The Next Decade: Valuations & The Destiny Of Low Returns

Authored by Lance Roberts via RealInvestmentAdvice.com,

Jani Ziedins via Cracked Market recently penned an interesting post:

“As for what comes next, is this bull market tired? Is a crash long overdue? Not if you look at history. Stocks rallied for nearly 20 years between the early 1980s and the late 1990s. By that measure, we could easily see another decade of strong gains before the next “Big One”. Of course, the worst day in stock market history happened during that 20-year bull market in 1987, so we cannot be complacent. But the prognosis for the next 10 years is still good even if we run into a few 20% corrections along the way.”

After a decade of strong, liquidity-driven, post-crisis returns in the financial markets, investors are hopeful the next decade will deliver the same, or better. As Bob Farrell once quipped:

“Bull markets are more fun than bear markets.”

However, from an investment standpoint, the real question is:

“Can the next decade deliver above average returns, or not?”

Lower Returns Ahead?

Brian Livingston, via MarketWatch, previously wrote an article on the subject of valuation measures and forward returns.

“Stephen Jones, a financial and economic analyst who works in New York City, tracks the formulas that several market wizards have disclosed. He recently updated his numbers through Dec. 31, 2018, and shared them with me. Buffett, Shiller, and the other boldface names had nothing to do with Jones’s calculations. He crunched the financial celebrities’ formulas himself, based on their public statements.”

“The graph above doesn’t show the S&P 500’s price levels. Instead, it reveals how well the projection methods estimated the market’s 10-year rate of return in the past. The round markers on the right are the forecasts for the 10 years that lie ahead of us. All of the numbers for the S&P 500 include dividends but exclude the consumer-price index’s inflationary effect on stock prices.”

-

Shiller’s P/E10 predicts a +2.6% annualized real total return.

-

Buffett’s MV/GDP says -2.0%.

-

Tobin’s “q” ratio indicates -0.5%.

-

Jones’s Composite says -4.1%.

(Jones uses Buffett’s formula but adjusts for demographic changes.)

Here is the important point:

“The predictions might seem far apart, but they aren’t. The forecasts are all much lower than the S&P 500’s annualized real total return of about 6% from 1964 through 2018.”

While these are not guarantees, and should never be used to try and “time the market,” they are historically strong predictors of future returns.

As Jones notes:

“The market’s return over the past 10 years,” Jones explains, “has outperformed all major forecasts from 10 years prior by more than any other 10-year period.”

Of course, as noted above, this is due to the unprecedented stimulation the Federal Reserve pumped into the financial markets. Regardless, markets have a strong tendency to revert to their average performance over time, which is not nearly as much fun as it sounds.

The late Jack Bogle, founder of Vanguard, also noted some concern from high valuations:

“The valuations of stocks are, by my standards, rather high, butmy standards, however, are high.”

When considering stock valuations, Bogle’s method differs from Wall Street’s. For his price-to-earnings multiple, Bogle uses the past 12-months of reported earnings by corporations, GAAP earnings, which includes “all of the bad stuff.” Wall Street analysts look at operating earnings, “earnings without all that bad stuff,” and come up with a price-to-earnings multiple of something in the range of 17 or 18, versus current real valuations which are pushing nearly 30x earnings.

“If you believe the way we look at it, much more realistically I think, the P/E is relatively high. I believe strongly that [investors] should be realizing valuations are fairly full, and if they are nervous they could easily sell off a portion of their stocks.” – Jack Bogle

These views are vastly different than the optimistic views currently being bantered about for the next decade.

However, this is where an important distinction needs to be made.

Starting Valuations Matter Most

What Jani Ziedins missed in his observation was the starting level of valuations which preceded those 20-year “secular bull markets.” This was a point I made previously:

