Futures Fade After Algos Sell Latest Burst Of “Trade Deal Optimism”

Is the oldest trick in the Trump market manipulation book finally coming to an end?

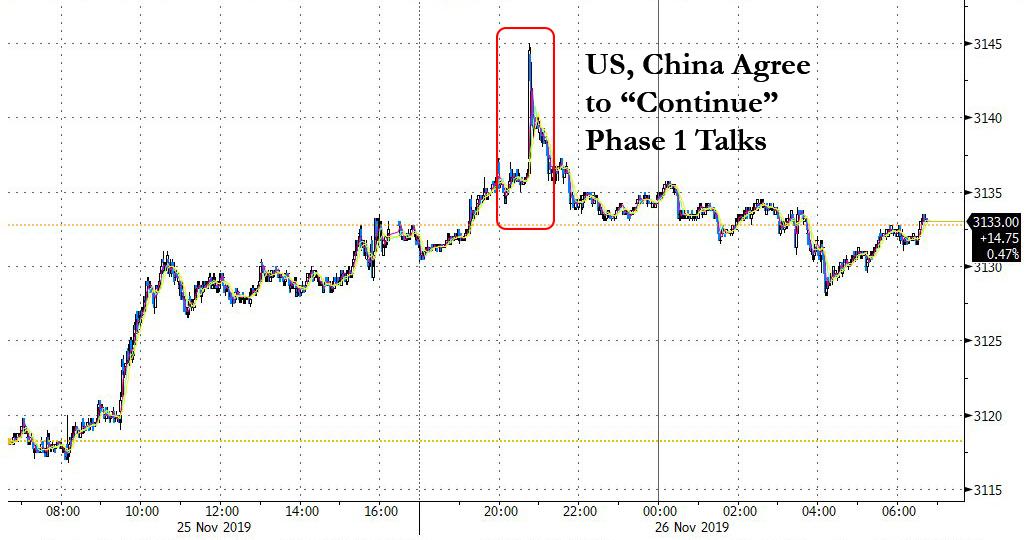

12 hours after futures spiked by 10 points to a a new record high, after algos reacted as if stung to the following China headline:

- CHINA, U.S. HELD CALL TODAY; AGREED TO CONTINUE PHASE-1 TALKS

… and which said that China’s Vice Premier Liu He, Robert Lighthizer and Steven Mnuchin held a phone call in which they “reached consensus on properly resolving relevant issues” and agreed to stay in contact on the remaining points for a “phase one” trade deal during a phone, yet which if one thinks about it said absolutely nothing new – the US and China agreed to continue talks to reach a deal which Trump already announced back on October 11? – futures have faded the entire move higher and as in danger of rolling over as it suddenly appears that algos are no longer responding to the daily injections of artificial “trade deal optimism.”

China’s Global Times tweeted later that topics in the call may have included tariff removal, agricultural purchase and a possible face-to-face meeting citing experts close to trade talks. Furthermore, Global Times later reiterated that China and the US have basically reached broad consensus on a phase one trade deal including the removal of tariffs, although some differences remain over how much tariffs should be rolled back citing experts close to the talks. Yet if that is the case why did the two sides agree to continue the talks, and is this just a charade to keep stocks high, Trump happy, and China free to intervene in HK without angering the US president?

“We take any positive pronouncements on a trade deal with healthy skepticism given how long this has dragged out,” Rabobank strategists wrote in a note Tuesday. “It would seem that any major progress on the trade deal front will be hindered by the ongoing unrest in Hong Kong.” Perhaps this skepticism is starting to rub off on the algos too?

The following “flow” chart shows the most notable moments and comments in the past year of the US-China trade war, whose end continues to remain “just around the corner”:

And with Monday’s attempt to stimulate optimism crashing and burning, S&P futures slid from all time highs and world stocks edged off their highest in almost two years on Tuesday, even after a strong Hong Kong debut for Chinese e-commerce giant Alibaba, which sent the stock price higher by 6.6%.

Overnight, the MSCI World index touched its highest level in almost two years, before drifting lower as the European session wore on. Still, it remained less than 1% off record highs hit in early 2018.

