Market’s Repo Addiction Getting Worse With Latest Term Repo Operation

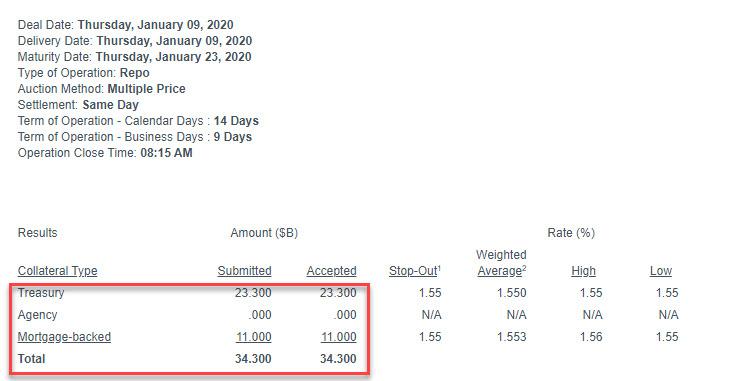

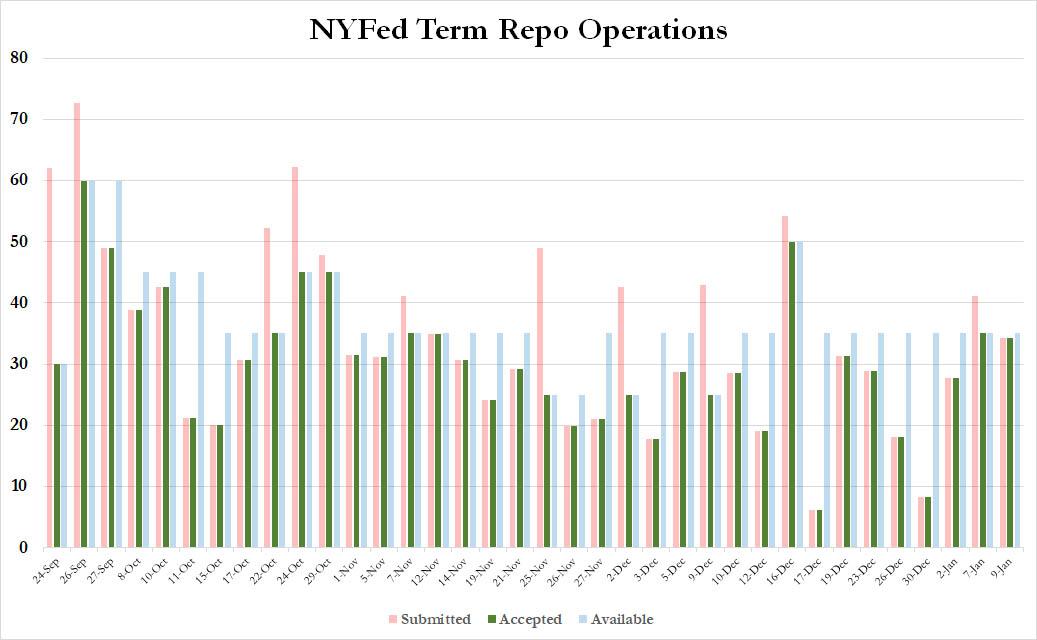

Two days after we reported that a disturbance may be brewing below the surface of the repo market again, after the first oversubscribed term repo in over three weeks, when on Jan 7 the Fed received $41.1BN in submissions for its $35BN two week repo, we got another indication just how strong the market’s addition to the Fed’s easy repo money has become, when moments ago the Fed announced that its latest 2-week term repo operation was also almost oversubscribed, as $34.3BN in securities ($23.3BN in TSYs, $11BN in MBS) were submitted for today’s $35 billion operation, as dealers continue to scramble to the Fed for liquidity which they are no longer using for merely “regulatory” year-end purposes (since it is no longer year-end obviously), but are instead using it to pump markets directly.

Today’s operation, which was just shy of the maximum $35BN allowed, was the second highest term repo since Dec 16, and suggests that as repos are now maturing at a rapid burst (as we noted last week in “Mark Your Calendar: Next Week The Fed’s Liquidity Drain Begins“), dealers remain as desperate as ever to roll this liquidity into newer term operations.

