Institutions, Retail And Algos Are Now All-In, Just As Buybacks Tumble

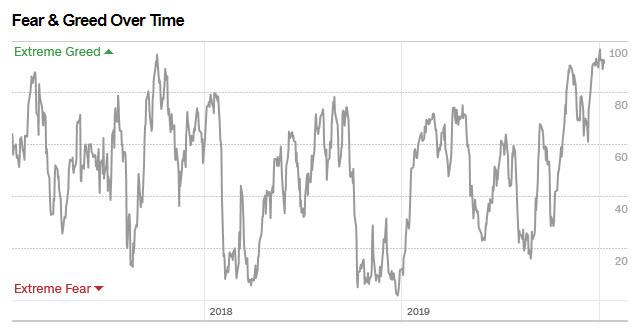

When it comes to gauging market euphoria, one place to find the current state of retail investor (super) sentiment, is the CNN Fear and Greed Index, which over the past three weeks, has printed at all time series highs.

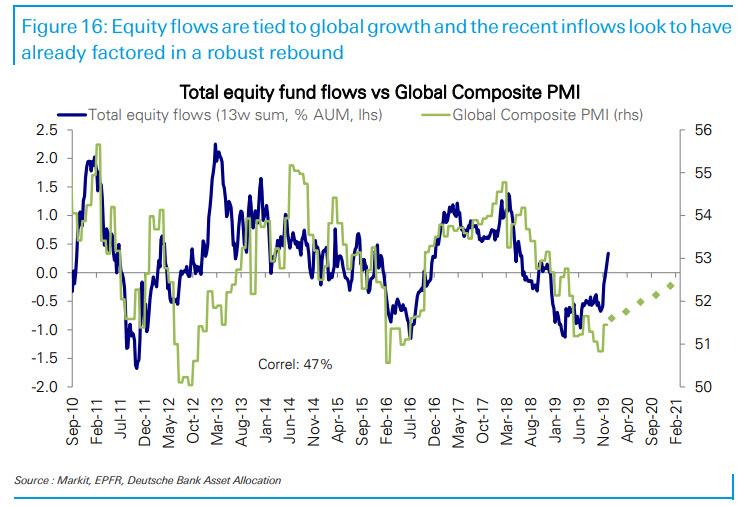

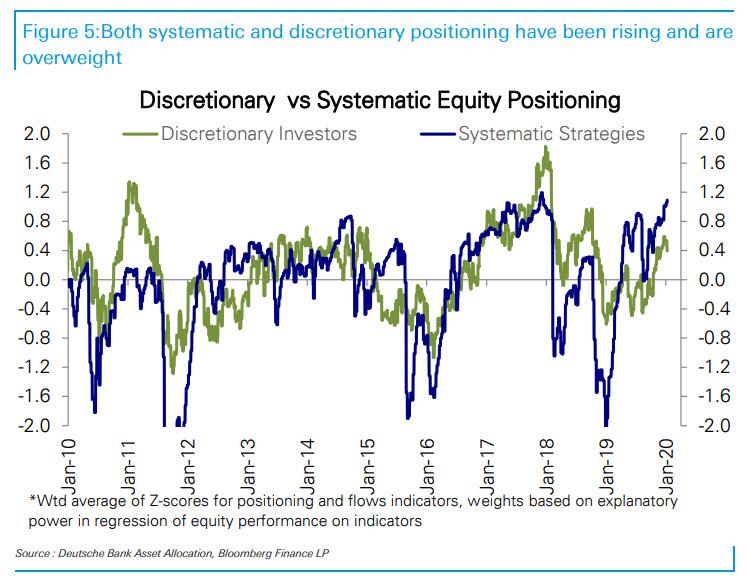

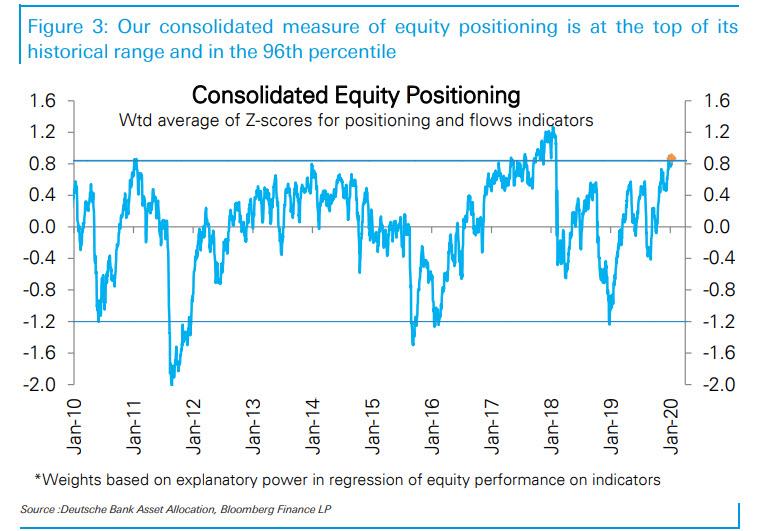

What about institutional sentiment? Well, contrary to several goalseeked indicators which erroneously repeat week after week that whales and other prominent institutional traders remain “on the fence” despite the now daily record highs in the S&P, the truth is that virtually everyone is now all in: from simple human-driven discretionary, to macro funds, all the way to algo and CTAs. In fact, as Deutsche Bank’s Parag Thatte writes in his weekly flow report, “positioning in equities has been rising and is now in the 96th percentile on our consolidated measure, with a wide variety of metrics very stretched.” And, as we have noted previously, equity flows as well as “equity positioning, like the market itself, has run far ahead of current growth as investors price in a global growth rebound.“