European stocks, with the exception of London’s FTSE were broadly lower with gains in food and beverage firms offsetting declines in travel stocks. That said, the European Stoxx 600 index, remained within striking distance of four-year highs.

“The outlook is positive as world trade angst is the biggest negative out there, especially when you throw in loose policy, the pick-up yields for equities versus bonds and the like,” said Raymond James strategist Chris Bailey, adding that “the residual issues are clear: The first is a reversal in world trade optimism, the second is that valuations become perceived as overstretched – this can easily happen given lackluster corporate earnings growth.”

Earlier in the session, Asian stocks edged up for a third day of gains, led by health-care firms, following the initial, much more positive response to China’s statement that Beijing and Washington are working toward an initial trade deal. Markets in the region were mixed, with Australia leading gains and the Philippines retreating. Japan’s Topix climbed 0.2%, buoyed by electronics makers. The Shanghai Composite Index closed little changed, as China Merchants Bank declined and China Life Insurance climbed. Hong Kong’s Hang Seng Index slipped 0.3%, reversing earlier gains, as the city’s top official refused to make any new concessions to protesters. India’s Sensex fluctuated after Monday’s record close, with ICICI Bank advancing and Bharti Airtel dropping

Alibaba shares opened 6.6% higher in Hong Kong than their issue price and at a small premium to pricing in New York. The listing has been seen as a vote of confidence in Hong Kong after months of anti-government protests that have rocked the financial hub.

A flurry of M&A activity also supported sentiment in equity markets, with France’s LVMH agreeing to buy U.S. jeweler Tiffany for $16.2 billion and Charles Schwab set to purchase TD Ameritrade in a deal valued at $26 billion.

Still, as Reuters and Bloomberg note, it is the outcome of U.S.-China trade talks that remained the key driver for world markets. Hopes that a partial trade deal is just around the corner have helped sustain a rally in global stocks for a third month, alongside a flurry of stock buybacks and buyouts, yet while China’s Ministry of Commerce pointed to trade progress in a statement, Hong Kong remains a source of tension, with Beijing summoning America’s ambassador to express its opposition to U.S. interference.

In FX, the Bloomberg dollar index stayed positive, although the pace of its advance cooled with traders fatigued over U.S.-China trade talks. The Aussie failed to hold gains which it made after RBA Governor Lowe said the point when QE will be needed is unlikely to be reached. The yen fell early on to a two-week low, only to reverse losses, while the pound slipped as polls showed a narrowing lead for the ruling Conservative Party. The euro was also a touch firmer at $1.10150. China’s yuan – the currency most sensitive to the trade war – had risen to a one-week high of 7.0181 against the dollar, but was last trading at 7.0388.

“China and the U.S. agreed on a framework to resolve their phase one issue, which is just a way of saying that they did admin work,” said Sebastien Galy, senior macro strategist at Nordea Asset Management.

In rates, German bund yields nudged back down, also reflecting the more cautious tone among investors. The 10-year U.S. Treasury yield was last down 2 basis points on the day at around 1.75%.

Elsewhere, Bitcoin dipped to $7,065, although it earlier rebounded after a tenth day of declines, which would be its longest losing streak on record. The crypto was holding above six-month lows hit on Monday after the People’s Bank of China launched a fresh crackdown on cryptocurrencies.

In commodities, the crude complex was broadly higher but remains choppy, as Tuesday morning trade remains bound within tight USD 57.85/bbl to USD 58.30/bbl and USD 63.50/bbl to USD 63.90/bbl parameters respectively for front month WTI and Brent contracts. There has been little by way of fresh crude specific fundamental drivers, however, looking ahead, forecasts for today’s API Inventory data predict a 939mln bbl draw. OPEC’s Economic Commission Board is set to meet on Wednesday and Thursday and will then likely make a recommendation on what OPEC should do regarding of production cuts over the course of 2020. While the board can make a recommendation, there is no certainty that OPEC ministers will follow this advice as they ultimately make the decision.

