US Futures Rally As Trade Deal, Brexit Optimism Return Despite Prevailing Chaos

One day after US stocks ended last week on the back foot amid growing uncertainty over Brexit, the ongoing trade talks on “Phase one” deal between the US and China and signals of a global slowdown, world stocks and US futures have rebounded, with risk sentiment boosted as the “ole’ faithful” – optimism in trade talks – made a return, with the added kicker of resurgent hopes that Britain will avoid a disorderly exit from the European Union gave cause for riskier bets, even though Saturday’s events in the UK showed that BoJo is anything if in control of the process.

Global markets started off the new week, the second busiest in Q3 earnings season, on the front foot, with MSCI’s world equity index rising 0.2%, with the broad Euro STOXX 50 adding 0.4%, led by mining and banking shares. Major European bourses are modestly firmer after risk sentiment turned more constructive following AsiaPac indecisiveness, during which the latest developments (or lack thereof) on the Brexit front and the PBoC’s decision not to cut Loan Prime Rates contributed to the cautious tone. The FTSE 100 (+0.1%) lags amid a stronger Pound on hopes that the worst possible Brexit outcomes are off the table and that PM Johnson may have enough backing for his Brexit deal. Sectors are mostly in the green, apart from defensives, with Consumer Staples (-0.6%), Health Care (-0.5%) and Utilities (-0.2%) all lagging on improved risk appetite.

The positive mood mirrored gains for Asian stocks earlier in the session. MSCI’s broadest index of Asia-Pacific shares ex-Japan rose 0.3%, with Chinese shares gaining 0.3%. The Asian advance was led by financial and industrial firms, as traders awaited quarterly earnings and a Brexit deal that’s still up in the air. Markets in the region were mixed, with Japan advancing and Australia retreating. The Topix rose 0.4%, supported by services, telecommunications and banking shares. The Shanghai Composite Index erased earlier losses to close 0.1% higher, with large lenders and insurers among the biggest boosts. China’s economy may be ready to stabilize despite recent warning signs, according to some economists.

In the US, S&P500 futures nudged up, pointing to a firm open that would keep American stocks still within sight of a fresh all-time high.

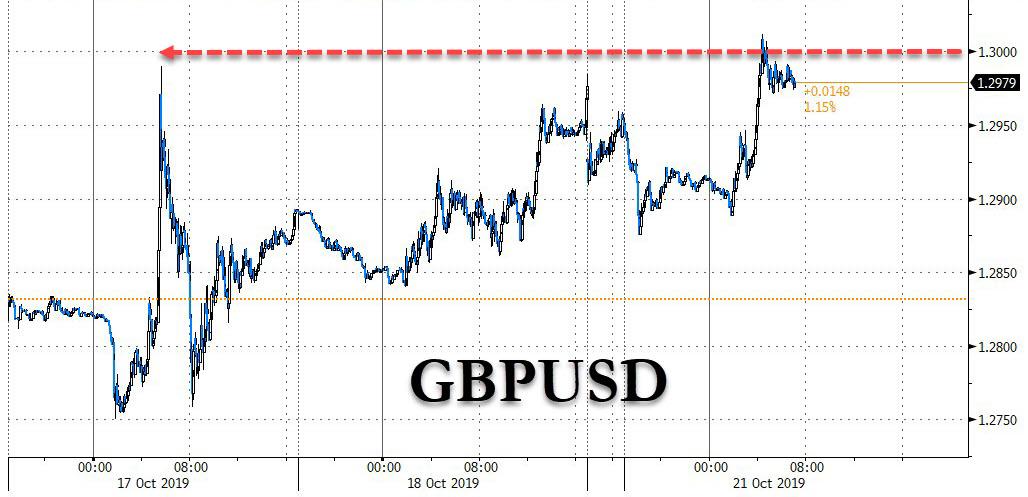

Appetite for riskier assets was supported as markets judged the chances of a disruptive “no deal” Brexit as lowering, even after Britain’s parliament delayed a vote on Prime Minister Boris Johnson’s deal to exit the EU. As reported earlier, BoJo will seek to put his Brexit deal to a vote on Monday, with the government proposing a debate on the agreement. Parliament was due to open at 1330 GMT. It was unclear, though, whether parliament’s speaker would allow a vote to go ahead; for now however traders bought the pound first and would ask questions later, with cable rising as high as 1.30 before, the highest level since May, a long-term resistance level, before paring back some of the move.

