Record Rally Fizzles As Fed Meeting Begins, Investors Look For Reasons To Keep Buying

After the S&P hit a record on Monday – just as the Fed was set to cut rates for the 3rd consecutive time for reasons unknown – and world stocks hovering near a 15 month high underpinned by optimism over a U.S.-China trade deal after Trump said on Monday he expected to sign a significant part of a trade deal with China ahead of schedule but did not elaborate on the timing, S&P 500 futures edged lower, and European market slumped into a sea of red led by the FTSE 100 and telecom shares, while tech names dropped after Alphabet earnings missed.

Google parent Alphabet meanwhile slipped after missing analysts’ estimates for quarterly profit even though revenue growth topped expectations. A mixed bag of earnings also offset some of the chipper mood on European bourses, with the Stoxx 600 easing 0.4% after six straight sessions of gains, with energy producers among the biggest laggards. BP Plc shares declined as the driller said it’s unlikely to raise its dividend this year.

The European losses followed a mixed performance in Asia, where stocks gained for a fourth day, with materials and health care sectors advancing, following a rally in the U.S. equities that pushed the S&P 500 Index to a record. Japan’s Nikkei rose 0.4% to reach a 2019 high, while Shanghai stocks dropped after a warning against speculation on blockchain-related stocks depressed trading (one day after blockchain stocks soared). India’s Sensex Index rose the most and China’s Shanghai Composite Index being the laggard. India’s stock market reopened after a holiday and jumped on earnings optimism. Japan’s Topix Index closed at its highest level since Dec. 3. China shares retreated after a two-day gain, dragged by with Agricultural Bank of China and China Life Insurance Progress in U.S.-China trade talks helped boost risk-on sentiment in the region. U.S. President Donald Trump said the U.S. is ahead of schedule to sign a big portion of the China deal.

The U.S. trade representative also said Washington was studying whether to extend tariff suspensions on $34 billion of Chinese goods set to expire on Dec. 28, but analysts cautioned that trade tensions were far from over. “It isn’t yet clear that an interim deal that kicks trade worries down the road would be sufficient to allay concerns about the geopolitical, economic, earnings, and policy backdrop,” Mark Haefele, CIO at UBS Global Wealth Management.

“President Trump’s announcement of a Chinese commitment to buying $40–50 billion of U.S. agricultural products appears unrealistic – U.S. exports to China peaked at just $26 billion in 2012, when prices were much higher.”

With the S&P already at all time highs, investors are struggling to find new reasons to buy and extend the record-breaking rally in stocks. Optimism on the China trade front from President Donald Trump is aiding the bull case, and an anticipated Fed rate cut on Wednesday adds fuel. Still, recent data has come in mixed and while corporate earnings are topping estimates on average, the bar has been set low.

“What we’ve had happening in markets in the last few weeks is a lifting of that perceived uncertainty” about U.S.-China trade and Brexit, with central bank easing providing a lift, Sue Trinh, a global macro strategist at Manulife Investment Management, told Bloomberg TV. “The real risk is that we’re seeing a boost to asset prices but no real uptick in the real economy,” she said.

In rates, with markets in wait and see mode for Fed and trade developments, bond yields inched lower. Yields on Japanese 10-year bonds hit the highest since June and their Australian counterparts jumped almost nine basis points, while peers in the U.S. and Germany halted a surge that’s lasted several days. Germany’s benchmark 10-year bond yield hovered just below three-month highs hit on Monday, when yields across the single currency bloc rose sharply after the European Union granted Britain a Brexit extension.

