It’s Now Virtually Impossible To Get Bank Credit As Lending Standards Soar

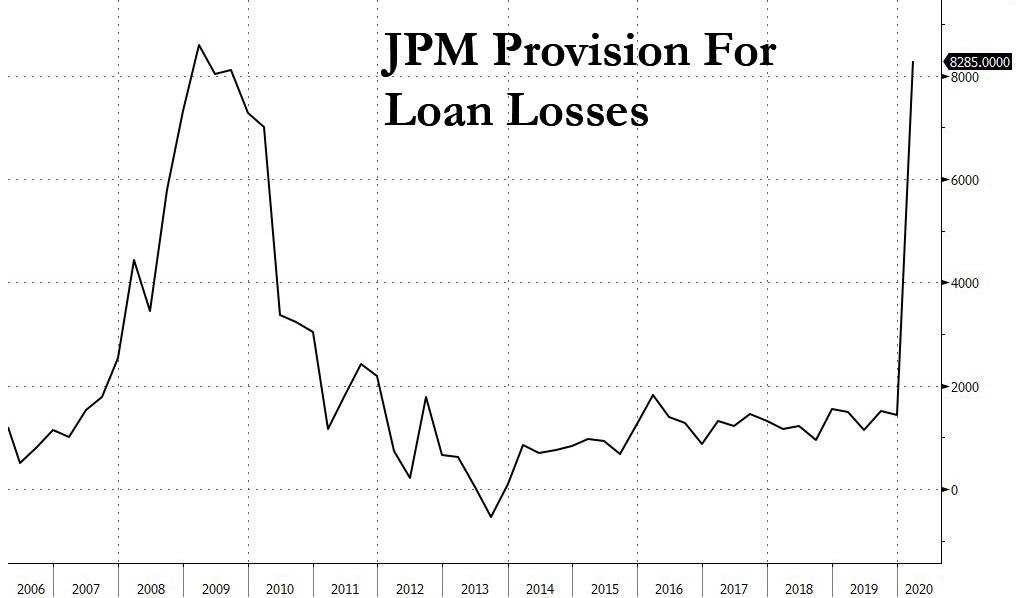

Two weeks ago we pointed out something concerning:shortly after JPMorgan reported that its loan loss provision surged five fold to over $8.2 billion for the first quarter, the biggest quarterly increase since the financial crisis, in preparation for the biggest wave of commercial loan defaults since the financial crisis…

… the bank hinted that things are about to get much worse when it first halted all non-Paycheck Protection Program based loan issuance for the foreseeable future (i.e., all non-government guaranteed loans) because as we said “the only reason why JPMorgan would “temporarily suspend” all non-government backstopped loans such as PPP, is if the bank expects a default tsunami to hit coupled with a full-blown depression that wipes out the value of any and all assets pledged to collateralize the loans.”

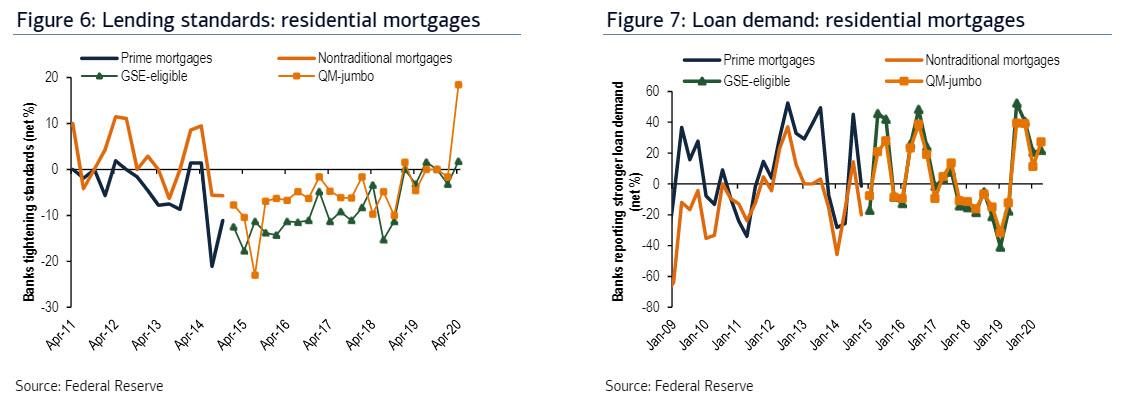

Shortly after, the bank also said it would raise its mortgage standards, stating that customers applying for a new mortgage will need a credit score of at least 700, and will be required to make a down payment equal to 20% of the home’s value, a dramatic tightening since the typical minimum requirement for a conventional mortgage is a 620 FICO score and as little as 5% down. Reuters echoed our gloomy take, stating that “the change highlights how banks are quickly shifting gears to respond to the darkening U.S. economic outlook and stress in the housing market, after measures to contain the virus put 16 million people out of work and plunged the country into recession.”

Finally, just days later, JPM also exited yet another loan product, when it announced that it has stopped accepting new home equity line of credit, or HELOC, applications. The bank confirmed that this change was made due to the uncertainty in the economy, and didn’t give an end date to the pause.

In short, JPM appeared to be quietly exiting the origination of all interest income generating revenue streams over fears of the coming recession, which prompted us to ask “just how bad will the US depression get over the next few months if JPMorgan has just put up a “closed indefinitely” sign on its window.”