Looking at the metals; gold is a touch firmer, moving north of USD 1464/bbl. In terms of physical demand for the precious metal; ING point to data from China’s National Bureau of Statistics, which shows that non-monetary gold imports declined by 43% M/M to a three year low of 34.9 tonnes in October, leaving YTD gold imports down 41% Y/Y. Stronger gold prices, a weaker currency and slowing growth have weighed on retail gold demand in the country, suggests the bank, citing similar reasons for the physical demand slowdown in India. Meanwhile, copper is more rangebound, as the red metal pulls back after making two-week highs yesterday.

Looking at the day ahead, we have a raft of data releases from the US today, including the Conference Board’s November consumer confidence reading, October’s new home sales, the Richmond Fed’s November manufacturing index, the preliminary October reading for wholesale inventories, along with the September FHFA house price index. Analog Devices, Best Buy, Autodesk, Dell Technologies, HP and VMware are among companies reporting earnings.

Market Snapshot

- S&P 500 futures little changed at 3,132.25

- STOXX Europe 600 down 0.2% to 407.42

- MXAP up 0.1% to 165.09

- MXAPJ unchanged at 527.44

- Nikkei up 0.4% to 23,373.32

- Topix up 0.2% to 1,705.71

- Hang Seng Index down 0.3% to 26,913.92

- Shanghai Composite up 0.03% to 2,907.06

- Sensex down 0.2% to 40,823.37

- Australia S&P/ASX 200 up 0.8% to 6,787.53

- Kospi down 0.1% to 2,121.35

- German 10Y yield fell 1.1 bps to -0.36%

- Euro up 0.04% to $1.1018

- Italian 10Y yield fell 1.8 bps to 0.818%

- Spanish 10Y yield fell 2.1 bps to 0.392%

- Brent futures down 0.1% to $63.62/bbl

- Gold spot up 0.2% to $1,457.76

- U.S. Dollar Index little changed at 98.30

Top Overnight News from Bloomberg

- China and the U.S. “reached consensus on properly resolving relevant issues” and agreed to stay in contact on the remaining points for a “phase one” trade deal during a phone call Tuesday morning Beijing time, the Ministry of Commerce said in a statement.

- Federal Reserve Chairman Jerome Powell struck an upbeat tone in gauging the ability of policy makers to extend the record U.S. economic expansion, while signaling interest rates would probably remain on hold

- The Australian central bank’s No. 2 Guy Debelle says in text of speech in Canberra Tuesday that uncertainty over how far record labor market participation has to run clouds the outlook for unemployment

- For the third straight autumn, China is selling dollar bonds, with a potential $6 billion total offering of three-year, five-year, 10-year and 20- year securities, according to people familiar with the plans. The Ministry of Finance said in its 2017 resumption of dollar- debt sales it would help build a benchmark yield curve for Chinese issuers, which range from developers to local authorities

- China saw higher premiums than in 2018 in initial marketing for its latest sale of dollar bonds, the biggest offering yet and the third in three years.

- Japan needs to maintain the market’s faith in government’s commitment to erasing the budget deficit and paying down debt, Finance Minister Taro Aso says

- Former White House Counsel Donald McGahn was ordered by a judge to appear before a congressional committee probing possible obstruction of justice by Donald Trump — a ruling that could deepen the president’s political peril amid an impeachment inquiry launched by House Democrats

- Australian central bank chief Philip Lowe laid out his cards for unconventional policy: A government bond-buying program is an option at a 0.25% cash rate, but the threshold for such stimulus hasn’t been reached and is unlikely to be in the near term.

Asian equity markets traded mostly higher after taking impetus from the fresh record levels on Wall Street where sentiment was underpinned by the US-China trade optimism and a relatively busy day of takeover activity. ASX 200 (+0.8%) was positive in which the energy sector led the broad advances across Australia’s sectors as Caltex registered double-digit percentage gains on reports it received an offer from Couche-Tard and with Westpac finding some relief from the AUSTRAC-related losses after its CEO stepped down and Chairman announced an early retirement, while Nikkei 225 (+0.4%) was lifted by a weaker currency and with M&A also in focus as Hitachi Chemicals surged on a potential takeover by Showa Denko. Hang Seng (-0.3%) and Shanghai Comp. (U/C) opened positively on the recent trade optimism although the gains were later trimmed after another substantial liquidity drain by the PBoC and as Alibaba’s debut threatened to shun the regional darlings, while a brief spike in risk appetite attributed to algos reacting to news US and China trade negotiators held a phone call and reached a consensus on solving issues, later faded given the actual lack of fresh solid developments. Finally, 10yr JGBs were pressured in early trade by the lack of safe-haven demand and with participants sidelined heading into the 40yr auction, which eventually showed firmer demand and spurred a rebound in prices