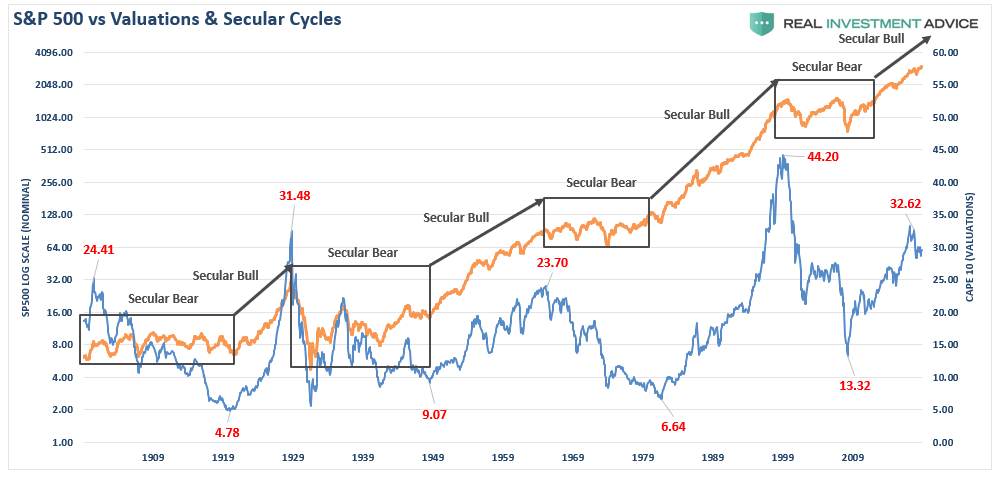

“The chart below shows the history of secular bull market periods going back to 1871 using data from Dr. Robert Shiller. One thing you will notice is that secular bull markets tend to begin with CAPE 10 valuations around 10x earnings or even less. They tend to end around 23-25x earnings or greater. (Over the long-term valuations do matter.)”

The two previous 20-year secular bull markets begin with valuations in single digits. At the end of the first decade of those secular advances, valuations were still trading below 20x.

The 1920-1929 secular advance most closely mimics the current 2010 cycle. While valuations started below 5x earnings in 1919, they eclipsed 30x earnings ten-years later in 1929. The rest, as they say, is history. Or rather, maybe “past is prologue” is more fitting.

Low Returns Mean High Volatility

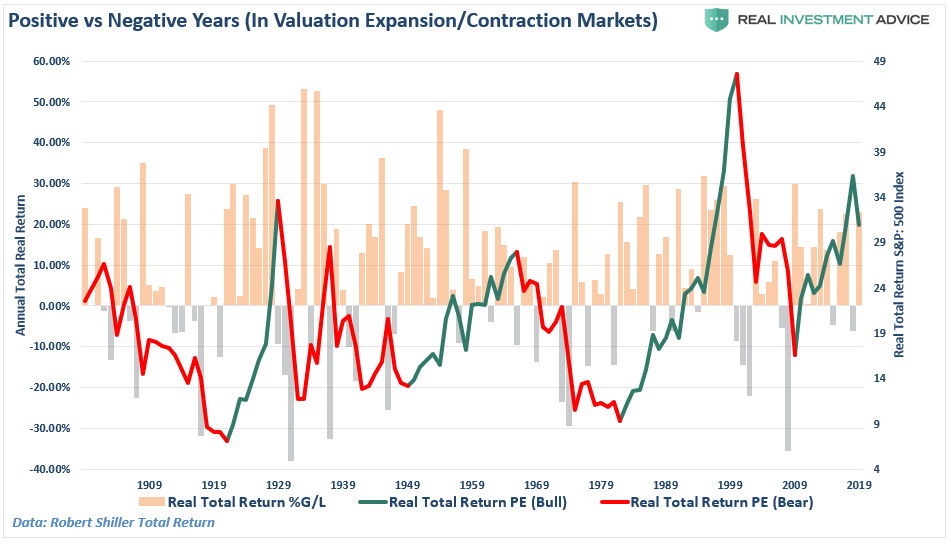

When low future rates of return are discussed, it is not meant that each year will be low, but rather the return for the entire period will be low. The chart below shows 10-year rolling REAL, inflation-adjusted, returns in the markets. (Note: Spikes in 10-year returns, which occurred because the 50% decline in 2008 dropped out of the equation, has previously denoted peaks in forward annual returns.)

(Important note: Many advisers/analysts often pen that the market has never had a 10 or 20-year negative return. That is only on a nominal basis and should be disregarded as inflation must be included in the debate.)

There are two important points to take away from the data.

-

There are several periods throughout history where market returns were not only low, but negative.(Given that most people only have 20-30 functional years to save for retirement, a 20-year low return period can devastate those plans.)

