“Liquidity Support Is Not Enough”: Why Central Banks Are Powerless To Fix This Crisis

Something strange happened when the Fed, and all other central banks went all in, and fired one bazooka after another in the past few days.

Nothing. For the first time since the financial crisis, perhaps ever, the masters of the monetary universe unleashed a liquidity tsunami and risk assets barely responded.

Perhaps this is just the start: in a note from Barclays strategist Jeffrey Meli, he writes that while the Federal Reserve has been providing abundant liquidity and other measures to unclog balance sheets, more can be done. According to Meli, there’s additional measures that could be taken on the regulatory front to improve the distribution of liquidity, of which the important would be loosening capital requirements through the leverage ratio and a reduction in risk-weighted assets for households and business loans.

“The Fed took a step in this direction with the MMLF,” by explicitly eliminating money market risk and capital/balance sheet burdens on the banking system, Meli wrote adding that “this lens is important when assessing the potential efficacy of new programs, to the extent that they represent risk transfer as well as liquidity relief we believe they will be more effective.”

However, even these steps are likely not enough: “we also worry liquidity support is not enough,” the strategists wrote in the note. One potential solution would be granting the Fed temporary emergency authority to purchase a wider array of municipal securities, as well as IG corporate debt and loans, something which is likely coming after Wednesday’s Bernanke/Yellen op-ed.

Another solution according to the Barclays analyst is fiscal support to households in the form of direct payments, tax rebates, or payroll tax deductions and direct assistance and loan guarantees to virus-affected industries such as airlines. And with the third fiscal package now in the works, and said to be around $1.3 trillion, this too is likely coming.

But beneath the rational justifications and explanations of what the Fed can or can not do, there is a more overarching issue: perhaps the Fed simply can’t fix a crisis such as this one, in which the entire world is grinding to a halt, and where trillions in cash flows that would have been there, simply won’t due to the unprecedented discontinuity in business.

That’s the ominous point raised by Deutsche Bank’s George Saravelos who writes that unlike the 2007-08 banking crisis, today the stress is driven by rising corporate default risk. As the global economy freezes, banks are hoarding dollars anticipating greater liquidity needs from companies and worried about corporate defaults. This, in turn, is preventing interest rate cuts in the US from being passed on to the FX market, resulting in hairraising moves such as Wednesday multiple Asian FX flash crashes. Indeed, despite the Fed slashing rates, the FX-implied interest rate differential has widened in favor of the dollar last week. Some more details below:

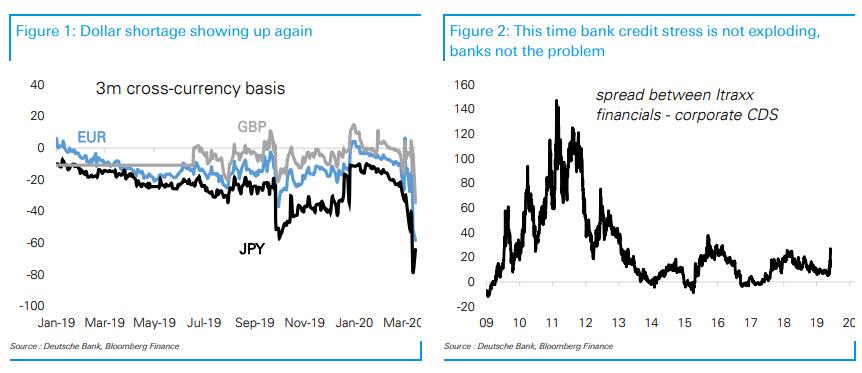

Dollar funding stress is back. Three-month dollar libor fixed higher today despite the Fed interest rate cut and cross-currency basis is widening out. What is driving the move?

Back in 2007-08 it was fear of counterparty default risk between banks that led to banks refusing to lend dollars. This time round, bank credit spreads are widening out much less compared to corporates. The market is more concerned about company, not bank defaults (chart 2). By extension, the shortage of dollar liquidity is not because banks are afraid of each other, but because they are worried about their clients.

All of this goes right to what we said over the weekend when we discussed about the $12 trillion global dollar margin call.

Addressing this point, Saravellos writes that he is worried that fixing this dollar shortage may be more difficult than policymakers think. And here is the $64 trillion problem as framed so well by the FX strategist: the source of liquidity stress is “real” companies and people, but central banks only have funding lines with banks.

So how can the dollar shortage be fixed: after all the Fed has already thrown the “kitchen sink” at the problem and the dollar keeps rising?

Well, back in 2007-08 the funding stress was more acute, but perversely it was also easier to fix as it was much more focused and concentrated as the shortages originated within the banks themselves – so long as banks were able to access liquidity or receive government guarantees the immediate tension was resolved. This time the challenge is far deeper: the dollar shortage is emanating from the real economy as corporates are facing an immediate liquidity crunch.

Meanwhile, as risk assets tumble and as the funding crisis get worse, banks’ are swept into a negative feedback loop as their willingness to lend is declining because default risk is rising. Worse, debt moratoria as some have suggested, won’t help improve liquidity. Central banks and governments will have to step in to guarantee corporate creditworthiness if liquidity is to be restored.

To be sure, the massive new QE announced by the Fed on Sunday will help increase dollar liquidity in the global financial system. But the money needs to flow down to the real economy. The Term Asset Lending Facility (TALF) from 2008 is an example of government-guaranteed funding facility, but its size was small and tailored to standardized loan pools of asset-backed securities.

The scale of the challenge this time is much more immense, and as Saravelos warns, “it may be more difficult than 2008.” Instead, and as Zoltan Pozsar wrote earlier this week, “governments may need to step in to directly guarantee liquidity provision to thousands of corporates and even people.“

With markets seemingly broken beyond repair, with every day that normalization fails to arrive meaning one day more that the global economy loses to the shutdown chaos of the Global Covid Crisis, and every single central bank intervention so far failing to restore confidence, one way or another we will get there. And the fastest way we will get there is for stocks to crash “more” (because there is nothing more “stimulating” for politicians to finally do their job than watching an angry army of pitchfork-armed (or pick any other weapon) people get bigger with every percent the stock market loses.

The only question is how much “more.“

Tyler Durden

Thu, 03/19/2020 – 18:14![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com