Mexican Exports Plunge Most On Record Despite Historic Peso Rout

Tyler Durden

Mon, 05/25/2020 – 09:30

The plunge in the Mexican peso in March and April was, in theory, supposed to boost Mexican exports. That did not happen and instead this morning the National Statistics Institute of Mexico reported that April exports crashed 41% Y/Y, the most on record to $23.38BN, while imports slumped $26.5 billion, as the Mexican economy followed the rest of the world into a state of self-induced shutdown.

The result was an April trade deficit of $3.09 billion, significantly worse than consensus expectations for +US$2.0bn surplus and the +US$1.51bn print a year ago.

It was also a mirror image of the March $3.4BN surplus and far below the $2.0BN surplus consensus estimate. In fact, the reported deficit was below the worst forecast among all economists. The April deficit was the worst going back to the financial crisis if one excludes the seasonally poor January when the Mexican economy has posted a substantial deficit every year.

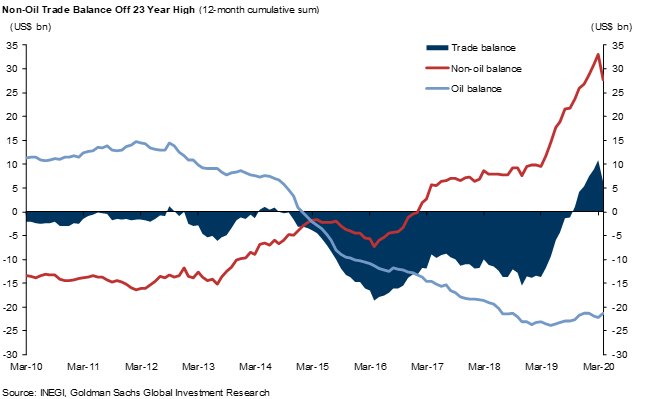

The deterioration in the trade balance from a year ago was driven exclusively by the non-oil balance (-US$1.8bn vs. +US$3.6bn a year ago) since the oil balance improved (-US$1.3bn from -US$2.1bn a year ago). The -39.4% yoy (-37.5% mom sa) variation in non-oil exports exceeded the also poor performance of non-oil imports (-27.6% yoy; -20.4% mom sa).

Crude oil export revenue declined 73.6% yoy in April, driven by a combination of lower export prices (-77.1%) but higher volumes (+15.2% yoy). The price of Mexican crude oil averaged $14.18 last month, down from $61.86 in April of 2019. Crude exports by volume increased to 1.18 million barrels per day from 1.02 million barrels per day a year before. The drop in oil prices also contributed to a 53% decrease in petroleum imports to $2.04 billion.

More ominously, non-oil exports declined by a large 39.4% yoy in April, with manufacturing exports down 41.9% yoy (auto exports -79.1% yoy and non-auto manufacturing exports -20.9% yoy). Non-oil imports declined 27.6% yoy in April: imports of non-oil intermediate goods declined 26.3% yoy and of non-oil consumer goods 37.9% yoy. Finally, as Goldman points out, imports of capital goods declined by 26.7% yoy in April (-17.4% yoy during Jan-Apr 2020). Finally, imports of capital goods declined by a large 7.4% mom sa in April (fifth consecutive monthly decline averaging -5.1% mom sa). The weakness of non-oil imports and of capital goods in particular do not bode well for near-term activity.

Of note, shipments of vehicles and auto parts were down 79% and other manufactured goods down 21%. Mexico’s auto industry, considered nonessential, was shut down for all of April, and production of cars and light trucks fell 99% from a year before.

Going forward Goldman expects to see “weak exports and imports driven by the sharp contraction of both global and domestic demand, lower commodity prices, and some supply chain disruptions due to extensive lockdown protocols”, even though the Mexican auto industry was changed to essential as of May 18, and plants were allowed to start reopening once they have new health and safety protocols in place.

What is concerning is that if the Mexican economy posted a record drop in exports when the peso tumbled to record lows, what happens now that the Peso has stormed higher from recent levels in anticipation of a V-shaped global economy recovery even as the central bank has been aggressively cutting rates and is expected to cut by a further 125bps in the coming 12 months?

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com