Futures Rebound From Overnight Swoon On Strong Earnings As Key Brexit Votes Loom

After spiking higher in the early overnight session for no obvious reason besides a largish buy order in an increasingly illiquid market, US equity futures faded most of their gains during the Asian session despite some renewed “trade deal optimism” after China’s Vice Foreign Minister Le Yucheng said that China and the United States have achieved some progress in their trade talks, before recovering much of their losses after the European open, and pushing modestly higher following strong earnings from P&G, UPS and UTX which helped push future above the flatline.

It’s a huge week for corporate earnings, with around one-fifth of S&P 500 members due to report, including McDonald’s and Procter & Gamble on Tuesday followed by Microsoft and Caterpillar a day later. So far results have generally surprised to the upside, although estimates have declined sharply in recent week. Despite the beats, analysts are still cutting estimates for next year as the protectionist dispute between the world’s biggest economies continues to take a toll.

Futures closely tracked European markets which saw a flurry of company results including UBS profit beating estimates as the Swiss lender said it will book a roughly $100 million charge in the fourth quarter to restructure a unit. Helping European markets, drugmaker Novartis raised its earnings forecast for the third time this year. The European banking sector was off its best levels, however, with gains in tech and real estate names offset by losses in household, travels and construction.

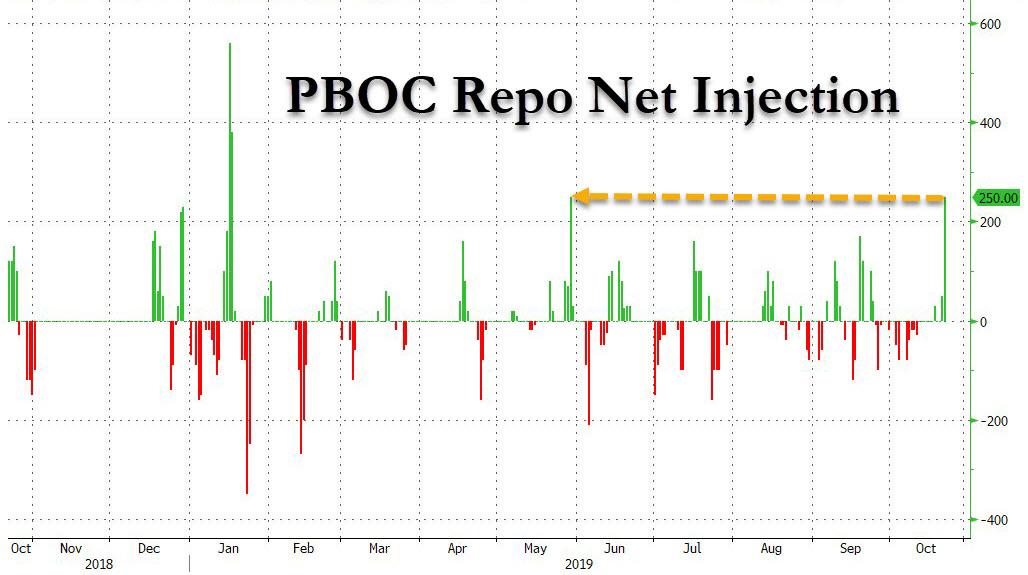

Earlier in the session, Asian stocks climbed for a second day, led by health-care firms, amid rising hopes that China-U.S. trade talks will progress toward an agreement. Most markets in the region were up, with South Korea – seen as a proxy for global trade – leading gains. Japan was closed for the Imperial Enthronement day. The Shanghai Composite Index closed 0.5% higher after erasing earlier losses, with Foxconn Industrial Internet and Industrial & Commercial Bank of China among the biggest boosts. China’s central bank used open-market operations to inject the largest amount of cash into the banking system since May, as upcoming corporate tax payments tighten liquidity conditions.

India’s Sensex fell 0.7%, snapping a six-day winning streak, as Infosys plunged following a whistle-blower complaint alleging irregular accounting at the software exporter. Infosys sank as much as 16%, weighing heavily on the gauge and more than offsetting post-earning gains in HDFC Bank Ltd. and Reliance Industries.