As a reminder, on Saturday, the UK Parliament vote on a Brexit deal was postponed after lawmakers voted (322-306) in favor of passing the Letwin amendment which withholds approval of the Brexit deal until legislation to ratify it is passed and which effectively forced PM Johnson to request a Brexit extension to January 31st under the Benn Act. Following this, PM Johnson stated that the legislation will be tabled in the upcoming week and sent a letter to the EU requesting a Brexit extension which he did not sign, while he sent 2 other letters where he stated that the extension request was from Parliament and urged the EU not to grant the extension. UK PM Johnson could be held in contempt by Scottish Court for urging EU leaders to ignore a letter asking for an extension to Brexit. Scotland’s most senior judge, Carloway, alongside two other judges will hear the allegations today. UK de facto Deputy Gove has triggered official contingency plans for a no-deal Brexit in an attempt to pressure MPs into backing PM Johnson’s Brexit deal. Elsewhere, the UK Government are reportedly drawing up plans for an election as soon as November 28th.

Daily Telegraph’s Political Correspondent Yorke tweeted that a senior DUP figure said the party could back a customs union amendment to the WAB in order to ensure whole of the UK leaves EU under the same customs arrangements and that the party will discuss issue over next 24-48 hours, while he added that another DUP figure said they’ll unleash guerrilla warfare in Parliament to block the Brexit deal unless Boris Johnson goes back to Brussels and addresses their concerns with the party said to be looking at multiple options this week.

Earlier in Asia, investors were boosted by Chinese vice premier Liu He’s comments on Friday that Beijing will collaborate with the United States to address mutual concerns on the trade war. President Trump on Friday also struck an optimistic tone, saying he thought a trade deal would be signed before an Asia-Pacific Economic Cooperation meeting in Chile next month.

“They seem to making progress,” said Jeremy Gatto, an investment manager at Unigestion in Geneva. “But we have seen in past that everything seems to look great and then a couple of days later seems to deteriorate again.” The 2020 U.S. presidential election was also influencing the talks, investors said, with Trump looking to avoid the possibility of tariffs imposed by China impacting his voting base. “Trump realizes that some of the tariffs that potentially could be implemented towards the end of the year could affect the consumer, which would be bad for the U.S. economy – and obviously bad for him,” Gatto said.

“It would be significant if they can get a phase one deal signed before Thanksgiving — the probability of that is probably a little bit over 60% right now,” Brett Ewing, chief market strategist at First Franklin Financial Services, told Bloomberg TV. “This is a very important issue, and I think it could remove a lot of uncertainty.”

Markets are also gearing up for high-profile earnings reports this week. Earnings season continues with a large number of releases taking place next week. On Tuesday, there’ll be Procter & Gamble, Novartis, McDonald’s, Texas Instruments, United Technologies and UBS Group. Wednesday will see Microsoft, Boeing, PayPal, Caterpillar and Ford announce results. On Thursday, there’s Amazon, Visa, Intel, Comcast, AstraZeneca, Royal Bank of Scotland, Nordea Bank and Twitter. And on Friday, announcements come from Verizon Communications, Anheuser-Busch InBev, Charter Communications and Barclays.

As noted above, in FX it was all about the pound, which had surged to $1.3015, recovering earlier losses of half a percent against the dollar. Sterling had by Friday risen by up to 6.5% in seven trading days to a five-month high, as a furious short squeeze underscored market expectations that either a deal or delay was most likely. As we reported on Sunday, Goldman Sachs said it now sees the chance of a no-deal Brexit reduced to 5%, from 10% previously.

Still, some investors said that sterling’s medium-term prospects were limited, even if no deal is avoided.

“I wouldn’t be too bullish because there is still going to be a huge amount of uncertainty going forward, even if the current deal is agreed,” said Tim Drayson, head of economics at Legal & General Investment Management. “If this deal does go through, ultimately it is still a relatively hard Brexit – we are out of the customs union – and it is still a deterioration in the UK terms of trade.”

Elsewhere, the dollar weakened against most G-10 peers as the week started with a pickup in risk sentiment.

In rates, Treasuries and euro-area bonds dropped as disagreements surfaced over next year’s budget, while gilts fall amid growing optimism that a Brexit breakthrough is possible. BTPs bear steepened, 10-year yields rising 5bps to 0.98%, reaching the highest since Sept. 12 ahead of a coalition meeting in Rome Monday. At the same time, Gilts slumped as U.K. PM Johnson attempts to put his Brexit deal to a vote in Parliament, with the U.K. 10-year yield climbing as much as 7bps to 0.78%.

