there as well as focusing on earnings season which begins tomorrow with big banks including JPMorgan, Goldman and Morgan Stanley.

In commodities, West Texas crude oil dropped after surging the most in almost a month on Friday.

Market Snapshot

- S&P 500 futures down 0.4% at 2,960.00

- STOXX Europe 600 down 0.8% to 388.47

- MXAP up 0.7% to 158.01

- MXAPJ up 0.8% to 509.56

- Nikkei up 1.2% to 21,798.87

- Topix up 0.9% to 1,595.27

- Hang Seng Index up 0.8% to 26,521.85

- Shanghai Composite up 1.2% to 3,007.88

- Sensex up 0.8% to 38,424.42

- Australia S&P/ASX 200 up 0.5% to 6,642.59

- Kospi up 1.1% to 2,067.40

- German 10Y yield fell 2.6 bps to -0.468%

- Euro down 0.1% to $1.1028

- Italian 10Y yield fell 1.6 bps to 0.6%

- Spanish 10Y yield fell 3.8 bps to 0.198%

- Brent futures down 1.9% to $59.36/bbl

- Gold spot up 0.4% to $1,494.27

- U.S. Dollar Index up 0.2% to 98.46

Top Overnight News

- China wants further talks as soon as the end of October to hammer out the details of the “phase one” trade deal touted by Donald Trump before Xi Jinping agrees to sign it, according to people familiar with the matter

- The pledges China and the U.S. made to keep prospects alive for a comprehensive trade deal did little to alter the deteriorating growth outlooks for both countries because they were sealed with something economists don’t trust: a handshake. China’s exports and imports shrank more than expected in September, as existing U.S. tariffs and the ongoing slowdown in global trade combined to undercut demand

- Boris Johnson’s attempt to secure a Brexit deal ran into trouble after the European Union warned the talks were still a long way from a breakthrough and the British prime minister’s political allies distanced themselves from his plans

- Euro-area industrial production rose more than expected in August, a rare bright spot in a downbeat picture for the currency bloc’s economy

- House Speaker Nancy Pelosi wants to finish the impeachment inquiry into Donald Trump before the heart of the 2020 election, but she will likely need to do it without help from federal courts, which could take months to resolve any fight over presidential stonewalling

Asian equity markets began the week on the front-foot as the region reacted to last week’s announcement of a US-China Phase 1 deal, in which China agreed to make between USD 40bln-50bln of agricultural purchases from the US and the latter will refrain from implementing the October 15th tariffs. This spurred a relief rally for the majors across the region with the ASX 200 (+0.6%) led by the energy sector as Santos shares surged from a deal to buy assets from ConocoPhillips, although gold miners suffered after the precious metal retreated further below the USD 1500/oz level. Hang Seng (+0.8%) and Shanghai Comp. (+1.2%) were also lifted by the euphoria from President Trump’s deal announcement and suggestion that the sides were close to ending the trade war, with further violent protests in Hong Kong as well as weaker than expected Chinese Exports and Imports figures, doing little to dent the mood for Chinese stocks. As a reminder, Nikkei 225 was closed as Japan observed Health-Sports Day.

Top Asian News

- China’s Imports, Exports Both Worse Than Expected in September

- State Banks Sell Dollars to Ease Pain of Sanctions Risk for Lira

- South Korea’s Moon Apologizes After Justice Minister Resigns

- Singapore Central Bank Eases Policy as Economy Avoids Recession

- H.K. Police Say Improvised Explosive Device Detonated Sunday

European stocks kicked the week off on the backfoot [Eurostoxx 50 -1.0%] as the US-China trade truce euphoria dissipated amid reports that China wants more talks before signing US’ “phase 1” deal and as Brexit angst further weighs on sentiment, with the prospect of a breakthrough deal between UK and EU seem further than previously thought. Thus, the UK banking names and housebuilders underperform with substantial losses seen in RBS (-2.4%), Lloyds Banking Group (-3.2%) and Barratt Developments (-2.1%) who all rest at the bottom of the FTSE 100 (-0.5%). Broad-based losses are seen across all other major bourses. Turning to sectors, Materials and Financials underperform, with the former weighed on by a recoil in base metal prices and sentiment and the latter due to a lower-yield environment and the aforementioned Brexit jitters. Meanwhile, defensive sectors fare slightly better due to the overall risk aversion in the market. In terms of individual movers; Swiss heavyweight pharma names Roche (-1.6%) and Novartis (-1.7%) are subdued by source reports that the US is mulling tariffs on the Swiss pharma sector to narrow the US trade deficit with the country. Meanwhile, Daimler (-1.2%) shares are hit on reports that the Co. is to recall hundreds of thousands of Mercedes-Benz vehicles amid diesel emission issues. On the flip side, Spain’s Ferrovial (+1.0%) remains near the top of the Stoxx 600 index as it is reportedly to bid for Spanish railway concessions with French National Railway Company.

