Buy The Retail Trading Frenzy, Sell The Reality

Submitted by Eleanor Creagh, Australian Market Strategist at Saxo Bank,

Summary: Investors continue to buy the reopening story, with markets remaining completely detached from fundamentals and the real economy.

Asian stocks are pushing higher to start the week. This as technicals remain on side with higher equities, the VIX has dropped below 30 as central banks expanding balance sheets succeed in vaccinating volatility likely driving systematic inflows and China stimulus hopes buoy sentiment. Aussie stocks powering higher towards the heavy resistance levels at 5,500 as lockdowns are set to be eased in the most populous states NSW and VIC this week.

Re-opening Uncertainty

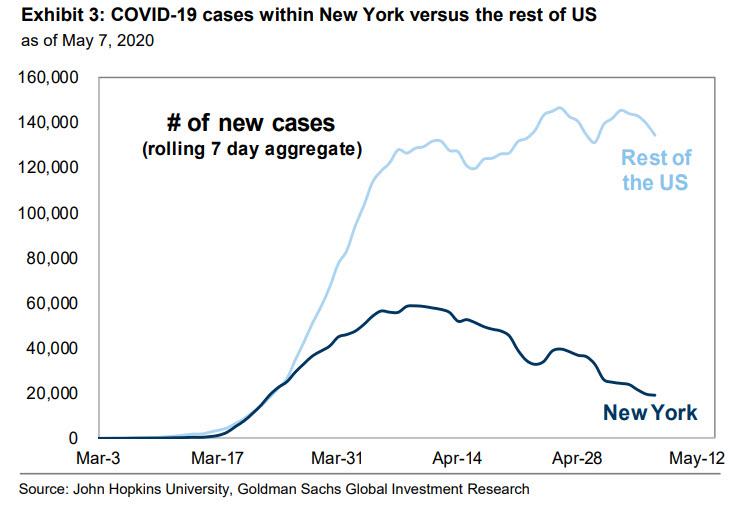

At this juncture, we remain cautious and see few remaining positive catalysts to drive continued upside. But this view must be balanced with retail investor flows and speculative positioning betting on a sharp rebound and unwavering central bank support that continues to drive equities higher. The optimism with respect to re-opening is priced and the news flow is incrementally negative with the resumption of the US/China disentanglement rhetoric, surging unemployment and 2nd infection waves in China and South Korea as restrictions are relaxed. In South Korea, it appears that cases have risen once more following the re-opening of bars and nightclubs. A clear sign that the rebound dynamics will be altered by prolonged distancing measures and the “reopening reality” is likely to be clunky and slow. Also a warning bell for the US reopening where the case count is slowing, but remains high as restrictions are lifted. A risk for renewed case growth as activity resumes.

Chain reaction

The dissonance of price action in equity markets and the real economy is even stranger in the context of the uncertainties that surround the re-opening process (above), employment recovery and consumers behavioral response. There is a wide range of economic and consumer outcomes that perpetuate an increasingly murky outlook. In China, recent evidence has shown that consumers remain fearful and consumption activity has not rebounded back to “normal” levels, local governments have resorted to distributing vouchers to shoppers in a bid to get consumer spending again. Given the sheer cliff edge drop in consumption due to aggressive lockdowns a rebound in consumption will not be hard to generate, but the more pertinent question is how quickly previous levels of demand can be resumed. A cautious consumer will lag on any recovery and generate second order implications in itself beyond the impact of COVID-19 restrictions.

The labour market recovery will also be crucial to aggregate demand rebound dynamics. Jobs around the world have been lost with frightening speed. According to the International Labour Organisation 2.7bn workers worldwide are now affected by lockdown measures, representing around 81% of the world’s workforce. Employment recoveries are never V-shaped, although it is true that this recession has been “self-inflicted” and therefore the labour market may rebound more quickly than in prior recessions. The downturn in itself generates negative externalities and second order implications that cascade making it less likely the labor market can snap back. Particularly if we consider jobs that may never be re-instated, a reality that calls into question aggressive market pricing of a V-shaped recovery.

In reality it will take a long time to return to normal or pre-crisis output levels, it may not be hard to improve economic activity from the sudden stop but don’t confuse that with confirmation of a V-shaped recovery. The re-opening story will not be one-dimensional, the secondary effects of a cautious consumer and lagged consumption rebound along with slow labour market recovery make the re-open far more complicated than the simplistic story investors are buying.

FOMO and Retail Participation

However, with the above in mind and looking at the price action across major equity indices, it is clear the market forces and real economy direction are very different at present.

Valuations have rebounded hard and fast, leaving equities with little margin for error and vulnerable to correction if the real economy outlook takes center stage. However for now markets continue to trade on liquidity and fiscal stimulus/monetary intervention with a side of speculative mania/FOMO.

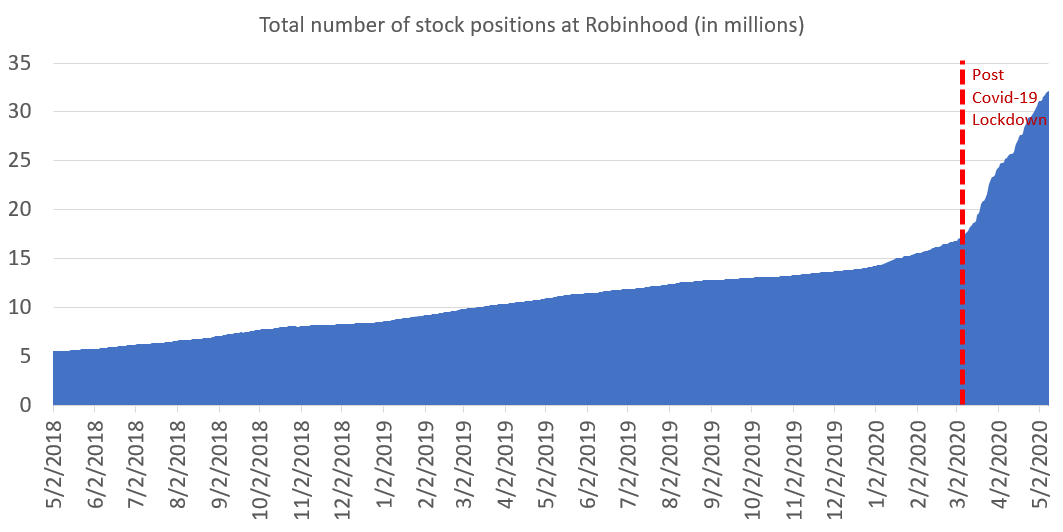

Retail investor flows are soaring as investors conditioned by the central bank put to “buy the dip” go all in a snapback in economic activity. Using Robinhood positioning as a proxy for retail sentiment, that certainly seems to be the case:

Tyler Durden

Mon, 05/11/2020 – 11:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com