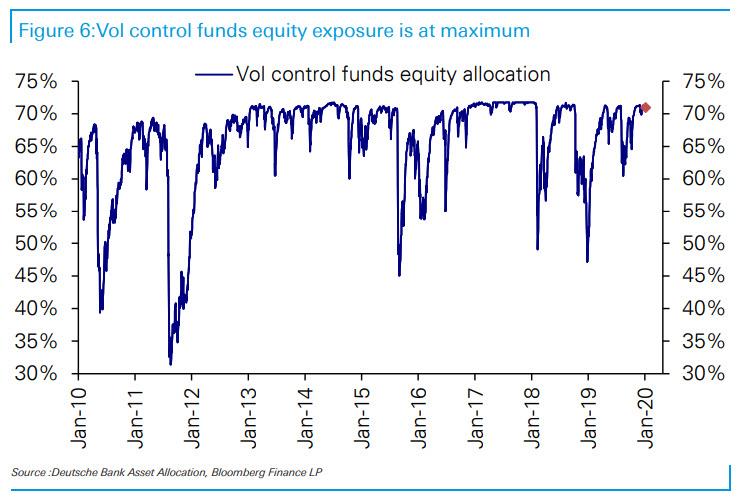

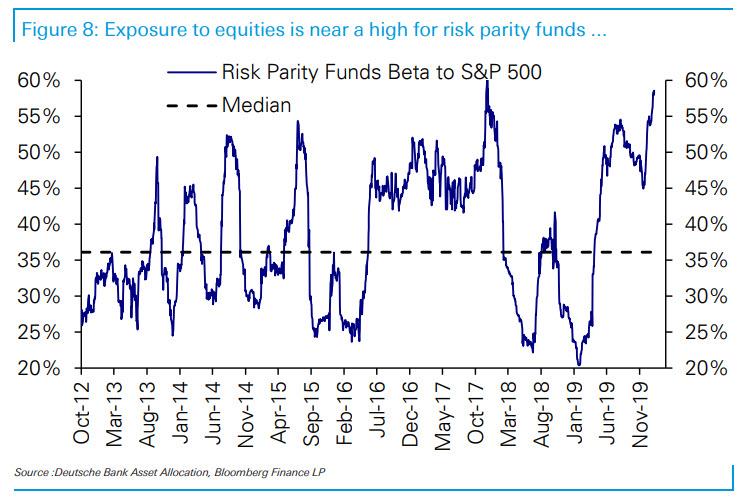

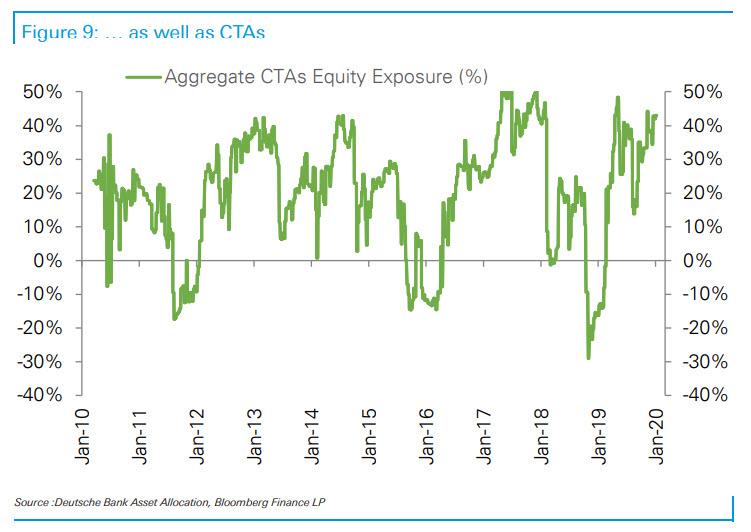

But while it has been known for a while that most humans have thrown in the towel amid a mauling of bears and shorts, it now appears that systematic strategies – i.e., algos, quants, risk parity, etc – have also raised equity exposure to the top of its range. According to Thatte, the equity allocations for Vol Control, CTAs, and Risk Parity are all near a historical maximum, which means that algos are now effectively all in.

Some more details:

- Vol Control: Vol Control funds are near their maximum equity allocations for more than 2 months now. 1M SPX realized volatility has been sub-10% since November without >1% daily moves in more than 2 months. VIX was also seasonally low this past December. Sustained low volatility environment helped VC funds maintain their high equity exposure through the recent flare-up in geopolitical risk.

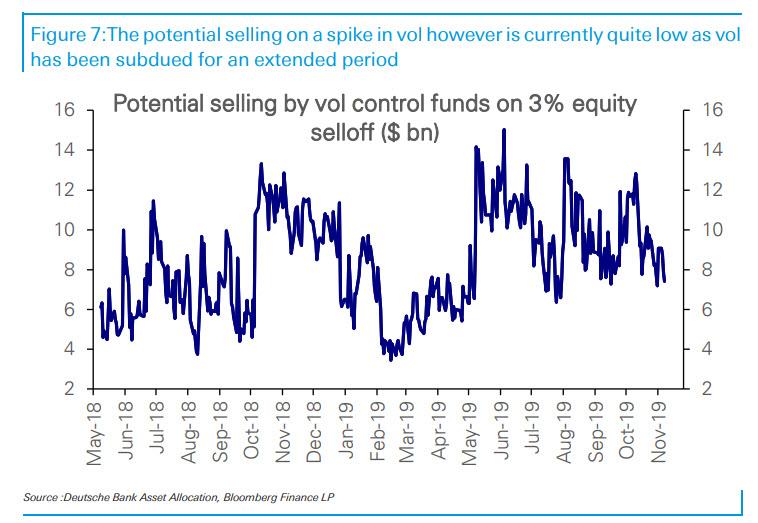

Selling pressure from VC on a 3% pullback in SPX now stands at ~ $7bn-$8bn, while DB’s aggregate volatility metric targeted by VC funds is close to 10% and stands near the bottom end of its past 10Y range. And here a warning from Thatte: with barely any upside bid left, the downside risk from VCs is higher at this stage of the market rally.

- Risk Parity funds: Risk parity have scaled their SPX exposure back up to near record levels. A near uniform uptrend in equities, coupled with low equity volatility and bonds moving sideways, have boosted RP exposure to equities. Extended period of low RV likely prompted relatively slow moving RP funds to steadily increase their equity allocation over the past month. In addition, moderating negative returns correlation between bonds and equities have seen this equity exposure increase occur at the expense of exposure to bonds. Bond volatility remains relatively elevated despite trending lower over the past month. Indicative RP bond exposure is now back near March 2019, leaving limited upside for further higher equity exposure and lower bond exposure.

