“Buybacks Secured”: Boeing Obtains $12 Billion Financing From Over Dozen Banks

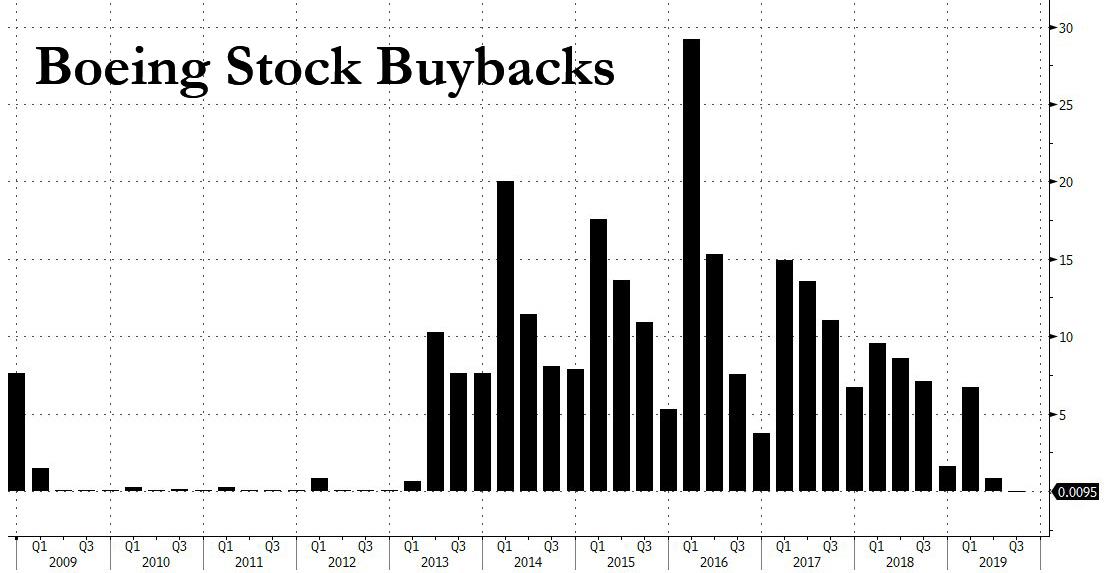

For all the flawed, cost-gutted and, on at least two occasions, deadly engineering of the 737 MAX which has indefinitely grounded the seemingly doomed plane, what investors and traders were much more concerned about was whether the company that had repurchased over $100 billion in stock in the past decade…

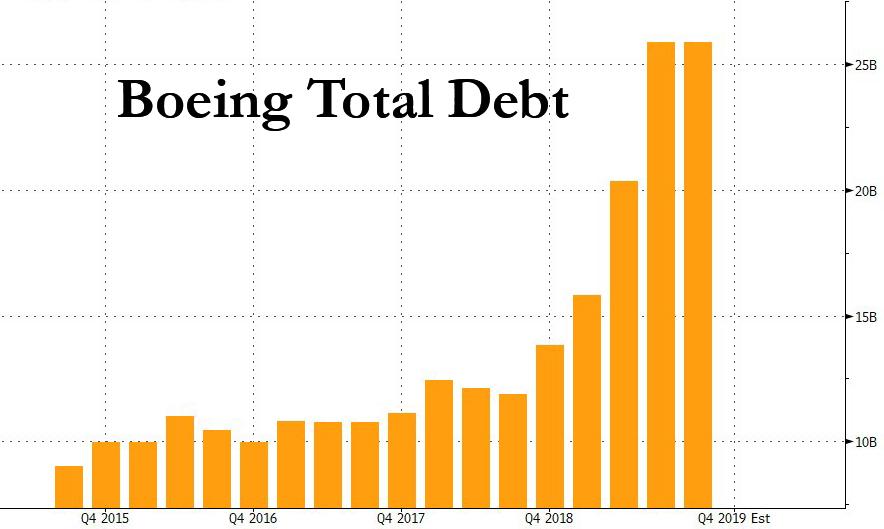

… would keep the Kool-Aid coming and its stock price if not rising then at least above $300, especially with Boeing’s total debt ballooning, and its free cash flow crashing just as fast as its badly designed airplanes.

Those investors got an answer, if only a short-term one, when moments ago CNBC’s Leslie Josephs reported that Boeing has secured more than $12 billion in financing from more than a dozen banks “as the industrial giant shores up its balance sheet.”

Last week, CNBC first reported that the US aerospace and military giant was trying to secure a loan of at least $10 billion, with the final size of the loan, some $2 billion more than originally sought, said to be “a vote of confidence” in the manufacturer from Wall Street, according to CNBC.

That’s one way to look at it – another is that Boeing will promptly turn around and engage in even more financial engineering, using the proceeds from the delayed-draw loan to repurchase Boeing stock currently held by its “generous” Wall Street lenders who will not only get their money back from the company, but will find themselves far, far higher in the capital structure, priming virtually every asset below them with a new secured loan ahead of taking control of the company should a worst case scenario happen, and Boeing is forced to file Chapter 11.

Tyler Durden

Mon, 01/27/2020 – 15:36

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com