Auto Lenders Have Verified Income On Just 7% Of All Loans Since 2017

The auto industry in 2019 is starting to look a lot like the subprime mortgage market in 2007.

One such example of an industry trying to move vehicle inventory by any means necessary was Mirna Lopez, a 65 year old who was able to buy a 2018 Nissan Pathfinder on monthly earnings of just $660. Her car loan’s monthly payment was slated to be $809.

How was this possible? The Wall Street Journal reports that an employee at the dealership that sold her the car simply listed her monthly earnings at $7,833. Nothing creative, nothing fancy: just plain old fraud.

It’s no longer good enough for customers to be buying cars with debt only. Now, while the auto industry struggles to pull itself out of the recession it is mired in, some dealerships around the country are “dressing up” loan applications with fake incomes, according to consumer lawyers. Additionally, some large lenders have cut back on safeguards that could catch the fraudulent applications.

The result is usually a quick default on these loans and consumers destroying their credit.

Richard Feferman, a New Mexico lawyer who has sued dealerships and lenders said: “The consequence for a lot of people is to ruin them financially for five to 10 years.”

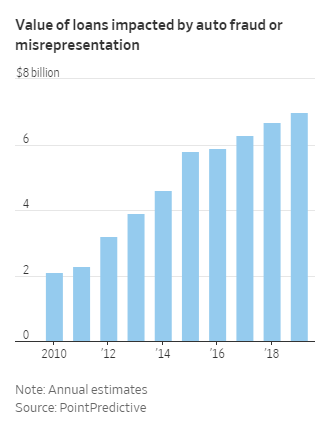

The amount of false applications is “hard to quantify” according to PointPredictive, which sells software to detect loan fraud. The company estimates that more than 20% of loans have inflated incomes.

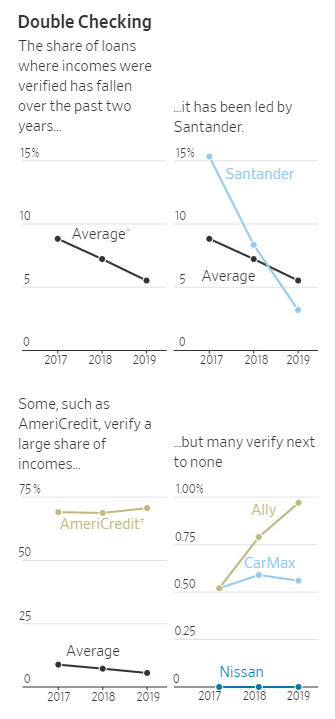

Of course, dealers have the option to ask for documentation to prove income, but over the past few years some subprime lenders have stopped checking them – partly in response to dealers demanding faster decisions. In fact, lenders verified income on only about 7% of all loans since 2017, the Journal found.

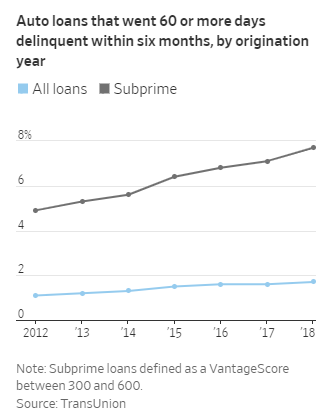

And the share of loans that go delinquent after origination is rising, specifically among subprime loans. Satyan Merchant, SVP of TransUnion’s auto business said: “That can be a signal of fraud.”

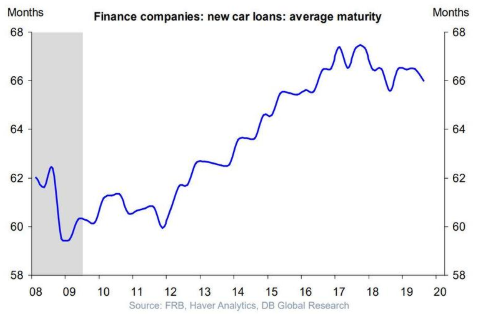

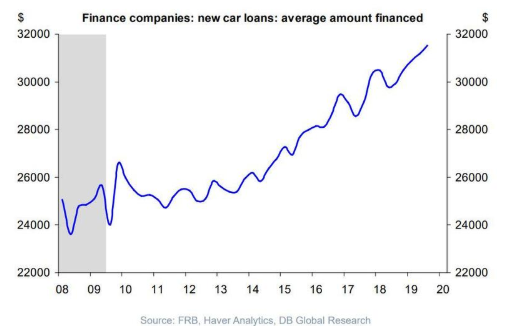

By the end of September, U.S. consumers had $1.3 trillion in auto debt outstanding, up $740 billion from a decade prior.

After disclosing their income to a salesperson in the financing office at a dealership, that information then sends an electronic loan application to banks and finance arms of the dealership, which then decide whether to fund the loan.

“Problem loans” often start with borrowers making poor decisions about what they can afford. Many borrowers don’t even read their loan application or final contract.

Dealerships can add to the trouble, rushing borrowers through the process or only showing them a partial copy of the application.

Sometimes, dealers will even “fill out one application with correct information and submit an incorrect one to lenders.” Others tell the consumer they can come back and refinance some months later to a lower interest loan, only to find out it isn’t really an option.

As we have reported on, dealers now make more money from financing than they do on the sale of vehicles. And the Consumer Financial Protection Bureau oversees auto lenders, but not dealerships, leaving room for dealers to act in bad faith. Last year, the FTC went after dealerships in Arizona and New Mexico for allegedly making up car buyers’ income.

GM’s AmeriCredit verified incomes on roughly 70% of loans in some bond pools, while the auto financing arms of CarMax and Ally Financial were found to have verified income on less than 1% of loans, an analysis of 6 million prime and subprime loans showed.

Tyler Durden

Sat, 12/28/2019 – 17:00

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com