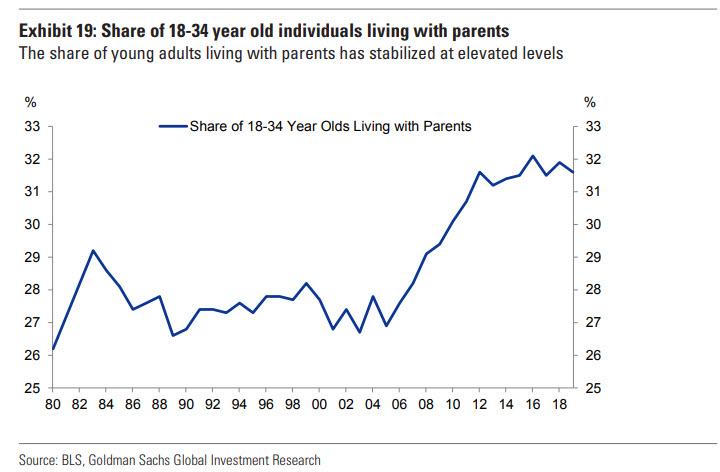

A Third Of 18-34 Year Olds Live With Their Parents And Other 2019 Housing Market Highlights, In Charts

As Goldman housing strategist Marty Young writes in his “year in review” housing and mortgage market summary, 2019 was characterized by sharply falling mortgage rates and a strengthening housing market:

-

120bp: 30-year mortgage rates fell by 120bp between 2018Q4 and 2019Q4.

-

+17%: single family housing starts increased by 17% from November 2018 to November 2019.

-

+3.2%: the Case-Shiller US house price index has grown by 3.2% over the past 12 months.

-

50%: 50% of outstanding conventional 30-year mortgage borrowers have a 50bp or larger refinance incentive as of 2019Q4 (up from 6% as of 2018Q4).

-

5bp: agency MBS spreads widened by 5bp in 2019 (vs. 60bp of tightening of IG corporate bond spreads).

-

$230bn: Federal Reserve agency MBS holdings declined by $230bn over the past year.

-

$25bn: non-QM RMBS issuance has reached $25bn in 2019 year-to-date (vs. $11bn in 2018

One remarkable observation: roughly a third of young Americans aged 18-34 now live with their parents: up from 27% before the crisis. Depending on how one looks at this data, it means that either household formation is about to soar, or an entire generation now has doubts it will ever be able to own its own house.

Looking ahead, the Goldman strategist expects slightly higher mortgage rates and a strong housing market for 2020:

-

Expect mortgage rates to increase by 25bp in 2020, ending the year at 4.0%.

-

Look for single family housing starts to increase by 5% in 2020 vs. 2019.

-

Expect the Case-Shiller US house price index to grow by 3% in 2020.

-

Expect 30% of outstanding conventional 30-year mortgage borrowers to still be in-the-money for refinancing in 2020Q4.

-

Look for mortgage spreads to move sideways and for IG spreads to widen by 20bp in 2020H1.

-

Expect Federal Reserve MBS holdings to decline by an additional $220bn in 2020.

-

Expect non-QM issuance to grow again to $30bn in 2020.

And here are some of the pivotal charts recapping the housing market from the perspective of Goldman Sachs:

Tyler Durden

Wed, 01/01/2020 – 18:30

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com