“A Contradiction In Terms” – Here Is The Confusing Message Beijing Just Sent To Global Investors

Tyler Durden

Fri, 05/22/2020 – 11:55

While it has taken on secondary importance in light of the escalating international fight over the fate of Hong Kong, and it clearly is international as of Friday morning, as the following handy summary from Bloomberg demonstrated:

-

Pompeo condemns China’s plan to impose legislation

-

Biden says U.S. “should not remain silent”

-

U.K. says China must respect city’s freedoms

-

HK’s Lam offers full cooperation on security law

-

China says no country has right to interfere in Hong Kong

-

HKMA says it will maintain HKD stability

… a key message from the National People’s Congress as pertains to China’s economy which as a reminder served as the global reflation dynamo during the 2008 financial crisis, is that China – which for the first time removed its GDP target – plans to boosting growth by expanding its fiscal deficit from 2.8% of GDP to 3.6%, despite, as Rabobank pointed out, “nobody pretending to know what GDP will be, and that too many pretend this covers all the public-sector deficit when the IMF says it is 10% if you include local governments, which you must unless you want to imagine vast defaults ahead.”

Additionally, the NPC projected issuance of CNY3.75 trillion in “special” bonds, up from 2.15 trillion in 2019, and CNY1 trillion in sovereign bond issuance, which as we noted yesterday is pittance compared to what the US or even the UK are spending relative to GDP. Indeed, the South China Morning Post yesterday ran a story suggesting a larger fiscal stimulus is coming soon than was seen post-GFC. If so, as we keep saying, watch CNY very closely.

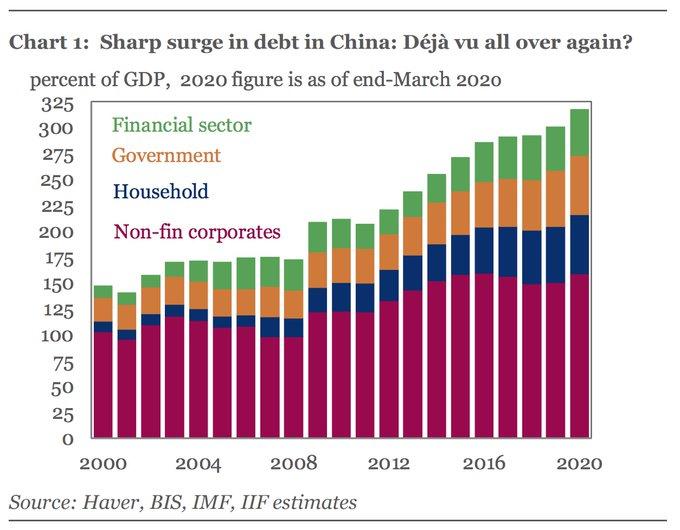

Meanwhile, a far bigger problem facing China is its already outrageous debt load, which according to the IIF, hit a record 317% of GDP in Q1, 2020 up from 300% at the end of 2019. As shown in the chart below, the rise in China’s total debt in

the years since the 2008 global financial crisis has been unprecedented, from around 172% of GDP to over 300% in 2019.

So one one hand, Beijing has eliminated its anchoring GDP forecast, which for years provided at least artificial stability and was used as a safety benchmark by domestic producers and consumer to know that no matter what happens Beijing will be there to prop up the economy, while on the other it is suggesting that its intervention will be severely limited by the already grotesque debt limitations. As BMO’s FX strategist Stephen Gallo puts it, “the messages from the CCP on domestic policy at the annual session of the 13th NPC were a mix of activism and restraint.”

As he further notes, “while dropping the GDP target and moving away from “unprofitable growth” is not unhelpful for financial stability risks, investors are not left with the impression that debt-dependency is going to decline sharply from here either; for instance, the CCP will be explicitly targeting some forms of credit growth alongside the unemployment rate.”

Put differently, this suggests that “the CCP’s stance on the issues of debt and “growth at all costs” is a confusing contradiction in terms” (i.e. this is the “cold fire” version of economic policy).

Putting these disparate message together, Gallo summarizes that “when these developments are factored into what we already know about local interest rates and the latest geopolitical developments, the case for a sustained rebound in the RMB becomes even less convincing (and it already wasn’t that convincing)” and adds that “one reason PBoC is allowing the RMB to weaken a tad vs the USD now is because the latter is trading sideways” as the last thing Chinese regulators want is to set off a wave of aggressive USD buying across the FX space.

His conclusion: “Who was it that said China is not dollar-dependent? Hint: it is.“

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com