- CTAs: CTA equity exposure increased with the upward trending markets to near peak levels. Recent momentum in US equities have been uniformly strong across short and medium term signals, translating to a higher level of confidence in the latest uptrend. CTA exposure to EM equities also shows up as heavy with spot reaching back to 1Q18 levels. Bond positioning by CTAs have steadily moved lower and reached their 1Y lows. The cuts in bond exposure have been across most regions, especially in Japan where 10Y JGB yields have almost turned positive.

In this context, it is hardly surprisingly that the Deutsche strategist observes that the only other time that systematic strategy positioning was higher was in January 2018… just before the large February selloff.

And yet, unlike Feb 2018, a vol spike like the one observed in Feb 2018 may not be enough to trigger a market crash. The reason: vol control funds are usually the first to sell equities when vol rises, but with volatility having been subdued for an extended period of time, they would need to see a large and sustained spike in vol for their selling thresholds to be hit.

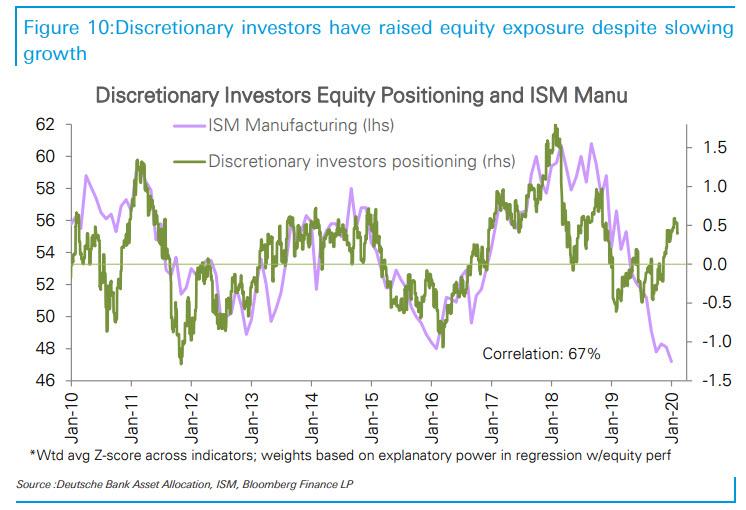

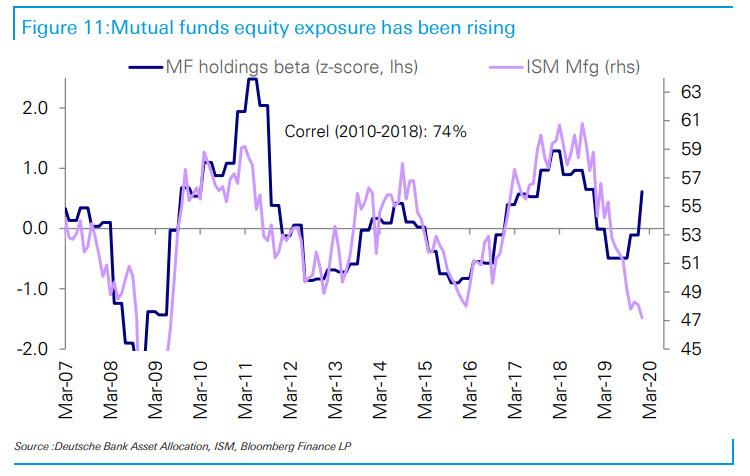

Still, while algos are only now rush to go balls to the wall, they are only now catching up to discretionary investors who have steadily raised their bullish positioning since August and are now clearly overweight in DB’s reading, and exposure is at the highest levels since October 2018. Discretionary positioning typically follows growth indicators closely but since September, it has diverged and has moved sharply higher even as growth is yet to rebound (instead, it appears that positioning is merely chasing the broader market which has soared on the back of the Fed’s QE4 which was launched to “fix” the repo market after JPMorgan broke it). Active mutual funds as well as retail investors have raised exposure following the strong market rally.

