Dan Loeb’s Q3 Performance Hammered By Argentina Blow Up

One week ago we reported that such hedge fund icons as Steve Cohen, Ken Griffin, and Dmitriy Balyasni were among the prominent investors hammered by the quant quake. We can now add Third Point’s Dan Loeb to the list.

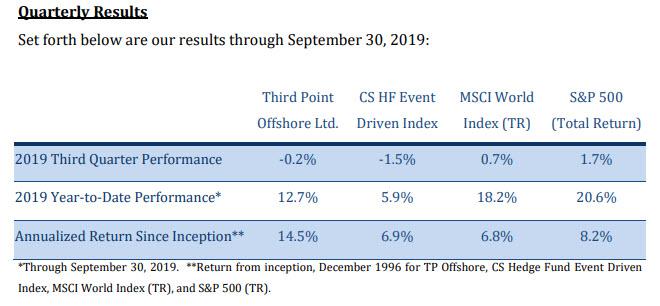

In his latest quarterly letter to investors, in which the Third Point founder revealed that his hedge fund had lost -0.2% in the quarter, and is now up 12.7% through Sept 30…

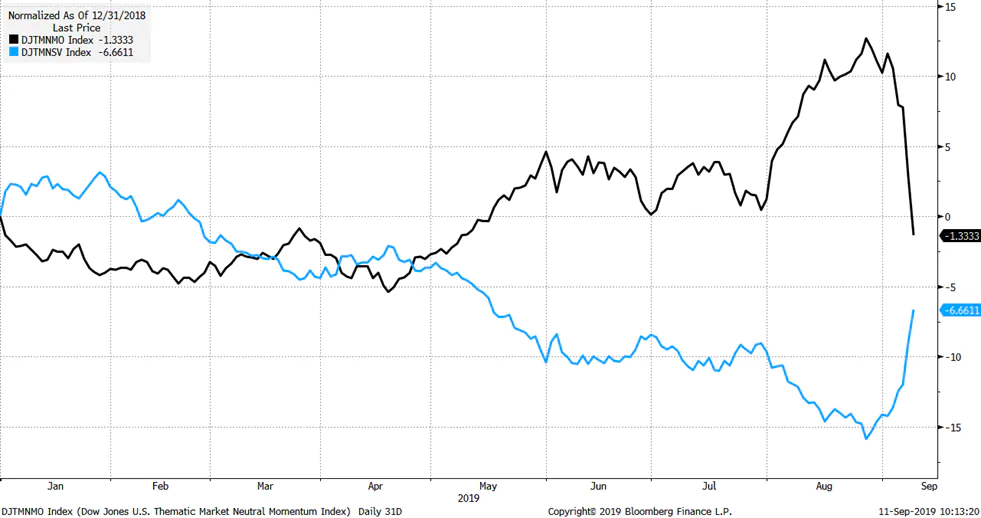

… Loeb added his two cents to the annals of the September quant quake, writing that “the market’s slight gain in Q3 masked tumultuous factor rotation.” As Loeb described it, and as shown in the chart below, “in August, equity portfolios tied to momentum or the near inverse – “laggards” – outperformed, as markets inflated assets reflecting economic weakening in a low inflation/low growth world. These momentum asset biases – favoring large cap over small cap stocks, growth versus value, or “min vol” strategies – became increasingly correlated, crowded, and sometimes expensive”, Loeb wrote, recapping what we predicted in out August 21 article “Crowding Is Now One Of The Biggest Market Risks” which was published two weeks before the violent market gyrations.

As Loeb continues, this unwind “extended itself more acutely in secular growth names and similarly punished unloved shorts. In September, and so far into October, this extreme positioning has been challenged by declining fears of an adverse trade war outcome, positive directional change in economic surprise indices, talk of fiscal stimulus outside the U.S., and an increasingly accommodative Federal Reserve,” in effect echoing something else we wrote in early September when we predicted that A Major Challenge Facing Today’s Market is “What If Things Get Better?”

Another reason for the violent reversal in September according to the Third Point billionaire may be the “steepening yield curve” which also gave “life to under-owned assets at the expense of the over-owned.”

And while Loeb tells his clients that he was “able to identify many of these shifts in Q3 and provided some protection to the long side of our book through position management, hedging, and directional optionality…the scale and suddenness of these factor moves caught us offsides in certain short positions.“

Yet September violent factor rotation was not the biggest hit to the $14.5 billion Third Point’s Q3 performance.

What was? The answer: the same event that crushed Michael Hasenstab and cost his Templeton fund $3 billion in AUM in Q3 – Argentina.

As Loeb writes, his funds’ “largest loss in the Third Quarter was in Argentine sovereign debt, when a surprising outcome in the August 11th presidential primary caused a panic in the capital markets. Argentine credit generated significant profits for us from 2014-2016 and our return to the sovereign bonds was driven by our view that: 1) the incumbent President, Mauricio Macri, had a good chance of prevailing in the national election in October as he had been gaining in polls and nearly every piece of data correlated with his electability was improving. We expected Macri to lose in August but by a slim margin to the opposing, market-unfriendly ticket of Alberto Fernández and Cristina Kirchner; and 2) even if the Fernández ticket prevailed in the general election, Argentina’s economic fundamentals and Fernández’s background suggested that the draconian restructuring the market feared was unlikely.”

So what went wrong? As Loeb admits, “in failing to anticipate the extent of Macri’s loss in the primary election, our most significant mistake was missing the second order thinking that in such a scenario, Argentina would be rudderless for almost three months between the August primary and the October election and economic mayhem could ensue. The huge margin in the primary effectively made Alberto Fernández the country’s President, but he had limited opportunity or incentive to

calm the market while Macri remained in power. In this vacuum, investor fears spiraled into a massive sell off in the currency and reserve depletion, making a debt restructuring inevitable.”

And since this outcome left Third Point’s Argentina thesis “in limbo”, Loeb writes that “to avoid unacceptable downside risk, we reduced our position at higher levels than are prevailing today.”

That said, Third Point has not given up on Argentina, and writes that “when the October 27th election presumably makes Alberto Fernández president-elect, we expect debt restructuring negotiations to begin and while this process will likely lead to more volatility”, however the fund expects that “the bonds will ultimately recover significantly more (30-50%) than current prices.” It was unclear if the fund was acting on its conviction of an Argentina bond rebound and pulling a SoftBank, doubling down into a losing investment, or just leaving that statement hanging there, just in case Argentina bonds do surge, and the fund’s LP ask why Loeb has dumped them instead of holding firm to the original thesis.

Third Point’s full Q3 letter is below

Tyler Durden

Thu, 10/24/2019 – 15:20

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com