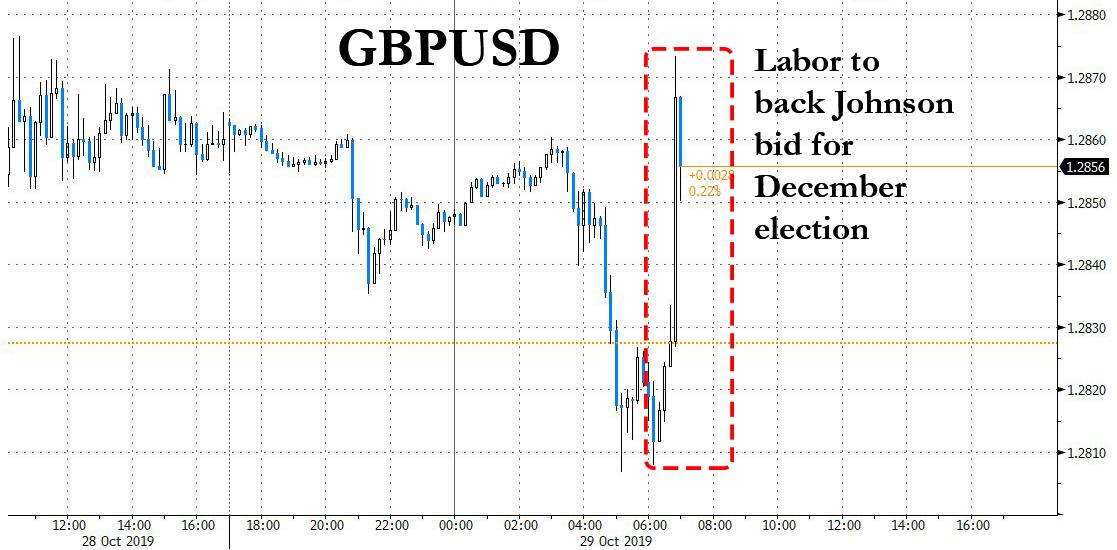

Bonds regained some of previous session’s losses, with Treasuries bull-flattening and European sovereigns firmer. Treasury futures retreated from near session highs as U.K. pound rallied on a report that opposition Labour party will support PM Johnson’s proposal for an early election; Yields on two-year Treasury notes were treading water after hitting four-week highs on Monday at 1.668%.

Investors are still looking forward to a likely rate cut from the Federal Reserve on Wednesday, though the outlook was less clear beyond that (and Jefferies expects the Fed to surprise markets by not cutting this week at all, instead saving its firepower for December). “We expect the Federal Reserve will cut rates this week and possibly once next year, as insurance against a broad economic slowdown,” BlackRock’s chief fixed income strategist, Scott Thiel, said in a note to clients. The futures market has another 50 basis points of cuts priced in by June. Central banks in Japan and Canada also meet this week, with talk the former might ease further if only to prevent an export-sapping bounce in its currency.

The shift from safe harbors saw the yen weaken slightly, with the dollar standing at 108.89 yen after having reached its highest in three months. It was eyeing a key technical level at 109.31. The euro edged up to $1.1095 and was little changed against a basket of currencies at 97.782. The Bloomberg Dollar Spot Index advanced in run-up to Fed decision and U.S. jobs data.

As shown above, the pound first extended losses vs. G-10 peers, with PM Boris Johnson still struggling to schedule a general election, before spiking on news Labour supports a December election.

Oil held below $56 a barrel after Russia said it’s too early to talk about deeper output cuts, casting doubt on the ability of OPEC and its allies to balance supply against a deteriorating demand outlook. Spot gold hovered at $1,493 per ounce after having pulled away from last week’s top around $1,517.

Expected data includes the August Case Shiller report, October consumer confidence and September pending home sales. Meanwhile the BoE’s Carney is due to speak while as for earnings, the highlights include MasterCard, Merck, Pfizer, BP, GM and Amgen.

Market Snapshot

- S&P 500 futures little changed at 3,034.50

- STOXX Europe 600 down 0.4% to 397.57

- MXAP up 0.5% to 162.50

- MXAPJ up 0.2% to 521.68

- Nikkei up 0.5% to 22,974.13

- Topix up 0.9% to 1,662.68

- Hang Seng Index down 0.4% to 26,786.76

- Shanghai Composite down 0.9% to 2,954.18

- Sensex up 1.6% to 39,887.04

- Australia S&P/ASX 200 up 0.07% to 6,745.42

- Kospi down 0.04% to 2,092.69

- German 10Y yield fell 1.4 bps to -0.346%

- Euro down 0.2% to $1.1083

- Italian 10Y yield rose 5.1 bps to 0.662%

- Spanish 10Y yield fell 1.5 bps to 0.292%

- Brent futures down 0.5% to $61.24/bbl

- Gold spot up 0.1% to $1,494.36

- U.S. Dollar Index up 0.1% to 97.84

Top Overnight News

- Boris Johnson is pushing for an election to unlock Brexit after failing for a third time to trigger a snap poll. He remains doggedly determined to secure a third general election in a tumultuous four years. On Tuesday, he will try again to persuade reluctant members of Parliament