-

Periods of low returns follow periods of excessive market valuations and encompass the majority of negative return years. (Read more about this chart here)

“Importantly, it is worth noting that negative returns tend to cluster during periods of declining valuations. These ‘clusters’ of negative returns are what define ‘secular bear markets.’”

While valuations are often dismissed in the short-term because there is not an immediate impact on price returns. Valuations, by their very nature, are HORRIBLE predictors of 12-month returns and should never be used in any investment strategy which has such a focus. However, in the longer term, valuations are strong predictors of expected returns.

The chart below shows Dr. Robert Shiller’s cyclically adjusted P/E ratio combined with Tobin’s Q-ratio. Again, valuations only appear cheap when compared to the peak in 2000. Outside of that exception, the financial markets are, without question, expensive.

Furthermore, note that forward 10-year returns do NOT improve from historically expensive valuations, but decline rather sharply.

Warren Buffett’s favorite valuation measure is also screaming valuation concerns (which may explain why he is sitting on $128 billion in cash.). The following measure is the price of the Wilshire 5000 market capitalization level divided by GDP. Again, as noted above, asset prices should be reflective of underlying economic growth rather than the “irrational exuberance” of investors.

Again, with this indicator at the highest valuation level in history, it is a bit presumptuous to assume that forward returns will continue to remain elevated,.

Bull Now, Pay Later

In the short-term, the bull market continues as the flood of liquidity, and accommodative actions, from global Central Banks, has lulled investors into a state of complacency rarely seen historically. As Richard Thaler, the famous University of Chicago professor who won the Nobel Prize in economics stated:

“We seem to be living in the riskiest moment of our lives, and yet the stock market seems to be napping. I admit to not understanding it.

I don’t know about you, but I’m nervous, and it seems like when investors are nervous, they’re prone to being spooked. Nothing seems to spook the market.”

While market analysts continue to come up with a variety of rationalizations to justify high valuations, none of them hold up under real scrutiny. The problem is the Central Bank interventions boost asset prices in the short-term, in the long-term, there is an inherently negative impact on economic growth. As such, it leads to the repetitive cycle of monetary policy.

-

Using monetary policy to drag forward future consumption leaves a larger void in the future that must be continually refilled.

-

Monetary policy does not create self-sustaining economic growth and therefore requires ever larger amounts of monetary policy to maintain the same level of activity.

-

The filling of the “gap” between fundamentals and reality leads to consumer contraction and ultimately a recession as economic activity recedes.

-

Job losses rise, wealth effect diminishes and real wealth is destroyed.

-

Middle class shrinks further.

-

Central banks act to provide more liquidity to offset recessionary drag and restart economic growth by dragging forward future consumption.

-

Wash, Rinse, Repeat.

If you don’t believe me, here is the evidence.

The stock market has returned more than 125% since 2007 peak, which is roughly 3x the growth in corporate sales and 5x more than GDP.

It is critical to remember the stock market is NOT the economy. The stock market should be reflective of underlying economic growth which drives actual revenue growth. Furthermore, GDP growth and stock returns are not highly correlated. In fact, some analysis suggests that they are negatively correlated and perhaps fairly strongly so (-0.40).

However, in the meantime, the promise of another decade of a continued bull market is very enticing as the “fear of missing out” overrides the “fear of loss.”

Let me conclude with this quote from Vitaliy Katsenelson which sums up our investing view:

“Our goal is to win a war, and to do that we may need to lose a few battles in the interim.

Yes, we want to make money, but it is even more important not to lose it. If the market continues to mount even higher, we will likely lag behind. The stocks we own will become fully valued, and we’ll sell them. If our cash balances continue to rise, then they will. We are not going to sacrifice our standards and thus let our portfolio be a byproduct of forced or irrational decisions.

We are willing to lose a few battles, but those losses will be necessary to win the war. Timing the market is an impossible endeavor. We don’t know anyone who has done it successfully on a consistent and repeated basis. In the short run, stock market movements are completely random – as random as you’re trying to guess the next card at the blackjack table.”

For long-term investors, the reality that a clearly overpriced market will eventually mean revert should be a clear warning sign. Given the exceptionally high probability the next decade will be disappointing, gambling your financial future on a 100% stock portfolio is likely not advisable.

Tyler Durden

Mon, 01/06/2020 – 10:02

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com