Which Stock Sector Has The Highest Revenue Exposure To China

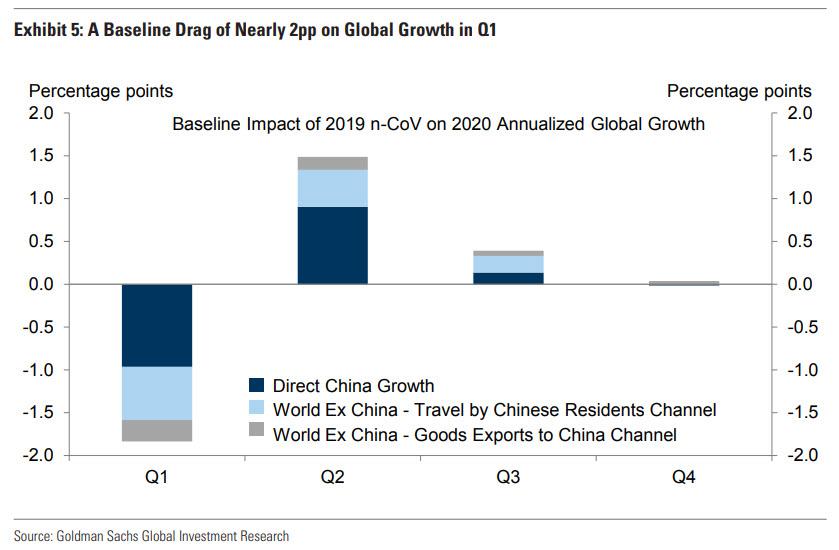

Earlier this week, when discussing Goldman’s latest downgrade to global GDP which the bank now expects to be cut as much as 2% in Q1 as a result of the coronavirus pandemic, only to rebound in subsequent quarters as the spread of the virus is contained…

… we asked why Goldman ignored the hit to corporate profitability, saying that “we are curious why Goldman did not account for the crunch that global supply chains are already sustaining: while Chinese tourism and exports are certainly important economic pathways, we wonder what will happen to both vendors and customers of intermediate goods that rely on Chinese factory tolling for output and for downstream products. Or perhaps that will be the topic of a subsequent Goldman report looking at how badly corporate earnings will be hit as the GDP hit impacts the corporate top and bottom line. We eagerly await such a report not only from Goldman but the other banks who have been oddly mute on the topic. Perhaps they are just waiting for the wave of guidance cuts that will inevitably be unleashed in the coming weeks by S&P500 member companies.”

Well, we didn’t have long to wait, because just two days later, Goldman’s chief equity strategist, David Kostin did a report looking at the “fundamental impacts of the coronavirus” on US companies.

Clearly, this was long overdue, because as we remarked earlier, “the crisis in China is creating havoc in global business: when commerce is interrupted, slowed or idled completely company revenues and profits drop hard. Analysts and investors have been viewing the developments in China as if business is merely deferred, not lost. That might be true for some of the businesses that deal with large-scale products, but for a number of businesses a large portion of sales are lost forever. For example, a lot of regular business and leisure travel that has been postponed is probably lost, so too are the sales at a number of consumer-related companies – there is no pent up demand for a hotel room, a coffee or a burger. And no one is considering the loss of labor income – due to the idling of production lost travel as well as the complete closure of sales offices – on all sides of the ocean that could reduce consumer spending in current and coming quarters.”

Indeed, the list of companies that so far have indicated that Q1 business operations will be impacted cut across a number of industries, and includes Delta, American, United, GM, Ford, Tesla, Google, Starbucks, McDonalds, Boeing, Nike, Wynn Resorts, Hilton Hyatt and Marriott – and the list will undoubtedly grow in coming months.

So what does Goldman think?

Well, curiously, to Kostin the coronavirus’s main impact on the US equity market will come through valuation changes rather than earnings, which is bizarre because if there is one thing that China’s economy grinding a halt in Q1 will do, is send earnings in free fall as copper producers around the globe have already found out. And while we think this is ludicrous, to Kostin what matters is just the multiple, specifically he writes that “S&P 500 NTM P/E peaked at 18.7x on January 17, traded down to a low of 18.1x (January 31) as coronavirus concerns intensified, and has rebounded to 19.1x as the market has become more sanguine on the economic reverberations of the spreading illness.”

Paradoxically, Kostin ignores all the evidence to the contrary and predicts that “the impact of lower global and US economic activity on 2020 S&P 500 EPS will be limited.” Well, that’s now timestamped, and we will certainly revisit it in three months time. In any case, Kostin justifies his cheerful prediction based on Goldman’s forecast that the overall impact on full-year global GDP growth is expected to be -0.1 to -0.2 pp, which would result in a $0.30 to $0.60 reduction in the bank’s full-year EPS estimate of $174 (20 to 40 bp decline in 2020E growth of 6%).

While Goldman’s big picture assessment is suspiciously optimistic, the bank does note – correctly – that the impact of coronavirus on US equities will likely be focused on select firms with the most exposure to China (which is obvious in a day and age when virtually every firm has some exposure to China).

