Jim Simons’ Legendary Medallion Fund Up 36% In 2020, Expects More Volatility Ahead

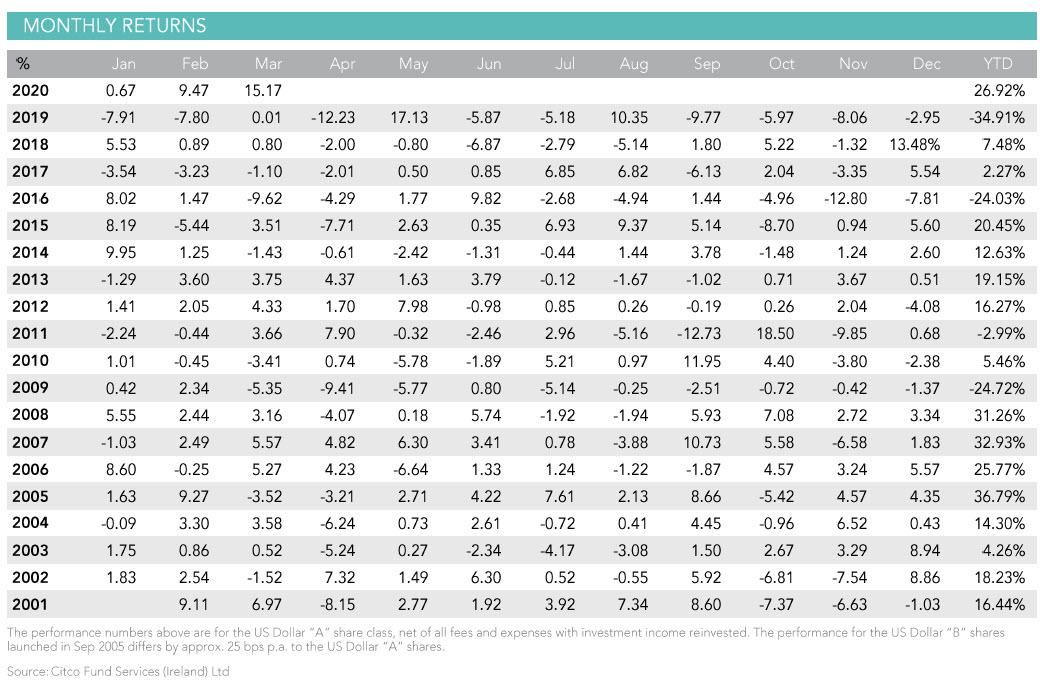

Yesterday we reported that the “most bearish hedge fund manager” (or as he prefers to be called “the most logical and rational fund manager”), Russell Clark, had a tremendous March, returning 15.17% after an impressive 9.47% in February. The 26.92% YTD return made his Horseman Global one of the best performing funds of the year, although in fairness that was only because the fund had been dramatically short for much of the past decade, losing 34.9% in 2019.

There was another hedge fund that had an almost as stellar return year-to-date, rising 24% in 2020. Only unlike Horseman, this fund was also up in 2019, and in 2018, and the year before, and before that too, and so on. We are of course talking about the greatest hedge fund in history: Renaissance’s ultra secretive and ultra lucrative (open only to friend and employees) Medallion fund.

According to the WSJ, Medallion’s stellar performance is thanks in part to a 9.9% gain in March, which while less than Horseman, comes from a fund that is directionally agnostic and is best known for dabbling occasionally in HFT and countless quant and stat arb strategies. More impressive is that Medallion’s gains come even after its hefty investor fees, which include a performance fee of 36% and a management fee of 5% of all AUM. Before those investor fees, Medallion, which manages nearly $10 billion, was up about 39% for the year on April 14.

Furthermore, as we have profiled ever since 2009, unlike the perpetually outperforming Medallion, which is so secretive nobody outside Medallion has any idea what its strategies are, funds that Renaissance makes available to outside investors haven’t done nearly as well as well. The Renaissance Institutional Equities Fund (RIEF) which has a longer holding period than Medallion and focuses on U.S. shares and aims for returns that more closely track the overall market, was down 10.4% through April 10. By comparison, the S&P 500 index has fallen 11.4% this year, through April 14, while Vanguard’s 60/40 index fell 5.9%, in line with the performance of the average hedge fund, according to industry tracker HFR. Hedge funds aim to protect investors in times of crisis but few have performed like Medallion.

It wasn’t all smooth sailing though, with the WSJ noting that even Medallion had its rough moments lately: at one point in March, the fund faced slight losses for the year before surging in the month’s second half. Some people close to the firm say the unusual volatility raises questions whether the recent gains will continue apace. Since 1988, Medallion has averaged annual gains of 39% after fees, and its best years include 2000 and 2008, difficult years for most investors.

For those unfamiliar, the Medallion fund holds thousands of stocks at any one time, while betting against thousands of other shares and trading currencies, commodities and bond futures, according to people close to the firm.

During market collapses, most investments tend to plummet in unison, which can make it hard for Medallion to profit. That phenomenon may help explain why the fund treaded water in early March. In the aftermath of these difficult periods, and as markets settle, Renaissance’s 35,000 computer processors comb 30 trillion bytes of data each day searching for mispricings.

Ironically, the best hedge fund is the one that not even its managers know what it does:

Renaissance’s predictive models, developed by the firm’s 320 or so string theorists, astronomers and other scientists and mathematicians, are built on more than 10 million lines of computer code and rely on historic prices and other data. Preset algorithms generate all its trades, eliminating human emotion from the investing decision.

In fact, because Renaissance’s system employs elements of machine learning and is so complicated, it can be challenging for the firm’s own executives to immediately understand why the firm is doing well or poorly. Some of them believe their gains, at least in part, could result from mistakes rival investors make during challenging markets.

“The computer runs itself and we hardly ever interfere, the machine tells us what we should do,” says someone close to the firm. “Every experience we’ve had shows that humans mess up worse than machines.”

Renaissance’s chainsmoking, codebreaking founder Jim Simons, who is worth over $23 billion, is working from his Long Island home amid the coronavirus pandemic like many others at the firm, the Journal’s Greg Zuckerman reports.

Of course, since the fund basically runs itself, it’s unclear why anyone would ever need to show up to the office at all.

Medallion is a “medium-frequency” trading firm, generally holding its investments from “moments to months,” in the words of an employee, rather than milliseconds, like high-frequency firms. Still, Medallion also can benefit from volatile markets like those trading shops.

There may be reason to think investors should brace for continued market volatility, at least according to Renaissance’s predictive models. In late March, Medallion’s investors were given the opportunity to put more money in the hedge fund so the firm could expand its size. That move may have been made because the computers anticipate more opportunity for profits—and more volatile and challenging markets—in the months ahead.

This is one occasion when we will say that the machines are right, hands down.

Tyler Durden

Fri, 04/17/2020 – 19:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com