Futures Tumble As Historic Rally Fizzles; Treasurys, Dollar Jump

Tyler Durden

Tue, 06/09/2020 – 07:59

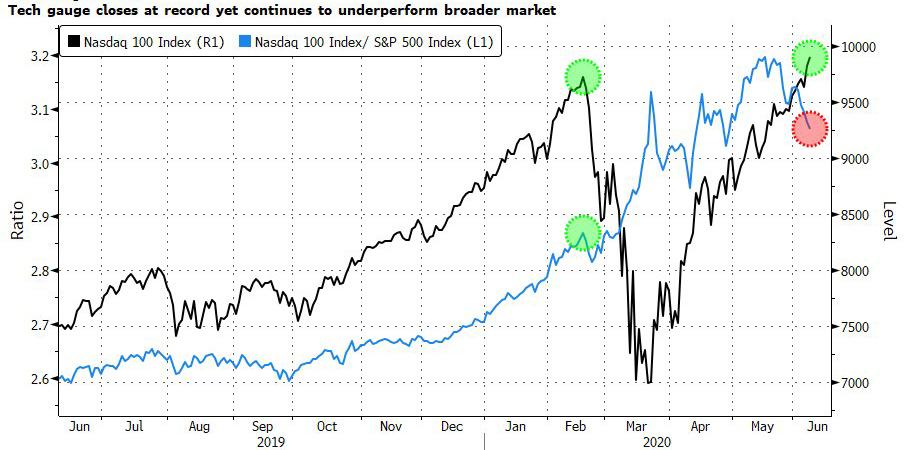

After hanging at 3-month highs, U.S. equity futures took a sharp leg lower around the time Europe opened, and fell around 1%, sliding back under 3,200 along European stocks on worries that the historic rally in risk assets has overshot the economic recovery giving back some gains after the Nasdaq notched a record closing high in the previous session, with focus now on the Federal Reserve’s two-day policy meeting. Treasuries advanced with gold and the yen.

The drop comes one day after the Nasdaq hit a fresh record closing high on Monday, while the S&P 500, which is about 5% below its own all-time high, also erased its year-to-date losses.

Declines in the U.S. premarket were broad, hitting many of the “value” stocks that had soared in recent days, ranging from cruise lines to oil drillers: American Airlines, United Airlines Holdings, Alaska Air and Marriott International all dropped between 4.5% and 9.0% in early trading after surging on Monday following another retail rush. Soon to be bankrupt Chesapeake tumbled by more than 50% following a Bloomberg reported it was preparing to file for Chapter 11; even bankrupt Hertz dropped and now sports a market cap of only $700 million or so. Macy’s rose 5.8% after raising $4.5 billion in financing, as it tries to navigate through the fallout from the COVID-19 pandemic.

In Europe, the Eurostoxx 50 dropped as much as 1.8%, with FTSE MIB and IBEX underperforming peers. The Stoxx 600 Banks Index slumped as much as 5.1% on Tuesday, the biggest drop in two months. Losses were broad, as cyclical sectors all dropped with banks, autos, oil and construction among the weakest sectors, while health care and food outperform. The decline comes after strong gains over the past two weeks that pushed the banking index up 24%.

Asian stocks gained, pushed higher by Monday’s US momentum, led by finance and consumer staples. Markets in the region were mixed, with Australia’s S&P/ASX 200 and Hong Kong’s Hang Seng Index rising, and Thailand’s SET and Jakarta Composite falling. The Topix declined 0.1%, with Asahi Broadcasting Group and Mynet falling the most. The Shanghai Composite Index rose 0.6%, with Chengdu B-Ray Media and Hangzhou Jiebai Group posting the biggest advances

As Bloomberg notes, “after a record-breaking rally that added $21 trillion to global stock markets, valuations look now stretched and technical indicators suggest a pullback is overdue. The World Bank warned the economy will contract the most since World War II this year, reducing incomes and sending millions of people into poverty in emerging and developing nations.”

“There are a lot of unknowns that we are dealing with despite the fact that normalizations of economic activities are still on track,” said Value Partners manager Frank Tsui. “There are still a lot of unknown factors.”

While no major policy announcements are expected when the U.S. central bank wraps up its meeting on Wednesday, policymakers will issue economic projections for the first time since December, before a decade-long economic expansion was brought to a grinding halt due to coronavirus-induced lockdowns. Last week’s strikingly strong employment data for May strengthened views that the worst of the economic fallout from the pandemic was over, and is also expected to be discussed at the meeting. On Monday, the Fed expanded its Main Street Lending Program, allowing more companies to participate and lessening the burden on banks that create the loans, confirming that America’s small businesses are getting crushed.