In commodities, oil prices largely held steady on Monday, recouping some early losses as investors took stock of global economic pressures that could impact oil demand. Global benchmark Brent crude oil futures were down 12 cents to $59.35 a barrel.

There are no major economic announcements today; Halliburton, Lennox, and Celanese are reporting earnings today.

Market Snapshot

- S&P 500 futures up 0.2% to 2,995.00

- STOXX Europe 600 up 0.3% to 393.07

- MXAP up 0.3% to 160.04

- MXAPJ up 0.4% to 514.63

- Nikkei up 0.3% to 22,548.90

- Topix up 0.4% to 1,628.60

- Hang Seng Index up 0.02% to 26,725.68

- Shanghai Composite up 0.05% to 2,939.62

- Sensex up 0.6% to 39,298.38

- Australia S&P/ASX 200 up 0.04% to 6,652.51

- Kospi up 0.2% to 2,064.84

- German 10Y yield rose 4.2 bps to -0.34%

- Euro up 0.09% to $1.1177

- Italian 10Y yield rose 3.6 bps to 0.586%

- Spanish 10Y yield rose 4.2 bps to 0.287%

- Brent futures down 1.2% to $58.71/bbl

- Gold spot little changed at $1,490.40

- U.S. Dollar Index little changed at 97.23

Top Market News from Bloomberg

Asian equity markets began the week with a cautious tone following last Friday’s lacklustre close on Wall St and amid continued Brexit uncertainty. ASX 200 (Unch) and Nikkei 225 (+0.3%) were mixed with Australia dragged by underperformance in the tech sector. However, resilience in the property and mining sectors has limited the losses in Sydney, while Tokyo sentiment was kept afloat by mild JPY weakness as a larger than expected contraction in exports ata added to the pressure for the BoJ to act. Hang Seng (Unch) and Shanghai Comp. (+0.1%) conformed to the indecision after the PBoC injected liquidity via open market operations but refrained from anticipated cuts to its Loan Prime Rates, with Hong Kong also mildly underpinned after China revised rules to permit mainland investors to trade Hong Kong-listed dual class shares through the Stock Connect. Finally, 10yr JGBs are lower in which prices retested prior support around the 154.00 level and with demand subdued as Japanese stocks remained afloat, although downside was stemmed amid the BoJ presence in the market for JPY 1.16tln of JGBs in up to 10yr maturities.

Top Asian News

- China Braces for Sub-6% Economic Growth in Key Policy Meetings

- Temasek Offers to Buy Control of Keppel for About $3 Billion

- Xiaomi’s Long Suffering Shareholders to Get Mainland Boost

- China Banks Unexpectedly Keep Loan Prime Rate Steady in October

- ESR Seeks $1.45 Billion in Year’s Second-Biggest H.K. IPO

Major European Bourses (Euro Stoxx 50 +0.4%) are modestly firmer after risk sentiment turned more constructive following AsiaPac indecisiveness, during which the latest developments (or lack thereof) on the Brexit front and the PBoC’s decision not to cut Loan Prime Rates contributed to the cautious tone. The FTSE 100 (+0.1%) lags amid a stronger Pound on hopes that the worst possible Brexit outcomes are off the table and that PM Johnson may have enough backing for his Brexit deal. Sectors are mostly in the green, apart from defensives, with Consumer Staples (-0.6%), Health Care (-0.5%) and Utilities (-0.2%) all lagging on improved risk appetite. In terms of individual movers; Wirecard (+8.2%) shares spiked higher on the news that the Co. had decided to commission an independent audit relating to the recent allegations made by the FT. Smith and Nephew (-8.0%) sunk after the Co.’s CEO stepped down. Micro Focus (-5.6%) fell on after Open Text confirmed that it is not considering a potential acquisition. Meanwhile, strong earnings saw SAP (+1.7%) move higher, while weak earnings saw Just Eat (-6.5%) head lower. Prudential (-8.2%) shares took a dive on the news that the Co. is to split its UK business (M&G Business) from its Asia operations today. Finally, Osram (-0.4%) shares were initially supported by an upgrade to buy at Commerzbank and after AMS (+4.9%) confirmed its offer for the Co. whilst lowering its minimum accepted threshold, whilst Pearsons (+0.1%) was upgraded to hold from sell at Deutsche Bank.