President Donald Trump stoked hopes that a trade deal can be reached next month, saying that China has indicated negotiations are advancing and has started buying more American agricultural products. “There are still residual concerns about the outlook as we head toward Christmas with memories of last year’s price capitulation still fresh,” said strategist Greg McKenna. “But earnings so far aren’t as bad — or should I say much worse — than thought. And there is still much cash on the sidelines, and the increase in bond yields is mildly supportive of stocks.”

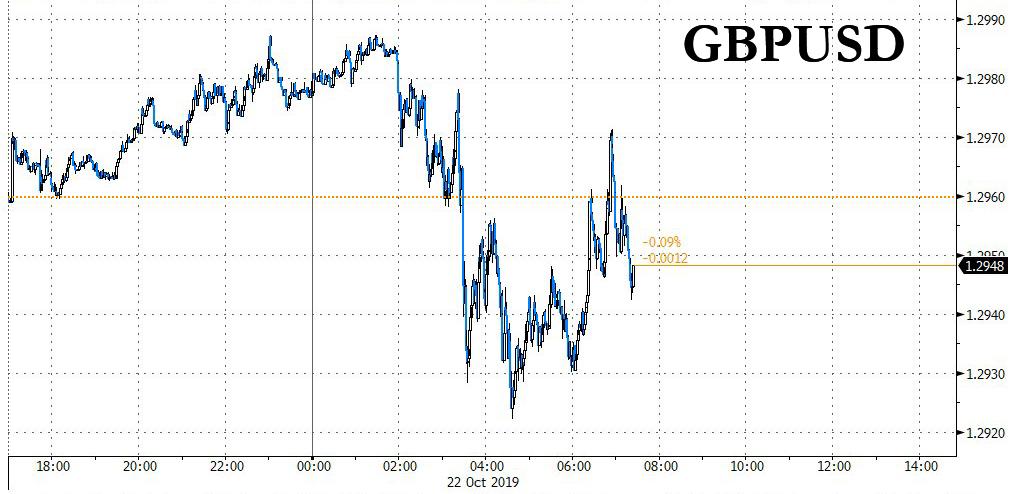

Eurozone government bonds yields fell on Tuesday, before a critical vote in British parliament crucial to determining whether the UK can leave the European Union in an orderly way on Oct 31. Prime Minister Boris Johnson faces two Brexit votes in the British parliament on Tuesday. Lawmakers will first vote on a Withdrawal Agreement Bill and then on the government’s timetable for approving the legislation.

“It’s too close to call whether there will be a majority,” said DZ Bank rates strategist Daniel Lenz. “This may be also very much reflected by market developments, that you don’t see major movement to one or the other side.” Johnson probably has the votes to pass the withdrawal bill but may struggle to pass his timetable on Tuesday, the BBC’s political editor said.

Ten-year government bond yields across the euro zone were down 2 basis point on the day. Germany’s 10-year yield was at -0.36%, bull flattening with German 30y yields 4.5bps lower. Analysts said much of the optimism around Brexit is already priced in and expect subdued reactions. Euro zone government bonds sold off as the first signs of a Brexit deal emerged; the German 10-year bond yield has risen 19 bps since Oct. 10.

“The market is pricing a lot of optimism, a) on the no-deal Brexit being taken off the table tonight, b) on the deal being approved tonight. Therefore, there’s not much room for rates to move higher,” said ING senior rates strategist Antoine Bouvet.

As one would expect, overnight volatility in sterling remained elevated as traders position ahead of the Second Reading vote, with cable drifting below the key 1.300 level.

In other FX markets, the dollar caught a bid with EURUSD trading around Monday’s lows, CNH is offered above 7.0800, while Canada’s Loonie traded flat after Prime Minister Justin Trudeau won a second term in elections, though with a reduced mandate. The shekel strengthened after Benjamin Netanyahu again failed to form a government in Israel.