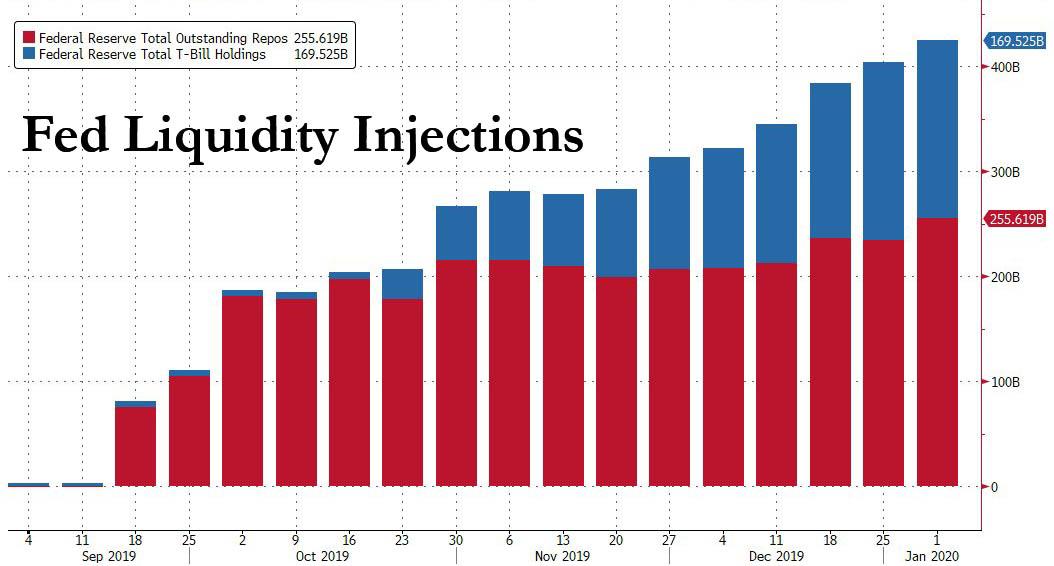

The latest term repo also confirmed what we discussed overnight in “Top Repo Expert Warns Fed Is Now Trapped: “It Will Take Pain To Wean The Repo Market Off Easy Cash“” in which we noted that according to Curvature Securities’ repo expert Scott Skyrm, something appears amiss as the total overnight and term Fed RP operations on Friday were greater than on year end! On year-end, the Fed had pumped a total of $255.95 billion into the market verses $258.9 billion on Friday.

The problem, as Skyrm explained, is that the market had gotten addicted to the easy Fed liquidity unleashed in September (via temporary repo ops), and then again in October (via permanent T-Bill purchases): “it’s easy to see how the Repo market can get addicted to easy cash from the Fed when the stop-out rates for the RP operations are 1.55% – behind the offered side of the market.” But, as the repo strategist added, as the Fed keeps injecting cash, the market gets used to it.

Which is great in the short-term as it sends risk assets soaring, but become a major issue over the long-term: “The long-term problem is that the some investor cash (real money cash) that was once going into the Repo market is now going elsewhere”, Skyrm explains.

Indeed, the problem is that repo rates are trading in the lower end of the fed funds target range. When GC rates were higher in the range, Repo general collateral, as an investment, was more competitive than other overnight rates. But now that cash has gone to other markets.

In short, just as the market got addicted to QE and the result was a 20% drop in the S&P in late 2018 when markets freaked out about Quantitative Tightening, the Fed’s shrinking balance sheet, and declining liquidity, Skyrm cautions that “it will take pain to wean the Repo market off of cheap Fed cash” since “it‘s a circle” which can be described as follows:

For the Fed to end daily RP ops, they need outside cash to come back into the Repo market. For the Repo market to attract cash, Repo rates need to move higher. For rates to move higher, the Fed needs to stop RP ops.

The problem is that stopping RP ops could spark another repo market crisis, especially with $259BN in liquidity pumped currently – more than at year end – via Repo. It also means that the Fed is now unilaterally blowing a market bubble with its repo and “NOT QE” injections, and yet the longer it does so the more impossible it becomes for the Fed to extricate itself from the liquidity pathway without causing a crash.

Or stated simply, the longer the Fed avoids pulling the repo liquidity band-aid, the bigger the market fall when (if) it finally does. The question then becomes whether Powell can keep pushing on the repo string until the November election, because a market crash in the months preceding it, especially since it will be of the Fed’s own doing, will result in a very angry president.

Tyler Durden

Thu, 01/09/2020 – 08:45

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com