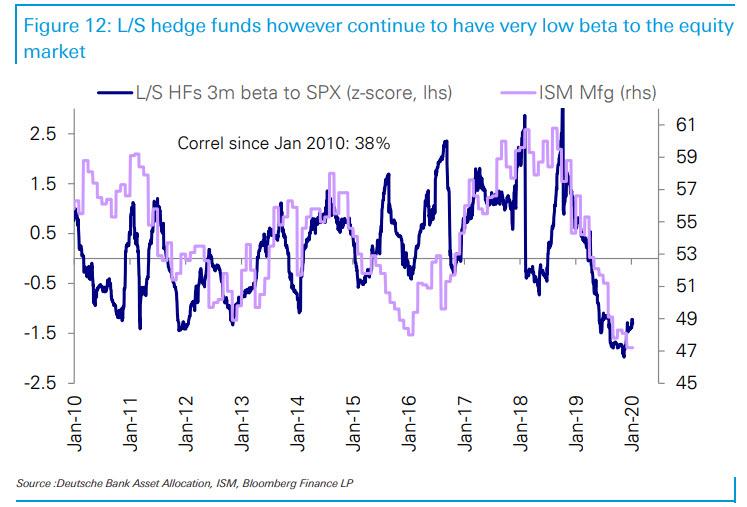

However, there is one place where the euphoria has yet to go off the chart: the popularly followed beta positioning for long-short hedge funds still remains very low, and in line with subdued growth indicators.

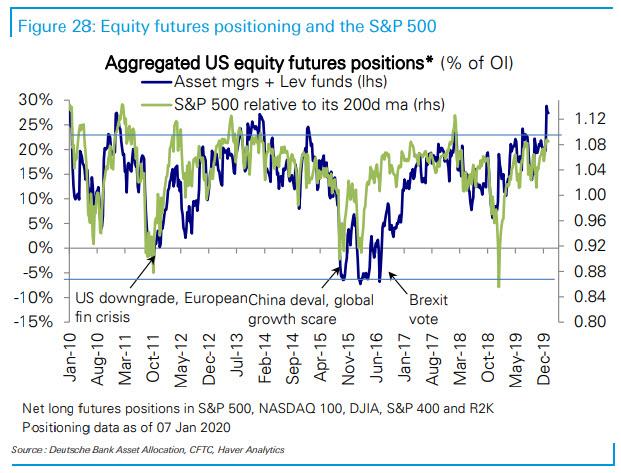

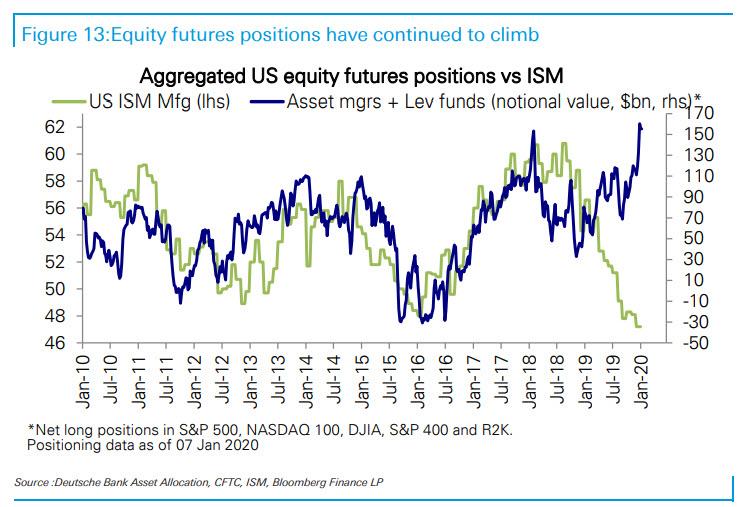

Finally, several indicators point to stretched positioning across other metrics. For example, equity futures long positioning for asset managers and leveraged funds combined is at record highs, driven by a broad-based rise in longs across the S&P 500 and Nasdaq as well as the small-cap Russell 2000 futures.