- House Speaker Nancy Pelosi moved the Democrats’ impeachment inquiry of Trump into a new phase Monday that signals the public soon will get a look at the witnesses and evidence being assembled to build a case against the president

- China’s third-quarter slowdown continued into October, with only a few signs of stabilization evident amid the weakest pace of expansion in almost 30 years

- New Zealand’s Treasury Department warned the finance minister that S&P Global Ratings could remove its positive outlook on the country’s AA credit rating following the government’s so-called Wellbeing Budget, which ramped up social spending, a document obtained by Bloomberg shows

- Consumer prices in Tokyo rose at the same pace in October even after a sales-tax hike, underscoring the challenge the Bank of Japan faces in stoking inflation as it prepares for a review of price strength later this week

- Oil held below $56 a barrel after Russia said it’s too early to talk about deeper output cuts, casting doubt on the ability of OPEC and its allies to balance supply against a deteriorating demand outlook

- PBOC skipped open-market operations again Tuesday, effectively draining 250 billion yuan from the financial system as funds come due. Fiscal spending at the end of the month will offset maturities, it said in a statement

- Global finance and banking chiefs used an investment forum in Saudi Arabia to renew a warning that central banks have run out of firepower to fight the next economic downturn. Billionaire hedge-fund founder Ray Dalio said the global economy was facing a “scary situation”

- Macquarie Group Ltd. is cutting about 100 equity research and sales jobs in London and New York, according to people familiar with the situation

Asian equity markets trade mixed as the region just about took impetus from Wall St where the S&P 500 and NASDAQ 100 notched record highs after US-China trade optimism was further fuelled by comments from US President Trump that suggested a signing of the phase 1 deal could be ahead of schedule. ASX 200 (U/C) was lifted at the open although some of the gains were later faded amid losses in commodity stocks due to lower oil prices and after the precious metal gave up the USD 1500/oz level, while Nikkei 225 (+0.5%) briefly reclaimed the 23000 milestone for the first time in over a year as it benefitted from a more favourable currency. Conversely, Hang Seng (-0.4%) and Shanghai Comp. (-0.9%) were the laggards despite the current backdrop of heightened trade optimism, as participants digested a slew of earnings and after the PBoC refrained from liquidity operations which resulted to a substantial CNY 250bln liquidity drain. Finally, 10yr JGBs tracked the losses in T-notes amid gains in stocks and with the Japanese benchmark at a yearly high, although some of the losses were recouped following a predominantly stronger than previous 2yr JGB auction results.

