Fed Injects $95 Billion Via Repos To Unfreeze Paralyzed Funding Markets

Forget equities: the far more important funding markets are locking up.

Between today’s surge in FRA/OIS which briefly rose to the highest level since the financial crisis, confirming the biggest dollar funding shortage in the interbank market in over a decade…

… to the explosion in the 3-month EUR cross-currency basis is 36 basis points wider, the largest move since 2008 on a closing basis which send the global basis swap crashing…

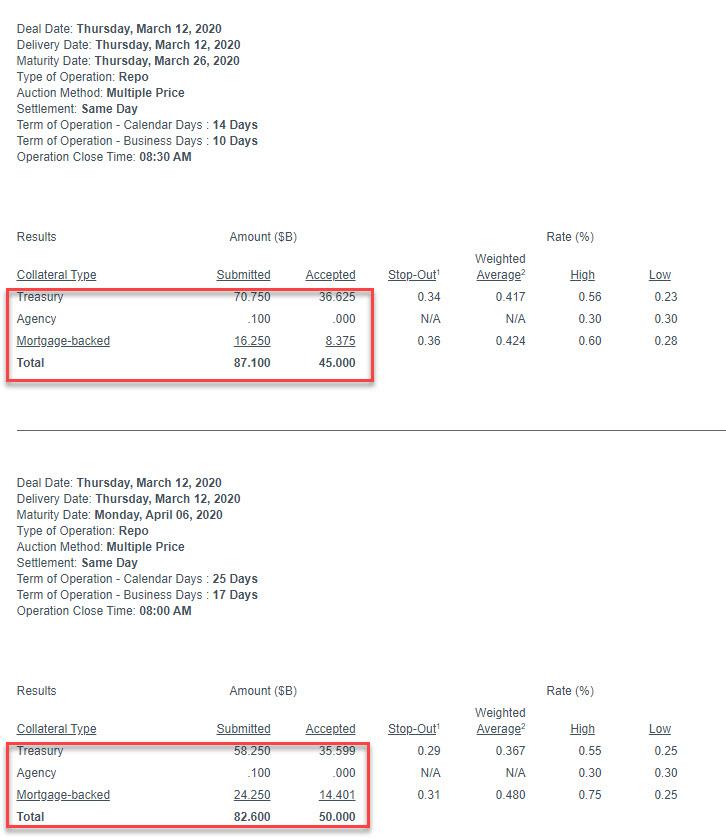

… the Fed has found itself woefully behind the curve. As a result, moments ago, the Fed announced that it has injected the maximum possible liquidity via today’s 2 term repos, including the just announced 1-month, $50bn term repo, for a total of $45BN + $50BN.

The bank also lowered the minimum bid rate on the 2-week term repo to 0.23% from 0.59% at the original announcement.

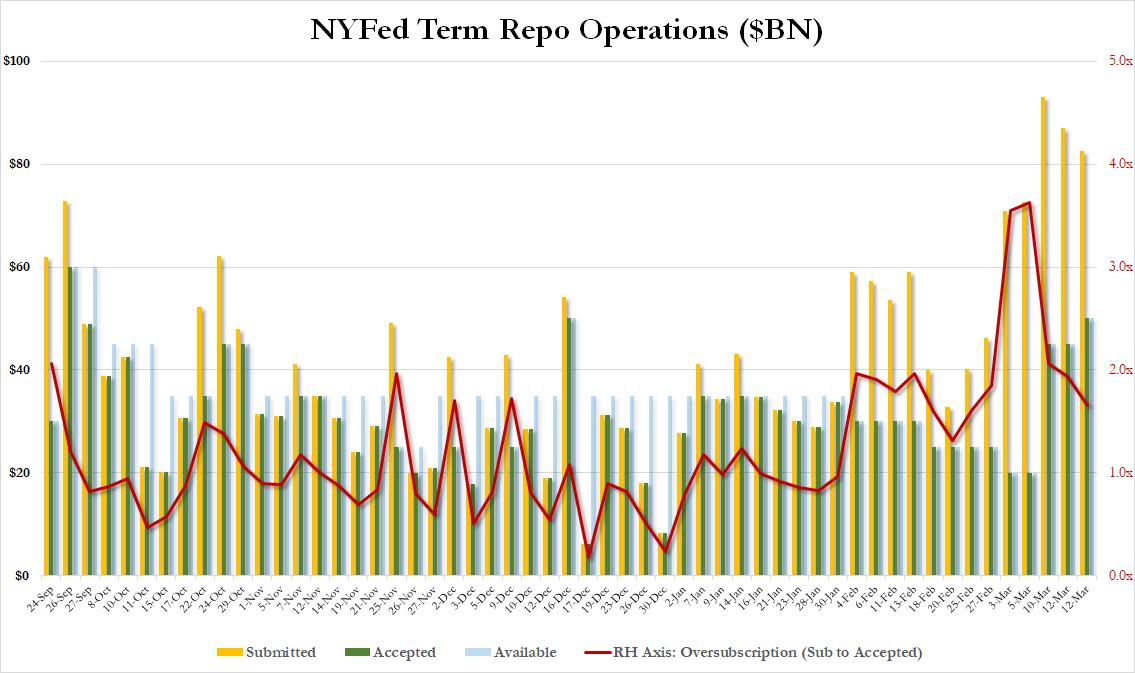

As has been the case in the past week, both term repos were oversubscribed, with the 2-week term 1.9x oversubscribed while the 1 month was 1.7x.

Unfortunately, these operations do nothing to fix the funding squeeze and the Fed is now dangerously behind the curve meaning Powell will need to unleash a far more aggressive liquidity injection if he wants to unfreeze the funding markets which appear to be locking up by the hour.

Tyler Durden

Thu, 03/12/2020 – 09:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com