In “Obscene” Move, Oil Tanker Rates Explode To Record Levels Amid Flurry Of Geopolitical Risks

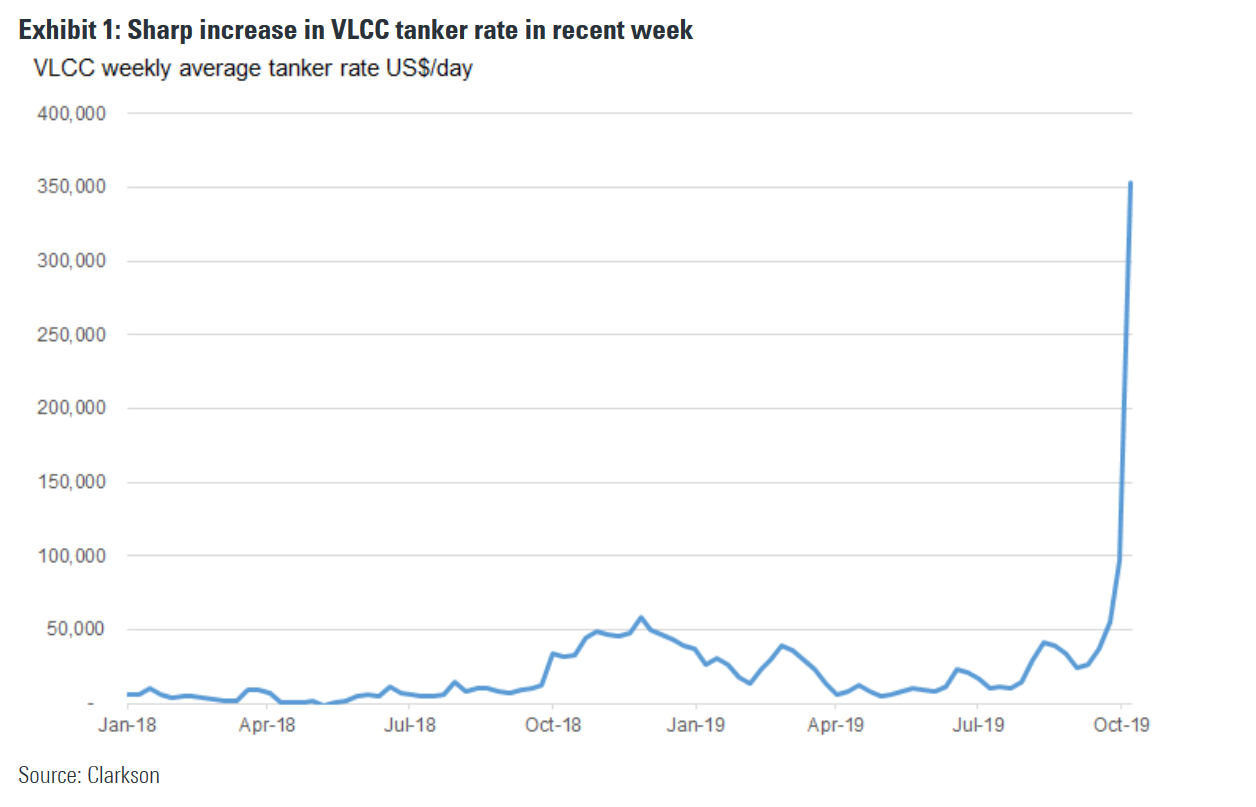

In a world where multiple-sigma events now happen with daily regularity, few people seemed to notice an unprecedented event taking place in the oil tanker industry, where spot charter contacts for very large crude carriers (VLCCs) exploded above $300,000 as the industry digested the fallout from the US focusing its spotlight on sanctions on oil, especially China’s Cosco Shipping company, and from the latest security incident in the Middle East.