Top European News

- Johnson Stumbles in Bid for Brexit Deal as EU Demands Answers

- Extinction Rebellion Takes Climate Fight to the Bank of England

- Trichet Backs Draghi as QE Spat Becomes Battle Over ECB Legacy

- Thoma Bravo Agrees to Buy U.K. Cyber Firm Sophos for $4 Billion

- Catalan Leader Jailed for 13 Years for Attempt to Break Up Spain

In FX, the major underperformers after Friday’s arguably outsized and overextended gains on US-China trade and Irish border optimism or even hype, with latest Chinese trade data revealing weak internals and intensive weekend talks between the UK and EU not yielding positive results. Note also, latest reports suggest that China wants to discuss matters further with the US before signing off on Phase 1 of the deal agreed in principle last week. The Kiwi and Pound are propping up the G10 table, as Nzd/Usd slips back under 0.6300 and Cable retreats from just over 1.2705 towards 1.2550. The Aussie has also relinquished big figure-plus status vs its US counterpart, but holding above 0.6750 amidst supportive Aud/Nzd crosswinds within a 1.0760-20 range.

- NOK/SEK – Soft oil prices and another shift in the tech landscape alongside fading risk appetite is weighing on the Scandi Crowns, with Eur/Nok bouncing ahead of 10.0000 and Eur/Sek back up over 10.8500 awaiting more top tier Swedish data this week in the form of jobs on Thursday.

- EUR/CAD/CHF/JPY – The Euro and Loonie are both sticking to relatively tight lines against the Greenback between 1.1015-50 and around 1.3200 respectively, but the single currency deriving some underlying support via marginally firmer than forecast Eurozone ip in contrast to the latter that is also having to contend with the decline in crude noted above. Meanwhile, the traditional safe-havens that were roundly shunned last week have regained some poise alongside Gold as the Yen pares losses from circa 108.50 to almost 108.00 and the Franc rebounds through 0.9950 and 1.1000 against the Euro even though latest Swiss sight deposit balances infer ongoing official activity aimed at curbing Chf demand. Back to Eur/Usd, decent option expiries may keep the headline pair in check, as 1.1 bn roll off between 1.0995-1.1000 vs 1.5 bn from 1.1090 to 1.1100.

- EM – The Lira continues to depreciate and slumped to 4 month lows against the Buck near 5.9200 on a negative mix of investor concerns about Turkey’s offensive in Northern Syria and the consequences of military action, such as sanctions. Moreover, data has also undermined the Try with a steeper deceleration in ip adding to the case for further CBRT easing ahead of next Thursday’s policy meeting.

In commodities, WTI and Brent futures are mirroring the risk aversion in the market with both benchmarks down around USD 1.5/bbl on the day as further downside was exacerbated by reported that China wants more talks before committing to President Trump’s mini deal. The complex has been little influenced by news-flow during the European session thus far, although Russian president Putin is in Saudi Arabia for the first time in over a decade, with the two countries poised to sign a partnership agreement. On the OPEC front, sources stated that the OPEC+ compliance in September will be in excess of 200%, albeit this is mostly to account for the attack on Saudi oil facilities in early September. Meanwhile, Russian Energy Minister Novak said that Moscow is currently fully committed to the OPEC+ deal and there is no current discussion to alter it. ticking with OPEC, Kuwaiti energy ministry noted that it prefers oil prices around 50-70/bbl. Turning to Aramco, its chairman noted that the IPO could be carried out this month, whilst last week, WSJ noted that the Aramco IPO prospectus could be released by month-end. As a reminder, this week’s inventory data will be delayed by a day as the US observes Columbus Day, albeit this is a non-market holiday. Elsewhere, gold edged higher towards the 1500/oz mark on the aforementioned China news with the next level to the upside seen at 1507.30/oz (50 DMA). Meanwhile, copper prices retreated back below the 2.60/lb mark on the risk sentiment coupled with poor China import figures. Copper sees its next level to the downside at 2.5866/lb.

US Event Calendar

- nothing scheduled

DB’s Jim Reid concludes the overnight wrap

This time last week the chances of an imminent US/China trade deal and a Brexit agreement looked bleak. As London went home on Friday market euphoria had broken out on both. In addition the Fed announced a new $60bn/month liquidity injection, aimed at bills, which they are trying hard not to call it QE but will be seen as a liquidity boost nonetheless. Markets did come off their European closing highs on Friday as the reality sunk in that the US/China deal is very limited and won’t be signed for several weeks. Meanwhile the chances of a Brexit deal, whilst hugely increased, are by no means a slam dunk. The weekend news-flow on this has been more mixed but talks are ongoing.

