Meet The Lender That Turned The US Farming Industry Into A Vortex Of Defaults And Lawsuits

BMO Harris is leaving a trail of defaults and lawsuits in the agriculture industry after being one of its most aggressive and prominent lenders in the 2010’s, according to Reuters.

Ohio corn and soybean producer Greg Kruger experienced the investment bank’s lending practices firsthand. He had asked the bank for a $2 million loan to build a grain elevator in 2013 and had walked away with a $5 million loan for the elevator and another $7 million to finance crops, machinery and debt consolidation – after just one half hour phone call.

Kruger even offered the bank supply receipts of sold grain and documentation, to which his loan officer reportedly responded: “‘Don’t worry. We’ll make the numbers work’.”

Now about a half decade after BMO Harris “aggressively expanded” its U.S. farm loan portfolio, it has called in Kruger’s loans and is filing to seize his farm. Corn and soy prices have both collapsed and the U.S. is now engaged in a years-long trade war with China that shows no signs of an imminent resolution.

In its wake, BMO Harris is leaving a trail of farmers just like Kruger, who have lost everything. And the bank, a subsidiary of Bank of Montreal, is struggling to recoup many of its investments through bitter legal fights.

John Blanchfield, founder of Agricultural Banking Advisory Services said: “BMO Harris did push for growth, and they’ve had some of those deals blow up spectacularly in their faces.”

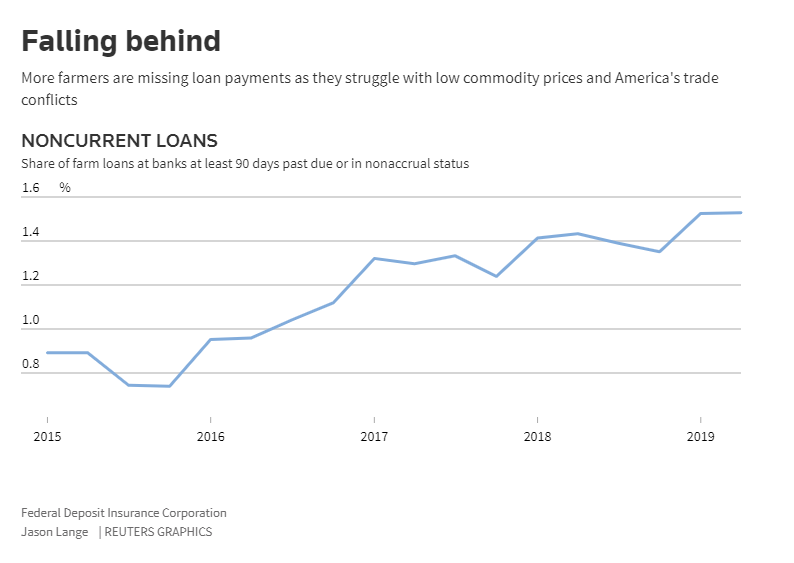

The struggles are indicative of how the farming industry has struggled overall. Farmers are now struggling to pay back loans or obtain new ones and shrinking cash flow has caused some farmers to retire early. Growing scores of farmers are also declaring bankruptcy.

Meanwhile, BMO Harris could be set up for even more defaults. At the end of June, 13.1% of its farm loan portfolio was at least 90 days late, compared to 1.53% for all U.S. farm loans at FDIC insured banks. BMO Harris had the highest rate among the 30 largest FDIC banks.

Ray Whitacre, head of BMO Harris Bank’s U.S. diversified industries unit, said: “…the bank’s distressed loans do not represent the overwhelming majority of its borrowers’ experiences.” He noted that the bank has been in farm lending for over a century and says that the bank takes a long-term view of helping farmings through “all stages of the economic cycle”.

This includes massive, catastrophic recessions, we guess.

The bank’s exposure to the farm sector reached $1.59 billion in 2018, while most other major banks have been scaling back their farm loan portfolios since 2015.

One deal that went up in flames for BMO Harris was $43 million in farm operating loans made to McM, Inc., which filed for Chapter 7 in 2017.

BMO Harris had secured $25 million of the loan with McM’s grain, cattle and farm crops, along with other assets. McM used the sale of these crops to pay the bank back. During the bankruptcy, BMO Harris said it was unable to locate the crops that were backing its loans, alleging that McM had sold some to pay off other creditors first. It was also revealed in court documents that the bank had not audited some of the farm’s financial statements.

It was later found that McM’s accounts receivable and inventory was overstated by at least $11 million.

Some experts and attorneys representing BMO Harris customers say the bank issued too many loans for too long. Examples like Michael and Byron Robinson are becoming ubiquitous:

Michael and Byron Robinson borrowed $2.5 million in an agricultural loan and another $2.5 million on a line of credit in 2013 through their Indiana businesses, court records show. The bank sued the Robinsons in federal court as part of its foreclosure process in 2016 and later sold the farmland at auction. The property brought far less than the value the bank had estimated the properties were worth to justify the original loans, said their bankruptcy attorney, Maurice Doll.

T.J. Mattick, the banker that lent to the Robinsons – and to Kruger – found his customers through farm magazine ads, word of mouth and church gatherings. Rural loan brokers who referred him business were paid a finder’s fee.

Mattick convinced the Robinson’s to buy two new farms, instead of one, when they were looking to expand their corn and soybean operations. BMO Harris financed 100% of the deal.

Michael Morrison, the Robinsons’ farm bookkeeper and a former agricultural banker said: “We used to say that T.J. never saw a loan he didn’t like. I kept telling them, ‘Don’t do this. Don’t take on the debt.’ But T.J. kept telling them, ‘Don’t worry, it’ll be fine’.”

Mattick said “extensive underwriting and analysis” was performed before loans were issued. “I worked with clients to help them determine what they could afford and never would have counseled them to incur debt beyond what they could afford,” Mattick said.

Kruger concluded: “I thought I could trust him. We would talk about church and faith all the time.”

Tyler Durden

Thu, 10/24/2019 – 16:55

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com