Oil Crashes Into Bear Market As Chinese Oil Demand Said To Plummet 20% Due To Coronavirus “Demand Shock”

While the world awaits with bated breath the clobbering that awaits Chinese assets when they reopen in a few hours after the Lunar New Year with the PBOC set to injects billions to prop up stocks while banning short selling as reported earlier, moments ago we got a dismal advance look at just how dire the impact on both the Chinese, and global, economies will be as a result of the coronavirus.

According to Bloomberg, Chinese oil demand has dropped by about three million barrels a day, or 20% of total consumption, as a result of the creeping economic paralysis unleashed by the coronavirus epidemic. The drop is said to be the largest demand shock the oil market has suffered since the global financial crisis of 2008 to 2009, and the most sudden since the Sept. 11 attacks. More importantly, the plunge in Chinese demand will likely force the hand of the OPEC cartel, which is already considering an emergency meeting to cut production and staunch the decline in prices (and to which one can only say that Saudi Arabia picked its Aramco IPO window exquisitely).

Chinese and Western oil executives, speaking on condition of anonymity because they aren’t authorized to discuss the matter publicly, said the decline was measured against normal levels for this time of year. It’s a measure of the current loss in demand, rather than the average loss since the crisis started, which would be smaller.

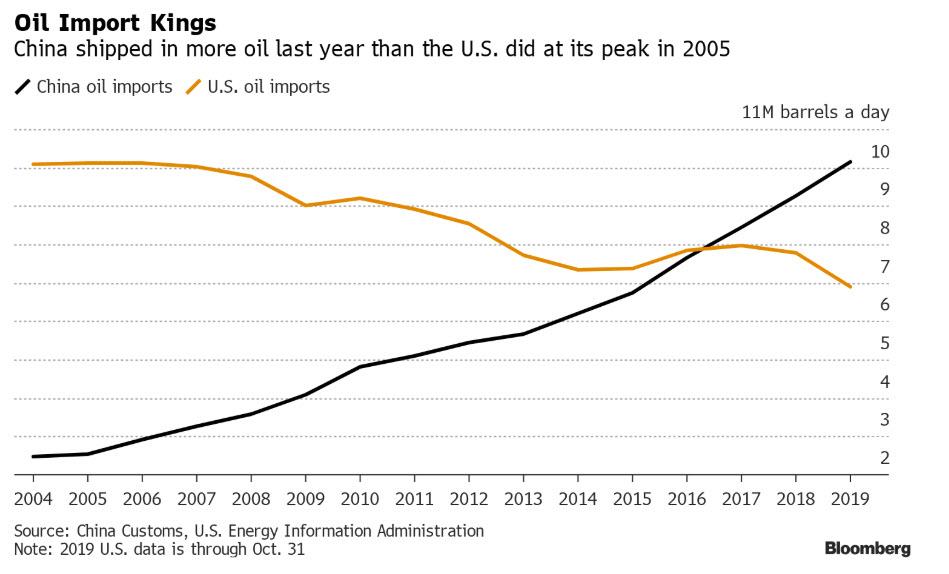

As a reminder, in 2016 China surpassed the US as the world’s largest oil importer (which in turn, has become energy independent in recent years, as a result of an explosion of shale oil production, at least until the day of reckoning for all those junk bonds keeping the US shale industry finally comes), and is the world’s marginal oil price setter, so any changes in consumption have an outsize impact on the global energy market.

The country consumes about 14 million barrels a day – equivalent to the combined needs of France, Germany, Italy, Spain, the U.K., Japan and South Korea. Or rather consumed, as that number is now about 2 million barrels per day less.

Predictably, the plunge in Chinese oil demand is already reverberate across the global energy market, with sales of some crudes slowing to a crawl, tanker rates crashing and benchmark prices in free-fall, with Friday closing price about 14% lower since Jan 20 when the world first started focusing on the China pandemic… a free fall which only accelerated after the Bloomberg report which sent Brent tumbling on Sunday night, and which has just entered bear market territory, plunging over 22% since its January 8 peak.

Sales of Latin American oil cargoes to China came to a halt last week, while sales of West African crude, a traditional source for Chinese refineries, are also slower than usual, traders said.

Meanwhile, as Bloomberg reports, Chinese refineries are storing unsold petroleum products such as gasoline and jet-fuel, but every day stockpiles are growing, and some refineries may soon reach their storage limits. If that were to happen, they would have to cut the amount of crude they process. One executive said that refinery runs were likely to be cut soon by 15-20%.

In response to the collapse in Chinese demand, OPEC and Russia are weighing options to respond to the crisis and there have been discussions about calling an emergency meeting. Saudi Arabia is pressing for a gathering sooner than the one scheduled for March 5-6, though it has run into resistance from Russia. As Bloomberg notes, the Saudi and Russian oil ministers spoke on the phone for an hour on Thursday and another 30 minutes on Friday, according to Russians officials. For now, OPEC has called a technical meeting this week to assess the situation, and the Joint Technical Committee will report back to ministers.

“Nothing concentrates a producer’s mind more than the prospect of a crude oil price bust,” said Bob McNally, president of Rapidan Energy Group, and a former White House oil official under President George W. Bush.

And judging by where Brent is trading now, having plunged into a bear market in just three weeks, the producers will be very, very concentrated.

Tyler Durden

Sun, 02/02/2020 – 18:48

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com