Fund Manager Survey, The “Apocalypse” Edition: Record High Pessimism And Cash Levels, Record Low Liquidity And Equity Allocations

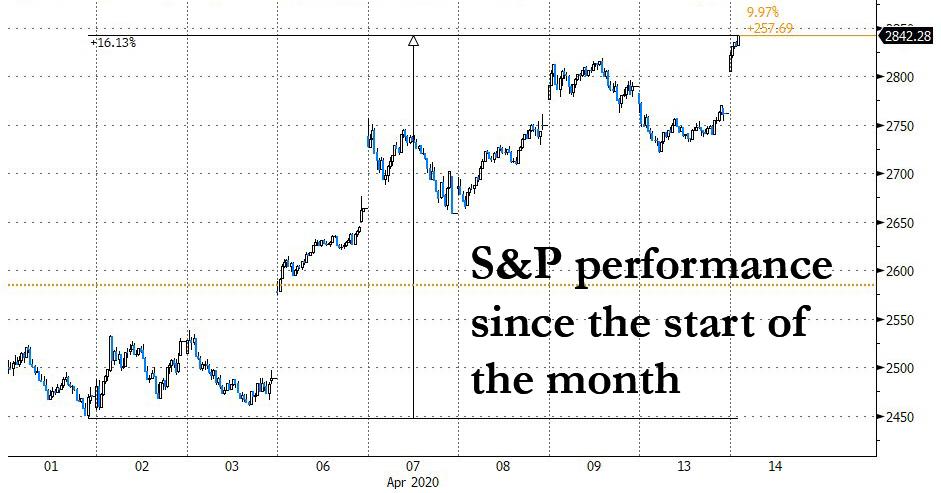

The latest, “coronavirus” edition of BofA’s Fund Manager Survey which polled 183 participants with $545bn AUM between April 1 and 7, found widespread fear and pessimism with most expecting a recession, a surge in cash (to levels not seen since Sept 11), expectations for a U not V-shaped recovery, and perhaps most paradoxically, bearishness at record levels… just as the S&P explodes higher with the S&P now up 16% since the start of the “cruelest month.”

Courtesy of the survey organizer, BofA CIO Michael Hartnett, here are the Top 10 highlights from the latest survey:

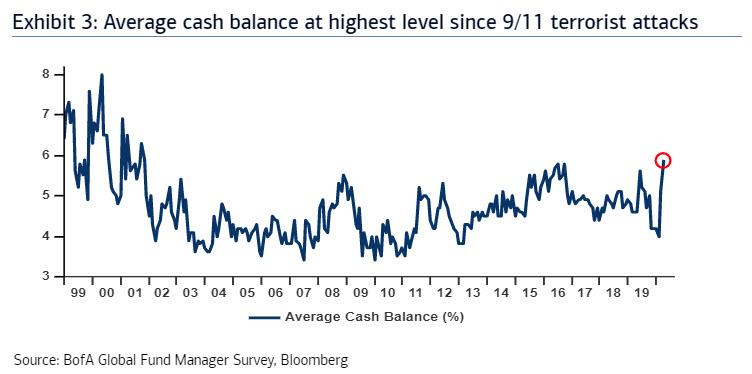

- BofA April FMS shows extreme investor pessimism…cash levels jump from 5.1% to 5.9% = highest level since 9/11 terrorist attacks; we say April = peak pessimism.

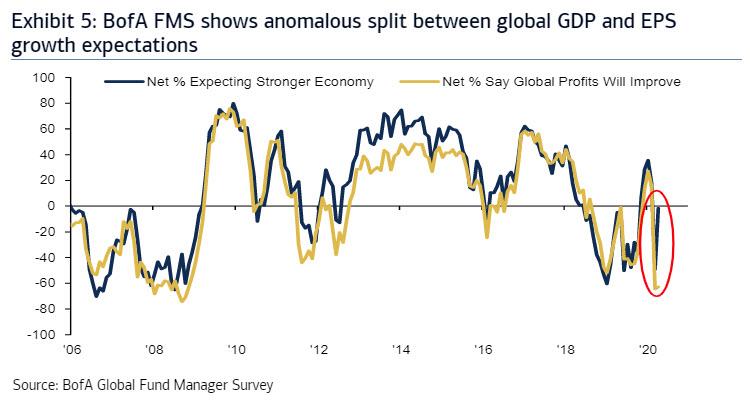

- 93% expect global recession in 2020; investors think global GDP cuts largely over, but global EPS cuts just beginning (rare dichotomy).

