SoftBank Held Secret LBO Talks With Elliott As Masa Plots “Going Private” Rescue

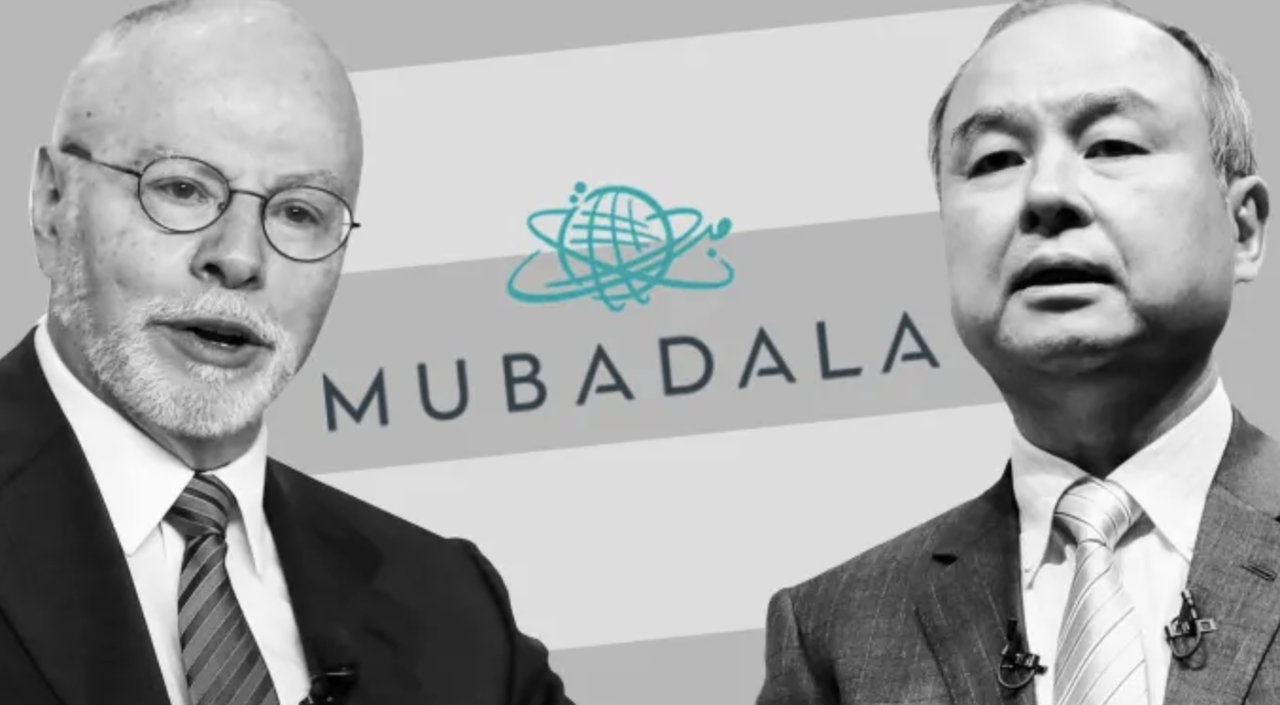

Yesterday, we joked that SoftBank’s decision to pursue a massive share buyback and deleveraging, ostensibly made to please activist investors like Paul Singer’s Elliott Capital Management, might have an important ancillary benefit: it could place Masa Son one step closer to taking the company – or at least a stripped down version of it – private, after the blowup of WeWork and a handful of other SoftBank-backed companies damaged Son’s reputation as one of the most savvy momentum investors of his generation.

By the time the unicorn bubble popped, following numerous warnings on Zero Hedge before the WeWork IPO’s collapse transformed the company into a cautionary tale.

SoftBank’s decision to yank $3 billion that it had promised to WeWork and raise even more money via asset sales suggested that Masayoshi Son was desperate. He felt he needed to retrench, then reassess, to protect his position, and as the FT reports, the SoftBank chairman went to considerable lengths to try and bolster his company’s valuation, including a scheme to take the company via an LBO, which he discussed with Elliott Management after the hedge fund said it might be interested in buying more shares.

But a potential take-private illustrates the extent to which Mr Son was considering all options to manage the turbulence that rattled SoftBank’s share price and global markets. At the end of last week, SoftBank’s shares had an equity value of around $50bn before any potential premium would have been applied. SoftBank, Elliott and Mubadala declined to comment.

Mr Son, who already owns a quarter of the company, began thinking about a leveraged buyout after Gordon Singer, who runs the London office of Elliott, expressed interest in buying more SoftBank shares last week as their price fell, according to one person close to the talks. During the course of those discussions, these people said, Mr Son began to seriously study the formation of an investor consortium to take SoftBank private.

“The idea originated from people around Masa and he wanted to explore it,” one person following the situation said. The discussions also involved some of Mr Son’s key lieutenants, including Yoshimitsu Goto, SoftBank’s chief financial officer, Rajeev Misra, the former Deutsche Bank trader who oversees SoftBank’s Vision Fund, and Marcelo Claure, the company’s chief operating officer. The plan was eventually abandoned for a number of reasons, including the complications around getting an investor consortium together quickly for such a large deal, Tokyo-listing rules and other tax considerations, multiple people said.

Those who know him well claim that Masa frequently grumbles about SoftBank’s steep market cap discount to the book value of its assets, a factor that has only gotten worse as Masa’s reputation as a risk-addicted gambler was highlighted by the Vision Fund’s many blowups, even if all the headlines made the blow look worse than it truly was.

By the end of last week, SoftBank said that its market cap discount to book had stretched to a record 73%, the widest in the company’s history.

Masa Son is desperate to win back total control of SoftBank and taking the company private with the backing of a few friends who believe in the Japanese billionaire is probably his last, best option, though Elliott seems like an odd match for this. The steep market cap discount is just a barometer showing now would be a good time to strike.

Though news that the company would sell some of its crown jewels, including some of its stake in Alibaba, to help pay down debt and buy back stock at a time when US lawmakers are bashing companies for spending more money on stock buybacks than their employeesl

But we suspect Masa would have no problem explaining all this to a Congressional Committee during a public hearing.

Tyler Durden

Tue, 03/24/2020 – 20:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com