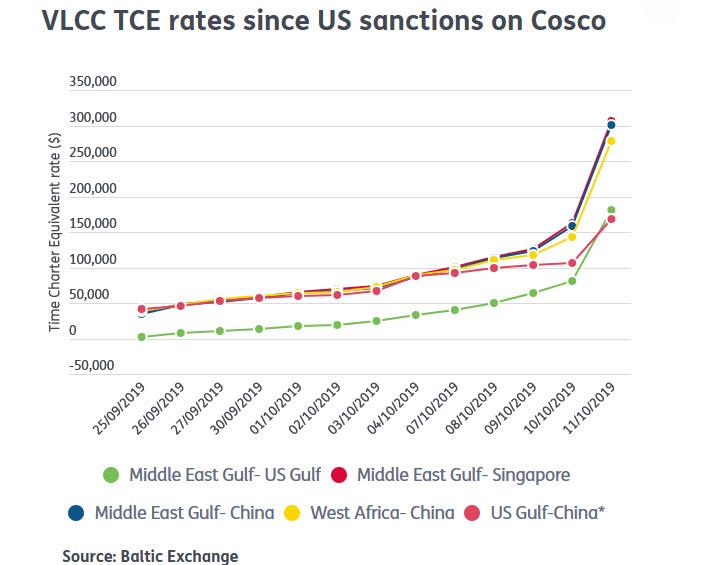

As Lloyd’s List notes, the Baltic Exchange Dirty Tanker Index, which aggregates global shipbroking charter rates, reported that by Friday afternoon, rates for West Africa to China VLCC routes had almost doubled within a day to reach $278,057. Middle East Gulf to Singapore and China routes had reached $305,998 and $300,391 respectively, marking an almost 100% day-on-day increase.

Clarkson’s take was even more shocking, reporting that the weekly VLCC tanker rate exploded nearly 15x in hours, soaring from $25,000 to $350,000.

“We are seeing record levels today,” said Evercore marine transportation analyst Jonathan Chappell last Friday. “$300,000 VLCC rates are unprecedented, at least in the last 20 years.”

“VLCC rates have now climbed to levels not recorded before, with spot earnings quoted above $300k/day – and brokers expecting the current activity level to continue,” said Pareto analyst Eirik Haavaldsen, adding that he expects “the product tankers to start benefiting from the obscene crude tanker markets, as more LRs are switching to dirty mode.”

VLCC rates have been rising sharply since the US imposed sanctions on units of Cosco Shipping. As Lloyds List adds, crude oil tanker rates have increased in recent weeks “as US sanctions have effectively squeezed tonnage out of the market.”

As a reminder, in late September, the US government sanctioned some of Cosco’s tankers for importing Iranian crude oil in violation of US sanctions. The sanctions not only knocked out those specific vessels from general availability, but also contaminated those in joint ventures where Cosco has a presence. And even though oil traders have again started booking supertankers operated by the Chinese shipping giant, rates have continued to climb.

That’s due in part to decisions by Exxon Mobil Corp. and China’s Unipec to avoid vessels that were involved in trades related to Venezuela, also under U.S. sanctions, affecting over 200 VLCCs and suezmaxes according to Burak Cetinok, head of research at Arrow Shipping Group in London.

Bimco chief shipping analyst Peter Sand told Lloyd’s List that as long as Asian refiners from India to Japan remain desperate for crude these high rates will continue. He warned, however, that when that situation changes these rates will fall off a cliff, and news Wednesday that Cosco’s Dalian VLCC has been given temporary waivers from US sanctions, which will allow the discharge of crude oil cargoes although once the discharge is complete, sanctions will resume may prompt traders to take some profits.

A spike in geopolitical risk in the Middle East also helped: Iran recently said that missiles hit one of its ships in the Red Sea, amid a recent surge in political tensions in the gulf. The attack on the Iranian ship has added to risk premiums that were already high following the attack in Saudi Arabia last month.

The incident came less than a month after an attack on Saudi Arabia’s oil industry, which initially knocked out half of the kingdom’s output.

As a result of the surge in rates, earnings for ships on the benchmark Persian Gulf-China route began to pass the $100,000-a-day mark last week. One supertanker, the Ardeche, has been booked for a journey in early November from the Middle East to Singapore at a rate equating to $327,853, excluding idle days, according to a fixture report listed by shipping pool Tankers International.

The surge is likely to continue through the fourth quarter, with a seasonal dip in early 2020, but 2020 should remain strong, according to Randy Giveans, vice president for equity research at Jefferies in Houston. He expects a very good market for at least 18 months and possibly into 2021-2022. “I’m not saying rates will stay at these record levels for 18 months, but rates will certainly remain well above recent years in the coming quarters/years,” Giveans said.

* * *

At this point readers may be asking how to best benefit from the vertical move in VLCC chart rates, and the answer comes from Harris Kupperman of Adventures in Capitalism, who summarized the recent moves in tanker rates in a recent post “Shipping Is All About Upside Leverage“, which we repost below in its entirety:

Nine months ago, I began writing quite regularly about shipping (first article, second article, third article, fourth article). The thesis was simple; there was a dearth of new orders, IMO2020 would likely lead to further supply disruption and shipping is a leveraged play on geopolitical volatility (it was pretty obvious that Trump was going to keep causing chaos), hence you wanted to be long shipping. Part 1 of this thesis played out almost immediately, part 2 gathered momentum starting in late Q2 and the past month has all been about geopolitical volatility (Saudi refinery attacks, COSCO sanctions, Venezuela, etc). After many months of elevated charter rates, the share prices finally responded in the past two weeks. Despite many stocks appreciating by 50% more, I think the fun is just getting started.