Top Asian News

- RBA Says QE Is Option at 0.25%, Doesn’t Expect to Need It

- China Faces Biggest State Firm Offshore Debt Failure in 20 Years

- China Sees Higher Cost for Dollar Bonds in Initial Pricing

- Westpac CEO Hartzer Resigns Amid Money-Laundering Scandal

- Hong Kong Exports Extend Fall to 12 Months, Imports Drop Again

Major European bourses (Euro Stoxx 50 -0.2%) are modestly softer as recent upwards momentum seen in global equities subsides amidst a lack of fresh fundamental drivers. Another bout of seemingly positive US/China news-flow overnight, in which the two sides reportedly held a phone call where they reached a “consensus on solving issues” and “agreed to keep in contact”, largely failed to lift sentiment; Lloyds argue that negotiators will now need to “walk the talk”, i.e. show real evidence of progress, if further market risk appetite is to be stoked. It is also worth noting that a number of banks’ month end rebalancing models forecast flows out of equities and into bonds – another factor potentially behind this morning’s moves. Sectors are mostly in the red, bar Tech (+0.3.), Materials (Unch), Healthcare (+0.1%) and Consumer Staples (+0.3%). In terms of equity specific movers; Faurecia (+1.0%) had a strong start to the session on the news that it targets FY revenue above EUR 20.5bln and had confirmed its FY targets, although the stock eventually gave back the majority of its gains. Valeo (-0.3%) opened higher in sympathy, before gains were also eroded. Similarly, Peugeot (-0.4%) and Fiat Chrysler (-0.1%) also struggled to hold on to early gains, which were spurred by the news that both Cos had told employees via internal communication that they would sign a binding merger agreement in the coming weeks. Enel (-0.5%) is lower despite decent earnings in which it raised its FY20 EBITDA guidance and increased its dividend. Elsewhere, Compass Group (-5.2%) sunk after earnings underwhelmed, while EasyJet (Unch.) managed to fight off early losses sustained after the Co. was downgraded to hold from buy at Berenberg.

Top European News

- France Says 13 Soldiers Killed in Helicopter Accident in Mali

- Berlin’s Biggest Landlord Says Rent Fix Sparks Investor Backlash

- An Old Boys’ Club in Shipping Lost Its Top-Ranking Woman

- EU’s Green Energy Laggard Readies Record Wind Power Auction

In FX, sterling has lost its recent impetus in light of fresh polls depicting a narrowing Tory lead over labour, with the latest Kantar poll showing an 11-point gap vs. 18 last week, whilst the overnight ICM polls indicated a narrowing to 7 points from 10 in the previous week. That said, it’s worth caveating that Labour’s handling of its anti-Semitism crisis has garnered some focus with Chief Rabbi Mirvus suggesting that Labour Leader Corbyn is not fit for office. Cable dipped back below the 1.2900 mark (having flatlined around the figure throughout APAC hours) and continues to drift lower to session lows having traded within a 1.2852-2907 intraday band thus far. Meanwhile, the Single Currency remains little changed and within a tight range of 1.008-19 with no pertinent comments from ECB speakers so far and with touted support at 1.1004 ahead of the round figure.