Elsewhere, Italian government bonds outperformed, the 10-year yield falling 6 basis points to 1.03%. “Think of BTPs at the moment as being bunds with greater volatility. So when the bund market sells off, BTPs tend to sell off more,” ING’s Bouvet said. The European Commission has sent a letter to Italian authorities, asking for clarification over their 2020 draft budgets. Rome will reply by Wednesday. That said, a major conflict is not expected, unlike last year when the Commission sent back Italy’s draft budget and asked for a new one, sparking a surge in Italian yields. Italy’s draft 2020 budget assumes a rise in its structural deficit of 0.1% of GDP. Under EU rules, it should fall to 0.6% of GDP. A successful sale of BTP Italia inflation-linked bonds to retail investors also supported Italian bonds

In commodities, crude futures popped higher off the Asian lows back into the green. Mixed trade in metals, LME tin drops 0.6. Upside in prices coincided with reports that Indonesia’s Pertamina has temporarily halted fuel distribution via the pipeline in parts of West Java due to an explosion. Local media noted that the fire broke out on parts of the pipeline due to drilling activity in close proximity, although this was not confirmed by Pertamina’s spokesperson. WTI prices gained traction above the 53.50/bbl and currently eyes its 200 WMA at 53.81/bbl, while its Brent counterpart rose comfortably above the 59.00/bbl mark. In terms of demand side commentary, Goldman Sachs lowered its 2020 oil growth demand outlook to 1.3mln bpd from 1.4mln bpd and sees US oil growth expectations to be reduced, while it suggested there is room for OPEC output to increase beyond 2020.

In geopolitics, Turkey President Erdogan vowed to go ahead with its Syria offensive “more strongly” if the US “breaks its promises”. Further, Kurdish YPG Militia are to initially withdraw from the 120km strip of border with Turkey in Northeastern Syria, according to Turkish Security Forces sources.

Looking at the day ahead, as well as the beginning of the debate in the House of Commons on the Withdrawal Agreement Bill, earnings season picks up again, with releases including UBS Group, McDonald’s, Procter & Gamble, Novartis, Texas Instruments and United Technologies. In terms of data releases, we have UK public sector net borrowing for September, Canada’s retail sales for August, and in the US there’s September’s existing home sales and October’s Richmond Fed manufacturing index. Finally, the Hungarian central bank will be deciding on rates.

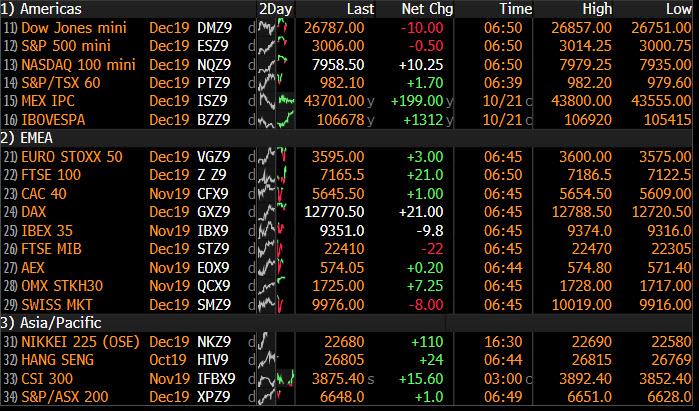

Market Snapshot

- S&P 500 futures little changed at 3,004.25

- STOXX Europe 600 down 0.3% to 392.90

- MXAP up 0.2% to 160.49

- MXAPJ up 0.4% to 516.62

- Nikkei up 0.3% to 22,548.90

- Topix up 0.4% to 1,628.60

- Hang Seng Index up 0.2% to 26,786.20

- Shanghai Composite up 0.5% to 2,954.38

- Sensex down 0.6% to 39,069.54

- Australia S&P/ASX 200 up 0.3% to 6,672.18

- Kospi up 1.2% to 2,088.86

- German 10Y yield fell 2.9 bps to -0.373%

- Euro down 0.1% to $1.1137

- Italian 10Y yield rose 5.6 bps to 0.642%

- Spanish 10Y yield fell 2.4 bps to 0.262%

- Brent futures up 0.4% to $59.20/bbl

- Gold spot up 0.3% to $1,488.80

- U.S. Dollar Index little changed at 97.40

Top Headline News

- Prime Minister Boris Johnson will find out Tuesday evening whether he has any chance of getting his Brexit deal through Parliament — and whether he can do it ahead of his Oct. 31 deadline

