“The Disconnect Is Getting Wider And Wider”: Futures Storm HIgher As America Burns For 8th Night

Tyler Durden

Wed, 06/03/2020 – 08:10

“The disconnect between what the average person sees happening in the world and what they see happening in the financial markets is getting wider and wider,”

– Marshall Gittler, head of investment research at BDSwiss, wrote in a note to clients.

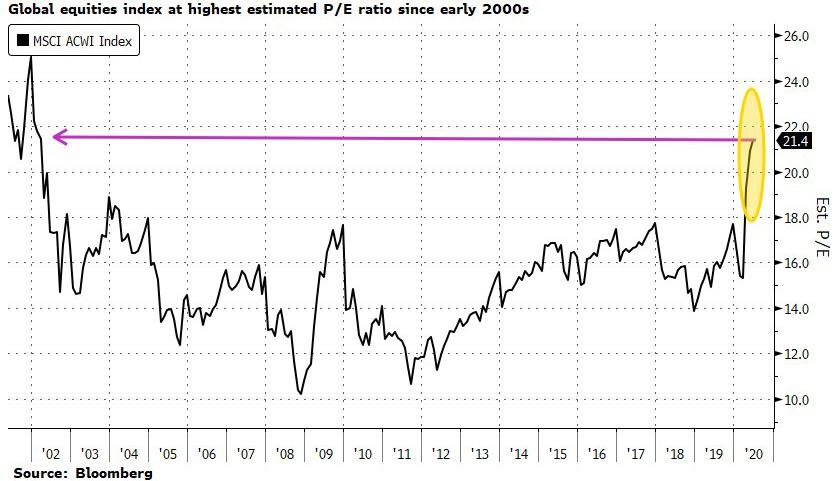

What rioting, what 40 million unemployed, what second wave? The MSCI All Country World Index has risen for 8 days in a row, a testament to the fact that not only retail investors but global markets now view stocks as a risk free asset, assuring that the next bursting of the bubble will be unforgettable, prompting even Bill Dudley to say on BBG TV that “some Fed intervention has created a bit of moral hazard.” That’s right Bill, and it may have something to do with the fact that overnight America burned for an 8th consecutive day in nationwide riots as tens of thousands of people defied U.S. curfews to take to the streets.

Anyway, until the next crash all one can do is buy, confident that central banks will always be there to step in and bail everyone out, and sure enough world shares hit three-month highs on Wednesday and the dollar fell for the sixth day on the usual narrative of “hope” and “optimism” for more monetary stimulus and the global economic reopening, while ignoring the worst civil unrest in the United States in 50 years as well as rising COVID-19 tolls.

The MSCI world equity index, which tracks shares in 49 countries, rose to its highest since March 6, having gained throughout the Asian session. The index is down 7% year-to-date, after pandemic lockdowns that have pushed many economies into contraction, but with markets now confident in a V-shaped recovery it’s only a few days before stocks turn green for the year.

Futures rose on both the S&P 500 Index and the Nasdaq 100, which closed on Tuesday within 1% of its record high. Micron Technology and Apple climbed in the premarket, helping lift the S&P just shy of 3,100, and now trading at 26x consensus 2021 earnings! Treasuries dropped as did gold, while the dollar index hit its lowest level since early March.

“If I look at the markets, I see a V-shaped recovery,” Mark Mobius, co-founder at Mobius Capital Partners, said on Bloomberg TV. “What we’re hearing from companies around the world is that once the lockdown is over, they’re going to get the customers coming back in droves.”

They better, because with the global PE ratio at the highest level since the dot com bubble, risk is priced to absolute perfection.

Meanwhile markets continued to ignore every single risk, including tense U.S.-China relations that may jeopardize the US-China trade deal, as well as violent clashes and looting in American cities.

European shares – which have emerged as the latest focal point for momentum chasers – also advanced, led by insurance and bank subgroups lead gains as they advance 4.1% and 3.2%, respectively. Europe’s Stoxx Europe 600 Index rose as much as 1.5% to a session peak, heading for the highest close since March 6, as renewed risk-on appetite boosts global equity markets.

Asian stocks also gained, led by finance and IT, after rising in the last session. All markets in the region were up, with Singapore’s Straits Times Index gaining 2.9% and South Korea’s Kospi Index rising 2.9%. Trading volume for MSCI Asia Pacific Index members was 32% above the monthly average for this time of the day. The Topix gained 0.7%, with DLE and W-Scope rising the most. The Shanghai Composite Index was little changed, with Eastern Gold Jade advancing and Danhua Chemical Technology declining the most. In China, Japan and South Korea, where COVID-19 is relatively contained, stock indexes have recovered substantially to be only about 5-6% below this year’s peaks.

There are some signs of recovery in business activity as governments restart their economies, albeit in the knowledge that easing lockdowns too early could trigger a second wave of COVID-19. China’s Caixin Service PMI survey showed activity in China recovered to pre-epidemic levels in May, with the index printing at the highest level in a decade.

In rates, the 10Y yield briefly rose above 0.70% – a level many claimed was a CTA selling trigger – but has since dipped back under, confirming again that nobody has any real idea what prompts systematic funds to buy or sell. The Treasury yield curve continued to steepen, partly reflecting the sale of more government debt to finance massive stimulus efforts. The 30-year U.S. Treasuries yield rose to as high as 1.532%, its highest since mid-March, as expectations of central bank policy support kept shorter yields in check; the yield gap between five- and 30-year Treasuries rose to 118 basis points, the highest since early 2017.

Germany’s ten-year government bond yield rose to its highest since mid-April as the global risk-on mood saw demand for safer debt decline, slipping back slightly to -0.386% by 0825 GMT. The European Central Bank is expected to ramp up stimulative bond purchases when it meets on Thursday.

In FX, broader economic optimism supported risk-sensitive currencies and pushed down the dollar, which hit a three-month low against a basket of comparable currencies. The euro which rose above $1.12 for the first time in 11 weeks in early London trading as data showed the region’s economic activity increased in May to the highest in three months after an easing of lockdown restrictions, is on track for a seven-day winning streak against the dollar – its longest streak since December 2013. The safe-haven Japanese yen hit a two-month low of 108.85 to the dollar before bouncing back to around 108.79 per dollar.

“In a scenario where there’s no meaningful recurrence of the virus, and progress is made on treatments and vaccines, we expect the U.S. dollar’s weakness to continue,” said Mark Haefele, CIO at UBS Global Wealth Management. And if there is a recurrence, Mark probably expects the Fed to inject another several trillion, which would also force the dollar lower.

Oil initially rose on Wednesday, with Brent above $40 for the first time since March, as optimism mounted that major producers will extend output cuts and a recovery from the pandemic will spur demand for fuel. However, crude failed to sustain the rally above $40 after Bloomberg reported that a meeting between OPEC and its allies is unlikely to happen this week over issues of cheating. Spot gold fell 0.5% to around $1,717 per ounce.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com