US Budget Deficit Blows Out To Nine Year High, Up 25% From Year Ago

The gaping US budget deficit hole is getting bigger with each passing month.

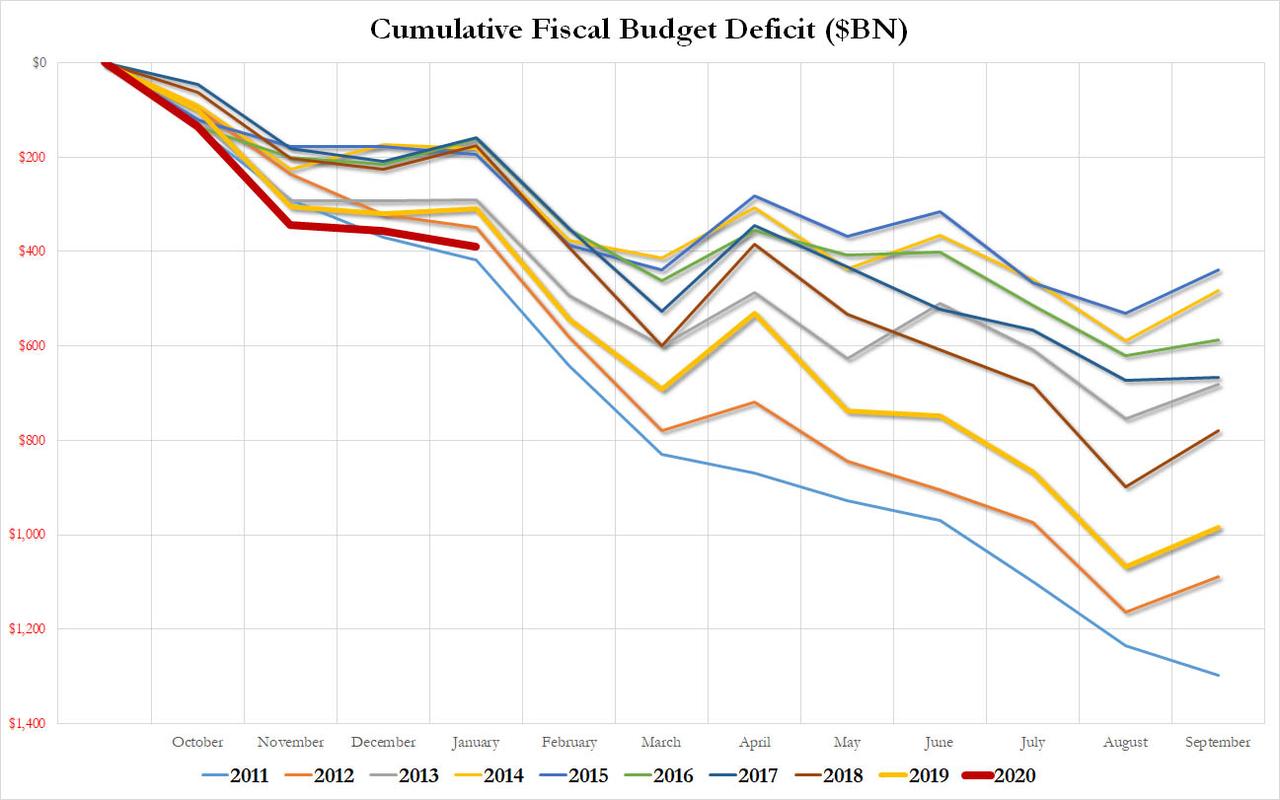

Earlier today, the US Treasury announced that in January (the fourth month of fiscal 2020), the US spent $32.6 billion more than it pulled in, resulting in a deficit that was materially worse than the $11.5BN expected, and also the biggest January deficit since 2011, when the US government spent a net of $49.8 billion.