- AUD, NZD – The Aussie took top spot among the G10 gainers as RBA Governor Lowe pushed back on QE and unconventional measures until Australia sees a bleaker economic picture. The Governor stated that QE will only be needed in the case of two more 25bps rate cuts, (i.e. the Cash Rate at 0.25%) and reaffirmed that negative rates in Aussie are extremely unlikely. All-in-all a hawkish outlook on monetary policy against the backdrop of recent economic data, and especially given the Central Bank’s rhetoric earlier in the year that unconventional tools are prepared to be rolled out if warranted – which also prompted most house views to converge towards QE at some point next year. Unsurprisingly, AUD/USD derived support from the Governor but the pair stopped short of the 0.6800 level to the upside vs. a low of 0.6770, albeit the pair has given up the gains as the Dollar climbs off lows. Meanwhile, the Kiwi remains supported by overnight NZ retail sales data but now trades relatively flat and still retains its 0.64+ status having earlier dipped to proximity of the round figure.

- DXY, JPY – Minimal action in the DXY thus far as the Index continues its APAC sideways trade around 98.30 having printed a tight intraday range of 98.26-35. Overnight, Fed Chair Powell failed to provide much by way of new substance, whilst the latest in the US-Sino trade saga did little to inspire the Buck. Looking at the state-side calendar, Adv. Goods trade balance and Richmond Fed may attract some attention on a quiet day ahead of Fed-voter Brainard’s speech on monetary policy and tools. Similarly, the Japanese Yen has been stuck within a relatively narrow band at 108.90-109.20. The pair knee-jerked to session high overnight, potentially on algo-related action on trade headlines regarding a call between Chinese and US trade negotiators, albeit the move was short lived as it provided little substance. USD/JPY meanders around its 200 DMA at 108.93 with around USD 500mln of options expiring around 108.90-109.0 and USD 2.3bln at 109.50.

- EM – Modest downside bias in the Turkish Lira amid jitters that its S-400 radar tests could provoke US lawmakers and result in sanctions. Further, reports stated that Russia and Turkey are mulling signing the second regiment contract for the Russian-made defence system. Turkey’s President more-or-less shrugged questions about resolving the dispute with US whilst reaffirming his pledge that interest rates will fall to single digits from the current 14%, albeit a timeframe was not mentioned. USD/TRY remains on the offensive having breached 5.7500 to the upside after multiple attempts and briefly surpassed its 50 DMA at 5.7509 (vs. low of 5.7355). Elsewhere, the Rand continues to be weighed on by the recent downbeat outlook from the IMF coupled with S&P’s outlook downward outlook revision. USD/ZAR found a base at 14.7500 and topped its 100 DMA at 14.7940 to print a current high of around 14.8500.

In commodities, the crude complex is broadly higher but remains choppy, as Tuesday morning trade remains bound within tight USD 57.85/bbl to USD 58.30/bbl and USD 63.50/bbl to USD 63.90/bbl parameters respectively for front month WTI and Brent contracts. There has been little by way of fresh crude specific fundamental drivers, however, looking ahead, forecasts for tonight’s API Inventory data predict a 939mln bbl draw. ING highlight that the last stock drawdowns were seen in mid-October – some desks have suggested that some of the upside seen this morning could be the market “front-running” tonight inventory report. Looking to the rest of the week; OPEC’s Economic Commission Board is set to meet on Wednesday and Thursday and will then likely make a recommendation on what OPEC should do regarding of production cuts over the course of 2020. While the board can make a recommendation, there is no certainty that OPEC ministers will follow this advice as they ultimately make the decision. Looking at the metals; gold is a touch firmer, moving north of USD 1464/bbl. In terms of physical demand for the precious metal; ING point to data from China’s National Bureau of Statistics, which shows that non-monetary gold imports declined by 43% M/M to a three year low of 34.9 tonnes in October, leaving YTD gold imports down 41% Y/Y. Stronger gold prices, a weaker currency and slowing growth have weighed on retail gold demand in the country, suggests the bank, citing similar reasons for the physical demand slowdown in India. Meanwhile, copper is more rangebound, as the red metal pulls back after making two-week highs yesterday.