In rates, Treasuries jumped with yields falling 1-6 basis points across the curve, the 10Y sliding just above 0.80%, bull-flattening for second consecutive session. Cash volumes have been light, however, especially in long maturities. According to Bloomberg, the bull-flattening eroded profit in curve steepeners, a popular trade ahead of Wednesday’s FOMC meeting. Yields richer by 1bp to 7bp across the curve led by 20- and 30- year sectors, flattening 5s30s by 3.2bp and 2s10s by 3.5bp; 10- year yields lower by 4.4bp at ~0.83% with bunds, gilts both cheaper by around 4bp. Treasury auction cycle resumes with $29b 10-year reopening at 1pm ET, concludes with $19b 30-year reopening Thursday, with FOMC meeting intervening on Wednesday. A gauge of European junk-grade credit risk increased the most since April.

In FX, the dollar rose against a basket of currencies for the first time in nine days. The Bloomberg Dollar Spot Index ended its longest losing streak since 2011 as the greenback rose against most Group-of-10 peers ; the euro edged lower, to trade below 1.13 per euro dollar and bunds edged higher. The pound fell against the dollar after an eight-day winning streak for the currency looked to have taken it far enough, and wider risk appetite faded on global markets. Norway’s krone plunged as oil prices slumped. Japan’s currency rose against all its Group-of-10 peers and staged its biggest 2-day rally against the greenback in more than two months after a decline in stocks in Tokyo prompted traders to cover short yen positions. The Australian dollar swung to a deep loss against the greenback after climbing to the highest level this year, dragged lower by the yen’s surge.

In commodities, the energy complex continued to leak in the aftermath of the OPEC+ meeting as players question the enforcement (or not) of the agreed upon output cuts with laggards such as Iraq already hinting as difficulties on overcompliance. Further, some traders also cite a “buy the rumour, sell the fact” playbook given the rally in the complex heading into the meeting. Meanwhile, BP’s demand-driven job cuts yesterday added further weighed on prices. Elsewhere, in Libya, source reports noted that El-Sharara’s production has again been shuttered by armed men ordering employees to stop working – which comes just two days after the restart and lift of force majeure on exports (now reimposed), albeit the oilfield was only producing at a tenth of its 300k BPD full capacity – which was expected to be reached within 90 days

Expected data include wholesale inventories. Tiffany and Chewy are reporting earnings

Market Snapshot

- S&P 500 futures down 1% to 3,196.25

- STOXX Europe 600 down 1.2% to 369.75

- MXAP up 0.4% to 161.06

- MXAPJ up 0.5% to 517.26

- Nikkei down 0.4% to 23,091.03

- Topix down 0.1% to 1,628.43

- Hang Seng Index up 1.1% to 25,057.22

- Shanghai Composite up 0.6% to 2,956.11

- Sensex down 0.4% to 34,228.05

- Australia S&P/ASX 200 up 2.4% to 6,144.95

- Kospi up 0.2% to 2,188.92

- German 10Y yield fell 1.9 bps to -0.338%

- Euro down 0.4% to $1.1247

- Italian 10Y yield fell 0.7 bps to 1.234%

- Spanish 10Y yield rose 0.8 bps to 0.556%

- Brent futures down 1.8% to $40.07/bbl

- Gold spot up 0.5% to $1,706.57

- U.S. Dollar Index up 0.5% to 97.06

Top Overnight News from Bloomberg

- Demand for government bonds is showing no signs of letup, with Ireland securing record investor demand despite a host of countries, including the U.K., selling debt

- Prime Minister Boris Johnson will talk his cabinet through his plans for easing the U.K.’s lockdown on Tuesday after officials reported the lowest number of daily deaths since restrictions were imposed

- German exports plunged at a record pace in April when economies around the world shut down to contain the coronavirus

- French economic output will take two years to recover from the virus-related slump that that will inflict even longer lasting damage on the labor market, the country’s central bank said

- Deflation is back on the minds of European Central Bank officials, presaging battles for President Christine Lagarde over whether the euro zone needs yet more monetary stimulus.

