US Banks Are Pulling Back From Lending To European Companies: FT

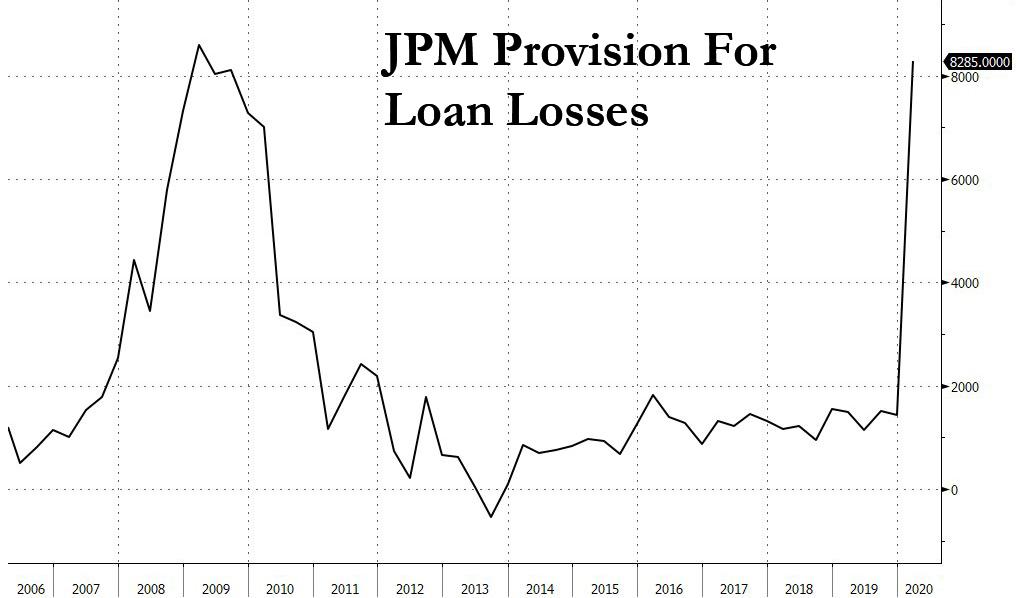

One week ago we showed that the largest US commercial bank, JPMorgan, which just hiked its provisions for loan losses in anticipation of a surge in defaults…

… appeared to be “getting out of Dodge“, because after exiting (non-government guaranteed) loans and hiking mortgage standards, JPMorgan had also stopped accepting HELOCs. It now appears that the largest US bank – and its peers – are also quietly shunning all European business as well, because as the FT reports, “US banks are pulling back from lending to European companies during the coronavirus pandemic, fuelling concerns that Wall Street may be quietly withdrawing to its home market in a repeat of the last financial crisis.”

One small correction here: Wall Street is not withdrawing to its home market – as we have described before, US banks are also quietly shunning their home market as well amid rising fears of a surge in corporate defaults, suggesting that the current crisis could be far worse than 2008/2009.

We do agree with the rest of the FT note however: “bankers, advisers and company executives said American lenders had become more cautious in underwriting bilateral and syndicated loans to large corporate clients across the region in recent weeks.”

As an example of US bank reticence, the FT notes that in Germany, JPMorgan recently pulled out of talks over an additional credit line for BASF, the world’s largest chemicals group, while Bank of America lent half as much as the other six international banks that underwrote a €3bn state-backed loan to sportswear giant Adidas.

At events and publishing group Informa, JPMorgan and BofA turned down a request for a short-term loan and were not among underwriters on a £1bn share placement, even though the latter had been broker to the UK company for 10 years. BofA also turned down a potential capital raise for struggling cinema chain Cineworld.

Even Goldman Sachs – which helped underwrite a €3.5bn syndicated loan for Italian-American carmaker Fiat Chrysler this month – is getting cold feet and did not take part in a similar €12bn facility for German rival and long-standing client Daimler, leaving other lenders to make up the difference.

“We are increasingly observing an ‘America first’ attitude among large US banks,” said an adviser directly involved in negotiations between banks and corporates in Germany. “Those are not just idiosyncratic cases: there is a clear pattern.”

That pattern is that in the first quarter, the five large US banks’ combined market share in syndicated loans in Germany fell by more than a third to 14.6%, according to Refinitiv data. It’s only gotten worse since then.

“Every bank is under the cosh of its national regulators, who in times of crisis show a huge home bias,” said Jan Pieter Krahnen, director of the Center for Financial Studies at the University of Frankfurt. “This heavily influences risk management and regional exposure, which comes at the expense of clients abroad.”

The trend has attracted the attention of European regulators. “We have received many signals that foreign lenders are starting to retreat from the German market,” said a senior supervisory official. “We cannot force them to lend.”

In the UK, JPMorgan pulled out of a recent £324m debt and equity rescue package for airport concession operator SSP, despite being the company’s corporate broker. Only British banks were left in the consortium.

Amusingly, the pull back by US bank lending in Europe has caused concerns in Europe about the reliability of US banks in a crisis. One reason Berlin politicians last year endorsed merger talks between Deutsche Bank and domestic rival Commerzbank was the desire for a “national champion” that would continue to lend at times of stress.

German companies that want to tap large government-backed loans are in a particular bind because they need the support of their existing lending group to access funds from state-owned development bank KfW, which can shoulder as much as 80% of new syndicated loans. But KfW insists private-sector banks take on the remaining 20% as well as guaranteeing existing credit lines, which need to be drawn first.

Judging by the comments of one of the FT’s unnamed sources, Europe is clearly not used to getting shunned: “If one bank in an existing consortium steps out of line, it’s not only that the others have to fill in the blank, but some of them may also start to get second thoughts.”

BofA, Goldman Sachs and JPMorgan declined to comment to the FT on specific clients, but stressed they had increased lending globally in recent weeks. While the data shows BofA’s share of syndicated loans has declined, the US bank pointed out it ranked second in league tables of euro-denominated bonds since March 18, when debt markets reopened after the initial coronavirus shock.

JPMorgan said: “We extended over $25bn in new credit to clients in March alone, and nearly half of that was in Europe. Our commitment to companies in the region remains unwavering.”

Senior US bank executives said that compared with American clients, European companies had drawn down more of their credit lines, reducing banks’ appetite for further lending. They also typically wanted to borrow money over longer time horizons whereas US companies saw bank loans more as a “bridge to markets”.

Indeed, one look at the recent surge in outstanding loans and leases shows that there has been roughly half a trillion dollars in new product, which may explain why US banks are now calling it a day, both in Europe and domestically.

Amusingly, some US bankers told the FT that European lenders were acting “recklessly”, loading up their weak balance sheets with more risky loans that could turn into problems in years to come. “I don’t understand why the Europeans want to do these things,” said a senior investment banker, who apparently has not looked at US balance sheets in the past five years…

Tyler Durden

Sat, 04/25/2020 – 09:55![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com