Nomura: “Imagine The Concept Of A Fed “Hiking Cycle” Ever Again – HAAAAA”

One day after Charlie McElligott laid out his medium-term bearish case, warning that a combination of excessive exuberance on the reopening coupled with adverse seasonals would make this a summer to sell, this morning the Nomura strategist looks at the rates complex in the aftermath of yesterday’s record Treasury refunding announcement which led to a sharp spike in the long-end amid rising fears of a supply deluge, and writes that the “cash-crunch issuance realities for both Govts and Corps is the catalyst behind the recent incremental bear-steepening seen in curves”, adding that while the 10Y issuance acted as the pivot, where issuance increased $5B/month and $15B/qtr…

… the real shocker “that crunched the long-end however was the new 20Y auction, coming-in ~ $10 larger than the highest estimate at $54B.”

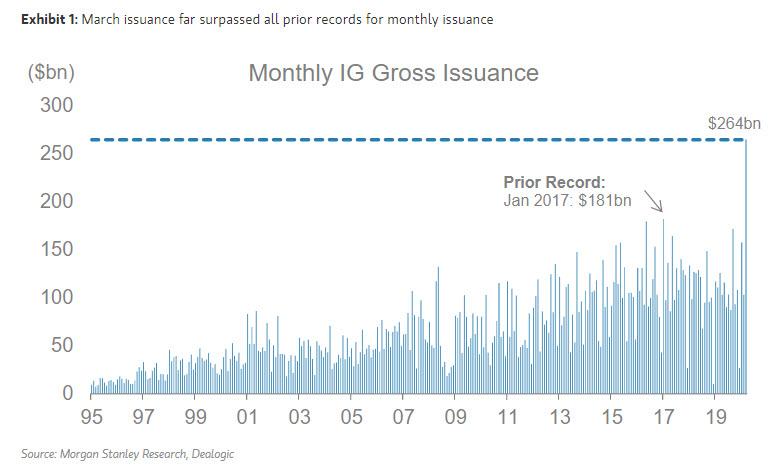

The flood of Treasury issuance comes at a time when as we pointed out two weeks ago…

… there is already a record rush to market from corporates due to the crisis – bolstered by another $29B in 17 deals on Wednesday, $17B on Tuesday; and another $29B Monday – all “seeking operational funding to stay liquid or even “alive”—and seeing remarkable demand for said paper from investors—who realize that there will be no escaping from the central bank “financial repression” this time around, and are thus grabbing into any “safe” yield they can find.”

Which brings us to McElligott’s cynical summary: “imagine the concept of a Fed “hiking cycle” ever again—HAAAAA.“

However, quick to pour cold water on expectations that the steepening in the yield curve is a bullish sign for equities, hinting at rising inflation, McElligott is quick to note that despite Brent Crude now +35% off late April lows, “the bear-steepening is a SUPPLY phenomenon and NOT about a more upbeat view on growth- or inflation- trajectory, with 10Y Breakevens effectively “unch” during the past 10 sessions.”