- Japan’s famously low- yielding bonds hold surprising appeal for Australian investors, thanks to how cheap the yen is in funding markets. Investors holding Australian dollars can generate healthy returns on 10- year and 30-year JGBs using cross-currency basis swaps

The risk tone across the Asia-Pac region was mostly positive with the regional bourses spurred by the firm handover from Wall St where the DJIA led the respectable gains across the major indices and the Nasdaq printed a fresh record high as there wasn’t much to derail the ongoing reopening and recovery narrative. Furthermore, the S&P 500 turned positive YTD and all sectors closed in the green with substantial gains seen in energy names following the OPEC+ output cut extension, despite an actual pullback in oil prices that was attributed to participants selling the news and concerns regarding compliance issues. ASX 200 (+2.4%) and Nikkei 225 (-0.4%) traded mixed with Australia the outperformer as it played catch up on return from the holiday closure and with gains spearheaded by financials and energy, while the Japanese benchmark lagged as exporters suffered from the ill effects of a stronger currency. The KOSPI (+0.2%) was subdued after North Korea announced to sever communication with South Korea completely from today and with index heavyweight Samsung Electronics failing to hold on to most the opening gains despite the court ruling to reject the arrest of de facto head Jay Y. Lee. Elsewhere, Hang Seng (+1.1%) climbed back above the 25k milestone with the government planning to bailout Cathay Pacific through a HKD 30bln loan and the Shanghai Comp. (+0.6%) conformed to the predominantly upbeat tone after the PBoC resumed its liquidity efforts, albeit with a reserved CNY 60bln injection. Finally, 10yr JGBs extended on this week’s rebound amid a similar recovery in USTs and underperformance of Japanese stocks, but with upside capped amid the lack of BoJ presence in the market today.

Top Asian News

- Japan Low-Yield Bonds Have Surprise Appeal for Aussie Funds

- China Urges Students to Assess Risks of Studying in Australia

- How Covid Upended 20 Million Lives in India’s Finance Hub

European stocks continue to deteriorate with downside exacerbated since the European cash open [Euro Stoxx 50 -2.0%] as investors side-line the recent Central bank/reopen-induced rally and fixate on the backdrop of skittish US-Sino rhetoric, potential second wave as lockdown measures ease and amid Western protests/riots. An argument could also be built for profit-taking at near pre-COVID highs ahead of immediate risk events such as the FOMC meeting and the Eurogroup summit. Sectors are mostly in the red with underperformance in energy and financials amid the deterioration in energy prices and yields, whilst broader sectors point to a more risk averse session and defensives fare better – particularly healthcare. The detailed breakdown paints a similar picture Travel & Leisure also bearing the brunt of risk aversion. In terms of individual movers, the session kicked off with the French aerospace sector significantly higher amid France unveiling a EUR 15bln package for the sector vs. Exp. EUR 10bln, albeit the likes of Airbus (-6.6%), Thales (-2.9%) and Safran (-3.5%) have since conformed to the broader risk tone. Meanwhile, British American Tobacco (-4.5%) extended on losses after trimming its FY guidance and pointing to low growth.

Top European News

- VW Board Infighting Rocks Carmaker Struggling With Virus Crisis

- Deflation Fears at ECB Mean Stimulus Battles Ahead for Lagarde

- Ireland Gets Record 50 Billion Euros of Orders in Bond Sale

- SocGen Signals Mixed Second Quarter as Tough Market Endures

In FX, not the biggest G10 move today, but Usd/Jpy has now reversed in excess of 2 big figures from post-NFP highs alongside similar pronounced retracements in Eur/Jpy and other Yen crosses as risk appetite evaporates amidst further re-flattening in debt markets. The headline pair is back down below 108.00 and a key technical level (200 DMA at 108.44), with the 50 DMA (107.65) exposed ahead of last Tuesday’s 107.51 low as safe-haven demand picks up generally to the benefit of Gold (over Usd 1700/oz again) and the Swiss Franc (Usd/Chf testing 0.9550 and Eur/Chf 1.0750 after breaching its 200 DMA – 1.0769). Back to the Yen, no adverse reaction to S&P cutting Japan’s A+ ratings outlook to stable from positive.

- AUD/NZD/CAD – The aforementioned deterioration in risk sentiment on rising Chinese-US/Australian tensions, NK terminating official lines of communication with SK and crude prices unwinding more OPEC+ extension gains, has hit the high beta Aussie and Kiwi particularly hard, even though independent impulses via improvements in NAB and ANZ business surveys overnight may otherwise be supportive. Indeed, Aud/Usd has pulled back around 150 pips to sub-0.6900 and Nzd/Usd is losing grip of 0.6500 after extending gains on the handle to around 0.6580, albeit Aud/Nzd still trending lower towards 1.0750 in the run up to NZ Q1 manufacturing sales. Meanwhile, the Loonie has handed back a chunk of its recent oil-powered upside vs the Greenback with Usd/Cad rebounding from circa 1.3359 to 1.3487 ahead of the FOMC on Wednesday, and this along with an element of broader risk-off positioning is keeping the DXY afloat near 97.000.