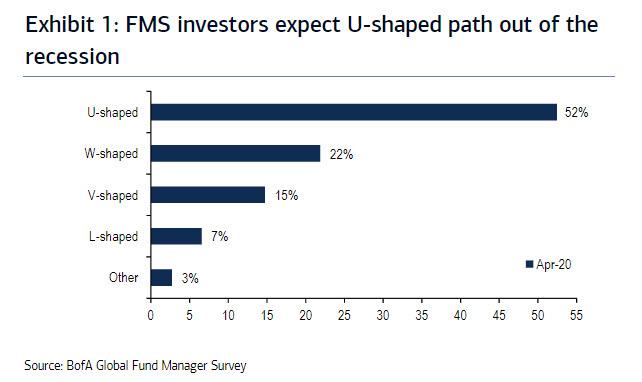

- 52% believe economic recovery from COVID-19 shock will be U-shaped, 22% say W-shaped, just 15% say V-shaped (Exhibit 1)…macro pessimism.

- FMS equity allocation lowest since Mar’09 (when S&P500 hit 666 low during GFC)…equity pessimism.

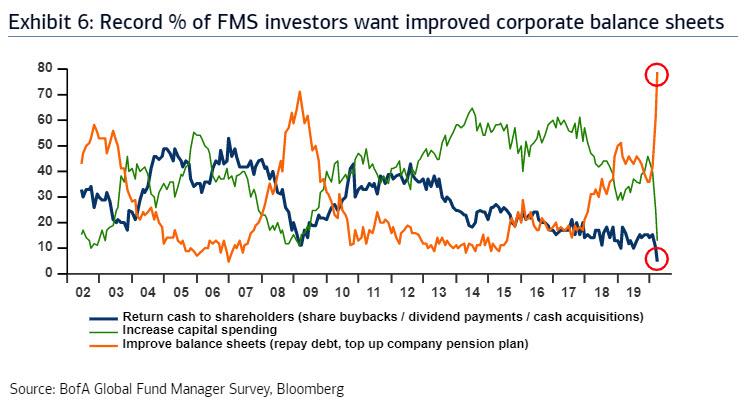

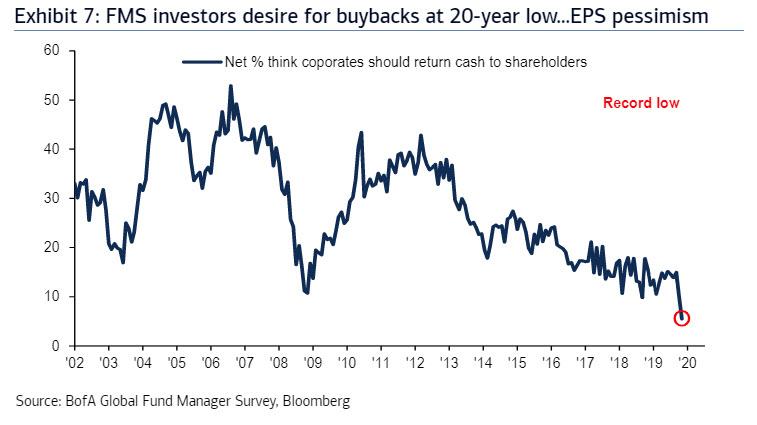

- 79% want corporations to improve their balance sheets, highest in 20 years; just 5% want corporate buybacks, lowest in 20 years…EPS pessimism.

