A Grim Milestone

Submitted by Michael Every of Rabobank

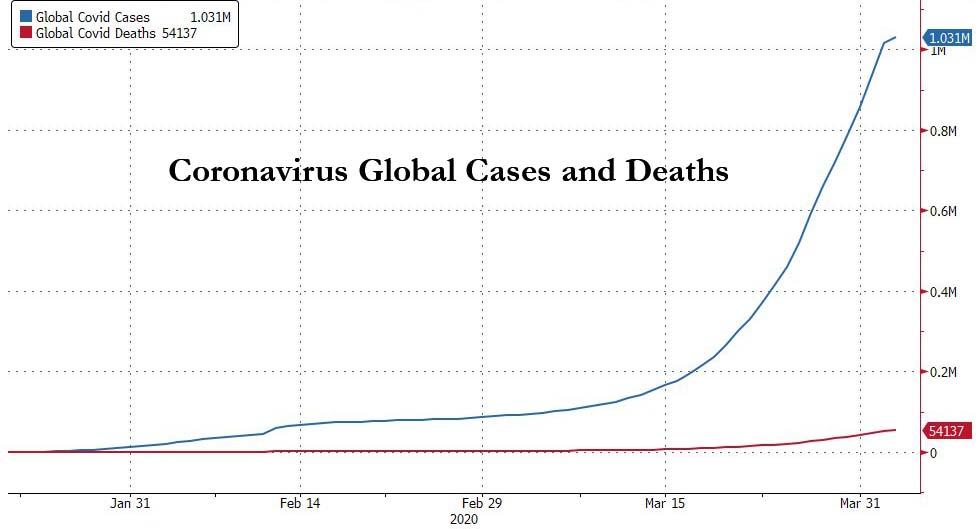

As this working week comes to a close we pass one grim milestone: over a million people world-wide are now infected with COVID-19, and likely already many millions given how poor global testing efforts have been. The disaster is probably only just getting started in countries with poor public health systems, where social distancing and regular hand-washing are sick jokes for those living ten to a shack without running water.

Tellingly, even as far, far richer Wuhan moves towards lifting its travel ban on 8 April, all its residents have been told to stay indoors and strengthen protection measures. The Caixin services PMI likewise printed at just 43.0 today, above consensus at 39.0, but far below the manufacturing measure’s just-over-50, underlining that even when using a helpful month-to-month measure of sentiment, smaller services businesses still feel terrible (though last month’s 26.5 print is thankfully behind us). A long, hard road lies ahead of us yet on many fronts.

As such, the RBNZ have just underlined that borrowing costs are staying low for a long time and that there is much more they can do to boost liquidity. (Presumably more QE.) Fiscally, we also continue to see billions being thrown around from those who can afford it. Japan is planning to hand over JPY200,000 (USD1,851) to households who have seen their incomes fall, for one example. For another, yesterday’s daily COVID-19 press briefing saw newly-recovered Health Secretary Matt Hancock state that GBP13.4bn in pre-existing NHS debt would be written off. Once upon a time that was a lot of money in the UK budget – now it’s a rounding error.

We at least saw the beginnings of a UK plan to win the war based on mass testing, and the gradual emergence of an “immunity passport” – based on the assumption that reinfection can’t happen, which is not yet scientifically verified. As in all wars, having a plan to win is crucial, but it being realistic helps. And implementing it rapidly and effectively is vital.

On the latter front, in the US the White House again invoked the Defence Production Act to compel six US firms to produce medical equipment such as N95 masks and ventilators. It helps to have the right equipment, after all (and the UK is also painfully short there, as are others). US banks are doing their part too – refusing to lend to struggling small businesses at 0.5% with no credit risk at all due to a government backstop as the USD349bn part of the USD2.2 trillion fiscal package; they have successfully lobbied to make the loans at 1.0% instead. Yet banks are also reported as far from ready to start rolling out liquidity to SMEs as from today as scheduled. Details of the loan scheme are apparently unclear: is due diligence required? And can the loans be sold on again? Because, having had regulatory requirements loosened and funding costs slashed, they don’t want to actually keep these low-yielding assets on their balance sheets. Is there a financial equivalent of the Defence Production Act, one wonders?

Clearly,, the need for action not talk or questions was underlined dramatically with the US initial claims print of 6.65 million, up from 3.3 million the week before. These kind of readings are, literally, off the chart. That is a Great Depression happening in the blink of an eye.

Yet, the major market mover yesterday was oil, which just after I had floated the hypothetical idea of the US imposing energy tariffs to set a price floor to match the ceiling that US shale already brings, heard Trump claim that the Saudis and Russia were set to slash output by up to 15m barrels per day. Initially, oil rallied hard. Then it gradually dawned that Trump’s talk of output cuts was an aspiration in line with reopening the US economy for Easter. Oil has fallen around 4% again, and we should probably expect it to continue to slump as the market tries to force the Kremlin and Riyadh to agree to something thought up in the White House.

Who is going to be the next market mover? Perhaps mortgages, where Moody’s warns that 30% of US home loans may stop being serviced, which seems entirely logical if everyone is out of work and small business aren’t getting the lifelines they need. But, frankly, who knows where the damage will spread to, and when, if we are going to see 25% unemployment across much of the developed world for an extended period?

Tyler Durden

Fri, 04/03/2020 – 09:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com