- President Donald Trump said China has indicated that negotiations over an initial trade deal are advancing, raising expectations the nations’ leaders could sign an agreement at a meeting next month

- Canadian Prime Minister Justin Trudeau won a second term in national elections and will lead a minority government with support from other smaller parties. The most likely partner for Trudeau would be the pro-labor New Democratic Party

- UBS Group AG got a boost from rich Asian clients in a quarter hit by a poor result at the investment bank. The key wealth management unit added $15.7 billion new money in the three months through September, helping lift assets overseen to a record $2.5 trillion

- House Democrats are looking to significantly advance the impeachment probe of Donald Trump with testimony Tuesday from the top U.S. diplomat to Ukraine, who had warned it was “crazy” to withhold military aid in a bid to get dirt on Trump’s political rivals

- Two London investment bankers were charged in the U.S. with selling information about pending deals as part of a “large-scale, international insider-trading ring” that, prosecutors claim, generated tens of millions of dollars in illicit profits.

Asian equity markets traded mostly positive amid mild tailwinds from Wall St where all major indices edged higher and the S&P 500 closed back above the 3000 milestone with sentiment underpinned as officials continued to suggest optimism regarding a trade deal, although gains were capped amid a light calendar, Japanese holiday closure and ahead of a busy week of earnings stateside. ASX 200 (+0.3%) was positive with the index propped up by strength in the commodity-related sectors aside from gold miners after the precious metal trickled further below the USD 1500/oz level, while corporate updates also provided a catalyst. Hang Seng (+0.2%) and Shanghai Comp. (+0.5%) were mixed despite a firm liquidity effort by the PBoC which conducted CNY 250bln of 7-day reverse repos for its largest daily net injection in nearly 5 months, with the mainland choppy ahead of upcoming earnings and with Hong Kong anticipating the announcement of further supportive measures for companies later today.

Top Asian News

- China’s $208 Billion Liquor Giant Just Hit Valuation Ceiling

- China Inc. in Exit Challenge as Deals From Yachts to Pizzas Flop

- China’s Central Bank Boosts Liquidity Ahead of Tax Payment Surge

- Infosys Dives Most in 6 Years as Whistle-Blowers Target CEO

Major European bourses are choppy (Euro Stoxx 50 +0.1%) albeit, the region drifted back into positive territory following initially losses seen at the open. Constructive reports on the EU/China trade during the early EU session ultimately did little to shift the sentiment at the time. In terms of sectors, the picture is mixed; with Consumer Staples (-0.5%) and Health Care (-0.2%) propping up and Tech (+0.4%) and Energy (+1.0%) topping the performance table. In terms of individual mover; Just Eat (+24.7%) shares spiked higher on the news that Prosus NV had made a cash offer for the Co, valuing it at GBP 4.9bln, or GBP 7.10 per share, Just Eat has since rejected the offer stating that it significantly undervalues the Co. in combination with Takeaway.com. Novartis (+0.1%) opened higher after the Co. raised net sales guidance but gave away gains in-line with the market-wide decline. UBS (+1.6%), SAAB (+5.4%), Software AG (+9.3%) and Sunrise Communications (+2.5%) were also beneficiaries of strong earnings reports. Conversely, weak earnings from AMS (+0.2%), Thales (-2.2%) and Reckitt Benckiser (-3.3%) saw their respective share prices under pressure. In terms of broker moves, a downgrade for TUI (-5.7%) at Morgan Stanley saw the Co.’s shares sell off.