Top Asian News

- Hedge Funds Fight for Asia Talent by Boosting Bonuses, Training

- Aramco to Trade on Saudi Exchange on Dec. 11, Arabiya Says

- Forget Zero Fees, Robots. One Broker Doubles Down on Humans

- HSBC’s Quinn Says Economics of Europe ’Do Not Work’ for Banks

European equities have drifted lower after a relatively uninspiring open [Eurostoxx -0.3%] following on from a mixed APAC. Bourses are broadly in the red and remain choppy with no clear underperformer, albeit the region remains cautious ahead of this week’s risk events. Sectors are mostly in negative territory with the exception of Healthcare, which is buoyed by Fresenius SE (+4.5%) and Fresenius Medical Care (+5.8%) after earnings topped analyst estimates. On the flip side, the energy sector bears the brunt of softer energy prices coupled with overall downbeat numbers from oil-giant BP (-2.2%) who reported a 41% drop in Q3 net profits due to lower upstream earnings, softer oil prices, maintenance and weather impacts. Individual movers are largely earnings orientated, Grifols (+3.2%) benefit following firm earnings coupled with a EUR 5.3bln refinancing programme whilst to the downside, Stora Enso (-8%) shares plumbed the depths after disappointing earnings in which the Co. cited weak Q4 demand, thus peers Smurfit Kappa (-0.5%) and Mondi (-0.3%) initial fell in sympathy but has since trimmed losses. Finally, Swedbank (-3.8%) sunk after Estonian Financial Inspector and Sweden’s FSA opened sanctioning cases regarding the Co’s alleged money laundering. Looking ahead to US earnings, Dow listed Merck & Co (2.1% weighting) and Pfzier (0.9% weighting) which may have follow-through effects to European peers.

Top European News

- MorphoSys Drops Most Since January On Trial Discontinuation

- Swedbank Faces Bigger Risk of Fines as Watchdog Weighs Sanctions

- Salvini Could Be Back to Shake Up Italy Sooner Than You Think

- LVMH’s Bid For Tiffany Puts Pressure on Rivals to Respond

In FX, GBP – The Pound was initially precarious after the latest Parliament rejection of a motion to hold a GE on December 12 and ongoing wrangle to find an alternative date that might garner enough backing between Downing Street and those opposition parties that are likely to vote in favour of a snap poll. However, Labour subsequently giving their support to a December General Election has generated Sterling strength with Cable now firmer on the day with a high circa 1.2870 thus far.

- USD – Sterling weakness and some contagion has nudged the DXY a tad closer to 98.000 ahead of more US data and day 1 of the October FOMC meeting that is widely expected to culminate in a 3rd 25 bp rate cut, but probably highlight ongoing divergence between Fed policy-makers resulting in less clarity over forward guidance.

- EUR/CHF/NZD/CAD – All softer vs the Greenback, as the single currency remains top heavy around 1.1100, but underpinned ahead of Fib support at 1.1065, while the Franc continues to pivot 0.9950, Kiwi straddles 0.6350 and Loonie meander either side of 1.3050.

- AUD/JPY – Bucking the overall trend, albeit marginally and also largely rangebound awaiting this week’s big events that kick off from Wednesday. The Aussie is still outpacing is US and NZ peers as Aud/Usd hovers around 0.6850 and Aud/Nzd just shy of 1.0800, but not deriving much impetus via comments from RBA Governor Lowe broadly reaffirming the on hold for now with an easing bias stance. However, looming CPI data could well be influential ahead of housing metrics on Thursday and PPI the following day. Elsewhere, the Yen has pared some losses from a test of 200 DMA support at 109.06 and decent option expiry interest from 109.00 to 109.10 (1.6 bn) even though Japan Post Insurance is eyeing less JGB holdings in the October-March period.

- NOK – The Norwegian Crown is underperforming and only just holding off fresh record lows vs the Euro circa 10.2575 amidst softer crude prices and Norges Bank rhetoric underlining that rates are likely to remain unchanged for the entire forecast horizon, or coming period to quote Nicolaisen verbatim.

- EM – The Rand has rapidly depreciated in wake of outlines of the SA Government’s plan for Eskom that did not include debt restructuring and propelled Usd/Zar up sharply towards 14.7200 vs near 14.5300 at one stage.

In commodities, WTI and Brent are softer this morning but once again not by any significant magnitude trading with losses of less that USD 1/bbl at present. News flow for the session thus far has again been light though this is likely to pick up from tomorrow via data and Central Bank meetings, including FOMC. For the rest of the session the main highlight will be tonight’s APIs which previously printed a build of 4.51mln and was notably not corroborated by the subsequent EIA metrics showing a draw of 1.69mln. Elsewhere, source reports note that Saudi Aramco is to announce the price range on November 17th and begin an IPO subscription on December 4th, aiming to trade on the Saudi Market from December 11th. Further, Nigeria’s new Energy Minister was on the wires this morning, albeit provided little by way of new substance. Elsewhere, gold prices remain tentative within a tight range, as is usually the case ahead of the Fed’s monetary policy meeting; however, the metal has just seen a modest sell off. Meanwhile, copper trimmed some of yesterday’s losses, again on the lookout for risk events. Finally, Dalian iron ore futures ended the day lower by 1.7% amid China demand woes.