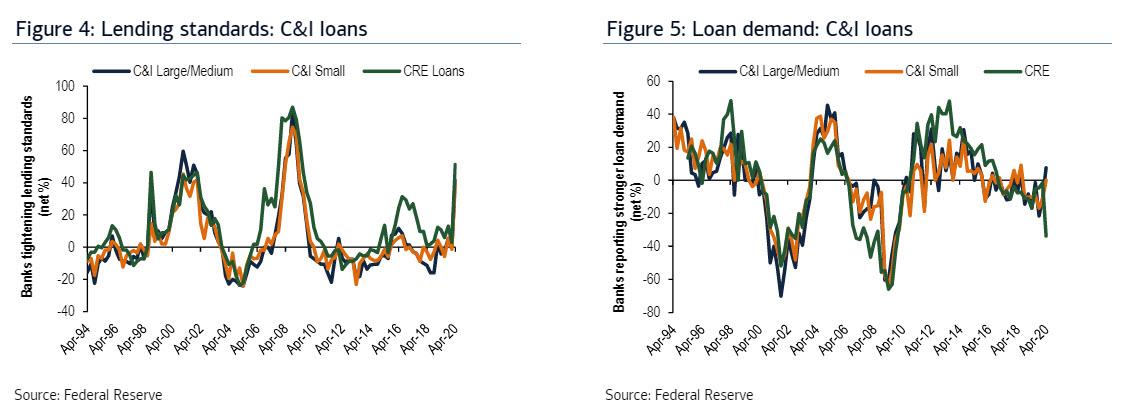

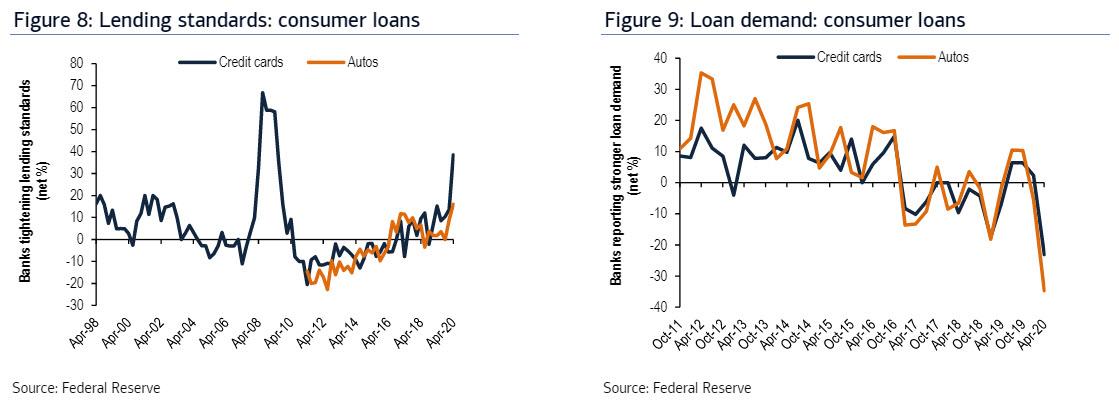

On Monday, we got confirmation that it was not just JPMorgan but all US commercial banks that are making the issuance of new credit virtually impossible, when the Fed’s April senior loan officer survey showed that banks tightened lending standards across the board for C&I, CRE, mortgage, credit card and auto loans. The loan standards for most products – such as C&I loans, residential morgages and credit cards – were hiked so much they nearly matched the standards during the financial crisis when it was virtually impossible to get any new loans.

On the demand side, banks understandably reported stronger demand for large/medium C&I loans and mortgages but somewhat surprisingly weaker demand for CRE, credit card and auto loans. Most banks that reported stronger C&I loan demand cited an increase in customers’ precautionary demand for cash and liquidity and a decrease in customers’ internally generated funds as reasons, while several banks that indicated weakening CRE and consumer loan demand noted the impact of the COVID-19 crisis. Finally, banks pointed to clients’ increased interest in new credit facilities, in particular the Small Business Administration’s Paycheck Protection Program, which is logical: why struggle to get a nearly impossible bank loan when you can just get a grant from the government.

C&I and CRE loans

Net 41.5% and 39.7% of banks said they tightened lending standards for large/medium and small C&I loans in the April survey, respectively, compared with net flat and 1.4% reporting easing standards in the prior January survey, according to Bank of America. Meanwhile, the share reporting tighter standards for CRE loans jumped to 51.3% in the April survey from 2.9% in the January survey (Figure 4). Note that the CRE value reported here is the average for the three separate questions on loans for construction and land development, loans secured by nonfarm nonresidential structures, and loans secured by multifamily residential structures, which all showed increases in the share reporting tighter lending standards in the April survey compared to the January survey.

Meanwhile, a net 7.6% of banks reported stronger demand for large/median C&I loans while the net change in demand for small C&I loans was flat in the April survey, respectively, compared with net 11.1% and 11.4% reporting weaker demand in the January survey. On the other hand, the net share reporting weaker CRE loan demand increased to 33.8% in April from 1.5% in the January survey (Figure 5).

Mortgages

Net 1.8% and 18.5% of banks reported tighter lending standards for GSE-eligible and QM-jumbo mortgages in April, respectively, versus net 3.2% and 1.6% reporting easier standards in the prior January survey (Figure 6). On the other hand, the net share of banks reporting stronger demand increased to 21.8% and 27.3% in April from 20.6% and 11.3% in January for GSE-eligible mortgages and QM-jumbo mortgage loans, respectively (Figure 7).

Consumer loans

The net share of banks reporting tighter lending standards increased to 38.5% and 16.0% in April from 13.6% and 8.9% in January for credit card and auto loans, respectively (Figure 8). On the other hand, net 23.1% of banks reported weaker demand for credit card loans in April vs 2.3% reporting stronger demand in January, and net 34.7% reported weaker demand for auto loans, up from 5.4% in January (Figure 9).

Tyler Durden

Tue, 05/05/2020 – 18:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com