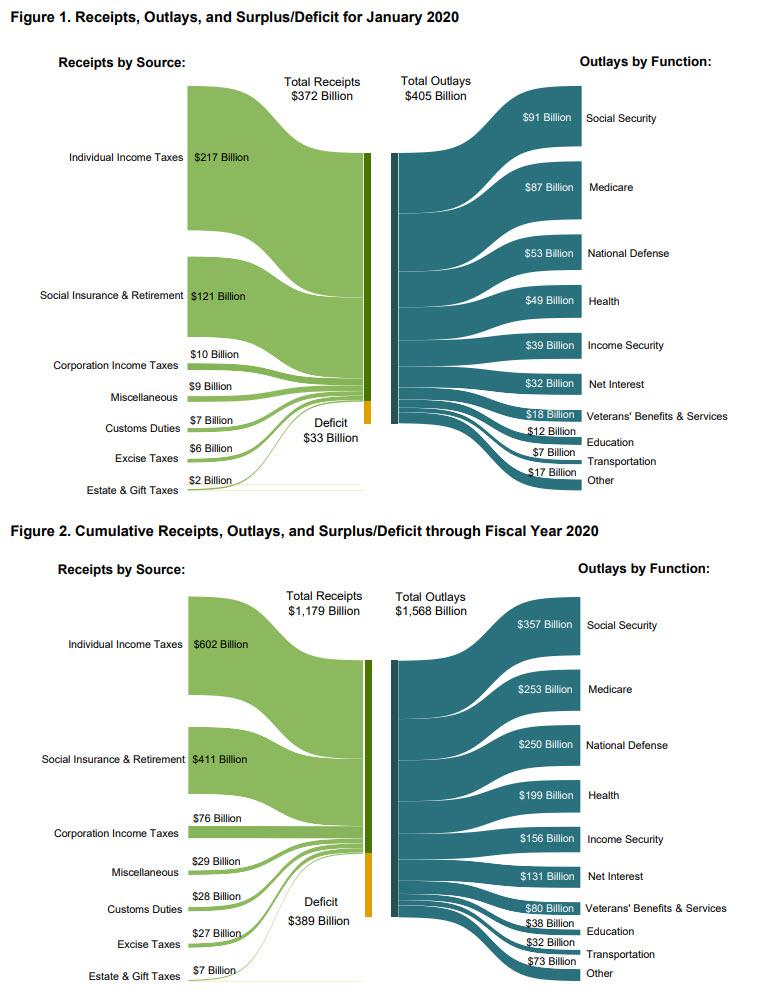

Total December spending of $405 billion, was 8.8% higher than a year earlier, with the biggest outlays for the month as follows: social security ($91BN), medicare ($87BN), national defense ($53BN), Health ($49BN), Income Security ($39BN), Net Interest ($32BN)and so forth. Meanwhile, receipts increased by a slightly higher 9.5%, from $340BN to $372.3BN, thanks to $217BN in individual income taxes, and $121BN in Social insurance and retirement receipts.

This means that the cumulative deficit for the first four months of the year has surged to $389BN, some 25% higher than the $310BN for the comparable period a year ago.

It also means that with a third of fiscal 2020 down, the US deficit was the widest going back all the way to 2011, when the nation was still spending like a drunken sailor under President Obama in response to the financial crisis, and when the final deficit for the full year soared to $1.3 trillion.

And while in 2020 nobody is predicting a full-year hole as big as 2011’s (at least not yet, although with the Coronavirus still spreading it could soon become the catalyst for another major fiscal stimulus), with every passing month we get closer to a number hinting that the US is spending as if it is emerging from a recession and a major economic crisis. That, or it is about to enter one. One more thing to keep in mind: if it wasn’t for $28BN in customs duties collected mostly from China as a result of the trade war tariffs, the cumulative US budget deficit through December would be even worse than that in 2011.

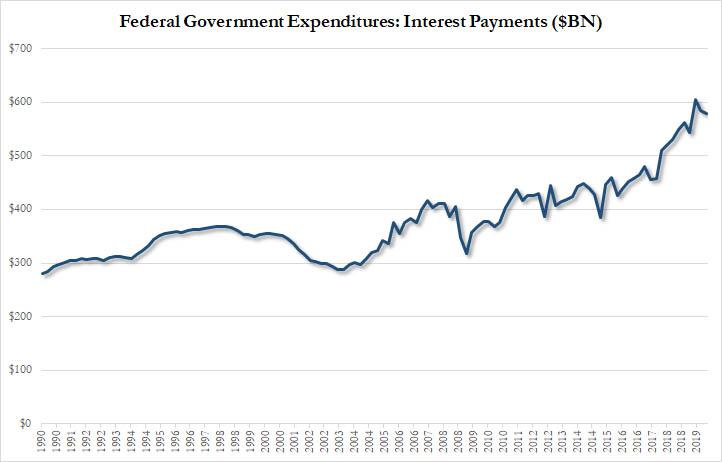

One final point: with US debt recently surpassing $23 trillion, it is no surprise that interest expense on this debt has also pushed to all time highs, and in the latest quarter it stabilized just shy of the prior record, dipping modestly to $580 billion, roughly double where its average for the two decade period from 1990 to 2010, at which point it soared. One can only imagine what the interest expense will be if the Fed ever allows rates to normalize again.

Tyler Durden

Wed, 02/12/2020 – 14:37![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com