US Event Calendar

- 9am: S&P CoreLogic CS 20-City MoM SA, est. -0.1%, prior 0.02%; 20-City YoY NSA, est. 2.1%, prior 2.0%

- 10am: Conf. Board Consumer Confidence, est. 128, prior 125.1; Present Situation, prior 169; Expectations, prior 95.8

- 10am: Pending Home Sales MoM, est. 0.8%, prior 1.6%; NSA YoY, est. 3.55%, prior 1.1%

DB’s Jim Reid concludes the overnight wrap

I got home last night to watch the latest big U.K. Parliamentary vote and found my 4yr old daughter hogging the TV and watching “Frozen”. Given the gridlock at Westminster at the moment this seemed pretty apt. There is a reasonable chance the ice will melt today though as the U.K. government reacted to not getting the necessary 2/3rds of Parliament vote for a General Election on December 12th under the FTPA by suggesting they will propose a single line bill today for an election on the same date. This will only require a simple majority.

The Lib Dems and SNP have already indicated that they would support a vote for December 9, so it seems like the two groups are just haggling over the exact date and details at this point. The opposition parties prefer an earlier poll to ensure that students are more readily able to vote and to further ensure against Johnson bringing his WAB to another vote before the election. The Government conceded last night that they wouldn’t progress the WAB before an election but trust is so low that there might need to be a way of guaranteeing this before the two smaller opposition parties agree to it. The main opposition Labour Party are seemingly opposed to the election but it wouldn’t surprise me if they voted for it if the other two parties found a way to support it. It would be bad optics to be opposed when all other main parties backed it. Even though Labour’s official position was to abstain last night 38 MPs still voted against it. So by this time tomorrow we could have an election date…. but then again it’s easily possible we don’t.

Away from Westminster and over in markets, with the distraction of the big macro events of the week not kicking in until tomorrow onwards, there was a new record high for the S&P 500 to get excited about. Indeed the index took out the previous July high to close 0.45% above it and +0.56% higher on the day – the fifth positive day in the last six. Actually since the October 8th close we’ve had 10 positive days out of 14, including each of the last four sessions. At the start of this three-week rally, three positive catalysts coincided: Johnson and Varadkar held their positive bilateral meeting; Chair Powell announced that the Fed would resume securities purchases to grow its balance sheet; and the US and China agreed on “phase one” of their trade deal. That trifecta of positive developments has certainly underpinned the recent rally. We certainly need the data to catch up now to justify the strength.

Back to yesterday and it was the tech sector which really led the charge after the NASDAQ rose +1.01%. It’s not quite back at the July record highs just yet but yesterday’s move puts it within 0.05%. Meanwhile, the NYSE FANG index nudged up +1.02 % and the trade-sensitive semiconductor index rose +1.75%. That is a +6.41% move over the last 3 sessions for semiconductors, the best stretch since July. Prior to this, the STOXX 600 closed up +0.25% which means the index has closed higher for 6 consecutive sessions. The last time it did that was back in July as well.

Credit markets also had a decent day with US HY spreads -3.5bps tighter. The flip side of the risk off move was a decent selloff across sovereign bond markets. Indeed 10y Treasuries sold-off +5.1bps to close at 1.846% while 10y Bunds closed up +3.0bps at -0.332%. It was the end of July that we last saw Bunds back at these ‘lofty’ levels, which was also the last time that 20-year bond yields were positive, though the whole curve is still currently negative out to the 20 year tenor. Similarly, gold was down -0.82% while safe haven currencies also broadly underperformed, with the yen down -0.29% to its weakest level since June. Argentinian assets were pressured following the weekend election results, with the benchmark MERVAL index down -3.90% while yields on 10-year international bonds rose +95.0bps. Finally, bitcoin rose another +10.02% to take its two-day move to +26.52%, the most since May after the China blockchain headlines we mentioned this time yesterday.