Top European News

- Wirecard Shares Jump After Hiring KPMG for Independent Audit

- Swiss Greens Surge at the Expense of the Anti-Immigrant Right

- Berlin Freezes Rents in Landmark Plan to Tackle Cost Spiral

- M&G Starts Trading in London at Low End of Analyst Estimates

In FX, sterling has staged a strong comeback from post-super Saturday lows amidst increasingly bullish calls for the Pound and more bouts of short covering on the premise that the risk of a hard Brexit is declining with every move by UK Parliament to assume control of proceedings and/or force another Article 50 extension. Cable snuffed out stops around 1.3000 after eclipsing last week’s 1.2990 peak, but topped out around 1.3012 and Eur/Gbp retreated through 0.8600, though the cross held above last Thursday’s 0.8575 base as the single currency climbed alongside its UK counterpart.

- NZD/AUD – Although Sterling’s resilience awaiting PM Johnson’s next move and attempt to put his WA to the HoC is noteworthy, the Antipodean Dollars are outperforming and extending their recovery gains vs the Greenback as the Kiwi climbs above 0.6400 and Aussie nudged over 0.6875. The improvement in US-China trade relations and less dovish on balance near term RBNZ and RBA policy outlooks have underpinned the Nzd and Aud, while the YUAN is also maintaining momentum with the aid of steady PBoC mid-point fixes.

- CAD/EUR/CHF/JPY – The Loonie is benefiting from broad Buck weakness, as Usd/Cad eyes 1.3100 and support residing just ahead of the big figure, while the DXY has declined through 97.280 Fib support to fresh sub-97.200 lows and closer to the next downside chart target before 97.000 even (97.033 lows from August). Not much sign of Canadian election jitters or pressure via the ongoing retracement in crude prices, with Tuesday’s retail sales data expected to reveal stronger consumption. Elsewhere, Eur/Usd has been tracking Cable as noted above, but also buoyed by higher Eurozone debt yields on its way up towards 1.1180 and conscious of decent layered option expiry interest from 1.1120-30 (1 bn) through 1.1150-60 (1 bn) to 1.1200 (1.1 bn), while the 200 DMA is also in close proximity (1.1209). Conversely, the Franc and Yen are lagging on mild risk-on trade and safe-haven unwinding, as Usd/Jpy and Usd/Chf pivot 108.50 and 0.9850 respectively after weaker than forecast Japanese trade data overnight and a decline in weekly Swiss sight deposits.

- NOK/SEK/TRY – The Scandi Crowns are both clawing back losses amidst the aforementioned risk positive tone, and also consolidating ahead of Thursday’s Riksbank and Norges Bank meetings that preface the ECB convene and could see the former retain guidance for tightening around the turn of the year. Eur/Nok has retreated from new record highs around 10.2440 to sub-10.1900 and Eur/Sek has pulled back further from peaks over 10.9300 to just under 10.7300 at one stage. However, geopolitical jitters have resurfaced to blight Turkey’s Lira after initial relief in wake of the 5-day ceasefire in Syria, with Usd/Try back above 5.8200 in advance of this week’s CBRT rate decision (also on Thursday and contributing to a Central Bank fest) and weighing up whether 1-week repo will be cut again, and if so by how much.

In commodities, crude markets are lower, but choppy, after risk sentiment seemingly took a turn for the better in early trade, although some downside was seen later in the session with no immediate fundamental catalysts of note. The recent downside took WTI Dec’ 19 futures back below the 54/bbl mark whilst its Brent counterpart lost the 59/bbl handle after initially consolidating around USD 59.50/bbl region during APAC/early EU trade. In terms of supply news, media reports alleged that Saudi Arabia and Kuwait are expected to sign an agreement within 45 days which would see oil production resumed at the neutral zone; and see production at the jointly run fields of Khafji and Wafra reopen following four years of closure amid an ongoing dispute between the two countries. Around 500mln BPD could be brought back online, however, ING note that given that both Iraq and Kuwait are part of the OPEC+ production cut deal, it should not have an impact on overall oil supply for the time being. On the geopolitical front, US Defence Secretary Esper noted that US troops in Syria are with SDF to deny access of oilfields to ISIS and others, but no decision has yet been made about keeping the troops there. Moving on to metals; Gold is slightly lower, but sits well within recent ranges, after the precious metal failed an early bid to get substantially above its 10DMA at 1493/oz. Copper, meanwhile, remains a beneficiary of the mostly weaker buck, despite a lack of decisive PBoC action overnight.