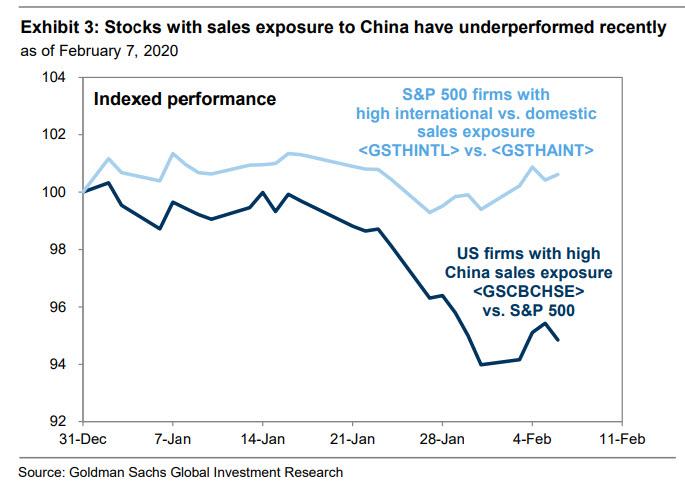

It also goes without saying, that those most exposed to China are Chinese firms: since January 13, Chinese stock indices have plummeted: CSI 300 has declined by 7% and Shanghai Shenzhen Composite by 8%. During that same period, a basket of US firms with high China sales exposure has underperformed the S&P 500 by 5 pp (-3% vs. +2%). Basket constituents with the highest sales exposure to Greater China are YUMC (100%), WYNN (75%), and QRVO (74%).

Here are some additional observations from Kostin on which sectors will be hit the hardest:

- Many consumer-facing US firms have halted operations in select Chinese locations. For example, CCL and RCL temporarily suspended cruise operations in China. SBUX has closed more than half of stores in China, which amounts to more than 13% of its global, company-operated storefronts. MCD closed hundreds of restaurants in the Hubei province, a small portion of the firm’s 37,000 global restaurants. Major airlines AAL, UAL, and DAL announced that they would suspend all flights to and from mainland China through March 27, March 28, and April 30, respectively. After reporting promising results from its new streaming service, DIS announced that it would close its parks in both Shanghai and Hong Kong. The expected income headwind of $175 million from those closures represents over 30% of the firm’s annual operating income from international parks.

- Airlines and Gaming are among the industries that will be most affected by the coronavirus. GS airlines analysts highlighted that UAL had more than two times the capacity exposure to China than AAL or DAL. The coronavirus will also have a significant impact on the gaming industry. Many US casinos have operations in Macau, which will be affected by venue closures and by potential extended travel restrictions even after the casinos reopen. According to their most recent annual filings, WYNN has the largest exposure to Greater China (75% of revenues; 46% of assets), followed by LVS (62%; 54%) and MGM (22%; 20%). For the profitability of these firms, the halt in operations comes at an inopportune moment because the Chinese New Year is typically the most lucrative time of year for Macao gaming.

Amusingly, even as it lays out its confusingly bullish take on how modest the Coronavirus impact will be, Goldman admits that nobody really knows anything, and that managements have given only limited guidance regarding the likely impact of coronavirus on business activity. And while most managements elected not to provide guidance due to the uncertainty surrounding the virus – and the longer the pandemic goes on, the greater the guidance cut will eventually be – a few firms with significant exposure to China estimated the potential impact to 1Q 2020 results. And here is where things start to make some sense, because of the 58 S&P 500 firms that guided on 1Q 2020 EPS, 67% provided EPS guidance below the prevailing consensus expectations, roughly in line with the historical average. Firms including ALGN, AVY, NKE, PH, and ITW explicitly cited the coronavirus as a factor contributing to reduced EPS guidance.

What are Goldman’s recommendations? According to Kostin, investors who believe the economic consequences of the coronavirus will be limited should increase exposure to cyclicals and value stocks. Despite above-average dividend yields, the bank’s Dividend Growth basket has declined sharply alongside cyclicals and currently trades with depressed valuations. The sector-neutral basket of 50 stocks offers an annualized dividend yield of 3.5% (vs. 1.9% for S&P 500) and is expected to grow dividends 9% annually during the next several years (compared with 5% for the S&P 500). The median constituent currently trades at a nearly 40% discount to the market (forward P/E of 12x vs. 19x for S&P 500).

In short, if fears of global pandemic are allayed, the basket should outperform. Basket constituents with the highest market betas are SWKS (1.77), DXC (1.74), WYNN (1.57), AVGO (1.55), and CAT (1.49).

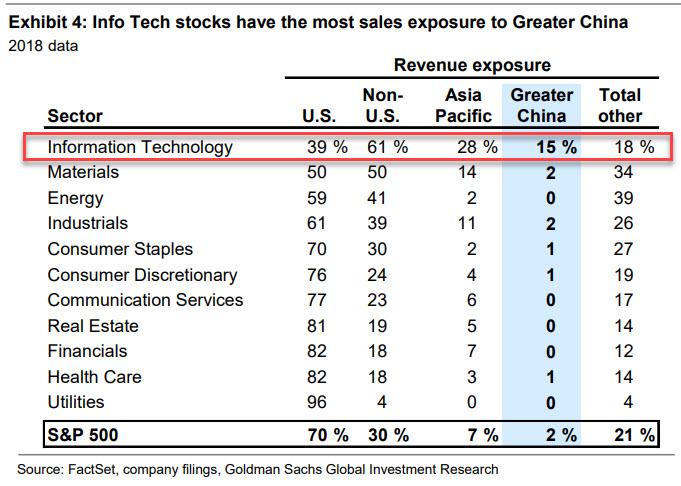

On the other hand, if Goldman – which is legendary for its irrational bullishness and in Dec 2018 predicted 4 rate hikes, even as the Fed ended up cutting rates 3 times – is once again wrong, and the coronavirus breakout is more serious than expected, then all bets are clearly off not just for the dividend growth basket, but all stocks, although one sector stands out. As we wrote last week in “Is Tech About To Suffer A “Dot Com” Bubble Collapse? It’s Suddenly All In China’s Hands”, the one sector with the greatest exposure to Greater China and Asia Pacific in general, is also the sector that has outperformed the most in recent months. Tech.

Tyler Durden

Sun, 02/09/2020 – 23:20

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com