Dictating the US tempo once again were trade headlines, this time the positive snippets from President Trump about the US being “ahead of schedule” to sign a deal. Some more idiosyncratic stock specific news also played a part. Of note was a +4.28% gain for AT&T following a board reshuffle and announcement to pay down debt. Microsoft climbed +2.46% after it won a $10 billion government contract to provide cloud computing services to the defense department. Its main competitor for the contact, Amazon, saw shares gain +0.89%, lagging the broader tech move.

Back in Europe, ECB President Draghi’s last week at the helm started with his final scheduled remarks at an honorary farewell ceremony in Frankfurt. He once again call for coordinated fiscal stimulus in the euro area. In front of the heads of government from Germany, France, and Italy, Draghi said that “we need a euro-area fiscal capacity of adequate size and design: large enough to stabilize the monetary union (…) uncoordinated policies are not enough.” By the end of the week he will handoff the institution to Christine Lagarde, who has also called for fiscal policy to support monetary efforts in recent years.

Meanwhile, after yesterday’s surge in China’s blockchain related stocks after comments by Chinese President Xi Jinping, the People’s Daily is carrying a commentary this morning saying that “The future is here for blockchain, but we need to stay rational.” This came as more than 70 tech shares surged yesterday by the daily limit in Shanghai and Shenzhen.

This has perhaps helped Chinese and Hong Kong’s bourses to trade lower this morning with the Shanghai Comp (-0.43%), Shenzhen Comp (-0.27%) and Hang Seng (-0.46%) all down. The Nikkei (+0.43%) is trading higher while the Kospi (-0.11%) is lower. As for FX, most Asian emerging market currencies are trading up this morning on trade deal optimism with the Chinese yuan up +0.14% to 7.0584 while the South Korean won is leading the advances by gaining +0.51%. 10y USTs yields are up +1.2bps, with 10y JGBs also up +1.6bps to -0.124% – the highest level since June this year. Elsewhere, futures on the S&P 500 are trading flattish.

Meanwhile, after markets closed last night, Alphabet shares fell -1.63% after profits fell year-on-year and missed expectations by around 10%. Much of the miss was due to higher capital spending, as the company focuses on expanding its cloud computing and machine learning business lines.

Switching play and coming back to the elections in Germany over the weekend, our economists highlighted in their note yesterday that the results have increased the probability of an early GroKo demise, but the team still think that the status quo forces are more likely to prevail; meaning that the GroKo treaty will be the ultimate arbiter in case of (more likely) conflicts. Calls from within the SPD to move to the opposition will not fall silent, but the SPD does not really have strong incentives to leave the coalition and trigger new elections, given their weakness in current polls. See our colleagues’ full summary here .

In other news, with the big data releases reserved mostly from tomorrow onwards – including payrolls on Friday – the warm up prints yesterday didn’t really move the dial. That said the advance goods trade balance in the US did provide a bit of food for thought following a narrowing in the deficit to $70.4bn in September from $73.1bn in August. That included drops in both imports and exports, with the latter down around 3% yoy. This should be a small negative for the FOMC statement on Wednesday given weakness in exports growth. Elsewhere, wholesale inventories were down surprisingly last month (-0.3% mom vs. +0.2% expected) while finally the Dallas Fed manufacturing survey was weak in October, printing at -5.1 (vs. +1.0 expected). That’s the weakest since July although it’s worth noting that the future expectations index did improve.

Prior to this, in Europe the September M3 money supply data showed a slowdown of money creation from 5.8% to 5.5% yoy. Credit growth also slowed and our economists noted that this resulted in the credit impulse turning negative for September having been in positive territory since April 2019.

To the day ahead now, which this morning includes October consumer confidence in France and September money and credit aggregates data in the UK. This afternoon in the US we have the August S&P CoreLogic house price index data, October consumer confidence and September pending home sales. Meanwhile the BoE’s Carney is due to speak while as for earnings, the highlights include MasterCard, Merck, Pfizer, BP, GM and Amgen.

Tyler Durden

Tue, 10/29/2019 – 07:53

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com