US Event Calendar

- Nothing scheduled

DB’s Jim Reid concludes the overnight wrap

The next 36 hours will be absolutely crucial in the whole Brexit saga…. hang on… I’m sure we’ve said that about 12 times in the last year. Perhaps this time it’s true but don’t hold all of your breath. There’s little point going through the whole twists and turns of Saturday other than to say that the Government’s Brexit deal vote was blindsided by an amendment that said they could not attempt to pass the deal until all the legislation had gone through Parliament. This was meant to shore up the defences against no-deal and forced PM Johnson to write an (unsigned) letter to the EU asking for an extension. He sent this with another letter saying that in reality he doesn’t want one and doesn’t think the U.K. needs it or is best served by it. If we take a step back the situation is actually more positive for the government than it was on say Thursday/Friday of last week but they have lost some momentum. Back then it was slowly swinging towards the PM’s deal but it still looked like it would fall slightly short whereas it actually probably would have passed had the main vote been held on Saturday.

Although the PM lost the amended vote by 322 to 306 that essentially means that only 8-9 need to now vote for the deal for it to go through. Given that a few of those that voted against the government on Saturday have already publicly stated that they will now vote for the deal given they now feel more certain that a no-deal is off the table, there is a decent chance the deal can still pass through Parliament. There are a few massive caveats below however.

It seems the government will try to have another meaningful vote today but there seems to be a high probability that the speaker won’t allow it as it would be essentially the same bill as Saturday’s which is not technically allowed. If so we will likely move onto Tuesday where first the government is expected to put the program motion with the timetable of events to try to pass the deal. This could be the first obstacle. Then when they try to bring the legislation through, the amendments will come thick and fast with the main ones likely being a confirmatory referendum on the deal and one on membership of the customs union. It’s not clear that the numbers are there for either but the second one is more likely, might get momentum, and would be something the current government is highly unlikely to accept which in turn might encourage more to vote for it. As such if this goes through expect the bill to be withdrawn and we’ll be back at square one – albeit with a no-deal Brexit being much less likely than it was two weeks ago

It’s possible that the lure of customs union membership may sway those who were going to vote for the PM’s bill out of there being no alternative. It may also attract those who have no interest in that but see it as the best way of stopping the PM’s bill going through. So it could be a lightning rod. So it’s possible that the Government’s deal loses a little of the momentum it had last week when MPs felt that they had to agree to it for lack of alternatives. We also have to take into account any response from the EU to the request for a delay. The most likely scenario is that the EU stays fairly quiet until they see what Parliament does and hoping that no response might encourage some MPs to go for the deal in case an extension isn’t offered. Ultimately it probably will be though. It’s also not impossible that there’ll be a vote of no confidence finally now that no deal has been ruled out (assuming the EU are onside). However the government (and ex Tories) are unlikely to support that if there’s a deal on the edge of passing. Confused? You’re not alone.

We still think most scenarios point towards a deal, a softer Brexit, an election or a second referendum (with a deal on the table) and as such any dips in Sterling should be a buying opportunity. However strange unexpected things continue to happen and what we’ll be talking about in tomorrow or Wednesday’s EMR is very much up for grabs.

This morning in Asia, Sterling is down around -0.6% and is relatively calm for now. Elsewhere markets are making modest advances in thin trading with the Nikkei (+0.37%), Hang Seng (-0.32%), CSI (+0.31%) and Kospi (+0.11%) all up. Futures on the S&P 500 are up +0.25% while oil prices are down c. -0.30%. As for overnight data releases, China’s October 1 year and 5 year loan prime rates both came higher than consensus at 4.20% (vs. 4.15%) and 4.85% (4.83%) respectively. Meanwhile, Japan’s September trade balance stood at JPY -123.0bn (vs. JPY -54.0bn expected) with imports declining by -1.5% yoy (vs. -2.8% yoy expected) while exports declined -5.2% yoy (vs. -3.7% yoy expected).