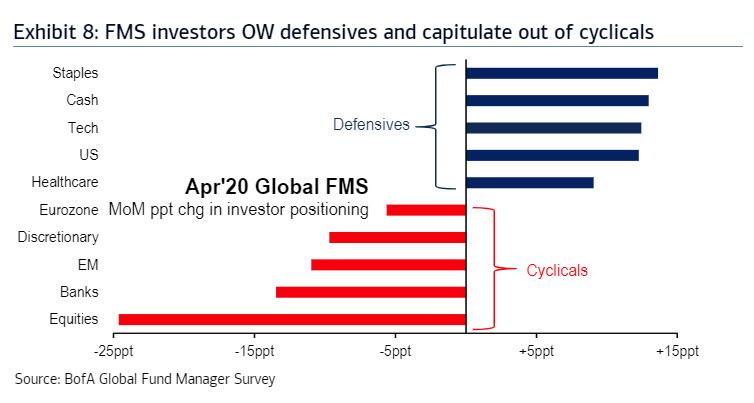

- FMS investors very long cash, healthcare, staples, utilities, US, tech, bonds (Exhibit 8); very short energy, equities, materials, industrials, UK, banks, Eurozone.

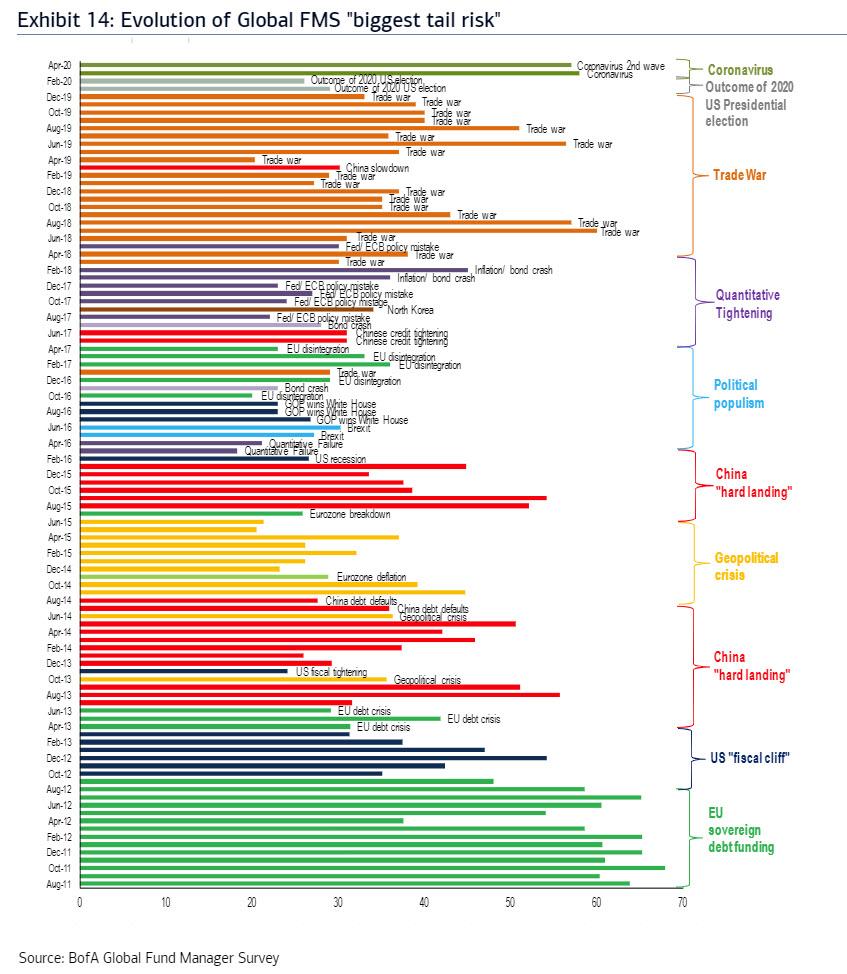

- 57% say COVID-19 second wave = biggest tail risk, followed by systemic credit event (30%).