Why do I say that? Let’s talk about operating leverage. On Friday, it was reported that a VLCC was chartered at the unheard-of rate of $300,000 a day. Let’s look at how the math on that works. Apologies as I’m going to do some generalizing and rounding here—if you want precise numbers, hire an actuary. A 10-year old VLCC is worth about $45 million and it costs about $20,000 a day to operate, so you’re getting cash flow of about $280,000 a day. If you finance your VLCC with 2/3 debt, you have $15 million of equity and you double your money roughly every 54 days. You’re basically making 6 times your money each year. Now, if you’re going to throw $300,000 into your financial model, someone should take away your crayons and stop you from hurting yourself because these rates are not sustainable. Still, doubling your money in 55 days, even if you can only do it only a few times during the next few quarters, will create a whole lot of value for shareholders. What other business can say that the share price should double in less than 2 months and potentially keep doing it? Now add in the fact that most share prices trade at a discount to NAV and NAV is rapidly increasing with vessel value appreciation and you could see some nutty upside in share prices—even when charter rates back off a good deal from here.

I want to show how this works in practice.

Since Scorpio Tankers (STNG – USA) is my largest position, let’s use it in the example. For the sake of simplicity, I’m going to use the example that management has used where LR rates average $50,000 and MR rates average $30,000 in 2020. Are those the right rates? Who the hell knows? However, you can add or subtract $0.80 a share per $1,000 of charter rate movement to get to your chosen cash flow number. In any case, with those selected charter rates, Scorpio has cash flow of $25 a share. Valuing a fleet is always somewhat subjective, but I’m going to go with $35 a share based on recent vessel transactions. Finally, Scorpio has 128 vessels. If those charter rates happen, the vessels are bound to appreciate. Let’s say they appreciate by $10 million each. That’s $1.28 billion of added value or $22 a share in added NAV. Add it all up and Scorpio is worth $82 a share ($25 + $35 + $22) at the end of 2020. There is almost no new tonnage expected in 2021. Why can’t charter rates remain elevated? If you are going to make $22 on $82 of value, you’re earning 27% on shareholder equity before including some added cash flow due to debt repayments. Companies earning such high returns on capital are often valued at a premium to NAV based on the ability to continue earning a high return on capital for at least a few more quarters while paying down debt and doing other accretive things. It is crazy to think that the company shouldn’t be worth 1.25 times NAV? During the 2003 to 2008 boom, most shipping companies traded at a few times NAV, so 1.25 seems almost conservative during a bull market. In any case, the above math gets you to $103 a share. Is the stock going that high? I don’t really know, but my average is $17 and despite a 9-month double, I feel like there’s plenty of meat on the bone here—especially if rates dramatically overshoot. No one thought that VLCC rates could ever get to $300k, but here we are. Why can’t LR rates go to $100k for brief moments in time? Not saying this is my prediction and don’t cry to me if it doesn’t happen, but why can’t it happen? Especially with the increased clean tanker demand from IMO2020 and the large number of older LRs which have recently gone into the dirty market to take advantage of Aframax rates.

You can do this similar math with any shipping company—just plug in where you think rates are and you can see the operating leverage available to shareholders. Naturally, the companies with the most leveraged balance sheets offer the most upside leverage along with the most risk if rates back off. I’m not here to pound the table on shipping (I’ve done that enough times already), rather, I want to show that the share price movements what we’ve seen in the past two weeks are only a small taste of what could come. Amazingly, many of these stocks still trade at large discounts to NAV. It’s been a decade since we saw a real bull market in shipping. Investors have forgotten just how explosive it could be.

On a final note, think back to the worst short squeeze of your career. That time something went insane and you were short. We’ve all been there at least once. Remember how thankful you were when it finally backed off a bit. What was your first reaction? Mine was to cover most at a much-reduced loss. Now pretend you’re in charge of logistics at a large trading house. You’re structurally short shipping at all times. Sure, you’ve locked in some time charters and maybe have some FFAs on the books, but you still have vessels to charter every month. Suddenly rates go up 10 times in a month. What do you do? You lock in as much length as you can on the first real pullback. Let’s just say that I don’t think VLCC charters are going back to $30,000 any time soon. I don’t know where the equilibrium rate is, but I think we’ve found a new and dramatically higher level for the next few years. The same can be said of many other shipping classes. This simply isn’t being priced in yet.

Tyler Durden

Wed, 10/16/2019 – 15:14

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com