US Event Calendar

- 8:30am: Advance Goods Trade Balance, est. $71.0b deficit, prior $70.4b deficit

- 8:30am: Wholesale Inventories MoM, est. 0.15%, prior -0.4%; Retail Inventories MoM, est. 0.1%, prior 0.3%, revised 0.2%

- 9am: House Price Purchase Index QoQ, prior 1.0%; FHFA House Price Index MoM, est. 0.3%, prior 0.2%

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.3%, prior -0.16%; S&P CoreLogic CS 20-City YoY NSA, est. 2.01%, prior 2.03%

- 10am: Richmond Fed Manufact. Index, est. 5, prior 8

- 10am: New Home Sales, est. 705,000, prior 701,000; MoM, est. 0.57%, prior -0.7%

- 10am: Conf. Board Consumer Confidence, est. 127, prior 125.9; Present Situation, prior 172.3; Expectations, prior 94.9

DB’s Jim Reid concludes the overnight wrap

I’ll be on Bloomberg TV at 10am GMT this morning so tune in if you want to watch me try to say something interesting whilst remembering that anything too controversial will be on film for eternity. Going on TV is one of the few times I have sympathies for the life of politicians. Thankfully Bloomberg are less inclined to tie knots around you than a political journalist would. To think that as a teenager I wanted to be a politician and was a member of a political party. Anyway it’s likely that Powell‘s remarks overnight will be discussed. He spoke at midnight London time and broadly repeated his recent rhetoric, saying that policy is currently appropriate provided the economy evolves as he expects. He repeated his new phrase that the outlook would have to change “materially” for him to want to change policy. Our economists think the labour market will be the key metric for gauging such a material reassessment, making next week’s jobs report even more important.

Before this, the S&P 500 (+0.75%) and the NASDAQ (+1.32%) climbed to record highs yesterday as trade-related optimism and “Merger Monday” boosted equity markets. Trade-sensitive indices outperformed, with the Philadelphia semiconductor index up +2.43%, while in Europe the STOXX Automobiles and Parts index rose +0.85%.

The initial catalyst for the rise seemed to be the weekend news we reported yesterday that China would increase the penalties on violations of intellectual property rights. We also had headlines yesterday from the Global Times in China which cited experts close to the talks as saying that the US and China had reached a broad consensus over a Phase One trade deal. However, it also said that differences remained between the two sides over rolling back tariffs. USDCNH was unchanged in response to that report which indicated that markets didn’t really see much new info attached. In terms of M&A, eBay (+2.08%) announced it will sell its ticket exchange website Stubhub for $4.05 billion in cash to Viagogo, a European competitor. Elsewhere, LVMH (+2.02%), the European luxury brand conglomerate, will pay $16 billion for iconic US jewelry-maker Tiffany and Co. (+6.20%). Meanwhile, Charles Schwab formally agreed to buy its rival TD Ameritrade, as reported last week. Its shares gained +2.30% (+10.19% since the deal was reported), while TD Ameritrade gained +7.58% (+25.13% since first reports).

Overnight we’ve seen similar trade headlines to those that have been around over the past few days with the Chinese government saying in a statement that China and the US “reached consensus on properly resolving relevant issues” and agreed to stay in contact on the remaining points for a “phase one” trade deal during a phone call this morning. The call was held between Chinese Vice Premier Liu He and the US Trade Representative Robert Lighthizer and U.S. Treasury Secretary Steven Mnuchin. Meanwhile, the Global Times reported, citing unidentified expert close to the trade talks, that officials on the call today may have discussed tariff removal, agricultural purchases and a review mechanism for the implementation of a potential agreement. They also suggested disagreement on how much tariffs should be cut. So it seems the same stories are rotating round on trade at the moment.

Nevertheless, the headlines sent Asian stocks higher with the Nikkei (+0.51%), CSI 300 (+0.17%) and Kospi (+0.68%) all up. The onshore Chinese yuan (+0.10%) also gained on the news. Meanwhile, the Hang Seng is trading down -0.07% after the city’s Chief Executive Carrie Lam shied away from making any new concessions to protesters in her first comments since pro-democracy forces’ thumping victory in the weekend local elections. Elsewhere, futures on the S&P 500 are up +0.10%.

There was a similar overall bullish market reaction in Europe yesterday, where the STOXX 600 advanced +1.02% to its highest level since May 2015. Bourses were up across the continent, with the DAX (+0.63%), the CAC 40 (+0.54%) and the FTSE 100 (+0.95%) all ending the day higher. Gold fell back somewhat, down -0.48% as it fell close to three-month lows.