- NOK/GBP/SEK/EUR – All weaker, albeit to varying degrees, as the Norwegian Krona underperforms in wake of another bleak Norges Bank regional survey and the correction in crude, while Sterling and the Swedish Crown are undermined by cross selling against the Yen and the overall bearish tone, but the Euro holds up bit better vs the Dollar in consolidative trade. Eur/Nok has bounced firmly following a more concerted test of the 200 DMA, Cable is back under 1.2650 after failing to sustain 1.2750+ status, Eur/Sek is back above 10.4000 and Eur/Usd is trying to keep afloat within a 1.1314-1.1242 range.

- EM – In contrast to widespread reversals vs the Usd, the Try is just staying north of 6.8000 by virtue of Turkey finally ending years of isolation from Euroclear for bond settlements and joining the international platform.

In commodities, the energy complex continues to leak in the aftermath of the OPEC+ meeting as players question the enforcement (or not) of the agreed upon output cuts with laggards such as Iraq already hinting as difficulties on overcompliance. Further, some traders also cite a “buy the rumour, sell the fact” playbook given the rally in the complex heading into the meeting. Meanwhile, BP’s demand-driven job cuts yesterday added further weighed on prices. Elsewhere, in Libya, source reports noted that El-Sharara’s production has again been shuttered by armed men ordering employees to stop working – which comes just two days after the restart and lift of force majeure on exports (now reimposed), albeit the oilfield was only producing at a tenth of its 300k BPD full capacity – which was expected to be reached within 90 days. All-in-all, the OPEC fallout and deteriorating risk sentiment sees WTI July back below USD 38/bbl and closer to USD 37/bbl (vs. high USD 38.86/bbl) , whilst Brent suffers and has breached USD 40/bbl to the downside (vs. high 41.45/bbl). Participants today will be eyeing the monthly EIO STEO – with focus on their estimates for US oil production – the prior report estimated an average output of 11.7mln BPD in 2020 and 10.9mln BPD in 2021. Meanwhile, the weekly Private Inventory data could also offer some short-term volatility in prices. Turning to metals, spot gold continues to gain ground above USD 1700/oz amid risk aversion despite the firmer Buck as investors flee to the safe haven metal, with geopolitical tensions between North Korea/South Korea coupled with Aussie-Sino strains also underpinning the yellow metal. Copper prices are pulling back in tandem with the stock markets and broader sentiment, but prices remain comfortably north of USD 2.5/lb at present.

US Event Calendar

- 6am: NFIB Small Business Optimism, est. 92.5, prior 90.9

- 10am: JOLTS Job Openings, est. 5,750, prior 6,191

- 10am: Wholesale Inventories MoM, est. 0.4%, prior 0.4%; Wholesale Trade Sales MoM, est. -2.0%, prior -5.2%

DB’s Jim Reid concludes the overnight wrap

Yesterday we officially waved goodbye to the longest US cycle in history as the National Bureau of Economic Research declared that the US has been in a recession since February, thus ending a 128 month expansion. Whilst we’ll never know what would have happened if Covid-19 had not occurred, it’s fascinating that the best predictor of recessions, namely the US yield curve, has struck again. More by luck than judgement this time but the cycle did look increasingly stretched beforehand so this cycle may not have had much life left in it anyway. However it sums the current financial world up perfectly at the moment when on the day we get the official recession word, the NASDAQ hit a new record high and the S&P 500 erased all its declines for 2020. Looking at these indices you’d be forgiven for wondering what all the fuss has been about in 2020.

Looking at the moves in more depth, the S&P 500 closed up +1.20% (+0.05% YTD now), while the NASDAQ climbed +1.13% on the day. The Dow Jones was a big out-performer with a +1.70% advance, driven by Boeing’s +12.20% move. The rotation of recent days was in full effect as cyclicals like Energy (+4.32%) and Banks (+2.78%) were among the best performing industries, while semiconductors (-0.26%) were the only industry group lower yesterday.