Top European News

- Just Eat Gets Rival Bid From Prosus, Challenging Takeaway Deal

- John Malone’s $6.4 Billion Swiss Sale to Sunrise Collapses

- Novartis Boosts Forecast Again as New Gene Therapy Shines

- Reckitt Benckiser’s New CEO Lowers Forecast in Company Reset

In FX, the USD is on a firmer footing, almost across the G10 board, with the DXY edging higher after testing support ahead of 97.000 yesterday and the index regains momentum to probe above 97.400 within a 97.440-259 range. However, the recovery looks largely due to declines in rival currencies rather than self-generated, as the Franc retreats further from recent peaks and Pound succumbs to a bout of more pronounced pre-UK Parliament vote jitters.

- NZD/AUD – The Kiwi is off best levels, but still outperforming and maintaining a bullish bias while holding above 0.6400 vs its US counterpart and having breached 1.0700 against the Aussie. Conversely, Aud/Usd continues to fade ahead of 0.6900 even though news on US-China trade has been mainly constructive of late amidst signs of the pair reaching overbought levels and a decent option expiry at 0.6850 (850 mn) may also be weighing. Back to the Nzd, trade data looms and may provide some fundamental impetus, while the Aud could be prone to comments from RBA Deputy Governor Kent also due later.

- CHF/GBP – The major laggards as noted above, with Usd/Chf nudging towards 0.9900 and Cable retreating further from Monday’s 1.3000+ peaks in the run up to the WAB 2nd reading in the HoC that could set-off a chain of further votes and an extremely compressed timetable to get Brexit legislation in place for October 31. The Pound is holding above 1.2900 and managing to contain its pullback vs the Euro to circa 20 pips below 0.8600, as the single currency also fades against the Dollar.

- JPY/CAD/EUR – All narrowly mixed compared to the Buck, as the Yen meanders between 108.50-75, Loonie sustains gains within 1.3100-1.3070 parameters after the Canadian election and bulk of votes indicating that PM Trudeau is heading for a return to office with his Liberal Party, but also conscious that retail sales and the Q3 BoC business/loan survey are on tap and could impact. Elsewhere, Eur/Usd remains capped ahead of 1.1200 and has tested the 100 DMA (1.1136), but not convincingly.

- EM – Although the Dollar has pared some losses vs G10 peers and the Yuan has eased from recent highs, several regional currencies are staging comebacks of their own, like the Rand and even the Lira despite the impending end of the ceasefire and ahead of Turkish President Erdogan’s meeting with his Russian counterpart.

In commodities, WTI and Brent futures are choppy but ultimately in the green. Upside in prices coincided with reports that Indonesia’s Pertamina has temporarily halted fuel distribution via the pipeline in parts of West Java due to an explosion. Local media noted that the fire broke out on parts of the pipeline due to drilling activity in close proximity, although this was not confirmed by Pertamina’s spokesperson. WTI prices gained traction above the 53.50/bbl and currently eyes its 200 WMA at 53.81/bbl, while its Brent counterpart rose comfortably above the 59.00/bbl mark. In terms of demand side commentary, Goldman Sachs lowered its 2020 oil growth demand outlook to 1.3mln bpd from 1.4mln bpd and sees US oil growth expectations to be reduced, while it suggested there is room for OPEC output to increase beyond 2020. For reference, the firm’s demand forecasts are modestly higher than that of the EIA, IEA and OPEC. Looking ahead, trader will be eyeing the weekly API crude data, but before that over in the UK, the vote on the 2nd reading of the Withdrawal Agreement Bill may prompt some sentiment-driven action. Elsewhere, gold prices remain firmer sub-1500/oz despite a bounce back in Dollar as participants could be hedging ahead of upcoming risk events, and with US-China also still on the radar. Meanwhile, Copper prices are on the backfoot today, mostly due to the indecisive risk sentiment coupled with a firmer Buck with prices back below 2.65/lb ahead of its 100 DMA at 2.63/lb. Finally, Dalian iron ore futures rose in excess of 1.2% at one point as the base metal was bouyed by continued supply woes after Vale halted a tailing dam earlier this month followed by downgrades in FY iron ore and pellet sales guidance.