In other weekend/ overnight news, China’s Vice Premier Liu He said that “China and the U.S. have made substantial progress in many aspects, and laid an important foundation for a phase one agreement,” while reiterating that China is “willing to work in concert with the U.S. to address each other’s core concerns on the basis of equality and mutual respect.” Staying with China, the National Development and Reform Commission’s spokesman Yuan Da said overnight that growth volatility is acceptable if other targets on new jobs, residential income and environment protection could be met while adding that the statement that China’s economy is going through severe slowdown is “unfounded”. Elsewhere, the Greens overtook the Christian Democrats in Switzerland elections to become the fourth-strongest party in parliament’s 200-member lower house, and the Green Liberal Party (GLP) also increased its share of the vote, meaning that the two now control about a quarter of the chamber (44 seats). Meanwhile, the euro-skeptic Swiss People’s Party (SVP) is set to lose 11 seats, according to state broadcaster SRF, as voters got swayed by environmental concerns. This is a trend that looks set to continue in the years ahead.

Outside of Brexit there’s a lot going on this week including the release of the crucial preliminary PMI readings for October (Thursday), Mario Draghi’s final ECB meeting as President (also Thursday), and earnings season gathering momentum with a large number of releases due.

Given how poor the PMIs have been over the last two months (with services catching down) the preliminary PMIs on Thursday will be potentially pivotal. Manufacturing has been doing particularly poorly, with the German PMI falling to 41.7 in September, its lowest reading since June 2009, while the Eurozone manufacturing PMI was also deep in contractionary territory in September at 45.7, the lowest reading since October 2012. The consensus expectation is for a modest rise in both the manufacturing and the services PMIs for the Euro Area, with the consensus expecting a 46.0 reading in manufacturing and a 52.0 reading in services. The US equivalent numbers will also be scrutinised for any signs that the “phase one” US/China handshake has made any very early impact.

The main central bank event next week comes from the ECB, who’ll be deciding policy on Thursday with a quiet one expected on Draghi’s last outing. The press conference will be his last opportunity to push the direction of the debate and it’ll be interesting to see the word count for the word “fiscal”. In terms of Fed speakers, it’s a light week as we enter a blackout period ahead of the next FOMC meeting on October 30th.

Other data releases to look out for include Thursday’s US preliminary durable goods orders for September along with September’s new home sales reading. Finally, Friday will see the release of the University of Michigan’s final consumer sentiment index for October, along with the current conditions and expectations readings. The preliminary release saw consumer sentiment rise more than expected to 96.0 (vs. 92.0 expected).

Earnings season continues with a large number of releases taking place next week. On Tuesday, there’ll be Procter & Gamble, Novartis, McDonald’s, Texas Instruments, United Technologies and UBS Group. Wednesday will see Microsoft, Boeing, PayPal, Caterpillar and Ford announce results. On Thursday, there’s Amazon, Visa, Intel, Comcast, AstraZeneca, Royal Bank of Scotland, Nordea Bank and Twitter. And on Friday, announcements come from Verizon Communications, Anheuser-Busch InBev, Charter Communications and Barclays.

Reviewing last week now, the “positive” Brexit news dominated attention last week, helping most global equities to rally. The S&P 500 and STOXX 600 gained +0.54% and +0.06% (-0.39% and -0.32% Friday), respectively, and the moves had a distinct cyclical tilt. Bank stocks gained +2.69% and +2.67% in the US and Europe (+0.43% and +0.12% Friday), while an index of utilities shares dropped -0.14% (+0.37% Friday). The moves retraced a bit on Friday, as some trade pessimism resurfaced when the White House announced the Vice President Pence will give a speech about China on Thursday. Will this be his long anticipated hawkish speech that’s been postponed previously? Semiconductor shares fell -0.06% on the week (-1.06% Friday), as some indeed expect him to be confrontational. The DOW fell -0.17% (-0.95% on Friday), dragged down by Boeing’s -8.19% fall (-6.73% Friday) as reports indicated that company employees had concerns about the 737 MAX plane as early as 2016.

Government bonds sold off again last week, with 10-year yields up +2.5bps and +6.0bps in the US and Germany (+0.2bps and +2.6bps Friday). The front-end treasury curve rallied -1.8bps, however (-2.6bps Friday), on firmer expectations for Fed rate cuts. Vice Chair Clarida gave the final Fed comments before their pre-meeting blackout period, and he continued to emphasize “evident risks” to the outlook, saying nothing to push back on market pricing. The market is now just about fully priced for a cut at the October meeting, plus around a 40% chance for another cut in December. That helped the dollar to weaken -1.18% (-0.48% Friday), which came despite euro and pound strength. Those currencies gained +1.13% and +2.49% (+0.38% and +0.72% Friday) amid the positive Brexit news.

Tyler Durden

Mon, 10/21/2019 – 07:37

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com