It was a more mixed session for fixed income, but an interesting stat was that yesterday saw the 2s10s curve flatten for a 9th consecutive session, down -1.6bps to 13.8bps, its flattest level since October 14th, just after President Trump proclaimed a “phase one” deal at the White House alongside China Vice Premier Liu He. Given the Fed has helped anchor the front end since the FOMC, the curve shape is now much more exposed to the long-end. For yesterday, 10yr Treasuries yields fell -1.6bps to 1.755%, but in Europe, 10yr bunds ended the session +1.0bps. Peripheral bonds rallied as well, with Italian 10yr yields falling by -1.8bps to 1.163, their lowest level in nearly three weeks.

In addition to Powell’s comments last night, we heard from a number of ECB speakers yesterday. Notably, Austrian central bank governor Holzmann said that the ECB’s strategy would be “under revision from the beginning of January.” This signposts the “strategic review” that President Lagarde mentioned in her speech on Friday, where she said it was “due to begin in the near future”. ECB Chief Economist Lane said, unsurprisingly, that the ECB is going to be in the bond market for a long time. More interestingly, he said that all of the ECB’s instruments can be adjusted if the outlook worsens. This is consistent with the ECB’s existing policy, but it is a divergence from President Lagarde’s comments last week, where she conspicuously did not include a comment about “all instruments.” Time will tell if this is was just an inadvertent rhetorical detail, or a true policy tension to iron out. Expect a lot of second guessing of Lagarde as the market gets used to her communication nuances.

Sterling was the strongest performing G10 currency yesterday, up +0.52% against the dollar, as investors continued to take heart from further strong opinion polls for the Conservatives over the weekend. However, it took a jolt later on in the session after the poll we discussed at the top out from ICM had the Conservatives on 41%, just 7pts ahead of Labour on 34%. Of course we shouldn’t read too much into one poll, but this is the narrowest lead we’ve seen for the Tories in a couple of weeks. There was some discussion on Twitter that the Labour saw a surge in votes in the 55-65 year old category in this poll. This could be due to an extraordinary promise over the weekend to pay £58bn compensation to women pensioners (of this age) who missed out as retirement ages were changed several years ago. However as we said we shouldn’t read too much into one poll.

Staying with European politics, our German economists put out a note yesterday (link here ) on the CDU conference and the upcoming SPD leadership result, which is going to be announced on Sunday. They say that the outcome of the leadership race is hard to predict, but it could have implications for the fate of the country’s grand coalition. A victory for Scholz and Geywitz would support their baseline of the coalition finishing its term of office in 2021, though they write that a win for Walter-Borjans and Esken wouldn’t automatically lead to a government collapse either. Indeed, a reason for both of the coalition parties to keep the government on the road is that current polls show they’d fall short of a majority.

In terms of data, the main highlight from yesterday was the Ifo business climate indicator from Germany, which rose to 95.0 in November, exactly in line with expectations. Although this is the highest reading since July, it’s still below the levels seen throughout all of 2013-2018. Looking at the other readings, the expectations indicator came in at 92.1 (vs. 92.5 expected), while the current assessment reading rose a tenth to 97.9 (vs. 97.9 expected). So still subdued relative to the recent past, but the positive takeaway is that all three indicators were up from October.

Turning to the US, the Chicago Fed National Activity index fell to -0.71 (vs. -0.20 expected), which was its second-lowest level since January 2014. However, the Dallas Fed’s manufacturing activity index rose to -1.3 (vs. -3.8 expected).

To the day ahead, and we have a raft of data releases from the US today, including the Conference Board’s November consumer confidence reading, October’s new home sales, the Richmond Fed’s November manufacturing index, the preliminary October reading for wholesale inventories, along with the September FHFA house price index. Meanwhile in Europe, there’s the GfK consumer confidence reading from Germany. From central banks, we’ll hear from the ECB’s Coeure and Wunsch, along with the Fed’s Brainard who’s discussing the policy framework review.

Tyler Durden

Tue, 11/26/2019 – 07:46

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com