- BofA Bull & Bear Indicator remains pinned at 0.0, i.e. investor positioning very bearish; we say one last leg up in risk rally but take profits SPX 2850-3000.

- FMS bull catalyst for distressed cyclicals…health breakthrough (“V is for Vaccine”) ends fear of long recession in GDP/EPS; China credit growth kicks-in.

- FMS bear catalyst for growth stocks…spike in US dollar signalling credit event the 3 “weak links” of energy, Euro-area and/or Emerging Markets

Digging into the survey reveals that over two thirds of respondents expect the recovery to be U or W-shaped, with just 15% expecting a V-shaped rebound (and only 7% expect no rebound, or an L-shaped recovery).

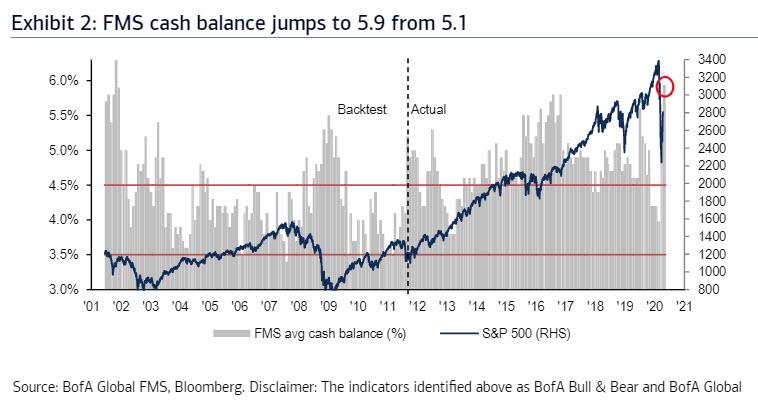

Going down the list, BofA finds that cash levels among Wall Street professionals jumped to 5.9% from 5.1%, the highest cash level since 2001, and well above the 10-year average of 4.6.

Additionally, the surge in cash levels to 5.9%, or the highest level since 9/11 terrorist attacks, (was 5.1% March, 4.0% Feb); “shows extreme investor pessimism”.

The surge in cash means that BofA’s Cash Rule is now in “buy” territory, with the BofA Bull & Bear Indicator at 0.0, a contrarian “buy signal” for risk assets (the FMS Cash Rule works as follows: when average cash balance rises above 4.5%, a contrarian buy signal is generated for equities. When the cash balance falls below 3.5%, a contrarian sell signal is generated).

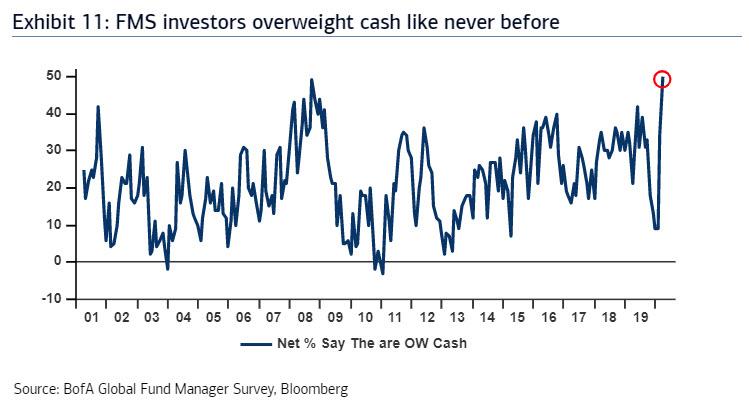

Another way of looking at the cash flood, a record net 50% of FMS investors say they are “overweight” cash relative to benchmark; the previous high was 49% in Oct’08, just after the Lehman bankruptcy.

