“I’ve Never Encountered Anything Like This”: China Stock Index Suffers Record Crash And Nobody Knows Why

One of the consequences of centrally-planned markets is that – with no organic price discovery – “prices” are whatever some computer decides they are, and while major glitches have yet to hit US capital markets, Chinese stocks just suffered one of the biggest crashes in recent history, and nobody knows why.

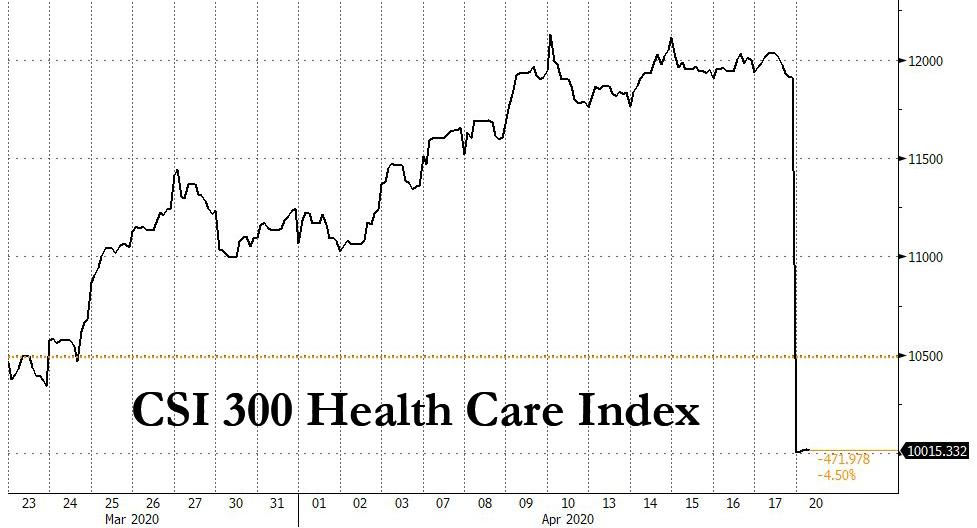

Moments after the open of trading on Monday, China’s CSI 300 Health Care Index fell as much as 17% according to data compiled by Bloomberg and confirmed by the Shanghai Stock Exchange. That’s even as none of the 29 stocks in the industry group lost more than 2%, indicating that this was most likely an ETF trade gone bananas and demonstrating to the world the unprecedented risk from relying entirely on passive investing when all links to underlying securities – let alone fundamentals – are severed.

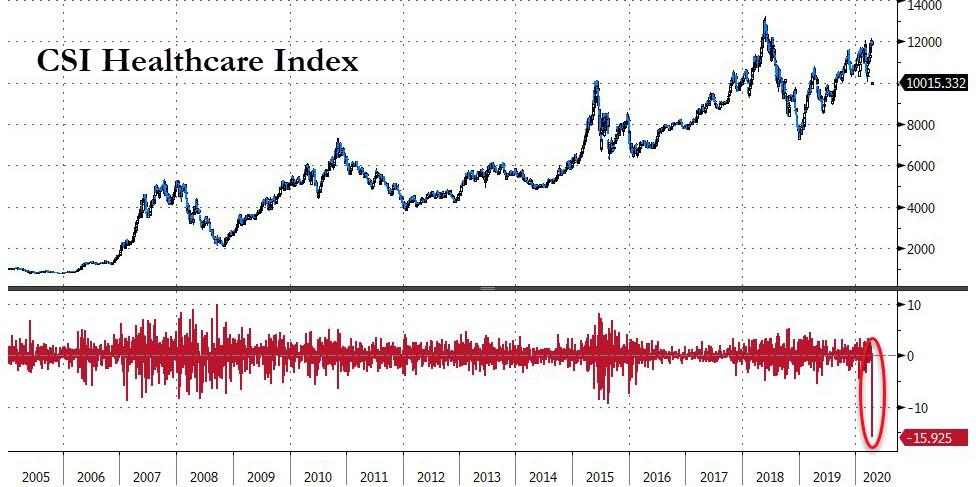

The crash, which was the biggest on record…

… sent the index to levels last seen in August of 2019.

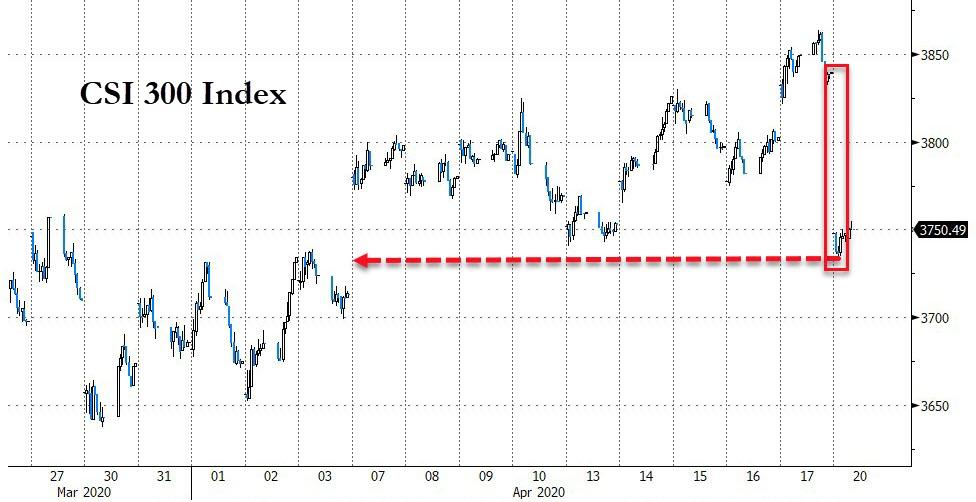

The broader CSI 300 Index, of which the Health Care Index is a constituent, and which comprises stocks listed in Shanghai and Shenzhen, was down 2.4% at 10:26 a.m. local time. Both the Shanghai and Shenzhen benchmarks were higher. Daily stock price moves on the mainland are capped at 10%.

“I‘ve never encountered anything like this in my entire career,” said Shenzhen Qianhai Daoyi Investment Holdings fund manager Lu Boliang. “It’s definitely a bad mistake, especially as it impacts various ETF trades — what will happen to those trades placed at misleading prices? No one knows as it’s never happened before.”

What will happen is that some people will lose money, while those who are connected and wealthy to begin with, will see any “erroneous” trades unwound, and may even get some compensation for their troubles. Because that’s how centrally planned “markets” work.

As Bloomberg reports, “the Shanghai Stock Exchange is looking into an apparent pricing error in a gauge of health-care shares which affected the broader index.”

The bourse operator reportedly said it noticed the issue and is looking into its pricing, according to an employee in the media relations department. It wasn’t clear if Beijing had to pre-clear whatever the new price was “agreed” upon.

Suggesting that China just had a mini version of August 2015, Bloomberg adds that at least 20 ETFs track the CSI 300 Index; “They are mostly listed in Hong Kong, mainland China, Taiwan and South Korea.”

So in addition to exporting deadly viruses, China is now also in the business of exporting massive capital losses due to ETF “glitches.”

Tyler Durden

Sun, 04/19/2020 – 23:58![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com