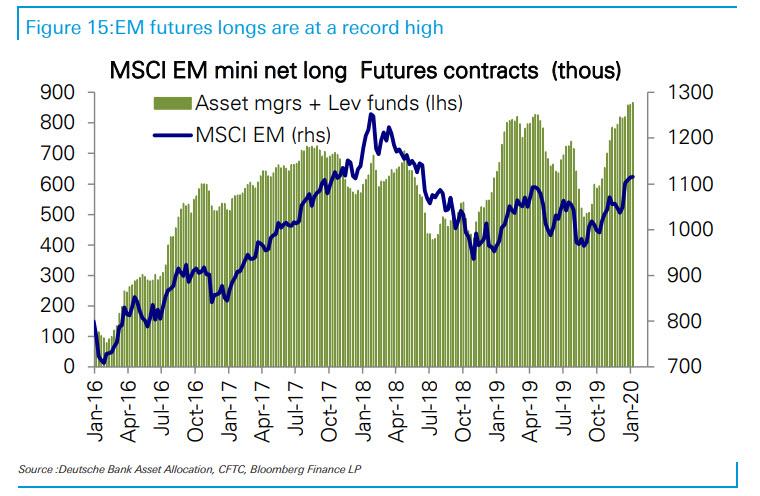

Longs in EM futures have risen to record highs.

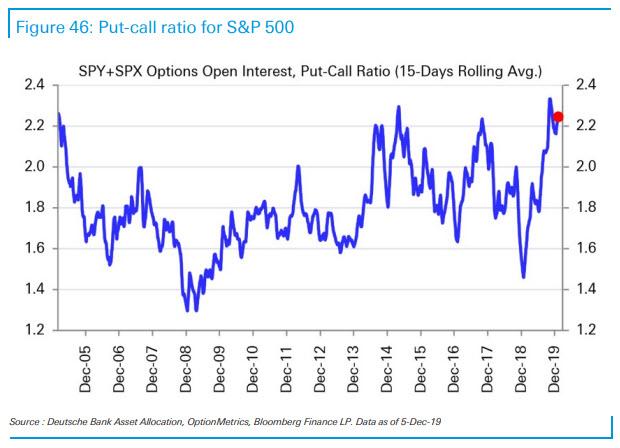

Call/put volume ratios are at the top of their historical range;

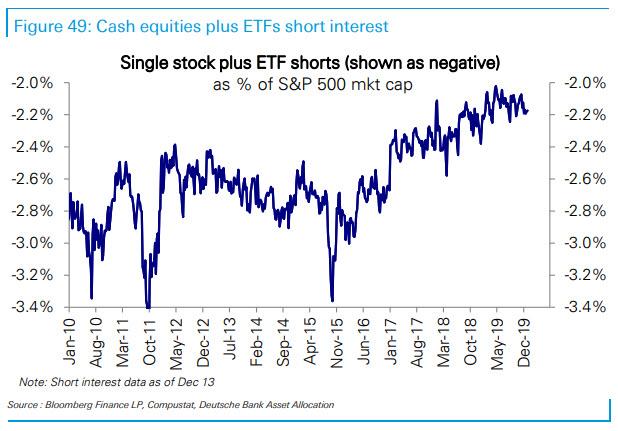

And short interest in single stocks is near record lows; and that in ETFs has also fallen to a new low.