US event calendar

- 10am: Richmond Fed Manufact. Index, est. -7, prior -9

- 10am: Existing Home Sales, est. 5.45m, prior 5.49m; MoM, est. -0.73%, prior 1.3%

DB’s Jim Reid concludes the overnight wrap

I appreciate that the UK population is only 0.9% of the world’s total and that there are perhaps more important things for global markets in the greater scheme of things than Brexit but you only have to look at the selloff in 10yr bunds since the bilateral meeting between Varadkar and Johnson (+20.5bps) two weeks ago to see the impact that a no deal risk has had on markets. Famous last words but we should know a lot more by the end of today as to whether the U.K. will leave the EU by the end of next week (or soon after). As expected the government were refused the opportunity for a meaningful vote last night for reasons explained yesterday but they are pressing on with the Withdrawal Agreement Bill today, the text of which was published by the government last night. The timetable will be intense and perhaps one risk is that MPs feel like they are being rushed into it and don’t vote for a bill that they might have otherwise have done. The Government want to have it pass the House of Commons by Thursday (with midnight sittings) before going to the House of Lords on Friday in order to try to deliver Brexit by October 31st (next Thursday). There is a vote today on this timetable (7:15 pm London time) and that could be a big test for the government’s strategy. Before this, the government is likely to hold what’s known as the Second Reading vote at around 7 pm (London time)– on whether Parliament agrees with the general principles of the bill. Sources this morning suggest Labour will abstain on this which would mean this vote will go through. If true Labour will use the amendments to create difficulties for the government.

We’ve copied the timetable below. Losing the Program Motion vote, which sets the timetable for the rest of debate, would simply make it very hard to hit the deadlines.

Tuesday

- 12.30 p.m.Second Reading debate starts

- 7 p.m.Vote on Second Reading – the general principle of the bill

- 7.15 p.m.Vote on Program Motion – the timetable for the rest of the bill’s passage

- 7.30 p.m.(If Program Motion passes) Committee Stage begins

- 10.30 p.m.First Committee Stage votes

Wednesday

- After 12.30 p.m. Committee Stage continues, with votes every three hours. Amendments on keeping the U.K. in a customs union with the EU and calling a second referendum are likely to appear

- After Midnight Committee Stage finishes

Thursday

- After 11 a.m.Report Stage begins. More amendments can still be proposed

- After 5 p.m.Report Stage votes

- After 7 p.m.Third Reading vote — the House of Commons’s final say on the bill

Even if the Program Motion passes, the passage of this legislation is also likely to be fraught, as opponents of the Brexit deal have already said that they’ll seek to amend the legislation as it passes through the Committee stage. As we discussed yesterday, likely amendments to watch out for will be those calling for a second referendum and another seeking a customs union. Labour’s shadow Brexit Secretary Sir Keir Starmer has also said that Labour would seek to avoid the possibility that at the end of the transition, the UK could simply revert to a no-deal scenario if no free-trade agreement has been reached with the EU. On Sunday it looked like momentum was building towards a customs union membership amendment passing. However the DUP seemed to indicate yesterday that they wouldn’t support it and a number of MPs who have previously supported it in indicative votes suggested they wouldn’t this time. Much might depend on the SNP and Lib Dems whose policy is to stop Brexit and therefore would only vote for it to bide time and complicate the government’s task. They may do so. The government have hinted they would withdraw the bill if such an amendment passes and we could soon be in caretaker government / imminent election territory. A second referendum amendment is not likely to pass according to those journalists close to the action but the Customs Union one is closer depending on the above.

Sterling was relatively strong yesterday as the dip was quite rightly bought, given the balance of risks, climbing above $1.30 in trading for the first time since May 13 yesterday. It ended up finishing -0.16% at $1.296, though that was +0.66% off its earlier lows from the open. Its trading up +0.16% this morning at $1.2981.