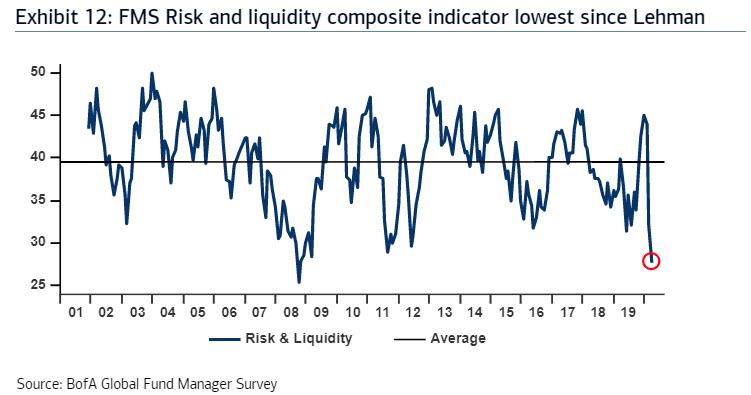

Another logical consequences of everyone hoarding cash amid a burst in pessimism is that BofA’s risk & liquidity composite indicator has plunged to 28, greater than 1 standard deviation away from average (40) to lowest level since Oct’08 (25).

The surge in pessimism – and cash levels – means that investor equity allocations plummeted 29% MoM to net 27% underweight; the lowest since March 09…which incidentally happened to be the generational low when the S&P hit 666.

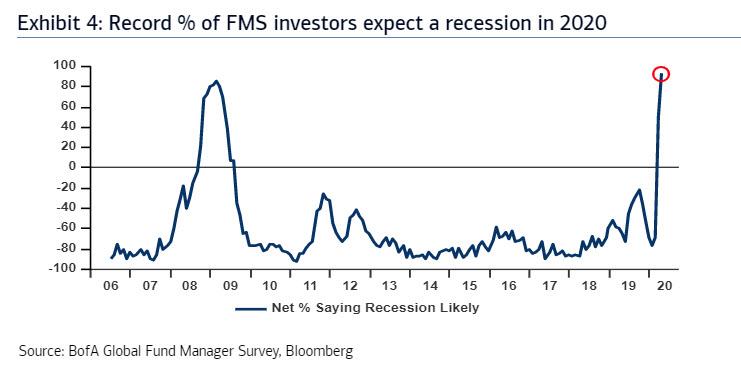

While it is hardly news, now that the US economy is cratering with GDP expected to plunge by as much as 40% in Q2 with tens of millions suddenly unemployed, a record number of survey respondents, net 93%, expect a recession in the next twelve months (the previous peak was in Mar’09 at 86% just as the recession was ending). Ironically, virtually nobody expected a recession at the start of the year.

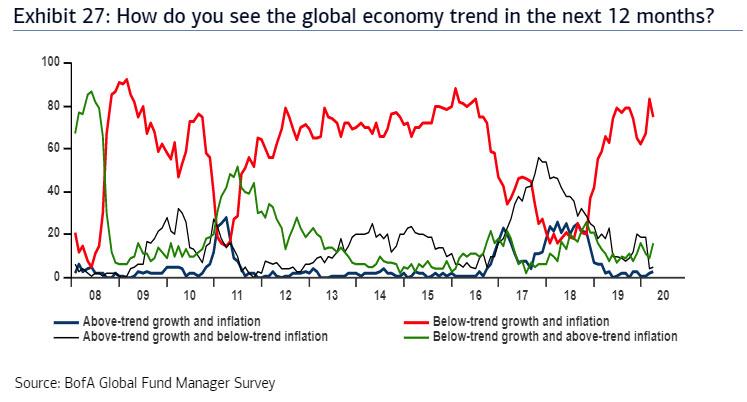

Tied with the gloomy outlook, 75% of FMS investors said they expect below-trend growth & inflation in the global economy over the next 12-months, down 8ppt MoM, while just 16% of FMS investors think the global economy will experience below-trend growth and above-trend inflation, up 7ppt MoM.