If you’re looking to enhance your Brexit knowledge ahead of this very crucial week (when have we heard that before), and you like soft 70s disco then I have the perfect Venn diagram for you. There is a very amusing (and credible) new concept album just out called “The Hustle: A Brexit Disco Symphony” by Article 54. It includes such tracks as “Backstop”, “Canada Plus”, “Alternative Arrangements”, “Freedom of Movement”, “No Deal”, and my personal favourite “Let Go W.T.O.” It’s on most major streaming services if you want to tap your feet on your commute this morning.

I haven’t yet heard a concept album about the trade war so you’ll have to make do with just the facts. On Friday the US reached a “phase one” deal in principle with China. The deal suspends the planned increase in tariffs that was due to take effect tomorrow, and in return China will implement reforms to their intellectual property protections and their financial markets openness, and will also buy $40-50 billion of US agricultural goods. The deal also includes new FX transparency commitments, though it does not include anything related to the sanctions on Huawei. The S&P 500 fell around -0.71% after the deal was announced (still up over a percent as we’ll see below), as expectations had already moved to incorporate the reported deal. Since the ultimate announcement did not roll back any existing tariffs or suspend the planned new tariffs due in December, it at the margin fell short of some hopes. The commitments outside of agriculture also look a bit vague. However we’ve kicked some of the can down the road even if we’ve not got close to solving many of the bigger issues behind the conflict. Not many businesses that have been disturbed by the trade war will yet be able to see a clear pathway ahead. So uncertainty will remain. China’s response to the partial agreement has been fairly muted with the Ministry of Commerce merely saying in a statement that, “the two sides have made substantial progress” in a number of areas and “agreed to work together in the direction of a final agreement.”

In terms of more detail on Brexit, to enter the negotiating tunnel this past weekend has been a phenomenal achievement relative to where we were after the unusually hawkish U.K. briefing on the Johnson/Merkel call early last week and the leaked no.10 source that basically said the Tories would now campaign on a no deal Brexit and start reducing cooperation with the EU on a whole host of things including security (per Bloomberg). All this has been forgotten but the key might still be the DUP and noises over the weekend have been mixed on whether they can support a deal. It’s also not clear that a deal can be negotiated and cleared in time for October 31st even if the will is there. Barnier suggested yesterday that no significant progress was made over the weekend but that talks would continue. He reportedly said that the UK’s proposals for breaking the deadlock over the Irish border lacked detail and risked leaving the single market vulnerable to fraud (per Bloomberg). So talks on a knife edge. Sterling is back down -0.42% this morning after a very strong end to the week.

Details on the negotiations remain scant but the jist seems to be that NI stays in the U.K. customs union legally but in the EU’s in practical terms with rebates on offer to NI businesses from the U.K. government where there’s a misalignment of duties. Outside of the DUP the questions to ask would be how many Labour MPs would vote for this deal (if reached) and whether the hardline ERG are brought onside (more likely). I still think the nuclear move would be for the EU to say that if this deal isn’t agreed by MPs then there will be no extension. This would then put huge pressure on those MPs that want to remain, want a better deal, want to embarrass the government and/or want a second referendum. I’m not sure the EU would press that risky button but maybe Johnson will insist on it as part of the negotiations?

The focal point of the week will be the EU Council summit taking place on Thursday and Friday. Amidst the negotiations with the EU, the UK government will also be outlining its legislative programme for the coming session of Parliament in a Queen’s Speech today. Surreal timing given all that’s going on but it will effectively be an election manifesto. This all comes before a planned special sitting of Parliament , which is also the deadline set under the Benn Act, which says if MPs either haven’t approved a deal by that date, or explicitly approved leaving the EU without a deal, then the Prime Minister has to ask for a three-month extension to the Article 50 deadline, currently set for 31 October. So a bumpy path to a binary moment on Saturday. Our FX strategist became bullish on Sterling on Friday morning and target $1.35. They are slightly less concerned as to whether the deal passes as they think the latest developments mean that as a minimum the Tories should now campaign on their deal if they get voted down in Parliament. So they believe the next election will be based around a deal (if one hasn’t been reached) or a second referendum and that no deal risks have fallen.