About a half hour before US markets closed, the Fed announced that their “Main Street” program, which will open soon to eligible lenders, would be available to more businesses. This seemed to drive the last half percentage point of the rally last night. In terms of details, the central bank lowered loan minimums to $250,000 from $500,000 while extending the loan term to five years from four. Also businesses in the program will be able to defer principal payments on their loans for two years, up from the previously announced one. And finally, in a step meant to incentivize greater participation from banks, lenders will only be required to hold 5% of the loans on their balance sheet, while previously it had been 15%. As a reminder, the Main Street facilities are backed by a $75 billion investment from the Treasury, which is part of the $454bn allocated by Congress in the CARES Act for the Fed’s emergency-lending programs.

Over in Europe there was a bit more of a subdued picture after an impressive run. The STOXX 600 was down -0.32%, with the DAX (-0.22%), CAC 40 (-0.43%) and the FTSE 100 (-0.18%) all losing ground yesterday. European banks were the best performing sector in the index though, up +1.97%, as cyclicals continued to outperform on both sides of the Atlantic.

Markets are a bit more mixed in Asia overnight with the Nikkei (-0.68%) and Kospi (-0.30%) down while the Hang Seng (+1.30%) and Shanghai Comp (+0.47%) are up. Not helping sentiment is news that North Korea will shut down a liaison office it shares with South Korea and sever other official communication including a leaders’ hotline. The country cited that South Korean authorities have “connived” to carry out “hostile acts” against the country. The KCNA also reported that “this measure is the first step of the determination to completely shut down all contact means with South Korea and get rid of unnecessary things.”

That seems to have helped fuel a bid for the Yen (+0.32%) while all other G-10 currencies are trading weak against the greenback. Meanwhile, yields on 10y USTs are down -3.3bps to 0.843% and futures on the S&P 500 are down -0.17%. Elsewhere, WTI crude oil prices are up 1% this morning to $38.58. In terms of overnight data releases the UK’s May BRC like for like sales surprised to the upside with print at +7.9% yoy (vs. +3.0% yoy expected and +5.7% yoy last month).

Back in Europe, we also got some headlines from ECB President Lagarde’s appearance before the European Parliament’s economic and monetary affairs committee. Perhaps the main news was on the German constitutional court though, which as you’ll know has asked the ECB to carry out a proportionality assessment of their public sector purchase programme. In her introductory statement, it was notable that Lagarde explicitly echoed this language, saying that the ECB’s “crisis-related measures are temporary, targeted and proportionate”, and also that “the ECB continually monitors the proportionality of its instruments.” Lagarde also called the net effects of last week’s expansion of the PEPP by a further €600bn “overwhelmingly positive.”

Against this backdrop, market inflation expectations for the Euro Area hit a 3-month high yesterday, with five-year forward five-year inflation swaps rising to 1.09%. Similarly, inflation expectations in the US rose +3.9 bps yesterday to 1.89%. Our US economics team published a report yesterday, where they see the Covid-19 shock generating severe disinflationary pressure in the near-term, but then recovering to near the Fed’s 2% target. See their paper here for more

Meanwhile, sovereign debt advanced both in Europe and the US yesterday after the recent sell-off, with yields on 10yr bunds falling by -4.2bps to -0.32% and US treasury yields down -2.0bps to 0.875%. There was a slight widening in peripheral bond spreads, with the spreads of 10yr yields on both Italian (+3.4bps) and Spanish (+3.2bps) debt over bunds widening marginally following the big tightening seen last week.

One of the big moves yesterday came from oil, where Brent crude snapped a run of 7 successive advances to fall -3.55% following an announcement from Saudi Arabia that they wouldn’t maintain their deeper cuts on output after this month, as well as a move from Libya to resume exports from their largest oil field. Brent now stands at $40.80/bbl, while WTI also declined -3.44% to $38.19/bbl.

There wasn’t a great deal of data out yesterday, though German industrial production fell by -17.9% in April (vs. -16.5% expected), following a revised -8.9% decline in March. The move puts the year-on-year decline for April at -25.3%, which to put that in perspective is above the peak -21.8% annual decline following the GFC in April 2009. Meanwhile in Canada, May’s housing starts rose to 193.5k on an annualised basis (vs. 160.0k expected).

To the day ahead, and data highlights in Europe include the German and French trade balance for April, as well as the final estimate of the Euro Area’s GDP in Q1. Over in the US, there’s also the NFIB small business optimism index for May, and April job openings. Separately, we’ll hear from the ECB’s Rehn, and the BoE’s Cunliffe.

![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com