April’s FMS also showed a rare dichotomy between GDP and EPS expectations: to wit, investors think global GDP cuts are largely over, but global EPS cuts are just beginning, with net 63% believing profits will deteriorate in the next 12 months vs. net 2% expecting worse global growth in the next 12 months.

As in many previous cases, the survey showed that virtually every investor wants companies to focus on cleaning up their balance sheets and halt buybacks, which is ironic because without buybacks stocks would collapse, which in turn would put most of the survey respondents out of a job. Maybe they don’t understand this, but in any case BofA reports that a record high 79% of FMS investors want to see corporations improve balance sheets vs. only 5% want corporates to boost buybacks.

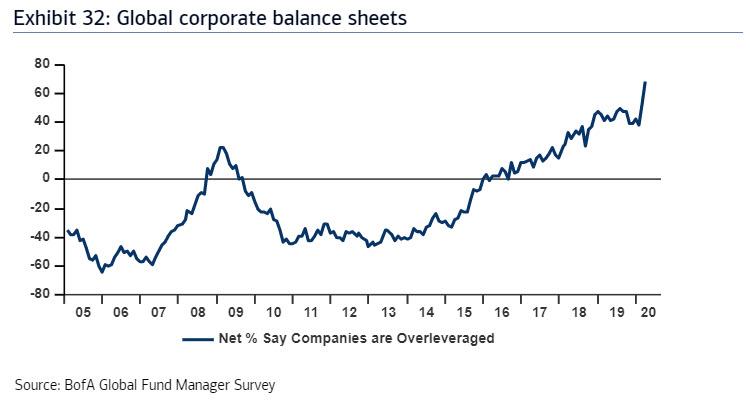

A record net 68% of FMS investors say companies are overleveraged (72% overleveraged, 4% under-leveraged).

Tied to this, just 5% of FMS investors think corporates should return cash to shareholders via buybacks, dividends or M&A (20-year low)…a record low. Maybe instead of FMS investors they should just be called “masochists”?

So how are investors positioned amid this apocalyptic sentiment:as BofA shows, the entrenched recession concerns have led FMS investors to slash exposure to cyclical assets and rotate into defensive assets this month.

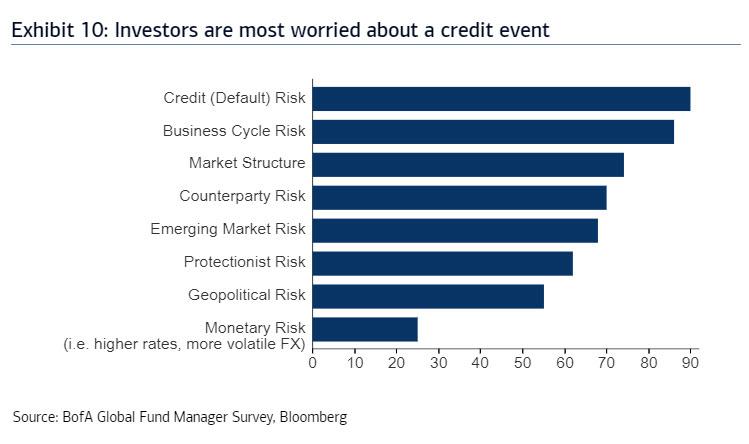

And since this is the “apocalypse” edition, BofA also notes that 90% of Wall Street respondents believe credit default risk poses biggest threat to financial market stability, highest credit default risk since Mar’09 (91%).

And just in case all of this needed some wrapper, for the second month in a row investors are most concerned about the Coronavirus, which they see as the “biggest tail risk”, although this month it is the second wave of the epidemic, which we profiled last week in “This Is What Happens After We Pass The Virus Peak.”

Putting it all together, with pessimism and cash levels at all time highs, with liquidity, equity allocations and hope of the future either at record lows or at levels last seen during the March 2009 generational lows, it is probably not a surprise that since the start of the month in which Wall Street turned apocalyptic, the S&P is up 16%.

Tyler Durden

Tue, 04/14/2020 – 11:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com