Overnight, Asian markets are trading higher following Wall Street’s lead with the Hang Seng (+1.03% ), Shanghai Comp (+1.38%), and Kospi (+1.40%) all making advances along with most other markets. Japanese bourses are closed for a holiday and the onshore Chinese yuan is up +0.50% to 7.0539. Elsewhere futures on the S&P 500 are also up +0.29%. As for overnight data releases, China’s September trade balance came in at $39.65bn (vs. $34.75bn expected) as the decline in imports (at -8.5% yoy vs. -6.0% yoy expected) was sharper than the decline in exports (at -3.2% yoy vs. -2.8% yoy expected). In terms of trade with the US, exports declined c. -22% yoy while imports declined by c. -16% yoy.

Turning to geo-politics, Bloomberg reported over the weekend that EU governments are pledging to coordinate on imposing an arms embargo on Turkey and are discussing other possible sanctions. Meanwhile, France and Germany called for an immediate halt to Turkey’s offensive in Syria, with President Macron and Chancellor Merkel meeting yesterday evening to coordinate. Elsewhere, US president Trump tweeted that ‘Dealing with @LindseyGrahamSC and many members of Congress, including Democrats, about imposing powerful Sanctions on Turkey. Treasury is ready to go, additional legislation may be sought. There is great consensus on this. Turkey has asked that it not be done. Stay tuned!’. Overngiht, we also got reports that the Turkish army captured Tal Abyad, a strategic town, while reaching its target of penetrating as deep as 30-35 kilometers (19-22 miles) into Syria. Meanwhile Syrian President Bashar al-Assad sent troops to the country’s northeast in response to a Turkish offensive, raising risks of an escalation. The Turkish lira is down -0.22% this morning but the situation remains live (per Bloomberg).

Moving onto this week now before recapping the numbers from last. Even outside of Brexit it’s going to be busy culminating with global policymakers gathering in Washington for the IMF and World Bank’s annual meetings. The latest IMF world outlook is out tomorrow which will attract lots of headlines. There will be lots of talk around this as to whether the global economy is at risk of slipping into recession. Obviously the trade deal will reduce some of the risk but many will feel it’s too little too late and won’t remove a lot of the uncertainties. Elsewhere China’s Q3 GDP release (Friday) should give us a further indication of how the economy is being affected by trade issues. Other data releases to watch out for include US retail sales (Wednesday) and industrial production (Thursday), Germany’s ZEW survey (tomorrow), today’s Euro Area IP and the start of US earnings season. Momentum will start tomorrow with the highlights including Goldman Sachs, Citigroup, JPMorgan, BlackRock, Johnson & Johnson, Wells Fargo and UnitedHealth Group. On Wednesday, Bank of America, Netflix, IBM and Abbott Laboratories will all be reporting. Thursday sees Morgan Stanley, Philip Morris, Honeywell International and Union Pacific release earnings, while on Friday we have Coca-Cola and American Express. Meanwhile also in the US, with over a year to go until the presidential election next November, another Democratic primary debate will be taking place on Tuesday. 12 candidates will appear on a single night, including the polling frontrunners, former Vice President Joe Biden and Senator Elizabeth Warren.

Last week’s trading was dominated by two parallel themes: the Brexit negotiations and the US-China trade war. At the start of the week, things looked ominous on both fronts, and equity markets started out in the red. However, by Thursday and Friday, optimism had resurfaced on both fronts, buoying risk appetite and sending equities higher. The S&P 500 gained +0.62% (+1.09% Friday) to snap a three week losing streak. The DOW (+0.91% on the week, +1.21% Friday) and NASDAQ (+0.93% and +1.34% Friday) gained similarly, with banks (+1.19% and +1.63% Friday) and transport firms (+2.61% and +2.23% Friday) pacing the gains. In Europe, the Stoxx 600 gained +3.00% (+2.31% Friday) for its best week since February. Safe havens fell, with gold down -1.11% (-0.40% Friday). Ten-year bond yields rose +20.7bps, +26.2, and +14.4bps in the US, UK, and Germany (+6.8, +11.7, +2.7bps Friday). The US yield curve steepened +2.3bps (+2.1bps Friday), taking it to 14.3bps, as front-end yields rose more moderately. 12-month bill yields ended the week +5.6bps (+1.5bps), falling -4.2bps from their highs on Friday after the Fed announced that they will buy $60 billion of bills per month through at least Q2 next year, to boost reserve balances and prevent volatility in money markets.

As for the substance of the two main drivers, the breakthrough on the Brexit front was the surprise positive talks between the UK and Ireland, and by extension with the EU27. The pound rallied +2.57% on the week, its best weekly performance in over two years (+1.81 Friday).

Tyler Durden

Mon, 10/14/2019 – 07:41

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com