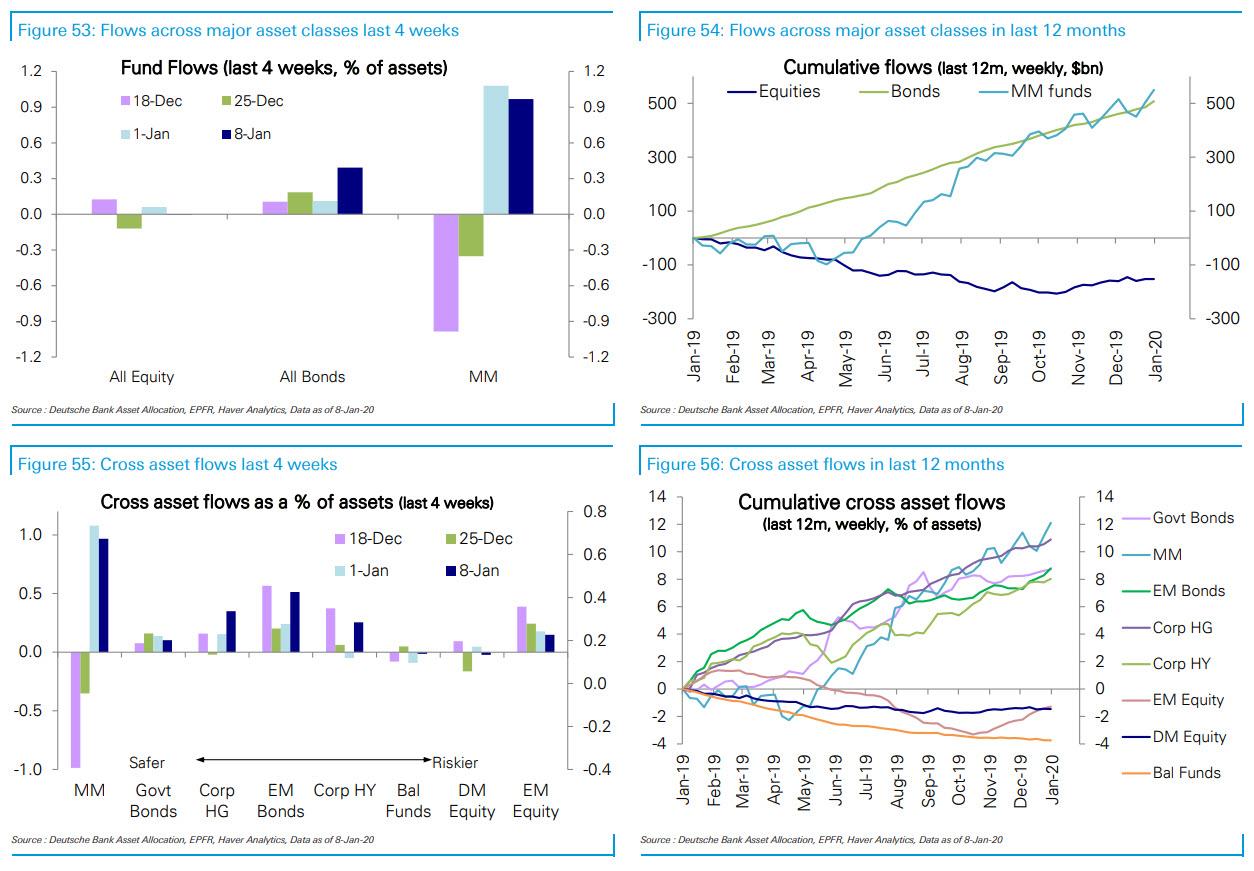

One last confirmation of what appears to be a bullish capitulation into the QE4-inspired melt up is that equity fund flows have also turned up strongly over the last 3 months. Almost $50bn came in over this period, compared with over -$300bn in outflows in the prior 10 months.