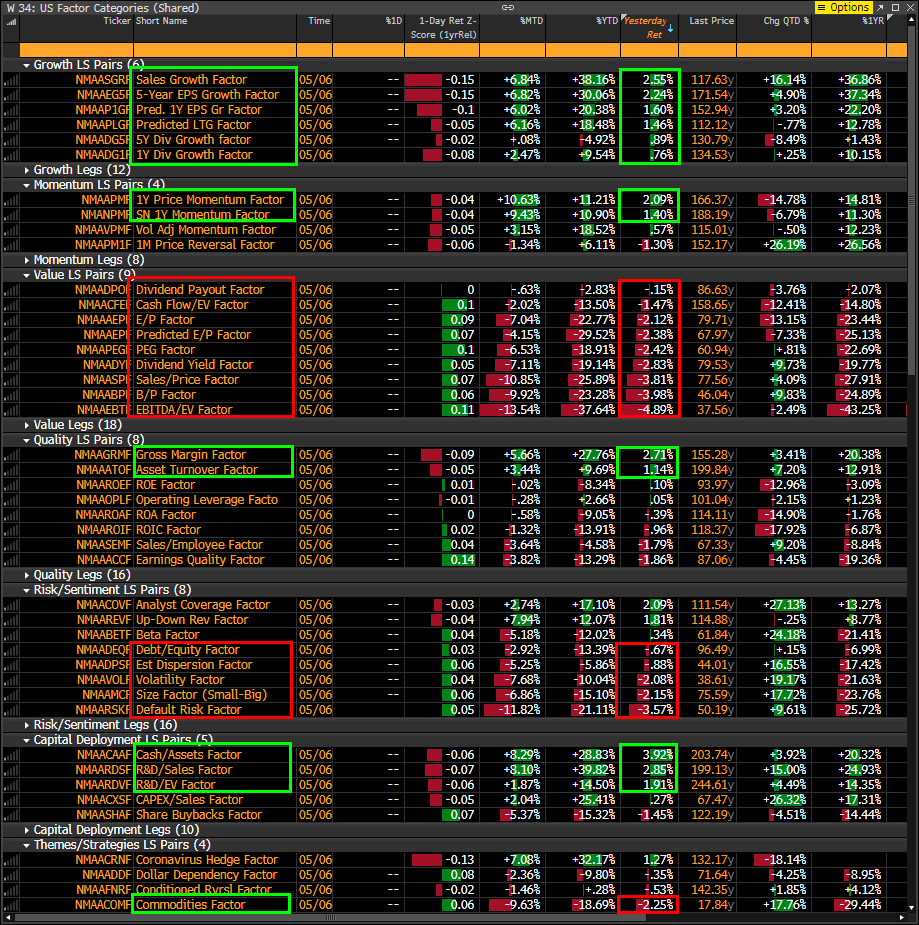

This is where, as McElligott adds, he ties-in his bullish “1Y Price Momentum” factor call from yesterday into the anticipated Summer doldrums and pivot lower in risk-sentiment “because investors continue to have no interest in those “most economically sensitive” Cyclical sectors (“Momentum Shorts” are predominately “Value/High Beta Longs”), while continuing to hide in the “comfort blanket” of Duration-Sensitives (“Momentum Longs” are predominately Secular Growth / Nasdaq which can grow regardless and don’t require a hot economic cycle to work).”

Furthermore, Cyclicals remain under pressure with Industrials, Materials, Financials and Energy as 4 of the 6 worst-performing sectors in the S&P, as momentum juggernaut tech continues to steam roll everything in its path, confirming again that despite the UST curve bear-steepening yesterday “this was an issuance- driven curve move, NOT one about a growthier outlook.”

Summarizing all of this, McElligott writes that “despite Crude’s rally and the “optical” curve bear-steepening, “Value” was SMASHED (again) yesterday (EBITDA / EV factor -4.9%, Sales / Price factor -3.8%, B/P factor -4.0%), while “Growth” yet again screamed higher (Sales Growth factor +2.6%, 5Y EPS Growth +2.2%)”, in line with the Nomura strategist’s rationale behind my bullish “Momentum” call in coming months got off to a strong start (+2.1% on session).

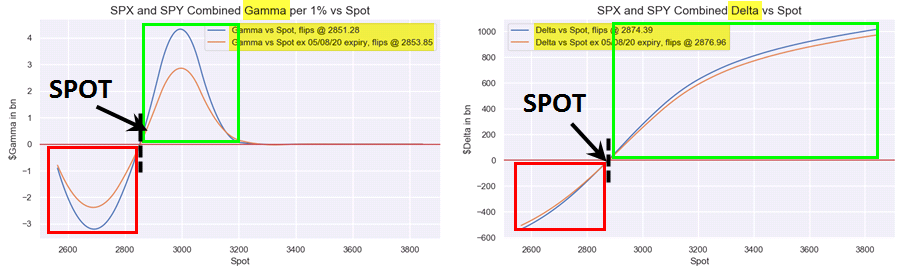

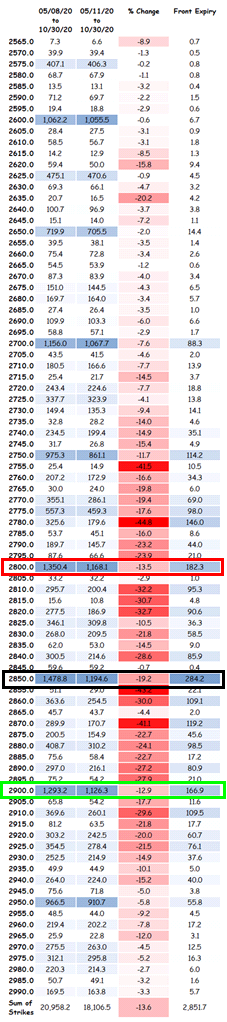

And while McElligott’s medium-term view remains unchanged from yesterday, what about the short-term? Here, as he points out, the S&P remains in the same “no man’s land” gamma dynamic as yesterday, with the S&P held at the “Neutral Gamma” line (flips at ~2850-2855 in spot), the “Neutral Delta” line (flips at spot 2875) and between the monster $Gamma strike lines at 2800 ($1.350B), 2850 ($1.479B) and 2900 ($1.293B)

… with no momentum ignition triggers in proximity to spot as the Emini remains quite far from nearest CTA triggers in either signal direction: stocks have to either drop below 2733 to get to “-100% Short” or rise above 2944 to get to “+100% Long”.

Tyler Durden

Thu, 05/07/2020 – 11:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com