Amidst the political developments, equity markets advanced yesterday as optimism over the Brexit saga and positive noises on trade boosted sentiment on both sides of the Atlantic. The S&P 500 closed up +0.69% to reach its highest level in a month, leaving the index shy of just a +0.64% rise from its all-time high back in July. The NASDAQ (+0.91%) also advanced, although the Dow Jones was up just +0.21% thanks to Boeing, which fell -3.76% yesterday ahead of its earnings release. The energy sector led sectoral gains, closing +1.86% higher, led by Halliburton (+6.35%) after a strong earnings report. The company announced plans to expand more aggressively overseas, while simultaneously limiting costs in the US. The positive earnings momentum outweighed the fall in oil prices, with Brent down -0.62%.

Meanwhile in Europe, the STOXX 600 (+0.61%), the DAX (+1.0x%) and the FTSE MIB (+0.91%) all climbed to their highest levels in over a year. It was the reverse picture in bond markets, with sovereign bonds losing ground and curves steepening in both the US and Europe. 10yr Treasuries ended the day +4.7bps, while the 2s10s curve steepened +0.2bps to its highest level since July. Bund yields climbed +3.8bps to -0.344%, also its highest level since July, while OATs (+3.3bps), BTPs (+5.8bps) and Gilts (+4.1bps) also suffered losses. Banks were the beneficiaries however, with the S&P 500 Banks index up +2.02% at a thirteen month high, while the STOXX Banks was also up +2.17% to its highest level since May.

There was little to report directly on the trade war yesterday, though President Trump did say that a deal with China was coming along very well, while the Director of the National Economic Council, Larry Kudlow said to Fox Business that President Trump could call off the planned December tariffs if the talks went positively. Meanwhile Reuters reported that China was seeking $2.4bn in retaliatory sanctions against the US in response to the US failing to comply with a previous Obama-era WTO ruling. This should be separate from the trade war noise. In the FX market, the dollar snapped a run of four consecutive sessions lower to close up +0.05%.

Overnight Asian markets are trading mixed with the Kospi (+1.17%) and Hang Seng (+0.15%) up while the Shanghai Comp (-0.09%) is down. Japanese markets are closed for a holiday. Elsewhere, futures on the S&P 500 are up +0.20%.

In other news, Canadian Prime Minister Justin Trudeau won a second term in national elections with a reduced mandate as his Liberal Party won or was leading in 155 of Canada’s 338 electoral districts, short of the 170 needed for a majority in Parliament. The most likely partner for Trudeau would be the pro-labor New Democratic Party, which is on track to win 26 seats, giving the two parties a combined 181. The Canadian dollar is trading largely flat this morning at 1.3082.

Chilean assets slumped yesterday as markets reacted to recent protests in the country that have seen 11 people killed. The country’s IPSA equity index was down -4.61%, its worst daily performance in nearly two years, while the Chilean peso weakened -2.26% against the US dollar, its sharpest depreciation in four years. The unrest was originally started by a now-suspended rise in public transport fares, but has since become a broader movement against inequality and economic conditions. President Sebastian Pinera has taken a tough stance against the rioters, saying in a speech on Sunday night that “We are at war against a powerful, relentless enemy”. It’s worth keeping an eye out on copper prices (up a further c. 0.40% this morning), which rose to their highest level in over a month yesterday, as Chile is the world’s biggest copper producer and unions in the country have called for strikes that could threaten supply.

There was little in the way of data, though German PPI in September fell by -0.1% yoy (vs. -0.2% expected), which was the first yoy decline since October 2016. Energy prices dragged in particular, down -1.9% over the last year, with the PPI excluding energy actually up +0.5%. However, the market’s expectations of euro area inflation seem to be rising, with five-year forward five-year inflation swaps up +1.5bps to 1.238% yesterday, their highest level in a month.

Turning to the day ahead, as well as the beginning of the debate in the House of Commons on the Withdrawal Agreement Bill, earnings season picks up again, with releases including UBS Group, McDonald’s, Procter & Gamble, Novartis, Texas Instruments and United Technologies. In terms of data releases, we have UK public sector net borrowing for September, Canada’s retail sales for August, and in the US there’s September’s existing home sales and October’s Richmond Fed manufacturing index. Finally, the Hungarian central bank will be deciding on rates.

Tyler Durden

Tue, 10/22/2019 – 07:44

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com