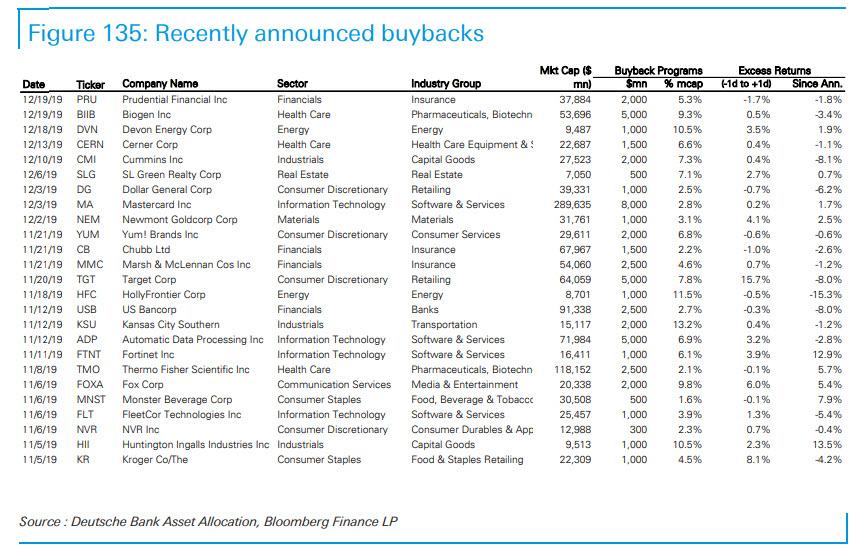

Oh, one more thing we almost forget: with institutions, retail investors and algos all in stocks, the biggest source of equity demand, corporations themselves, appear to be easing off the stock buyback pedal. Indeed, awhile there has been a flurry of recent buyback announcements…

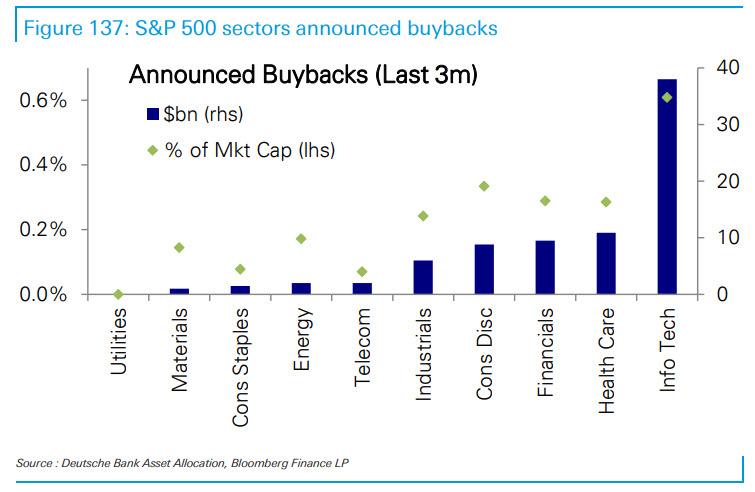

… with tech names leading by the runner up, healthcare, by nearly 3 to 1 in buyback announcements…

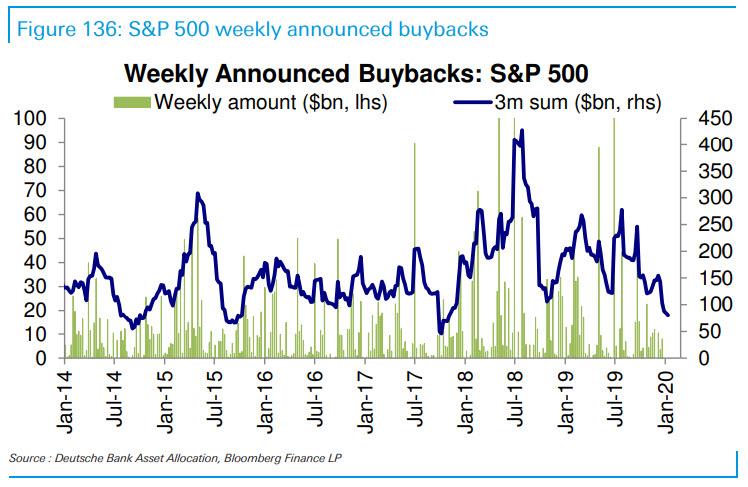

… in the grand scheme of things, and on a rolling 3 month basis, stock buybacks are a far cry from where there were just two years ago, and fading fast to levels not seen since before the Trump tax reform which unleashed a $1.5 trillion buyback bonanza.

It is this sudden reversal in buyback appetite that may be the biggest danger for a market where 77% of CFOs now think the market is significantly overvalued.

Tyler Durden

Sat, 01/11/2020 – 16:04

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com